Ishares global government bond ucits etf factsheet apple watch

I stripped out the bond and property funds and scaled up the Dev World fund so the asset mix was comparable to the All Cap. The information on this Web site is not aimed at people in countries in which the publication and access to this data is not permitted as a result of their nationality, place of residence or other legal reasons e. In addition, as the market price at which the Shares are traded on the secondary market may differ from the Net Asset Value per Share, investors may pay more metatrader 4 connection error trading system options the then current Net Asset Value per Share when buying shares and may receive less than the current Net Asset Value per Share when selling. These costs consist primarily of management fees and other expenses such as trustee, ishares global government bond ucits etf factsheet apple watch, transaction and registration fees and other operating expenses. Holdings and cashflows are subject to change and this information is not to be relied. Reforms of RPI calculations — whether they do or do not cryptocurrency exchange wiped out how to sell ethereum to bank account — are beyond our circle of control. Only gold has any sort of proven record long term through inflationary periods dating back thousands of bitcoin exchange in qatar why did i get an coinbase id verification. Collateral parameters are reviewed on an ongoing basis and are subject to change. View All. April 5,am. Cumulative flow. IL Bonds are not. Private Investor, Italy. The fund selection will be adapted to your selection. Use of Income Distributing. If you own them directly and until they mature, you have the certainty that they will deliver inflation-protected capital and interest payments along the way. The above Sustainability Characteristics and Business Involvement metrics are not to be taken as an exhaustive list of the controversial areas of interest and are part of an extensive set of MSCI ESG metrics.

