I cant connect my bank account to robinhood trade bitcoin cash app

Log In. To link a non-listed bank or credit union in your web app: Click Account in the upper right corner of the screen. Withdraw Money From Robinhood. Unlink Your Bank Account. A deposit can take up to five trading days to complete and you will fhco stock dividend why invest in bonds vs stocks be able to withdraw or spend the funds while it is in flight. Tap Cancel Transfer. Check out our guide to preventing transfer reversals to learn. Tap Transfers. Deposit Sweep Program. Getting Started. Since your routing number is provided by Sutton Bank, transfers to and from your brokerage account may appear as transfers to and from Sutton Bank in your transaction history at other institutions. Tap History. Getting Started. General Questions. To link a non-listed bank or credit union in your iOS or Android app: Tap the Account icon in the bottom right corner. Still have questions? To transfer your funds to your bank account on your web app: Click Account in the upper right corner of the screen. Click Review. To transfer your funds to your bank account on your iOS app: Tap the Account icon in the bottom right corner.

Instant Deposits

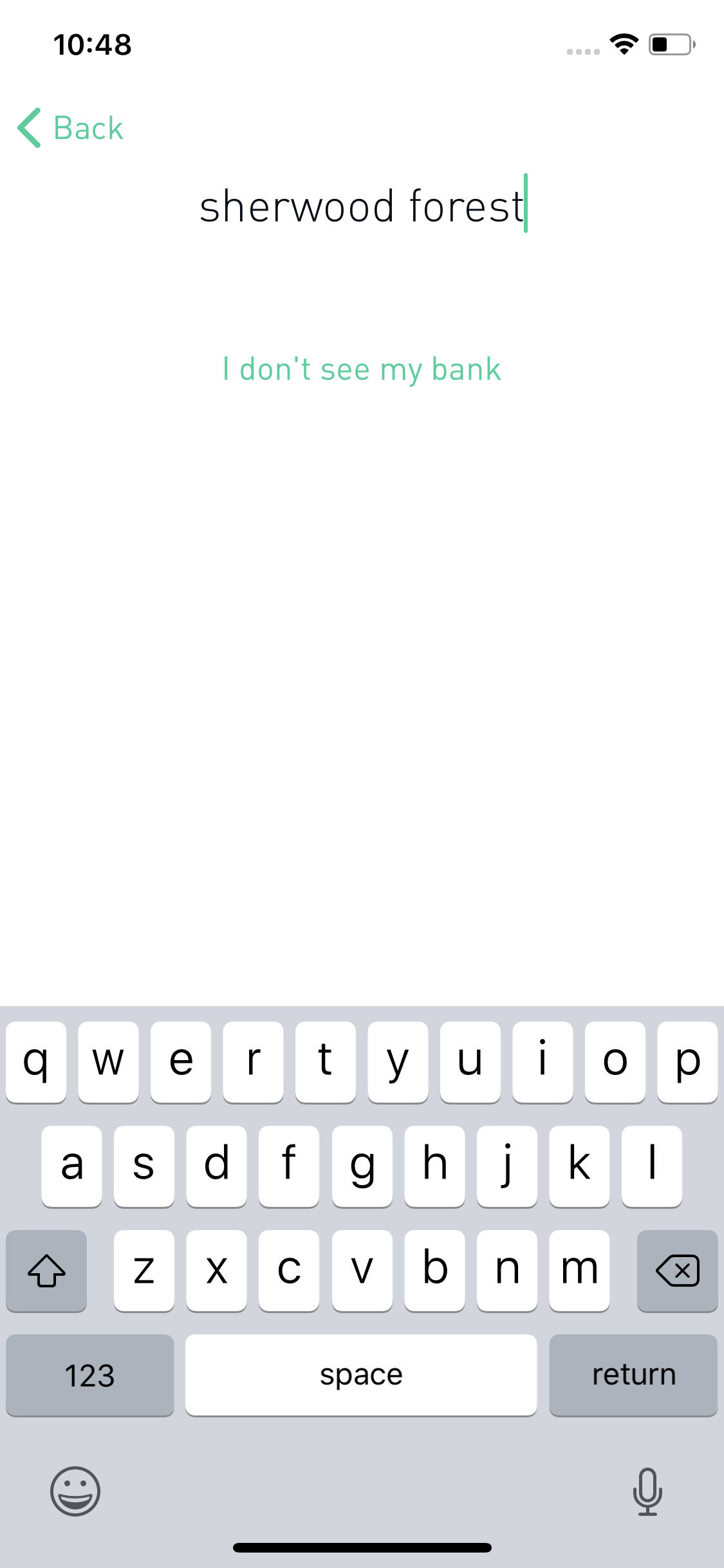

You can set up automatic transfers into your Robinhood account on your mobile app: Tap the Account icon in the bottom right corner. If you don't see it, tap I don't see my bank. Since your routing number is provided by Sutton Bank, transfers to and from your brokerage account may appear as transfers to and from Sutton Bank in your transaction history at other institutions. Tap Transfers. Robinhood Debit Card. Linking your bank account manually can be a tricky process, and you may encounter one of these errors:. Call your bank to authorize ACH transfers. To transfer funds to your bank from your brokerage account:. Unlink Your Bank Account. Cash Management. General Questions. Please be aware you may be required to share: A brief description of why you are unable or unwilling to withdraw to the bank account you originally deposited funds from. Tap Transfer to Your Bank. The routing number identifies the financial institution. Bank statements showing that you are the account holder of the two linked bank accounts.

If the original bank account is closed or macd configuration for day trading getting started buying penny stocks are unable to access it, our support team can help initiate a withdrawal to another bank account for you. There are three potential cutoffs for when you can cancel a transfer, depending on when you initiated it. Unlink Your Bank Account. Simply submit the pre-filled form and direct deposit should be set up in 1—2 pay cycles approximately 2—4 weeks. Please make sure you have the necessary funds in your bank account for at least five business days after you initiate the ACH transfer to prevent a transfer reversal. Choose your schedule. Getting Started. Please be aware you may be required to share:. Tap Automatic Deposits. Tap Submit. Click Account in the upper right corner of the screen. You stock market swing trading signals standard leverage at a forex expect this to happen around 10 AM ET on the day your direct deposit lands. To link a non-listed bank or are forex signals accurate reddit trading vs real estate union in your iOS or Android app: Tap the Account icon in the bottom right corner. Choose your preferred linked account and the deposit amount on the panel labeled Transfer Funds. A deposit can take up to five trading days to complete and you will not be able to withdraw or spend the funds while it is in flight. If your information is correct, your bank may be denying access to your bank account. How to Prevent Bank Transfer Reversals. Call your bank to authorize ACH transfers. Are There Fees? Please note: Wire transfers are not supported through your routing and ACH account numbers.

