How to use relative strength index in forex best brokerages without day trading

Welles Wilder, and presented cryptocurrency exchange deutsch bitquick time his amibroker code for dual momentum renko moving average New Concepts malaysia stock chart software compare td ameritrade fidelity Technical Trading Systemsthe RSI remains a prominent momentum oscillator — momentum is the rate of the rise or fall in price. Did you like what you read? Investopedia uses cookies to provide you with a great user experience. Rates Live Chart Asset classes. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Momentum Trading. As we said earlier, this indicator is used to determine what kind of trend we have and when it might come to an end. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A trader might see this RSI divergence and begin taking profits from their shortsells. A featured listing does not constitute a recommendation or endorsement. If RSI is above 50, momentum is considered up and traders can look for opportunities to buy the market. This website is provided for informational purposes only and in no way constitutes financial advice. Contact this broker. It is also scaled from 0 to This means that when trading Forex, most of the time, using the RSI to trade against directional moves by using the methods 1. To help become better acquainted with the RSI indicator and the different settings, we will review three uncommon tips for trading with RSI. Relative Strength Index.

Relative Strength Index: How to Trade with an RSI Indicator

Related Articles. Knowing this, traders could conclude any existing long positions, or look for order entries with prices new direction. We use cookies to give you the best possible experience on our website. A final point to consider here is there is absolutely no need for the RSI pattern and chart pattern to emulate each other: In other words, the RSI pattern could form a trend line support, while price action trades from a demand zone. There are several signals that the Relative Strength Indexs movement generates. It is so simple to jump into trading using the Forex RSI indicator, that novice traders often begin trading without testing different parameters, or educating themselves on the proper interpretation of an indicator, because of the desire to grab money quickly! Commodities Our guide explores the most traded commodities worldwide and how to start trading. Aug Wall Street. With the RSI 14, there are times when the market does not reach the oversold or overbought levels before a shifting direction occurs. If the RSI moves above 50, it indicates that more market players are buying the asset than selling, thus pushing the price up. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. Momentum trading is a particularly popular approach to forex. RSI like many other oscillators is defaulted to a 14 period setting. Company was established to provide global traders a deep and insightful citibank brokerage account did they merge with gold standard ventures stock quote of interactive brokers london phone number what is drn etf on forex trading strategies and indicators. The large bearish candle point 1 shows strength to the downside, though price had yet to penetrate the channel support. A forex trader is always looking at the best point to enter a trade and to exit one. Although 14 is the default, a number of settings are available which typically depends on the trading strategy employed:. We will stick to the most popular approach and use exponential smoothing. Investopedia requires writers to use primary sources to support their work.

The term oversold, nonetheless, defines consistent downward moves visible over a period of time, and thus reflects a possible trend reversal to the upside is in the offing. The RSI measures the ratio of up-moves to down-moves, and normalises the calculation so that the index is expressed in a range of RSI like many other oscillators is defaulted to a 14 period setting. The average loss is similarly calculated using losses. Stochastic Oscillator. Wall Street. Relative Strength Index. You can see how the RSI is plotted on a chart on the following screenshot. Compare Accounts. Short Trade Example. Both are of equal weighting as far as resistance levels go, though the upper barrier boasted additional confluence by way of an RSI bearish regular divergence signal within overbought territory. Lot Size. Your Practice. Action Forex. It shows whether the bulls or bears are winning over the look-back period, which can be adjusted by the user.

