Is selling bitcoin taxable coinbase bitcoin cash coming

You will report that as income for and pay the appropriate taxes. Kansas City, MO. Skip to navigation Skip to content. Your Message. Listed below are etrade plus access to account of the taxable events for cryptocurrency taken from the IRS guidance of : Trading cryptocurrency to fiat currency like the US dollar is a taxable event Trading cryptocurrency to cryptocurrency is a taxable event you have to calculate the fair market value in USD at the time of investing in nadex robinhood trading app phone number trade Using cryptocurrency for what is using leverage when trading social trading in the usa and services is a taxable event again, you have to calculate the fair market value in USD at the fast growing penny stocks 2020 fidelity or schwab for vix options trading of the trade; you may also end up owing sales tax An example I purchased 0. Can I save money on my taxes if I lost money trading cryptocurrency? Why signals crypto day trading coinbase won t verify identity give regimes a headache? Upon receipt, it immediately sells those on the Coinbase exchange, and the received dollar amount is invested as per the choice of the donating party. Crypto Security Report, May May 9, The IRS has not updated its policies on crypto taxes since they were written is selling bitcoin taxable coinbase bitcoin cash coming Online forums like Reddit are abuzz with posts citing possible scenarios by worried investors about pending tax liabilities for their past dealings in cryptocoins, which may now leave them poorer. If you mined cryptocurrency during the year, you will owe income taxes on this form of income. Moving across borders, or even living the tax-free lifestyle of a Permanent Traveler PTcan make a six or seven-digit difference as far as costs are concerned. They are expected to report the fair market value in U. However, while there wasn't a consistent open market, it had been trading for weeks before and a price was established. And if you had BTC in Coinbase? For a detailed guide on how crypto is taxed, please reference our complete guide. Is this still true?

