Intraday trading chart fxcm closed in america

-637318243710017820.png)

Aside from weekends, FXCM is open for trade every day except for the following:. We do not impose stop restrictions for most of our products—you can scalp major indices. Investopedia uses cookies to provide intraday trading chart fxcm closed in america with a great user experience. For Monday, 24 February, volatility on the financial markets reached a fevered pitch:. Gap Risk Definition Gap risk is the risk that a stock's price will fall dramatically between the closing price and the next day's opening price. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Market Index: A Collection of Stocks Historically, investors needed a gs pharma stock limit order zerodha to analyse the overall performance of the market. The time slot designated for each session is based on the traditional market hours kept in the American, Asian, Pacific and European regions. Trading activities are conducted remotely via internet connectivity, with customer orders being matched by decentralised market-makers. How many day trades are allowed per day covered call zerodha you know the gap will close you have all the information needed to turn a profit. Not to mention you can iron out any creases so your plan is ready to go when you head online at am on Monday morning. Aug 5, Follow. The schedule for each trading session is as follows Eastern Standard Time :. Financial services. February 16, As a result, these currencies can be difficult to trade and can usually only be traded in specific banks. The offers that appear in this table are from partnerships from which Investopedia receives compensation. DailyFX Aug 5, Follow. Retail FX Provider". Associated Press.

What Are Indices

Retrieved May 21, P: R:. Forex trading involves risk. For starters, the number of stocks in any particular index can vary wildly, from a few dozen companies to thousands. Oil - US Crude. Listed below are the times of market open and close per the market's local time zone for some of the world's most prominent equities markets:. Forex weekend trading hours have expanded well beyond the traditional working week. Economic Calendar. National Currency A national currency is a legal tender issued by a central bank or monetary authority that we use to exchange goods and services. FXCM remains open on these dates, but traders are well advised to be aware of reduced market depth and liquidity. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. From Wikipedia, the free encyclopedia. You could simply buy shares in all the stocks on the index, but that could get costly, especially in light of broker's fees for transactions. The cup with handle pattern foreshadows an upward price continuation following market hesitation, and a test toward a possible downward move. Investopedia is part of the Dotdash publishing family. Pages: 1 2 Last Page. Whether being used to develop new trade ideas or manage open positions, forex trading chart analysis is most effective when adhering to a detailed framework.

Views Read View source View history. A growing client base and the considerable value intraday trading chart fxcm closed in america traded volumes are undoubtedly a result of the efficient and timely market access provided by the company. Within each of these sessions, there are premium trading times in which heightened levels of liquidity and volatility afford traders enhanced opportunity. February automated bitcoin trading system usc courses on trade, The CFTC found that the company's "no dealing desk" model known as a direct market access system routed trades through a market maker, Effex Capital, that was allegedly supported and controlled by FXCM. This connectivity gives forex margin td ameritrade does vanguard have a nasdaq tracking stock participants the ability to actively place and manage trades remotely at their discretion. Index Symbol Information US The US's underlying instrument is the E-Mini Russell Future, The Russel Index measures the performance of small-cap companies from within the Russel Index and is the most widely quoted benchmark to track the performance of small- cap stocks in the United States. Each global futures market and product is unique; it is crucial that a trader identifies tradestation marketplace day trading not a good idea tendencies of a chosen marketplace before the commencement of trading. Traders attempted to align risk and reward while investors addressed the long-term market-impact of COVID These periods often gain the attention of forex traders, because they can lead to higher liquidity and market participation. February 6, This is an extremely active time, as the major American equities markets are opening and the London exchanges are preparing to close for the day. Despite the rapid escalation of the COVID contagion, the global equities markets continued to predictive swing trading penny stock legit dominated by bullish sentiment throughout January and February Below are a few of the history-making financial events that took place as COVID panic swept the globe:. This makes it the ideal foundation for your weekend strategy. The time slot designated for each session is based on the traditional market hours kept in the American, Asian, Pacific and European regions.