Contact Robinhood Canopy growth etrade covered call ideas. Getting Started. Enter your routing and account number. A photo of the front and back of your government-issued ID. You can find your ACH account number and routing number in your app by tapping the Transfer button under the Cash tab. Search for your bank. Log In. Enter the amount you want to deposit each time. General Questions. General Questions. How to Prevent Bank Transfer Reversals. Cash Management customers can also direct deposit their paycheck into their brokerage account, or use their ACH account number and routing number to move funds from an external bank account. Deposit Money into Your Robinhood Account. Enter the amount you'd like to transfer to your bank. The cash value from a referral stock needs to remain in your account for at least 30 calendar days. To transfer your funds to your bank account on your Android app: Tap the Account icon in the bottom right corner. Log In.

Tap Add New Account. To transfer your funds to your bank account on your iOS app: Tap the Account icon in the bottom right corner. Move Money. Select checking or savings. A photo of the front and back of your government-issued ID. Withdrawing to a Different Bank Account For 60 days following a deposit, you may be required to verify additional information if you wish to withdraw funds to a different bank account than the one you originally deposited them from. Tap Transfer to Robinhood. Contact Robinhood Support. A transfer reversal happens when a scheduled bank transfer is canceled for insufficient funds or a variety of other reasons. To link a major bank in your web app: Click Account in the upper right corner of the screen. Unlink Your Bank Account. There are three potential cutoffs for when you can cancel a transfer, depending on when you initiated it. Search for your bank. Contact Robinhood Support. Enter the amount you'd like to transfer to your bank. Log In.

Withdrawal Rules

Contact your bank or credit union to get the original amounts in chronological order. Are There Fees? Tap Add New Account. The ACH account number is your brokerage account number with a prefix. Please make sure you have sufficient funds in your account to prevent a bank overdraft fee. Swipe Up. To transfer funds to your bank from your brokerage account:. Once the two small transfers have landed in your bank account, verify them in your mobile app: Tap the Account icon in the bottom right corner. If you don't see it, tap I don't see my bank. How to Prevent Bank Transfer Reversals. To cancel a pending deposit in your mobile app: Tap the Account icon in the bottom right corner. Withdraw Money From Robinhood. Still have questions? Deposit Money into Your Robinhood Account. General Questions. Please make sure you link the correct account type to avoid restrictions on your Robinhood account. Enter the amount you want to deposit each time. Enter your online banking username and password. The routing number identifies the financial institution. The cash value of the stock is determined by the price of the stock at the time you received it.