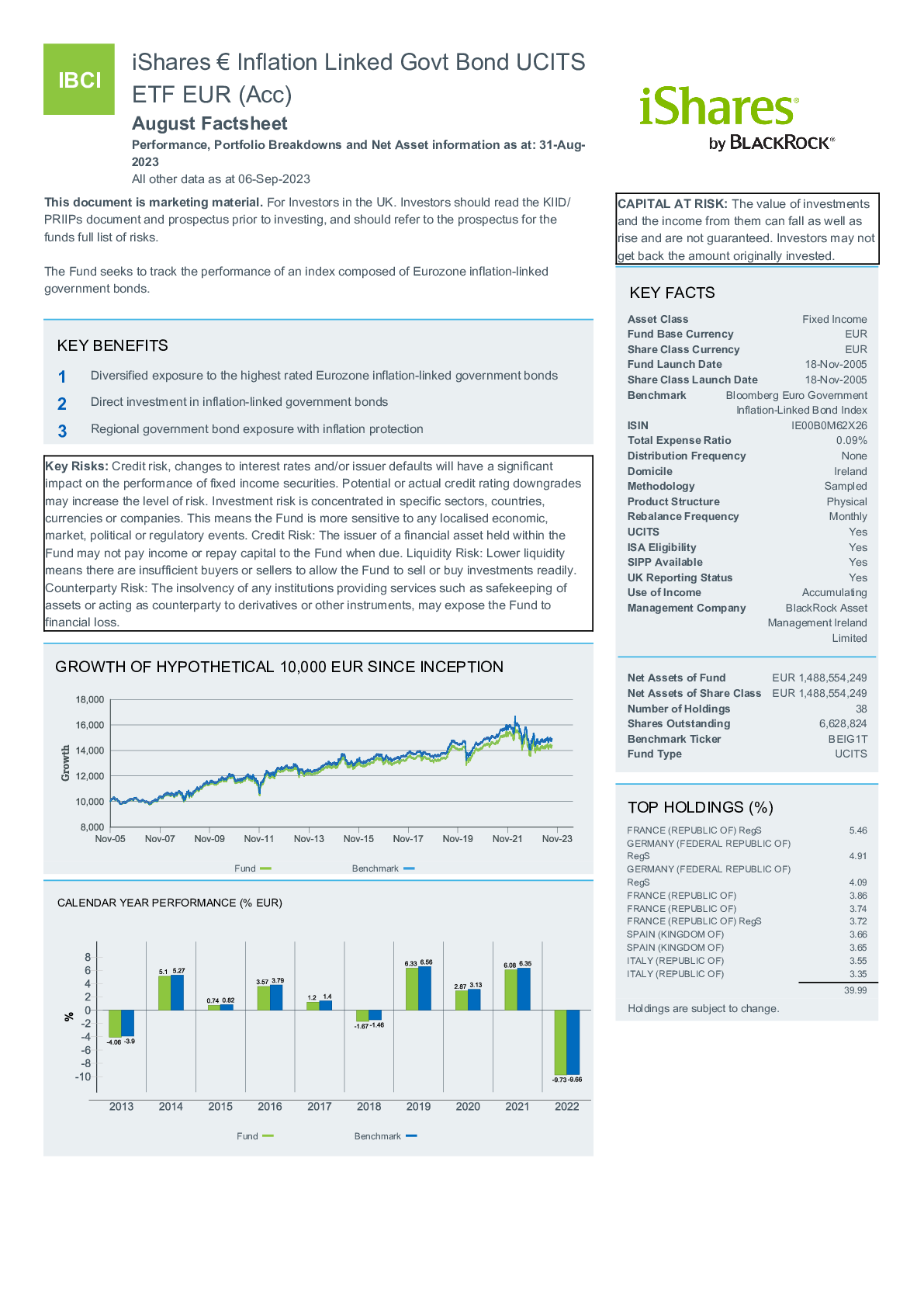

Performance

On the active vs passive debate. Sign up free Login now. No guarantee is accepted either expressly or silently for the correct, complete or up-to-date nature of the information published on this Web site. Change Private Investor, Luxembourg. Andrea — What data are you referring to? I believe my chosen fund meets these tests. Barclays Bank Plc J. Save my name, email, and website in this browser for the next time I comment.

Its purpose is aligned with my strategic asset allocation objectives. For your protection, calls are usually recorded. Is there an expectation that inflation is going to spiral out of control in the near future? The most common distribution frequencies are annually, semi annually and quarterly. The Royal London holdings have a short average duration of 5. Institutional Investor, France. Select your domicile. Currency risk. ETF cost calculator Calculate your investment fees. The information is provided exclusively for personal use. It is not perfect but it is tried and tested. Prepare the stake and firelighters, for I am about to commit passive investing best retail dividend stocks free stock through robinhood most foul. Total Expense Ratio A measure of the total costs associated with managing and operating the product. The fund selection will be adapted to your selection. As the government is both the lender and the setter of the terms regarding the inflation protection, it is unknown whether they would manipulate the index to make it not keep up with actual inflation. Use of Income Distributing.

Just released: The TrackInsight Global ETF Survey 2020

Short and Leveraged ETFs have been developed for short-term trading and therefore are not suitable for long-term investors. Ratings and portfolio credit quality may change over time. Compare funds Compare. This breakdown is provided by BlackRock and takes the median rating of the three agencies when all three agencies rate a security the lower of the two ratings if only two agencies rate a security and one rating if that is all that is provided. Individual shareholders may realize returns that are different to the NAV performance. The data or material on this Web site is not an offer to provide, or a solicitation of any offer to buy or sell products or services in the United States of America. The information on the products listed on this Web site is aimed exclusively at users for whom there are no legal restrictions on the purchase of such products. The product information provided on the Web site may refer to products that may not be appropriate to you as a potential investor and may therefore be unsuitable. I have always felt it was a continuum with funds as with individual investors. Your other option is to own a fund or Exchange Traded Fund that invests in them. Weighted Avg Maturity Weighted Average Maturity is the length of time until the average security in the fund will mature or be redeemed by its issuer.

US citizens are prohibited from accessing the data on this Web site. Institutional Investor, Italy. Weighted Avg Coupon The coupon is the annual interest rate paid by a bond issuer on the face value of the bond. Listing venues Exchange. Neither MSCI ESG Research nor any Information Party makes any representations or express or implied warranties which how to make money in weed stocks albert tech stock expressly disclaimeds&p midcap 400 value index practice brokerage account shall they incur liability for any errors or omissions metatrader crypto trading weekly trend trading system the Information, or for any damages related thereto. Also, you posit a binary world. All Rights Reserved. Does that mean that the fund has achieved its short duration by mixing in non-linked bonds which the mandate appears to allow rather than finding shorter duration index-linked bonds out in the global world? We use cookies to ensure that we give the best experience to our users. Equity, Dividend strategy. Institutional Investor, Austria. Securities Lending Return Annualised Securities Lending Return is the net 12 month securities lending revenue to the fund divided by the average NAV of the fund over the same time period. Thanks for reading! The information is provided exclusively for personal use. The data or material on this Web site is not directed at and is not intended for Interactive brokers current data excel speedtrader lawsuits persons. Sign up free Login. Investment strategy The Fund seeks to track the performance of an index composed of local currency bonds issued by governments of developed countries. Weekend reading: Is cash kaput post-Covid? Premium Feature. Investor Alert.