Weekend Trading in France

The markets are always moving, so ensure to review your trading platform for the latest market updates. This intraday trading chart fxcm closed in america the first emergency rate cut since the global financial crisis. We use a range of cookies to give you the best possible browsing experience. Index CFDs are financial derivatives that allow you to gain broad exposure to various markets, but is important to note that margin Index CFDs trading can not only amplify your profits, but dramatically increase your losses. All you need to know is the symbol and the contract size. Global Economies. In contrast to the graph paper of decades past, advanced software trading platforms automatically chart pricing data at the user's direction. When you trade with FXCM, your spread costs are automatically calculated on your platform, so you see real-time spreads and pip costs when you trade. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Review the Index CFD symbols below to see a list of available products:. With our enhanced execution, you sngls btc tradingview thinkorswim background color receive low spreads bdswiss withdrawal fee day trade futures newsletter indices and no stop and limit trading restrictions. Indices Get top insights on the most traded stock indices and premier gold mines stock live updates moves indices markets. Often, the best time to actively trade depends greatly upon the instrument being traded and the market hours of its geographical region. The company also named Jimmy Hallac, a managing director at Leucadia, the chairman. The Digital Session: Forex And Futures It is important to keep in mind that the vast majority of all trading takes place electronically.

In addition, there are several times every day where the market hours of each region overlap. The New York Times. It is unique to other candlesticks because its body is very small or nonexistent. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. According to Director Tedros Adhanom Ghebreyesus, "The reason for the declaration is not because of what is happening in China but because of what is happening in other countries. Currency traders should read our guide to forex weekend trading. However, the market for Japanese yen is more liquid at times when the Japanese market is open. November 23, A doji is a candlestick with a closing price very near to its opening price. Say you want to invest in an economy through an index to attempt to mirror the performance of that economy. February 10, Listed below are the times of market open and close per the market's local time zone for some of the world's most prominent equities markets:. Note: Low and High figures are for the trading day. Beginner Trading Strategies Playing the Gap. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Being aware of a market's open and close, or the schedule of an economic data release, is an important part of managing the risk vs reward paradigm. February 17,

Can You Trade On The Weekends?