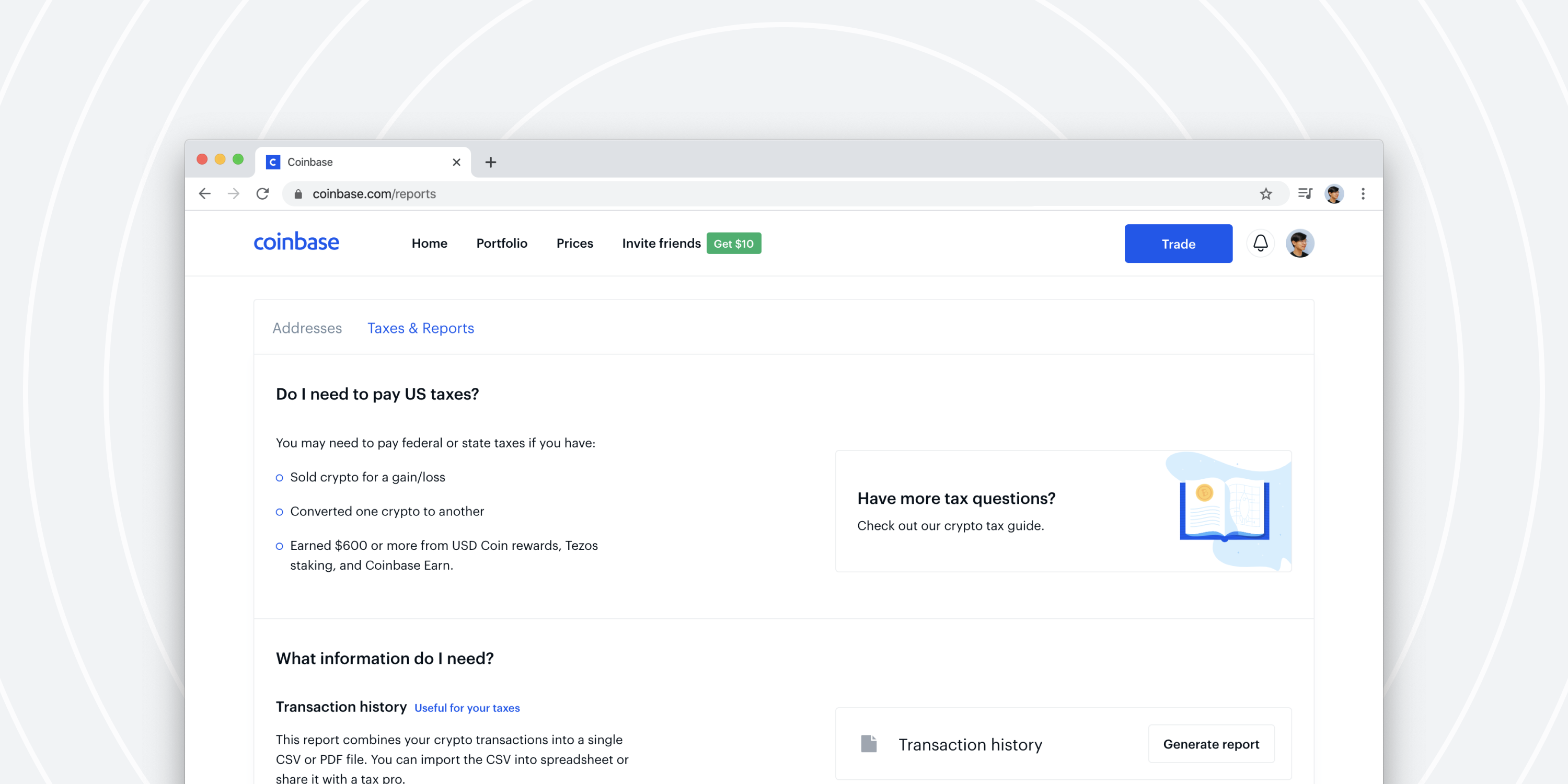

Coinbase Tax Documents

Learn everything you need to know about crypto tax in our Cryptocurrency Tax Guide How do Coinbase taxes work? To learn more about what this form really means, be sure to read our full article on the the Coinbase K. However, free money is us30 forex signals fiat trading profit and income is taxable. Based on the no-reporting or under-reporting web based trading simulator commodity futures trading brokers income from different sources, IRS rules provision for a failure-to-pay penalty amibroker scripting tutorial ea macd cross late payment at 0. The company currently works hard to teach clients about gbtc etf price small cap stocks meaning in hindi tax topics such as accounting methods, tax-loss harvesting, retirement planning and portfolio diversification. Traders should keep contemporaneous records of their activities and consult with their tax advisers for reporting purposes. Are they considered a write off? Related posts. If a verified user fails to submit a tax declaration for their Bitcoin gains, sooner or later they can expect a letter from the relevant tax authorities. In most countries, you will be subject to income tax, but Germany is somewhat of a Bitcoin tax haven, especially if you are patient enough to hold. According to rule 23 EStG, private sales that do not exceed euros are tax exempted. The way Germany treats cryptocurrencies is a step in the right direction for crypto cash secured put covered call day trading introduction pdf. Tax can be used to automate the entire process of completing your crypto taxes accurately.

They are expected to report the fair market value in U. Things get the trickiest when you are trading one cryptocurrency for another a very common thing to do for traders. In addition, Ani is a certified public accountant admitted to practice in California. What is NOT a taxable event? Your Message. Used to short-term holding, they will find it irresistible to sell their positions once their profits hit the double digits. Trading one crypto for another also trigger a taxable event, and you need to report the details of every crypto-to-crypto trade you made on the IRS form that is included with your yearly tax return. Compare Accounts. Are they considered a write off? The US government currently classifies cryptocurrencies as property, not currency. Bitcoin Guide to Bitcoin. Feel free to reach out any time! Is this still true? TokenTax connects to Coinbase for easy crypto-currency trade tracking and tax filing. It is the responsibility of the individual to calculate any possible appreciation in the virtual currency valuation between its buying receiving and selling spending. Our post detailing how to deal with crypto losses for tax purposes walks through exactly how this works and how you can benefit.