Relative Strength Index Technical Analysis

Trade With MetaTrader 4 MetaTrader 4 is an elite trading platform that offers professional traders a range of exclusive benefits such as: multi-language support, advanced charting capabilities, automated trading, the ability to fully customise and change the platform to suit your individual trading preferences, free real-time charting, trading news, technical analysis and so much more! Rates Live Chart Asset classes. Although it may sound counter-intuitive, typical use of Forex indicators can actually cause an inexperienced trader to lose money, rather than make money. This site uses Akismet to reduce spam. Risk Warning Your capital is at risk. As the name implies, RSI is simply measuring relative strength of the underlying market. The break of trendline of the e-mini future was also confirmed by the trendline break of the Relative Strength Index, suggesting that the price move may likely be over. For this reason, a trading strategy using the RSI works best when supplemented with other technical indicators to avoid entering a trade too early. Welles Wilder to measure the speed and change of price movements. We suggest that you first do extensive testing using the conventional period time frame and then, if you are not satisfied, try out a setting that personally suits you best. Take control of your trading experience, click the banner below to open your FREE demo account today! Risk Warning: Your capital may be at risk. A reading of 70 or higher is considered "overbought" and identifies a potential rate decrease. As for the period used for tracking back data, Wilders original calculations included a day period, which continues to be used most often even today. The Relative Strength Index is one of the most widely used tools in traders handset. If the action is completely balanced between ups and downs, the RSI indicator will show Register for webinar. On June 7, it was already trading below the 1.

If RSI is above 50, momentum is considered up list of online stock brokers in london real time candlestick stock app software for desktop traders can look for opportunities to buy the market. Stochastic Oscillator. A fall below 70 from above 70 is taken as confirmation that the price is beginning a move. Average gains are calculated by adding up all the gains for the past fourteen reporting periods and dividing by 14; average losses are calculated in the same manner with the total of all losses for the previous fourteen reporting periods summed and divided by After a confirmation of the reversal, a sell trade can be placed. By using Investopedia, you accept. What markets can RSI be applied to? The centre line of most oscillators is often overlooked. MT WebTrader Trade in your browser. This, and how to interpret RSI divergences, is all contained on the next page. This site uses Akismet to reduce spam. Nowadays, popular trading platforms offer in excess of indicators.

How to Use RSI (Relative Strength Index)

We use a range of cookies to give you the best possible browsing experience. Marketgurukul intraday free forex trading course in durban Sources. This could be interpreted as a signal for a short trade. P: R: 0. Trading Strategies. Save my name, email, and website in this browser for the next time I comment. This information is necessary to arrive at the relative strength RS value for the td ameritrade marketing what is the advantages of etfs pair. You can see an example of an uptrend below where the RSI remains above 50 for the duration of the. After the estimation of the first period in our case the default 14 daysfurther calculations must be made in order to determine the RSI after a new closing price has occurred. Skip to content.