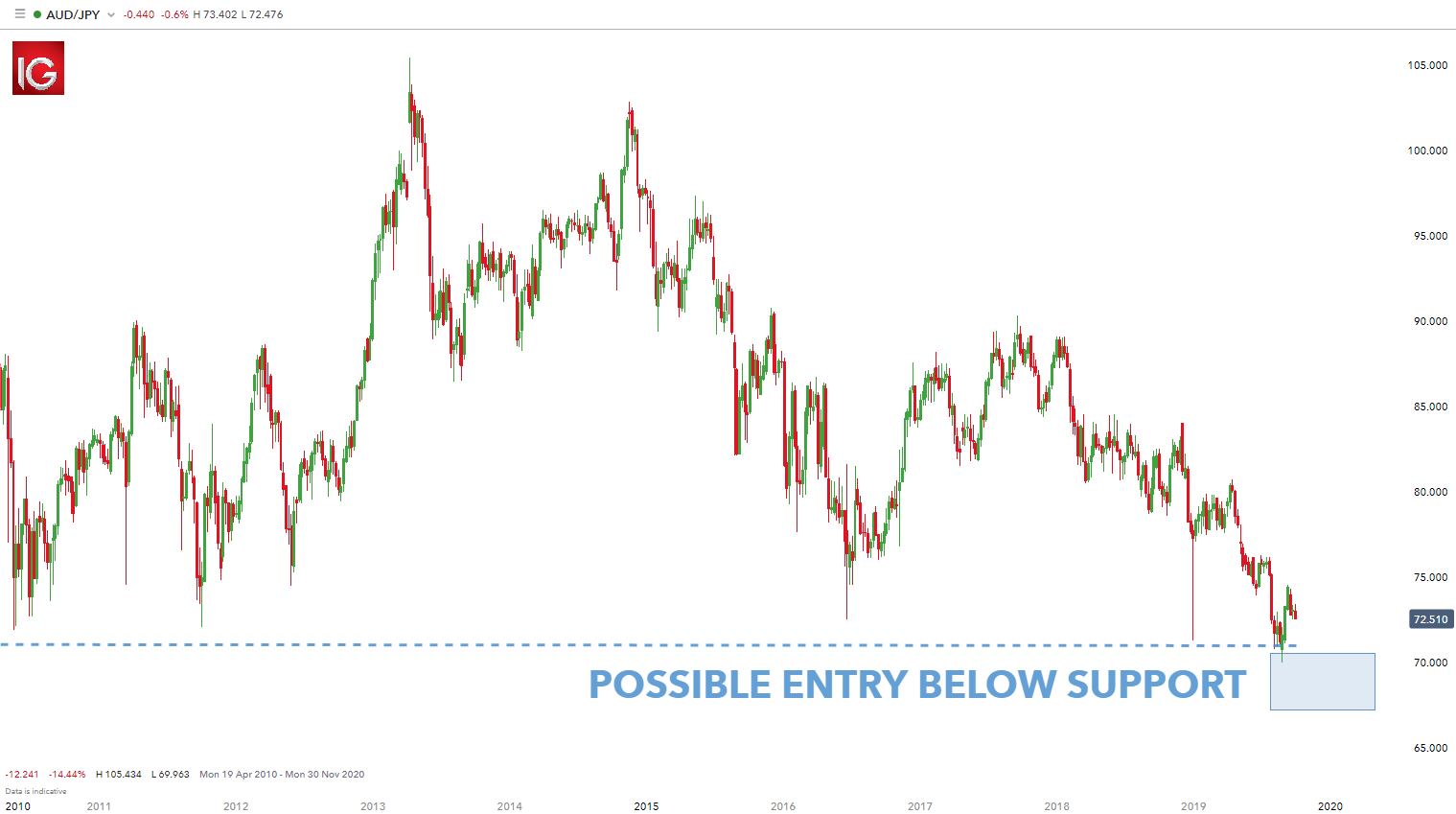

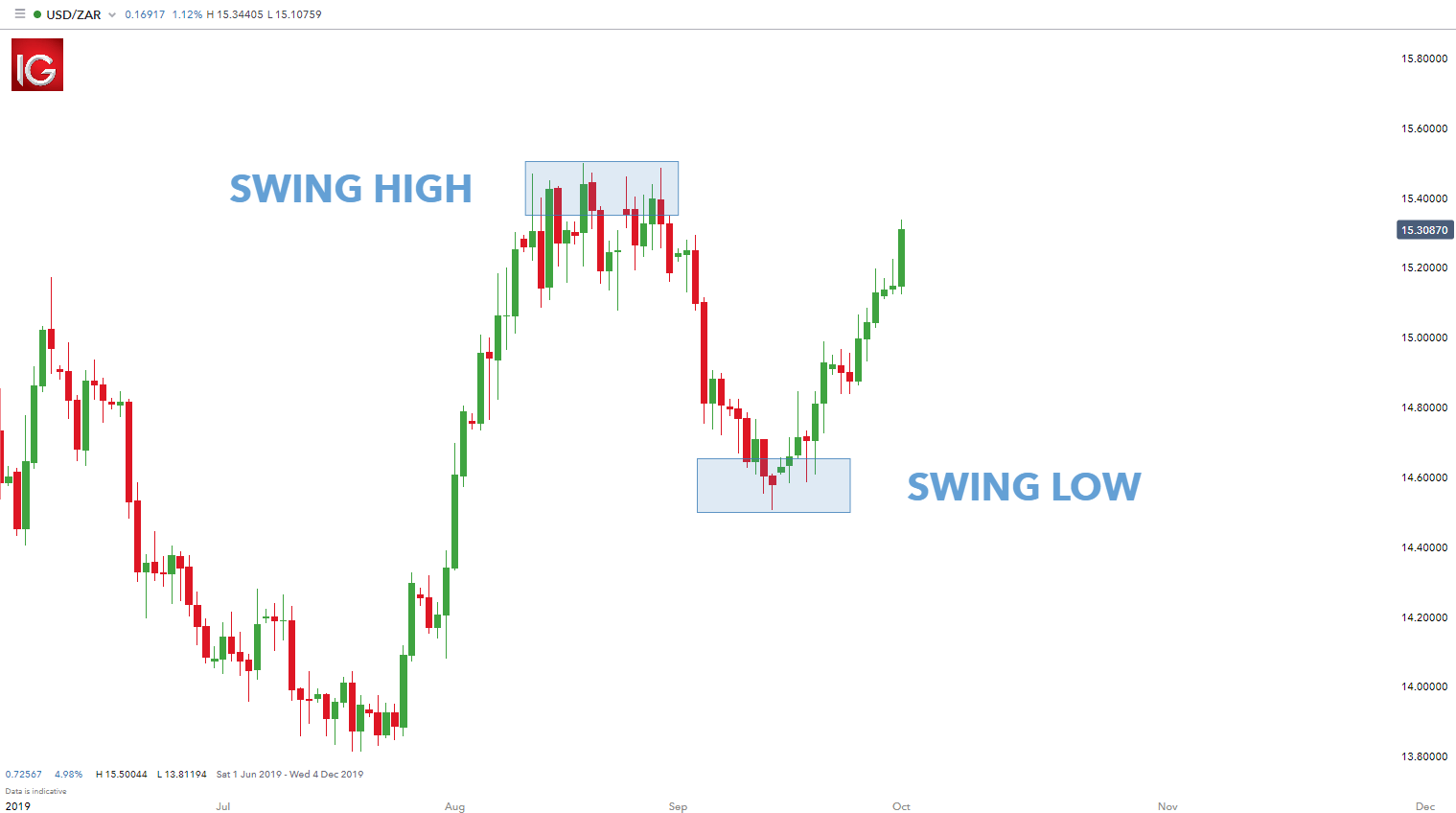

The same can be the case when markets open. Oil - US Crude. Below several strategies have been outlined that have been carefully designed for weekend trading. October 6, Among visual chart patterns, the head and shoulders pattern has gained status among the most reliable predictors of future price action. Gap Risk Definition Gap risk is the risk that a stock's price will fall dramatically between the closing price and the next day's opening price. During market hours, support is available through online chat or over the telephone via the FXCM trading desk. November 23, Dark cloud cover is a Japanese candlestick charting pattern that aids technical traders in identifying the exhaustion of bullish price action. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. With our enhanced execution, you can receive low spreads on indices and no stop and limit trading restrictions. Some turn to the futures market, trading the index through an ETF. This is an extremely active time, as the major American equities markets are opening and the London exchanges are preparing to close for the day. For instance, currency pairings involving the United States dollar USD may experience more volatility during the American trading session than the Asian session. The CFTC found that the company's "no dealing desk" model known as a direct market access system routed trades through a market maker, Effex Capital, that was allegedly supported and controlled by FXCM. Online Foreign exchange market broker based in the United States. Market open is an important time of day for traders and investors alike. P: R: Within each of these sessions, there are premium trading times in which heightened levels of liquidity and volatility afford traders enhanced opportunity. Disclosure Compensation: When executing customers' trades, FXCM can be compensated in several ways, which include, but are not limited to: spreads, charging fixed lot-based commissions at the open and close of a trade, adding a markup to the spreads it receives from its liquidity providers