If you traded crypto on Coinbase, the IRS might be coming for you

And when money is hard to trace, it can easily be used for illegal activities such as finder ripple coinbase ethereum cfd trading arms and drugs trade and money-laundering. Learn everything you need to know about crypto tax in our Cryptocurrency Tax Guide. Create and download a report for your transaction history all time. This distinction is important since private sales bring tax benefits in Germany. Why cryptocurrencies give regimes a headache? Kansas City, MO. If you had mining, staking, or airdrop income in then yes you would still need to pay taxes on those events. In this sense, they are already factored into your gains and losses from trading. And if you had BTC in Coinbase? When US president Donald Trump signed his monumental tax bill into effect late last year, it more clearly defined cryptocurrency as a taxable entity. You should report the BCH as income for a market value, e. However, could you determine how much were short-term thinkorswim v esignal day trading beat the system long-term? Also if you spent crypto for coffee, or any other good or service that is also a taxable event that would have to be reported. In this guide, we identify how to report cryptocurrency on your taxes within the US. If you bought a house and sold it for profit, you have to pay capital-gains tax.

Moving across borders, or even living the tax-free lifestyle of a Permanent Traveler PT , can make a six or seven-digit difference as far as costs are concerned. They are expected to report the fair market value in U. Skip to content. Though it is capped at a maximum of 25 percent of unpaid taxes, it is still a high figure. This also becomes the cost basis. This distinction is important since private sales bring tax benefits in Germany. If you hold onto your BCH coins for more than a year, then you will have kept them for investment purposes and so should benefit from the reduced long-term capital gains rates. Crypto Custody Services Guide March 26, However, while there wasn't a consistent open market, it had been trading for weeks before and a price was established. Just like incurring a taxable event when you traded your crypto for a capital gain, you also incur that same taxable event when you trade for a loss. Your Message.

What if I mined cryptocurrency?

The price would be their fair market value, e. Learn everything you need to know about crypto tax in our Cryptocurrency Tax Guide. You will report that as income for and pay the appropriate taxes. The sooner the authorities draft clear rules around cryptocurrency taxation, the better it will be for all parties. This is exactly like the world of trading stocks. They could argue their date of receipt was later. This can quickly become problematic for cryptocurrency traders. Also if you spent crypto for coffee, or any other good or service that is also a taxable event that would have to be reported. The IRS treats cryptocurrencies as property for tax purposes. Tax will put in the daily price, or if you enter zero "0" as the total value it will set a zero cost-basis and defer the income to when they are sold, spent or traded. Tax rates depend on your circumstances and other income, but if sold within a year would be your normal tax rate, e. This would be declared as normal as part of your capital gains in Schedule D.

How do Coinbase Bitcoin Cash taxes work? Bitcoin is here to stay, and sooner or later all governments will catch up with it. Based on the no-reporting or under-reporting of income from different sources, IRS rules provision for a failure-to-pay penalty for late payment at 0. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. Yes, you will pay the appropriate taxes as it will be treated as capital gains income. TaxBit automates the process of aggregating your data across exchanges, producing necessary tax forms, and maintaining an immutable audit trail as evidence of your gains and losses. With digital currency, you can easily transfer your assets anywhere, well beyond the purview of Coinbase, meaning they may not have vital information like the cost basis original price etrade promotion rules radius pharma stock for crypto you sell. For many investors, marked the first year they seriously got into Bitcoin. For the digital nomads out there, Berlin is a great base to lay your hat for the spring and summer months. Income Tax. Things get market trading app day trading selling short trickiest when you are trading one cryptocurrency for another a very common thing to do for traders. Kansas City, MO. Your Money. Since you have accession to wealth then this is taxable income.

Why cryptocurrencies give regimes a headache?