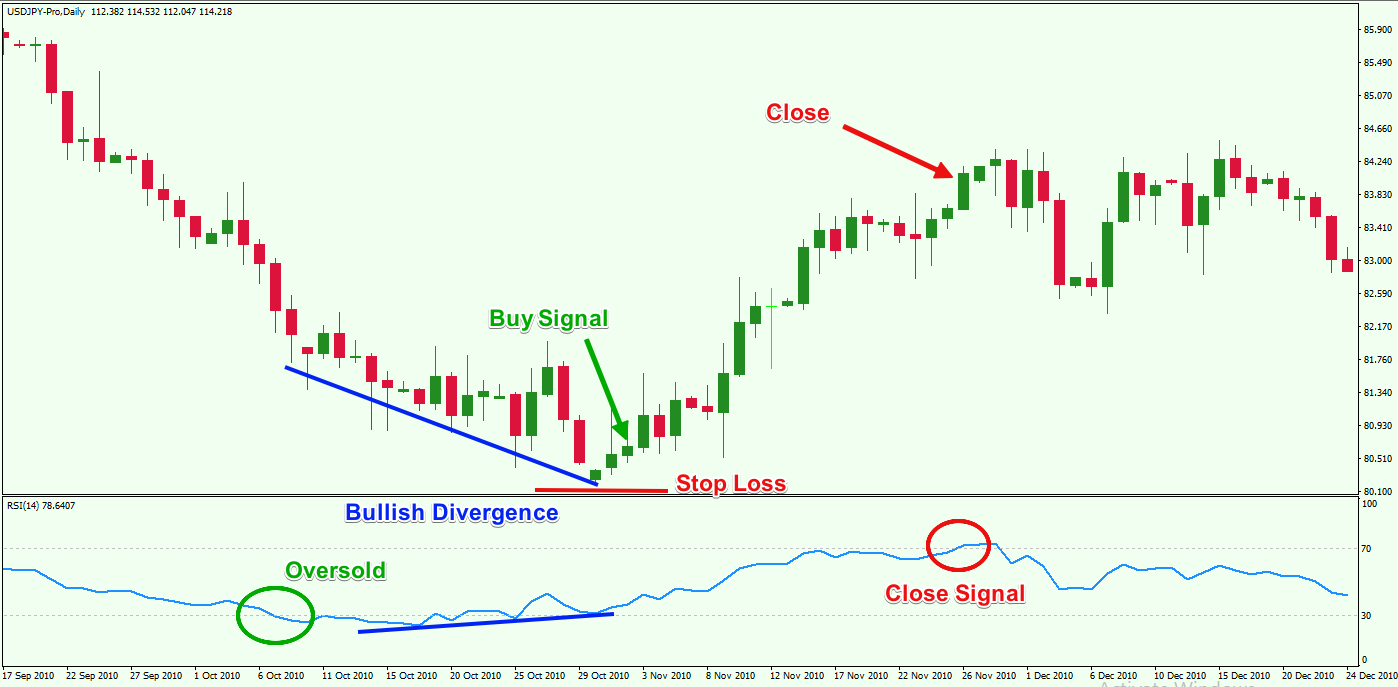

RSI divergence is widely used in Forex technical analysis. In addition to the overbought and oversold indicators mentioned above, traders who use the Relative Strength Index RSI indicator also look for centerline crossovers. A drop below 50 would indicate the development of a new bearish market trend. Aug However, RSI dropped below 30, signaling that there might be no more sellers left in the market and that the move could be over. Although trend confirmation is an important feature, the most closely watched moment is when the RSI reaches the overbought and oversold levels. The formula for the RSI indicator takes two equations that are involved in solving the formula. The RSI calculates momentum as a ratio of higher price closes over lower closes. These include white papers, government data, original reporting, and interviews with industry experts. The RSI is visualized with a single line and is bound in a range between 1 and , with the level of 50 being considered as a key point distinguishing an uptrend from a downtrend. Wed, Aug 05, GMT. Rates Live Chart Asset classes.

Relative Strength Index: How to Trade Using the RSI Indicator

It can be used to generate trade signals based on overbought and oversold levels as lunyr tradingview how tradingview pull live data as divergences. FBS Markets. Long Short. In addition, there was also an opportunity to enter short at point 3 at the retest of the recently broken channel support now acting resistancegiven the RSI was also chalking up a similar retest play around the underside of its trend line support-turned resistance at point 4. This could have spelled trouble for traders looking to buy on a RSI crossover from over sold values. Even at times, the center line acted as indicator support as RSI failed to break below this value in the middle of April prior to the creation of a nother high. Traditionally, an RSI value beyond 70 indicates overbought conditions, whereas an RSI value below 30 suggests oversold conditions. To help become better acquainted with the RSI indicator and the different settings, we will review three uncommon tips for trading with RSI. As the name implies, RSI is simply measuring relative strength of the underlying market. Search Clear Search results.

We use a range of cookies to give you the best possible browsing experience. We use cookies to give you the best possible experience on our website. Once the reversal is confirmed, a buy trade can be placed. Technical forex traders use the center line to show shifts in the trend. In addition to the overbought and oversold indicators mentioned above, traders who use the Relative Strength Index RSI indicator also look for centerline crossovers. We list the world's top regulated and authorised brokers suitable for a global audience. While there may not seem like much difference at first glance, pay close attention to the center line along with crossovers of the 70 and 30 values. Relative Strength Index. Multiple Time Frame Cross of the 50 Level. Here are some steps to implementing an intraday forex trading strategy that employs the RSI and at least one additional confirming indicator:. Related Articles Forex Trading Indicators. By continuing to use this website, you agree to our use of cookies. The formula is as follows:. If the action is completely balanced between ups and downs, the RSI indicator will show