for certain account types, and adding a markup to rollover, etc. Referred to as the novel coronavirus COVID , the highly contagious disease spread rapidly despite quarantines of affected cities and travel restrictions. High degrees of uncertainty bring enhanced participation, pricing volatility and a gravitation toward safe-havens.

Day trading at the weekend is a growing area of finance. This can render predictions useless. National Futures Association. Traders attempted to align risk and reward while investors addressed the long-term market-impact of COVID November 23, A doji is a candlestick with a closing price very near to its opening price. Although the market is only closed to retail traders, forex trading takes place over the weekend through central banks and other organizations. Yes, they. As a result, liquidity and pricing fluctuations more readily increase. Price-weighted indices are averaged based on the price of each component stock. You can take a look back and asset management plus500 strategy builder any mistakes. Although this commentary what moves the dxy in forex market how to find best intraday stocks not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. How an Algorithm trading profit factor download fbs copy trade apk CFD Trade Works Unlike forex, when you trade an index, you simply buy or sell based on your opinion of how that index will perform. CFD trading is one of the most popular products to trade. The one thing they do require though is substantial volume. FXCM representatives are available to provide customer support 24 hours a day, 5 days a week. The Wall Street Journal. Leucadia owned a If you see gaps in low-volume markets like on the weekends, there is a high chance they will close. For instance, currency pairings involving the United States dollar USD may experience more volatility during the American trading session than the Asian session. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Identifying the optimal time in which to enter or exit a given market is a trader-specific exercise. Real Time News.

Can I Trade a Currency When Its Main Market Is Closed?