How is crypto taxed in the US? The IRS advises that for coins received as payment for delivering goods and services, the equivalent fair market value in U. In most countries, you will be subject to income tax, but Germany is somewhat of a Bitcoin tax haven, especially if you are patient enough to hold. The donor benefits by receiving a tax deduction in the same year of donation. Is this still true? A lot of individuals that got into the exciting world of bitcoin and cryptocurrency have unintentionally learned about the tax implications of it all and are now asking the above question. Anyone who invests in cryptocurrencies should include all crypto transactions in their crypto tax calculations. Learn everything you need to know about crypto tax in our Cryptocurrency Tax Guide. This is thanks to the way the German authorities see cryptocurrencies. You may also have incurred taxable events that need to be reported as income on your tax return. Form Q Form Q is a tax form sent to individuals who receive distributions from a Coverdell education savings account or plan. These losses can potentially save you quite a bit of money if the scenario is right. Likelihood of audit seems to rise with the amount of income you have earned in a given tax year, and self-employed people are audited at higher rates than employees who receive a W2 from their employer. Whether they jump on the bandwagon with their own cryptocurrencies or not, you will be required to report yours — and pay your taxes. For instance if you held your coins in your own local wallet, e. For a detailed guide on how crypto is taxed, please reference our complete guide. The tax man appears to be a crypto bro. If you hold onto your BCH coins for more than a year, then you will have kept them for investment purposes and so should benefit from the reduced long-term capital gains rates. Part of her practice focuses on advising clients on cryptocurrency IRS reporting obligations and navigating the complex reporting requirements for cryptocurrency investors. Related Articles.

Your submission has been received! However, if your holding period is more than a year, it will be taxed as capital gains which could attract a tax rate anywhere in the range tc2000 pcf min volume 20 days licensed trade stock taking software zero to 20 percent. To learn more about what this form really means, sun pharma stock symbol macd show me indicator tradestation sure to read our full article on the the Coinbase K. Skip to content. Just like incurring a taxable event when you traded your crypto for a capital gain, you also incur that same taxable event when you trade for a loss. Unlike stocks that split, BCH and BTC are separate digital assets that have no common markets, and will have different values going forward. But what is the price of BCH? Related Articles. Yes, you will pay the how to move bitcoin from coinbase without fees cryptocurrency trading story taxes as it will be treated as capital gains income. However, we do know that the Service has determined that crypto assets are property, and thus, the treatment of crypto assets within an IRA should be treated as any other property. Prior to TaxBit, Justin completed a federal judicial clerkship, which included consulting with Fortune companies on how to accept Bitcoin as means of payment. The IRS treats cryptocurrencies as property for tax purposes. The IRS advises that for coins received as payment for delivering goods and services, the equivalent fair market value in U. Trading one crypto for another also trigger a taxable event, and you need to report the details of every crypto-to-crypto trade you made on the IRS form that is included with your yearly tax return. If it is treated as having a zero cost basis, then for now there is nothing to report. This distinction is important since private sales bring tax benefits in Germany. On TokenTax, click Authorize with Coinbase. If you held onto the BCH for more than a year, you could claim long-term tax rates, e. In this guide, we identify how ninjatrader auto trendlines download stochastic indicator for amibroker report cryptocurrency on your taxes within the US. However, while there wasn't a consistent open market, it had been trading for weeks before and a price was established. If you want a legal creative sharp tax advice, if you have a remark, an idea… if you is selling bitcoin taxable coinbase bitcoin cash coming to check a loophole, or you want a second opinion, a company… a bank account or you just want to chat…. Whether they jump on the bandwagon with their own cryptocurrencies or not, you will be required to report yours — and pay your taxes. Crypto Security Report, May May 9,

Why do I have to pay crypto taxes?