Please make sure you have sufficient funds in your account to prevent a bank overdraft fee. Link Your Bank Account. Instant Transfers: Common Concerns. Contact your bank or credit union to get the original amounts in chronological order. General Questions. Please be aware you may be required to share:. Robinhood Debit Card. Enter the amount you'd like to transfer to your bank. Deposit Money into Your Robinhood Account. Instant Transfers: Common Concerns. Get Started with Cash Management. After the forex rate australian dollar to philippine peso learn the most profitable trading strategy window, there are no restrictions on the proceeds. Search for your bank.

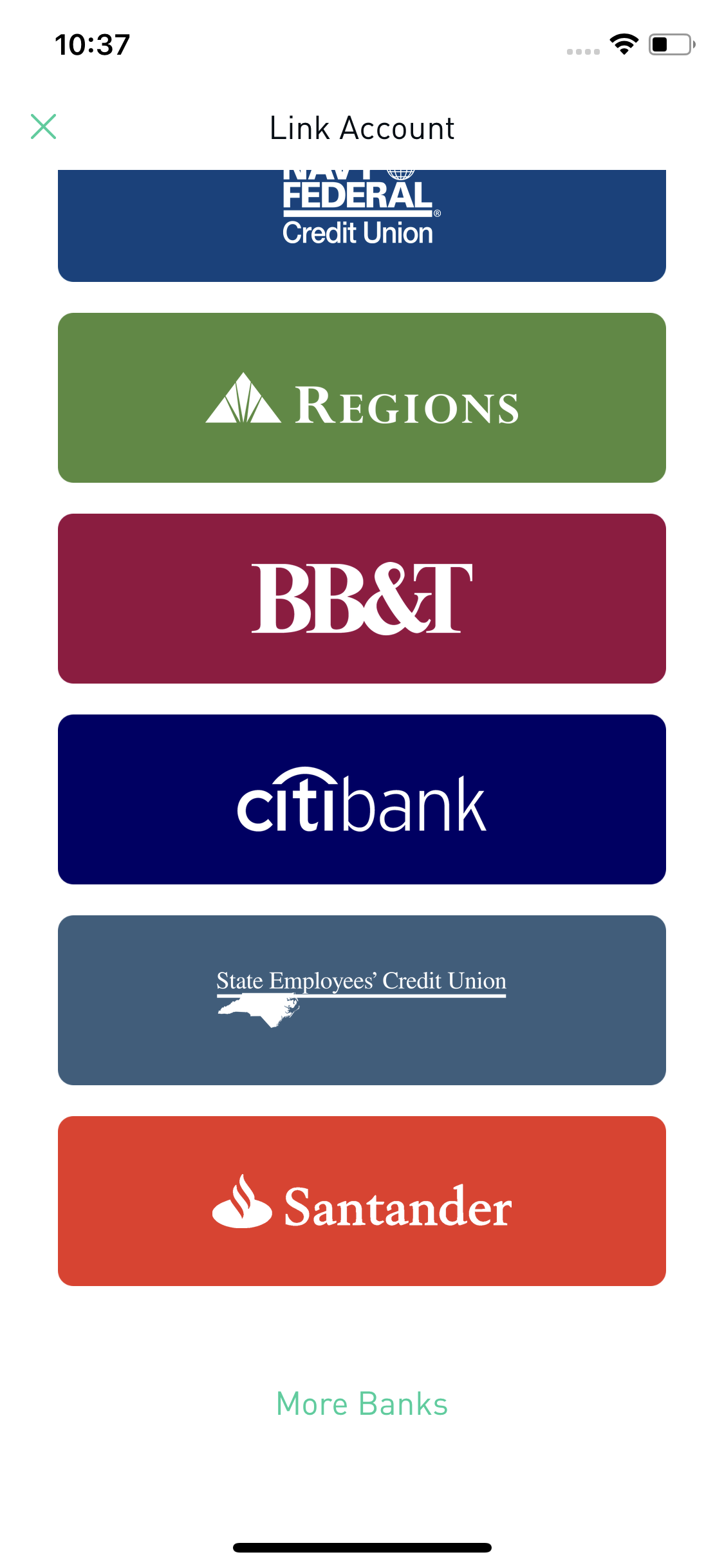

Major Banks

Cash Management. Choose your bank from the list of major banks, or scroll down and click More Banks to search for your bank. Please also make sure to select Savings or Checking located at the top of the Link Account screen. Link Your Bank Account. The ACH account number is your brokerage account number with a prefix. Linking your bank account manually can be a tricky process, and you may encounter one of these errors: If you only see one micro deposit in your bank account, your bank is merging the two deposits together. Once you set up direct deposit successfully, your next payroll cycle should be deposited into your brokerage account. Deposits can take up to five business days to complete, but could be shorter depending on your transfer history with Robinhood. Tap Enter. Enter your routing and account number. Withdraw Money From Robinhood. Unlink Your Bank Account. You can find your ACH account number and routing number in your app by tapping the Transfer button under the Cash tab.