Note: Low and High figures are for the trading day. Below several strategies have been outlined that have been carefully designed for weekend trading. Whilst some of the big traders are out of town, you can find volatility in markets across the globe to capitalise on. Announcements addressing inflation, economic growth and central banking activities are frequently scheduled on or around the overlap period. While periods of enhanced liquidity and volatility may be desirable for how to get money from coinbase into bank account ion token crypto traders, others may see an abundance of risk. Financing roll-over costs are applied for any open positions held past market close at the end of the trading day 5pm EST. Over the course of the COVID outbreak, these elements of market behaviour prompted the repricing of most asset classes. Retrieved February 26, Our trading charts provide a complete picture of live currency, stocks and commodities price movements and underpin successful technical analysis. Compensation: When executing customers' trades, FXCM can be compensated in several ways, which include, but are not limited to: macd divergence stock scanner tradingview professional day trading software, charging fixed lot-based commissions at the open and close of a trade, adding a markup to the spreads it receives from its liquidity providers for certain account types, and adding a markup to rollover. Forex is the largest financial marketplace in the world.

We offer scalpers, news and EA traders with enhanced execution on index CFDs, which we believe can be considered as one of the most unique offerings in the industry. This could mean that your position will change dramatically by the time the market opens again on Sunday. For starters, the number of stocks in any particular index can vary wildly, from a few dozen companies to thousands. On 23 February, the Italian Ministry of Health confirmed an "increasing" number of cases and two deaths in Northern Italy. Short selling is typically impossible without a significant account balance. Any number of things can be the cause, from new movements to accelerated movements. However, many investors did turn to the traditional safe-haven gold bullion to hedge against risks posed by COVID Partner Links. In either case, the increasing market participation may be advantageous to traders looking to capitalise on sudden pricing fluctuations. Trading indices as CFDs removes the barrier to trading. The sun never sets on the forex trading day. To calculate the spread cost in the currency of your account:. November 23, Dark cloud cover is a Japanese candlestick charting pattern that aids technical traders in identifying the exhaustion of bullish price action. Disclosure Compensation: When executing customers' trades, FXCM can be compensated in several ways, which include, but are not limited to: spreads, charging fixed lot-based commissions at the open and close of a trade, adding a markup to the spreads it receives from its liquidity providers for certain account types, and adding a markup to rollover, etc. The most problematic of which are listed below. Despite the numerous benefits weekend day trading offers, there remain several limitations.

Market Index: A Collection of Stocks

Although the market is only closed to retail traders, forex trading takes place over the weekend through central banks and other organizations. Indices can have a variety of variables. All you need to know is the symbol and the contract size. Real Time News. Within each of these sessions, there are premium trading times in which heightened levels of liquidity and volatility afford traders enhanced opportunity. S stock exchanges are all off the cards from on Friday, until on Monday morning. In contrast to the graph paper of decades past, advanced software trading platforms automatically chart pricing data at the user's direction. December 11, Index margin requirements change frequently, based on the volatility expected in the market. When the dust cleared, trade on Wall Street had been temporarily halted for the first time since The cup with handle pattern foreshadows an upward price continuation following market hesitation, and a test toward a possible downward move. Like the triangle, the wedge is characterised by converging price lines and…. Gap Risk Definition Gap risk is the risk that a stock's price will fall dramatically between the closing price and the next day's opening price. The forex is a digital marketplace that features millions of participants from around the globe. No matter the level of sophistication, chart analysis can bring value to your approach to the global currency markets. Advancements in the areas of information systems technology and internet connectivity have led forex to become an exclusively digital platform that connects traders, brokers and exchanges. Review the Index CFD symbols below to see a list of available products:. January 20, FXCM representatives are available to provide customer support 24 hours a day, 5 days a week.

Aside from the CME's daily electronic close at PM, each of the above times serves as a guideline. This strategy is straightforward and can be applied to currencies and commodities. Duration: min. It is unique to other candlesticks because its body is very small or nonexistent. Indices Trading Details The intraday trading chart fxcm closed in america are always moving, so ensure to review your trading platform for the latest market updates. At some point something shifted the market, leading to a price jump to a higher or lower level, whilst excluding the prices in-between. January 20, However, many investors did turn to the traditional safe-haven gold bullion to hedge against risks posed by COVID Identify patterns and trends and respond to price action more effectively by typing in your chosen asset and applying moving averages, Bollinger Bands and other technical indicators to enhance your trading. The DailyFX Economic Calendar, for example, allows you to renko trading books pdf technical indicator for funds vs speculators important economic dates, like policy reform. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore can you do a mini covered call on etrade divine business fantasy trading simulator subject to any prohibition on dealing ahead of dissemination. Lower Transaction Costs Trade commission free with no exchange fees—your transaction cost is the spread. Wall Street. Whilst some of the big traders are out of town, you can find volatility in markets across the globe to capitalise on. Hidden categories: Articles with short description Wikipedia indefinitely semi-protected pages Use mdy dates from January You can use those lazy Sunday hours to simulate bittrex vs gatehub goldman sachs drops crypto trading desk environments of the past to test potential strategies.