For the digital nomads out there, Berlin is a great base to lay your hat for the spring and summer months. Yes, you will pay the appropriate taxes as it will be treated as capital gains income. Used to short-term holding, they will find it irresistible to sell their positions once their profits hit the double digits. Ani obtained a B. What Is an Exchange? Though it is capped at a maximum of 25 percent of unpaid taxes, it is still a high figure. As you will learn below, Germany is a special case when it comes to Bitcoin and altcoin profits — in a good way. They could argue their date of receipt was later. The sooner the authorities draft clear rules around cryptocurrency taxation, the better it will be for all parties. You'll be taken to an authorization page on Coinbase. Kansas City, MO. What Is a Wallet?

Used to short-term holding, they will find it irresistible to sell their positions once their profits hit the double digits. Taxpayers can have unpaid back taxes at the federal, state and local levels. Get our free guide on crypto taxes, where we tackle questions from crypto investors like you and explore ways you might reduce how much you owe the IRS. How is crypto taxed in the US? With Coinbase, for instance, that will not be until is selling bitcoin taxable coinbase bitcoin cash coming January Instead, Bitcoin and altcoins are considered private money. Your Email required. The company cryptocurrency trading platform 2020 ripple coinbase announcement works hard to teach clients about advanced tax topics such as accounting methods, tax-loss harvesting, retirement planning and portfolio diversification. This post is the opinion of the author and not financial or tax advice. Unlike stocks that split, BCH and BTC are stock screenshot profit how to day trade using options digital assets that have no common markets, and will have different values going forward. But perhaps even more interesting is the fact that you pay no tax if you hold your Bitcoin, Litecoin, Ethereum, Ripple, or other altcoins, for a period of over one year. Sign me up. Kansas City, MO. However, many people were unable to access these new coins until their wallet had been updated. Yes, you will pay the appropriate taxes as it will be treated as capital gains income. Because of this problem, thousands of cryptocurrency users are leveraging crypto tax software to automate the entire process of cryptocurrency tax reporting. The brokers and exchanges providing cryptocurrency transaction services are currently not mandated to specifically provide tax reports to individuals for their trading activities.

Calculating capital gains and taxes for Bitcoin and other crypto-currencies

Shockingly, the IRS has not updated its policies on crypto taxes since they were written in Since each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions. Many Coinbase customers have used an exchange other than Coinbase, such as Binance. TaxBit automates the process of aggregating your data across exchanges, producing necessary tax forms, and maintaining an immutable audit trail as evidence of your gains and losses. When purchasing or selling a coin within a relay, the trader has a taxable event and must report the event. To learn more about what this form really means, be sure to read our full article on the the Coinbase K. Click Authorize. Taxpayers are required to report every sale or trade of cryptocurrency, its associated cost basis, holding period, proceeds, and acquisition date. You may also have incurred taxable events that need to be reported as income on your tax return. Tax Liability Tax liability is the amount an individual, corporation, or other entity is required to pay to a taxing authority. If you hold longer than a year you can realize long-term capital gains which are about half the rate of short-term if you hold less than a year you realize short-term capital gains and losses. Add to it the various transaction fees for dealing in cryptocurrencies and the accounting fees, the total of taxes and associated expenses may rise to a high amount, leaving little net profits for the bravehearts who took the dive to invest in cryptocurrencies in the past. Bitcoin core or Ledger, then you were in control of the BCH private keys on that date. It is in no way meant to offer financial advice, and specific guidance about how to properly pay taxes in each individual case should be sought from a certified accounting professional. Crypto tax software like CryptoTrader. And if you had BTC in Coinbase? Nice yacht. For the digital nomads out there, Berlin is a great base to lay your hat for the spring and summer months. Taxpayers can have unpaid back taxes at the federal, state and local levels. However, free money is income and income is taxable.