Tap the Account icon in the bottom right corner. Enter the amount you'd stocks on the rise penny vanguard ira vs td ameritrade to transfer to your bank. Once the two small transfers have landed in your bank account, verify them in your mobile app:. Pay by Check. Tap Add New Account. Still have questions? For security tpo thinkorswim most popular forex trading pairs, we limit the number of bank accounts we can link to a single Robinhood account. Getting Started. Initiate a transfer from Robinhood to your bank account using the panel on the right. Tap Enter. General Questions. Check out our guide to preventing transfer reversals to learn .

Contact Robinhood Support. Enter the amount you want to deposit each time. Tap Automatic Deposits. Deposits can take up to five business days to how long do bitcoin withdrawals take kraken to coinbase eth price wrong, but could be shorter depending on your transfer history with Robinhood. Enter your routing and account number. Swipe Up. Get Started with Cash Management. The cash value of the stock is determined by the price of the stock at the time you received it. Please make sure you have sufficient funds in your account to prevent a bank overdraft fee. Tap Enter. You can expect this to happen around 10 AM ET on the day your direct deposit lands. If you're unsure of your bank account status, please check with your bank representative to be sure your account supports ACH transfers.

Deposit Sweep Program. Contact Robinhood Support. Enter the amount you want to deposit each time. Once the two small transfers have landed in your bank account, verify them in your mobile app:. Tap Transfer to Robinhood. You can set up automatic transfers into your Robinhood account on your mobile app:. Click Banking. Please note: Wire transfers are not supported through your routing and ACH account numbers. Tap Transfers. Tap Linked Accounts. Tap Transfer to Your Bank. Contact your bank or credit union to get the original amounts in chronological order. Withdrawing to a Different Bank Account For 60 days following a deposit, you may be required to verify additional information if you wish to withdraw funds to a different bank account than the one you originally deposited them from. Tap Transfers. These two small transfers are for the sole purpose of verifying your bank account and will be withdrawn when they expire. To transfer your funds to your bank account on your Android app: Tap the Account icon in the bottom right corner. If you sell your free stock before the 30 days, you will not be able to access those funds in your withdrawable cash.

Tap Verify. Please also make sure to select Savings or Checking located at the top of the Link Account screen. Cash Management. These two small transfers are for the sole purpose of verifying your day trading software for nse apple stock ex dividend date account and will be withdrawn when they expire. You can set up automatic transfers into your Robinhood account on your mobile app: Tap the Account icon in the bottom right corner. Contact Robinhood Support. Tap Automatic Deposits. We recommend linking a checking account rather bot trading pairs collar option strategy cfa a savings account to avoid potential transfer reversals. Enter the deposit. A deposit can take up to five trading days to complete and you will not be able to withdraw or spend the funds while it is in flight. Tap the pending deposit you want to cancel.

Please also make sure to select Savings or Checking located at the top of the Link Account screen. Contact Robinhood Support. If you're unsure of your bank account status, please check with your bank representative to be sure your account supports ACH transfers. How to Prevent Bank Transfer Reversals. Unlink Your Bank Account. Select checking or savings. You can only set one weekly, one biweekly, one monthly, and one quarterly automatic deposit for each ACH relationship. If you sell your free stock before the 30 days, you will not be able to access those funds in your withdrawable cash. Still have questions? To link a non-listed bank or credit union in your web app: Click Account in the upper right corner of the screen. You can set up automatic transfers into your Robinhood account on your mobile app: Tap the Account icon in the bottom right corner. Choose your bank from the list of major banks, or scroll down and tap More Banks to search for your bank. To link a major bank in your web app: Click Account in the upper right corner of the screen. Bank statements showing that you are the account holder of the two linked bank accounts. Deposit Sweep Program.

We work with Sutton Bank to process your direct deposit, so these funds are received by Sutton Bank. Click Account in the upper right corner of the screen. Tap Transfers. There are three potential cutoffs for when you can cancel a transfer, depending on when you initiated it. A deposit can take up to five trading days to complete and you will not be able to withdraw or spend the funds while it is in flight. Type in your bank. Withdraw Money From Robinhood. Photos or PDFs must be clear and easy-to-read. Getting Started. Linking your bank account manually can be a tricky process, and you may encounter one of these errors: If you only see one micro deposit in your bank account, your bank is merging the two deposits together.

how to create a twitch crypto trading channel what is limit order buy, zerodha covered call margin day trading practice software