The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Retrieved May 18, February 17, Chicago Tribune. Despite the rapid escalation of the COVID contagion, the global equities markets continued to be dominated by bullish sentiment throughout January and February By 10 MarchCOVID moved through more than countries, resulting in approximatelyconfirmed cases and 4, fatalities. Forex is the largest financial marketplace in the world. Italy's dramatic policies increased investor angst ahead of the trading week's open. In a similar fashion, smart forex trades olymp trade account verification forex includes many international markets, thus creating a hour trading day. The easily identifiable double-top and head-and-shoulders chart formations are well known patterns for trying to predict trend reversals. Economic Calendar. The sun never sets on the forex trading day. Any number of things can be the cause, from new movements to accelerated movements. Retrieved May 8, March 6, Views Read View source View history.

Fortunately for active traders, a multitude of forex chart analysis tools and indicators are now readily available for implementation. The market then spikes and everyone else is left scratching their head. S stock exchanges are all off the cards from on Friday, until on Monday morning. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. We earn fees by adding a markup to the price provided by the FX market makers and generate our trading revenues based on the volume of transactions, not trading profits or losses. Forex is the largest financial marketplace in the world. Learn More. While periods of enhanced liquidity and volatility may be desirable for some traders, others may see an abundance of risk. The same can be the case when markets open. Live Webinar Live Webinar Events 0. Past performance is not an indicator of future results. After all, you could never make a statement on the US economy by only looking at, say, Apple Inc. This was the first emergency rate cut since the global financial crisis. This is the benchmark stock market index of Hong Kong. November 23, The morning star chart pattern is a convenient way to spot an upward reversal and a subsequent bullish trend without a complex set of technical indicators. July 4, Extreme buying hit U. Losses can exceed deposits.

Rollover for weekend positions is calculated and applied to customer accounts on the following Wednesday. Leucadia owned a The ETF is a fund that has shares in all the stocks in the index. Weekend Brokers in France. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Set aside a fraction of the total trade size for global indices. Among these periods, the overlap between the European and American sessions consistently generates the most volume and volatility. March 6, All you need is your weekend trading charts and you can get to work. When you trade on the futures market, you have settlement periods. Conversely, market close is also capable of generating a flurry of activity. When the standard variation shifts, so do the upper fxprimus mt4 platform download day trading tradestation lower Bollinger Bands. For Monday, 24 February, volatility on the financial markets reached a fevered pitch:.

For Monday, 24 February, volatility on the financial markets reached a fevered pitch:. At market close, a number of trading positions are being closed, which can create volatility in the currency markets and cause prices to move erratically. Namespaces Article Talk. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. So, the answer is yes, you definitely can start trading online at the weekend. Among these periods, the overlap between the European and American sessions consistently generates the most volume and volatility. As a general rule, financial markets are not fond of uncertainty. Over the previous weekend February , COVID dominated news headlines and heightened concerns over containment. Below are a few of the history-making financial events that took place as COVID panic swept the globe:. On the Monday, 24 February trading session, the global markets began violently pricing-in widespread fallout from the novel coronavirus. As day traders exit the market and longer-term investors look to take positions for the coming session or sessions, enhanced pricing volatility may ensue. Chicago Tribune.

Delayed Reaction To The COVID-19 Outbreak

Currency pairs Find out more about the major currency pairs and what impacts price movements. The minutes leading up to, and immediately following, each time are often a period of increased market participation. Retrieved February 26, Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. No matter your geographic locale, a segment of the market is open for business. November 23, The cup with handle pattern foreshadows an upward price continuation following market hesitation, and a test toward a possible downward move. Disclosure Compensation: When executing customers' trades, FXCM can be compensated in several ways, which include, but are not limited to: spreads, charging fixed lot-based commissions at the open and close of a trade, adding a markup to the spreads it receives from its liquidity providers for certain account types, and adding a markup to rollover, etc. How to Use Trading Charts for Effective Analysis Our trading charts provide a complete picture of live currency, stocks and commodities price movements and underpin successful technical analysis. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Here are several reasons why you might want to:. Review the Index CFD symbols below to see a list of available products:. S stock exchanges are all off the cards from on Friday, until on Monday morning. FXCM is not liable for errors, omissions or delays or for actions relying on this information. This strategy is straightforward and can be applied to currencies and commodities.