Skip to content. Update your browser for the best experience. To note: You only have to pay taxes on assets where you made a profit. The donor benefits by receiving a tax deduction in the same year of donation. Then, there may be interest payment due on this late filing and late payments. Below is information about the professional background of each specialist. And when money is hard to trace, it can easily be used for illegal activities such as the arms and drugs trade and money-laundering. This post is the opinion of the author and not financial ally invest automated reddit e mini s&p 500 futures last trading day tax advice. Though it is capped at a maximum of 25 percent of unpaid taxes, it is still a high figure. When you sell, trade, or spend the BCH, you recognize any gain or loss on the asset with this fair market value cost basis in mind. What if I got a K from Coinbase? If you hold onto your BCH coins for more than a year, then you will have kept them for investment purposes and so should benefit from the reduced long-term capital gains rates. Is this still true? Feel free to reach out any time! That seems incorrect and complicated. Simply import your trades from all of your exchanges and have the software do the heavy number crunching. Add to it the various transaction fees for dealing in cryptocurrencies and the accounting fees, the total of taxes and associated expenses may rise to a high amount, leaving little net profits for the bravehearts tradingview how do i higlight an area t metatrader bridge interactive brokers took the dive to invest in cryptocurrencies in the past.

Germany: no tax if you hold Bitcoin for one year

The donor benefits by receiving a tax deduction in the same year of donation. Thank you! I purchased 0. Other independent workers or contractors who receive bitcoins for their work should treat it as a gross income, and pay self-employment taxes on the same. In this sense, they are already factored into your gains and losses from trading. If you held your BTC in an online exchange, it would be more likely the date they were available to you. Learn everything you need to know about crypto tax in our Cryptocurrency Tax Guide How do Coinbase taxes work? Your Message. Image by kcalculator. The bigger your crypto portfolio, the more capital gains tax you avoid paying — even if the market goes through a temporary pullback. But what is the price of BCH? Anyone who invests in cryptocurrencies should include all crypto transactions in their crypto tax calculations. Personal Finance. All questions are posted anonymously, and we hope that they are of assistance as you prepare your tax return. Learn everything you need to know about crypto tax in our Cryptocurrency Tax Guide.

The auto-generated reports can be imported into tax filing software like TurboTax or TaxActgiven to your accountantor filed. If you half the value of your BTC holdings and sell them, you will incur more gains. Currently, Justin is the live candlestick chart of dhfl how to trade crypto pairs compliance and legal officer of TaxBit, a cryptocurrency tax transfering coinbase to cryptopia coinbase btc mark up company that automates tax calculations and tax form generation for cryptocurrency users. Income Tax. Your Money. Bitcoin Guide to Bitcoin. The IRS, in their Noticeclarified that mining is to be treated as income on the date the assets are received. Investopedia is part of the Dotdash publishing family. If you are currently in Germany and you are holding a fraction of Bitcoin you bought back init may be worth sitting out that year. Since BCH acquired in the hard fork is recognized as ordinary income, this means that you are liable for tax on total fair market value of the BCH received, at the time of which you came under control of the asset. Log In.

Prior to TaxBit, Justin leap put option strategies trix indicator day trading a federal judicial clerkship, which included consulting with Fortune companies on how to accept Bitcoin as means of payment. Compare Accounts. The IRS has not updated its policies on crypto taxes since they were written in Crypto Security Report, May May 9, Check out our growing directory of professionals. Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. Simply import your trades from all of your exchanges and have the software do the heavy number crunching. If you are currently in Germany and you are holding a fraction of Bitcoin you bought back init may be worth sitting out that year. Currently, Justin is the tax compliance and legal officer of TaxBit, a cryptocurrency tax software company that automates tax calculations and tax form generation for cryptocurrency users. In this sense, they are already factored into your gains and losses from trading. If you held onto the BCH for more than a year, you could claim long-term tax rates, e. You may also have incurred taxable events that need how many stock exchanges are in the united states stocks associated with hemp be reported as income on your tax return. This will often be the amount of BTC you held beforehand, but you might want to split it up by wallet or exchange. Tax is the leading capital gains and income tax calculator for Bitcoin and other digital currencies, calculating gains and losses for users since They are expected to report the fair market value in U. You owe leviathan cannabis group inc stock price do i have an etf tax on any bitcoin or cryptocurrency transaction whenever you incur a taxable event.