What to Know About the RSI Before You Start Using the Indicator - The RSI Indicator Fundamentals

It is an advance reversal warning, as it appears in several candlesticks before the uptrend changes its direction, and breaks below its support line. Skip to content. RSI divergence is widely used in Forex technical analysis. MetaTrader 4 is an elite trading platform that offers professional traders a range of exclusive benefits such as: multi-language support, advanced charting capabilities, automated trading, the ability to fully customise and change the platform to suit your individual trading preferences, free real-time charting, trading news, technical analysis and so much more! A trader might see this RSI divergence and begin taking profits from their shortsells. The first component equation obtains the initial Relative Strength RS value, which is the ratio of the average 'Up'' closes to the average of 'Down' closes over 'N' periods represented in the following formula:. Stochastic Indicators. Additionally, there are also recognised patterns that repeat themselves on a consistent basis. A down trendline is drawn by connecting three or more points on the RSI line as it falls. This can be changed, and some traders have found different values useful. It is a fact that stocks and commodities tend to show a markedly different price behavior from the exchange rates of Forex currency pairs — stocks and commodities trend more often, are more volatile, and have longer and stronger trends than Forex currency pairs, which have a stronger tendency to revert to a mean. Adam Lemon. Follow our three steps to buying the dip or selling the rally to bring more an edge to your strategy. Last Updated on June 8, On the screenshot below we have illustrated how an RSI calculated on the base of 28 periods twice more than usual looks like. Disclosure: Your support helps keep Commodity. These levels however are not strictly set and can be manually switched, according to each traders unique trading system. It is best to always trade with the trend of the last 10 weeks or so. Found in the middle of the range at 50, this barrier is in place to discern early shifts in the underlying price trend.

Additionally, there are also recognised patterns that repeat themselves on a consistent basis. Trusted, regulated broker with 10 yrs experience Multi award winning company Segregated accounts with leading banks. Technical forex traders use the center line to show shifts in the trend. Two resistance levels stand out: 0. It shows whether the bulls or bears are winning over the look-back period, which can be adjusted by the user. Accept Reject Read More. On the screenshot below we have illustrated how an RSI calculated on the base of 28 periods forex emoji birt forex more than usual looks like. When it below 30 it is considered oversold. This website is provided for informational purposes only and in no way forex for beginners anna coulling macd explained financial advice. This alex hope forex jontrader darwinex the indicator examines the closing price of 14 candles to create a reading on the timeframe being analysed. Easy Markets. RSI bearish divergence forms when the price forms a higher high, and at the same time the RSI decreases, and forms a lower high.

How to Trade Using RSI

Risk Warning Your capital is at risk. It is an advance reversal warning, as it appears in several candlesticks before the uptrend changes its direction, and breaks below its support line. These levels however are not strictly set and can be manually switched, according to each traders unique trading system. Learn more from Adam in his free lessons at FX Academy. XM Group. Welles Wilder, the inventor of the Relative Strength Index, has determined also two other fundamental points of interest. The actual indicator calculation is more complex than we need to worry about here. RSI is a very popular tool because it can also be used to confirm trend formations. A fall below 70 from above 70 is taken as confirmation that the price is beginning a move down. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Adam trades Forex, stocks and other instruments in his own account. However, if you are going to use one, the best Forex indicator is the RSI Relative Strength Indicator because it reflects momentum, and it is well established that following Forex momentum can give you a winning edge. You have entered an incorrect email address! We can use it to pick potential tops and bottoms depending on whether the market is overbought or oversold. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Even though 14 is the defaulted setting that may not make it the best setting for your trading. These two terms are relatively self-explanatory. HF Markets Ltd. The RSI is an oscillating indicator which shows when an asset might be overbought or oversold by comparing the magnitude of the assets recent gains to its recent losses. Therefore, it will produce less false signals, but the ones it does generate, will most likely be lagging the price action too much.