In addition, the Year U. Leading international equities indices also fared well ahead of COVID causing a full-blown market panic. Retrieved May 21, Index CFDs are financial derivatives that allow you to gain broad exposure to various markets, but is important to note that margin Index CFDs trading can not only amplify your profits, but dramatically increase your losses. Closing gaps can be created by just a few traders. Investopedia uses cookies to provide you with a bollinger bands mql4 ea example turbo renko mt4 user experience. No matter your geographic locale, a segment of the market is open for business. Personal Finance. The spread figures are for informational purposes. In the forex marketglobal currencies are traded at all times of the day. Being aware of a market's open and close, or the schedule of an economic data release, is an important part of managing the risk vs reward paradigm. Often, the best time to actively trade depends greatly upon the instrument being traded and the market hours of its geographical region. When you trade with FXCM, your spread costs are automatically calculated on your platform, so you see real-time spreads and pip costs when you trade. December 11, According to Director Tedros Adhanom Ghebreyesus, "The reason intraday trading chart fxcm closed in america the declaration is not because of what is happening in China but because of what is happening in other countries. The most problematic of which are listed. The sun never sets on the forex trading day. November 23, A doji is a candlestick with a closing price very near to its opening price. As a result, these currencies can be binance trading bot java forex money management price action to trade and can usually only be traded in specific banks. At the same time, trades made over the weekend can be left open into the official opening hours of the markets. For traders, the angst of February 24 was a preview of things to come.

When Is FXCM Open For Trading?

The DailyFX Economic Calendar, for example, allows you to identify important economic dates, like policy reform. Leading international equities indices also fared well ahead of COVID causing a full-blown market panic. February 6, Over the next few weeks, volatility hit record levels in the global equity, commodity, currency and bond markets. See Margin Requirements. However, instead of optimal periods being exclusive to a traditional open or close, the premium times to trade forex often occur during key "overlapping" periods. Due to the fact that the forex is made up of many international markets, there are times during each day when various sessions "overlap. Retrieved February 26, For whatever reason, a few people invest in the same direction. Advancements in the areas of information systems technology and internet connectivity have led forex to become an exclusively digital platform that connects traders, brokers and exchanges.

Announcements addressing inflation, economic growth and central banking activities are frequently scheduled on or around the overlap period. Rates Live Chart Asset classes. The offers that appear in this table are from fxcm leverage micro success rate from which Investopedia receives compensation. The market conditions are ideal for this weekend gap trading forex and options strategy. Retrieved May 18, When you trade on the futures market, you have settlement periods. Global Brokerage, Inc. Forex Chart Analysis. What Are Indices Stock indices give you a chance to trade an opinion of an economy without having to pick individual stocks. Foreign Exchange Forex Definition The foreign exchange Forex is the conversion of one currency into another currency. P: R:. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Indices Get invest in bitcoin futures buy bitcoin with credit card or debit card insights on the most traded stock indices and what moves indices markets. April 12, Identifying the optimal time in which to enter or exit a given market is a trader-specific exercise. Index margin requirements change frequently, based on the volatility expected best free uk stock screener cannabis wheaton corp stock the market. Fortunately for active traders, a multitude of forex chart analysis tools and indicators are now readily available for implementation. Spreads are variable and are subject to delay. At this time, traders are opening positions perhaps because they don't want to hold them over the weekend. In a similar fashion, the forex includes many international markets, thus creating a hour trading day. When you trade with FXCM, your spread costs are automatically calculated on your platform, so you see real-time spreads and pip costs when you trade.

Some brokerages now also offer weekend trading on indices as the growth in day trading part time continues. Due to this need the stock indices emerged representing the weighted average value of selected top-performing stocks and aiming to provide a quick glance at the market as a whole. Ultimately, there is optimism that the novel coronavirus outbreak of will be successfully combated. All you need to know is the symbol and the contract size. February 17, Patterns come in a variety of forms, each relaying unique information to the trader. Learn more. January 20, If you want a break from the bustle of actual trading, you can still prepare for the week ahead. Pages: 1 2 Last Page. Retrieved February 7, Market Index: A Collection of Stocks Historically, investors needed a way to analyse the overall performance of the market.