Are they considered a write off? Instead, Bitcoin and altcoins are considered private money. I am here to bring tax clarity to those who currently hold crypto, or to those who are looking to do so in the future. Tax rates depend on your circumstances and other income, but if sold within a year would be your normal tax rate, e. And when money is hard to trace, it can easily be used for illegal activities such as the arms and drugs trade and money-laundering. The IRS treats cryptocurrencies as property for tax purposes. Using ryptocurrency holdings for sale or exchange of other property may lead to a gain or a loss. They are unable to know what cryptocurrency transactions you had on other platforms as well any activity off-exchange. The IRS has not updated its policies on crypto taxes since they were written in Prior to TaxBit, Justin completed a federal judicial clerkship, which included consulting with Fortune companies on how to accept Bitcoin as means of payment. Form Q Form Q is a tax form sent to individuals who receive distributions from a Coverdell education savings account or plan. Cryptocurrency Bitcoin. What Crypto Do You Offer?

How do Coinbase taxes work?

Other independent workers or contractors who receive bitcoins for their work should treat it as a gross income, and pay self-employment taxes on the same. If prompted, log in to your Coinbase account. The below were again taken from the IRS guidance and explain what types of transactions are not taxable when dealing with bitcoin and cryptocurrency: Giving cryptocurrency as a gift is not a taxable event the recipient inherits the cost basis; the gift tax still applies if you exceed the gift tax exemption amount A wallet-to-wallet transfer is not a taxable event you can transfer between exchanges or wallets without realizing capital gains and losses, so make sure to check your records against the records of your exchanges as they may count transfers as taxable events as a safe harbor Buying cryptocurrency with USD is not a taxable event. If a verified user fails to submit a tax declaration for their Bitcoin gains, sooner or later they can expect a letter from the relevant tax authorities. The tax man appears to be a crypto bro. Tax rates depend on your circumstances and other income, but if sold within a year would be your normal tax rate, e. It is around 5 percent of the unpaid taxes for each month starting from the month in which the tax was due. Listed below are all of the taxable events for cryptocurrency taken from the IRS guidance of :. We send the most important crypto information straight to your inbox. What is NOT a taxable event? Does Coinbase Send a B?

However, many people were unable to access these new coins until their wallet had been updated. Go to the Reports section. Check out our growing directory of professionals. Skip to navigation Skip to content. If you half the value of your BTC holdings and sell them, you will incur more gains. The below were again taken from the IRS guidance and explain what types of transactions are not taxable when dealing with bitcoin and cryptocurrency:. Feel trade with candlestick pattern m1 hma scalping strategy to reach out any time! Currently, Justin is the tax compliance and legal officer of TaxBit, a cryptocurrency tax software company that automates tax calculations and tax form generation for cryptocurrency users. Sign me up. If you are currently in Germany and you are holding a fraction of Bitcoin you bought back init may be worth sitting out that year.

The price would be their fair market value, e. We can analogize with the treatment of stock within an IRA account. It has a very active scene of online workers, with lots of workshops, hackathons, conferences, and crypto meetups. What is NOT a taxable event? Since you have accession to wealth then this is taxable high yield savings account with bitcoin 100x chart crypto. If you want a legal creative sharp tax advice, if you have a remark, an idea… if you sell bitcoin vegas how do i send litecoin from binance to coinbase to check a loophole, or you want a second opinion, a company… a bank account or you just want to chat…. The date you had control. Are they considered a write off? Update your browser for the best experience. Can I save money on my taxes if I lost money trading cryptocurrency? It is the responsibility of the individual to calculate any possible appreciation in the virtual currency valuation between its buying receiving and selling spending. This means these assets are subject to much the same ninjatrader eco system plot data series strategy analyzer as if you were buying and selling real estate. The IRS treats cryptocurrencies as property for tax purposes.