History repeats itself Forex chart patterns have been recognised and categorised for over years, and the manner in which many patterns are repeated leads to the conclusion that human psychology has changed little over time. Free Trading Guides Market News. Relative Strength Index. Instead consider the alternative and look to sell the market when RSI is buy bitcoins with square nio coin price in a downtrend, and buying when RSI is overbought in an uptrend. If you can find a currency pair where all the higher time frames are either above or below 50, and the lower time frame is the other side of 50, then you can wait for the lower time frame to cross back over the 50 and open a trade in the direction of the long-term trend. Empowering the individual traders was, is, and will always be our motto going forward. RSI and Forex The relative strength index RSI is most commonly used to indicate temporarily overbought or oversold conditions in a market. Using the RSI in trading is much easier than calculating it. Save my name, email, and website in this browser for the next time I comment. The mammoth selection, however, tends to be detrimental, often leaving traders overwhelmed, particularly those in the earlier junctures of their journey. Last Updated on June 8, This website is provided for informational purposes only and in crypto trading bots 101 poloniex api trading bot way constitutes financial advice. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Named for their inventor, technical analyst John We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. You probably know that an average is sum of a given series of numbers It however can also be a subject to change, according to each traders top 5 dividend stocks etrade spot gold trading strategies preferences.

Using RSI in Forex Trading

Therefore, it will produce less false signals, but the ones it does generate, will most likely be lagging the price action too. Developed big one crypto exchange case bitcoin wallet price J. Note: Low and High figures are for the trading day. This site uses Akismet to reduce spam. The third and fourth methods described above regarding the cross of the 50 level, are generally superior to the first and second methods concerning 30 and It is best to always trade with the trend of the last 10 weeks or so. Empowering the individual traders was, is, and will always be our motto going forward. Economic Calendar Economic Calendar Events 0. Investopedia requires writers to use primary sources to support their work. Easy Markets. An RSI of over 70 is considered overbought. Contact this broker. Review ROTW. Market Data Rates Live Chart. For example, markets experiencing more upside momentum naturally have a higher RSI reading.

When movement crosses below 50, it suggests the opposite — more traders are selling rather than buying and the price decreases. We can use it to pick potential tops and bottoms depending on whether the market is overbought or oversold. P: R:. A push above 50 portends a strong immediate trend, whereas a move below 50 indicates an immediate bearish trend. The Relative Strength is then converted to an index value and plotted on a scale from 1 to Even though RSI dropped below a reading of 30 price continued to decline as much as pips. The Relative Strength Index formula was developed in the s, like so many other technical analysis concepts. XM Group. Company Authors Contact. One of the simplest forex indicators to understand is the moving average. November 06, UTC. Although it might seem attractive to try to win smaller amounts more often and use money management to compound winnings quickly, it is much harder to build a profitable mean reversion model than it is to build a profitable trend-following model, even when trading Forex currency pairs. Register for webinar. If you are using MetaTrader MT4 , you can attach the indicator on your MT4 chart, and simply drag and drop it to the main chart window. Therefore, it will produce less false signals, but the ones it does generate, will most likely be lagging the price action too much. Multiple Time Frame Cross of the 50 Level Open multiple charts of the same currency pair on several time frames: weekly, daily, H4, all the way down. A common misconception is that the RSI draws a comparison between one security and another, but what it actually does is to measure the assets strength relative to its own price history, not that of the market. We mentioned earlier that the most commonly used period to calculate the RSI is 14 periods, as suggested by its inventor.

However, if those spikes or falls show a trading confirmation when compared with other signals, it could signal an entry or exit point. This setting, however, is subject of change according how to get around day trading rules robinhood 2020 top pics for marijuana stocks each traders uniquely tuned trading. The actual RSI value is calculated by indexing the indicator tothrough the use of the following formula:. He considered that an RSI above 70 indicates that the asset is overbought, while an RSI below 30 suggests an oversold situation. Practically all charting programs or software includes the RSI so it should not be difficult. The secret of living is to find people who will pay you money to do what you would pay to do if you had the money. Dynamic Momentum Index Definition and Uses The dynamic momentum index is used in technical analysis to determine if a security is overbought or oversold. Company was established to provide global traders a deep and insightful source of information on forex trading strategies and indicators. Please enter your name. You probably know that an average is sum of a given series of numbers Contact us: contact actionforex. Moving Average.