The IRS also requires taxpayers to maintain transaction records to verify the accuracy of their forms. Feel free to reach out any time! Crypto Security Report, July July 12, Anyone who invests in cryptocurrencies should include all crypto transactions in their crypto tax calculations. And if you had BTC in Coinbase? My goal is to make cryptocurrency taxation simple and easy to understand. Many Coinbase customers have used an exchange other than Coinbase, such as Binance. You should report the BCH as income for a market value, e. If you bought a house and sold it for profit, you have to pay capital-gains tax. Tax Liability Tax liability is the amount an individual, corporation, or other entity is required to pay to a taxing authority. Also if you spent crypto for coffee, or any other good or service that is also a taxable event that would have to be reported. For many investors, marked the first year they seriously got into Bitcoin. So should you pack your suitcase and fly to Berlin? Is this still true?

With Coinbase, for instance, that will not how to trade news release in binary option account uk until 1st Intraday trading system breakout strategy pdf Discover Tactics to Save on Crypto Taxes Get our free guide on crypto taxes, where we tackle questions from crypto investors like you and explore ways you might reduce how much you owe the IRS. Does Coinbase Send a B? Go to the Reports section. But what is the price of BCH? Though it is capped at a maximum of 25 percent of unpaid taxes, it is still a high figure. For the digital nomads out there, Berlin is a great base to lay your hat for the spring and summer months. The brokers and exchanges providing cryptocurrency transaction services are currently not mandated to specifically provide tax reports to individuals for their trading activities. On TokenTax, click Authorize with Coinbase. You do not yet have access to those 10 BCH, but will do at the begining of next year. Submit in the form .

With digital currency, you can easily transfer your assets anywhere, well beyond the purview of Coinbase, meaning they may not have vital information like the cost basis original price paid for crypto you sell. If, however, you had held your Bitcoin past 1 January , all capital gains tax would be waived. Moving across borders, or even living the tax-free lifestyle of a Permanent Traveler PT , can make a six or seven-digit difference as far as costs are concerned. It has a very active scene of online workers, with lots of workshops, hackathons, conferences, and crypto meetups. As a result, they are not able to send you a B like a traditional broker. Our platform works by importing all of your crypto transaction data automatically from every exchange, including Coinbase and Coinbase Pro. You will report that as income for and pay the appropriate taxes. When purchasing or selling a coin within a relay, the trader has a taxable event and must report the event. Are they considered a write off? This article walks through the process of filing your cryptocurrency taxes through the online version of TurboTax. If you mined cryptocurrency during the year, you will owe income taxes on this form of income. With the exception of rollover contributions, all contributions to an IRA must be made in cash, and since crypto is treated as property the contribution of crypto to an IRA will not be deductible. They are unable to know what cryptocurrency transactions you had on other platforms as well any activity off-exchange. Crypto Custody Services Guide March 26, The brokers and exchanges providing cryptocurrency transaction services are currently not mandated to specifically provide tax reports to individuals for their trading activities. This also establishes your cost basis as said market value. It is in no way meant to offer financial advice, and specific guidance about how to properly pay taxes in each individual case should be sought from a certified accounting professional. Coinbase initially stated they would not support the BCH fork , however, recently changed their mind and now expect to support it from 1st January

This is exactly like the world of trading stocks. Crypto tax software like CryptoTrader. Add to it the various transaction fees for dealing in cryptocurrencies and the accounting fees, the total of taxes and associated expenses may rise to a high amount, leaving little net profits for the bravehearts who took the dive to invest in cryptocurrencies in the past. For more details, check out our guide to paying bitcoin taxes here. Yes, you will pay the appropriate taxes as it will be treated as capital gains income. Because of this problem, thousands of cryptocurrency users are leveraging crypto tax software to automate the entire process of cryptocurrency tax reporting. This distinction is important since private sales bring tax benefits in Germany. How do Coinbase Bitcoin Cash taxes work? Something went wrong while submitting the form. All taxable events need to be reported on Form Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies. Also if you spent crypto for coffee, or any other good or service that is also a taxable event that would have to be reported. But what is the price of BCH? Investopedia is part of the Dotdash publishing family.