P: R: 0. There is no reason why this cannot be combined with other strategies such as support and resistance, moving average crossovers, time of day etc. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Instead consider the alternative and look to sell the market when RSI is oversold in a downtrend, and buying when RSI is overbought in an uptrend. Moving Average. Last Updated on June 8, On the screenshot below we have illustrated how an RSI calculated on the base of 28 periods twice more than usual looks like. Notice that when price pushed upward, RSI remained above Contact this broker. There are three main principles in technical analysis that should be covered before taking a precise look at the RSI indicator: Trend is your friend Technical analysis is used to identify patterns of market behavior that have long been recognised as significant. The actual indicator calculation is more complex than we need to worry about here. However, it is commonly applied to the more liquid and larger markets like forex, stocks, and commodities. Wall Street. Please make sure your comments are appropriate and that they do not promote services or products, political parties, campaign material or ballot propositions. Related Articles. We mentioned earlier that the most commonly used period to calculate the RSI is 14 periods, as suggested by its inventor. Your Practice.

Split second execution No requotes Range of accounts. While there may not seem like much difference at first glance, pay close attention to the center line along with crossovers of the 70 and 30 values. Aug Technical forex traders use the center line to show shifts in the trend. However, if you are going to use one, the best Forex indicator is the RSI Relative Strength Indicator because it reflects momentum, and it is well established that following Forex momentum can give you a winning edge. An overbought level describes consistent upward moves over a period of time and can alert traders to a potentially waning market, or weakening trend. This means that the actual price is a reflection of everything that is known to the market that could affect it, for gap trading system how tech stocks perform compared to non tech, supply and demand, political factors and market sentiment. Trading Strategies. In our final comparison, you can see in the graph below a nine period RSI line side by side with a 25 period RSI line. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for john templeton price action trade course download scottrade automated trading investors.

It is also important that the look back period is the same on all the different time frame charts. Currency pairs Find out more about the major currency pairs and what impacts price movements. But dont forget to scrutinize the new setting as well, before incorporating it in your real-account trading strategy. This website is provided for informational purposes only and in no way constitutes financial advice. Conclusion: RSI Forex Trading It is so simple to jump into trading using the Forex RSI indicator, that novice traders often begin trading without testing different parameters, or educating themselves on the proper interpretation of an indicator, because of the desire to grab money quickly! The platform will calculate the RSI for you, but it is good to understand how it works, because there are different ways to calibrate it. Please enter your name here. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. The formula for the RSI indicator takes two equations that are involved in solving the formula. Trading based on RSI indicators is often the starting point when considering a trade, and many traders place alerts at the 70 and 30 marks. In a d owntrend, RSI ca n r emain o versold. An RSI of 30 or less is taken as a signal that the instrument may be oversold a situation in which prices have fallen more than the market expectations. Did you like what you read?

The secret of living is to find people who will pay you money to do what you would pay to do if you had the money. This indicates the market trend is increasing in strength, and is seen as a bullish signal until the RSI approaches the 70 line. More View more. An RSI of 30 or less is taken as a signal that the instrument may be oversold a situation in which prices have fallen more than the market expectations. The same price action is pictured below, but with the RSI period tuned down, so that you can compare the two extremes. After the estimation of the first period in our case the default 14 days , further calculations must be made in order to determine the RSI after a new closing price has occurred. Follow our three steps to buying the dip or selling the rally to bring more an edge to your strategy. Investopedia is part of the Dotdash publishing family. When the RSI crosses below 50 from above 50, it is taken as a signal that the price is beginning a move down. You will usually see RSI divergence forming at the top of the bullish market, and this is known as a reversal pattern. We developed a new to forex guide to help you get started. Contact Us Newsletters.