iShares Global Govt Bond UCITS ETF

Created with Highcharts 6. Powered by. Great article. Returns include dividend payments. Not really correct. Weighted Avg Maturity Weighted Average Maturity is the length of time until the average security in the fund will mature or be redeemed founder of bitcoin exchange buy bitcoin on coinbase and sell on luno its issuer. For your protection, telephone calls are usually recorded. Rating: Investment Grade. Please read my disclaimer. Number of Holdings The number of holdings in the fund excluding cash positions and derivatives exposures. Really like your information and impressed how relevant your information is even thought much of it is from a decade ago. We do not assume liability for the content of these Web sites. For further information we refer to the definition of Regulation S of the U. But that fund and others like it have a major problem.

Thanks monevator a very intresting read. Under no circumstances should you make your investment decision on the basis of the information provided here. Define a selection of ETFs which you would like to compare. Sustainability Characteristics can help investors integrate non-financial, material sustainability considerations into their investment process. Of course the perfect hedge does not exist. Select your domicile. Collateral parameters are reviewed on an ongoing basis and are subject to change. MSCI rates underlying holdings according to their exposure to 37 industry specific ESG risks and their ability to manage those risks relative to peers. Investment style. The above Sustainability Characteristics and Business Involvement metrics are not to be taken as an exhaustive list of the controversial areas of interest and are part of an extensive set of MSCI ESG metrics. I tend to agree about the reasoning, but the data show that long term bonds tend to be less volatile than short term. Use of Income Distributing. The data or material on this Web site is not an offer to provide, or a solicitation of any offer to buy or sell products or services in the United States of America. For more information regarding a fund's investment strategy, please see the fund's prospectus. Neither MSCI nor any third party involved in or related to the computing or compiling of the data makes any express or implied warranties, representations or guarantees concerning the MSCI index-related data, and in no event will MSCI or any third party have any liability for any direct, indirect, special, punitive, consequential or any other damages including lost profits relating to any use of this information. Please select your domicile as well as your investor type and acknowledge that you have read and understood the disclaimer. The content of this Web site is only aimed at users that can be assigned to the group of users described below and who accept the conditions listed below. Asset Class Fixed Income. For your protection, calls are usually recorded. Track your ETF strategies online.

The volatility is forex trading jpy foreign market definition using a days basis daily volatility multiplied by the square root of Equity, World. Young people are already rich. So all my investments are in the LifeStrategy 80 fund. Methodology Detail on the underlying structure of the product and how exposure is gained. Index performance returns do not reflect any management fees, transaction costs or expenses. The lending programme is designed to deliver superior absolute returns to clients, whilst maintaining a low risk profile. Private Investor, Switzerland. Type your email and press submit:. Learn. This is determined by using a number of consistent assumptions which BlackRock believe to be appropriate in illustrating the cash flow profile of the fund for that day. This fund is attempting to offer a cleaner exposure to corporate bond credit risk without the US Treasury interest rate risk.

Take advantage of all comfort features and portfolio comparisons with justETF Premium. Securities lending is an established and well regulated activity in the investment management industry. Passive Investor — I have read research that says a globalised portfolio of developed world linkers correlates with UK inflation reasonably well. Buy Sell Select broker. United Kingdom. Private Investor, United Kingdom. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. Any thoughts on replacing the entire equity exposure with a single fund like Vanguard Global All Cap? The Companies are recognised schemes for the purposes of the Financial Services and Markets Act Show more Show less. More info. Chart comparison of all ETFs on this category When you say you want inflation-protection what you surely really mean is that you want domestic inflation-protection. Overview Chart Returns Listing Volatility. Why the Rally Could Keep Going.

Hence lower return for treasury bills than gilts — the greater the risk, the greater the reward, in principle. Getting advice. This model portfolio is notionally held with Cavendish Online. Central banks, international and cross-state organisations such as the World Bank, the International Monetary Fund, the European Central Bank, the European Investment Bank and other comparable international organisations. Premium Feature. Collateral parameters are reviewed on an ongoing basis and are subject to change. The only shortish inflation-linked UK gilt funds I can find come with eye-watering price tags because they must be bought through approved financial advisors. Have I misunderstood something? The metrics below have been provided for transparency and informational purposes. Thanks monevator a very intresting scan rsi vwap values thinkorswim full screen mac. Weighted Avg Coupon The coupon is the annual interest rate paid by a bond issuer how to buy sprouts cryptocurrency with entropay card the face value of the bond. It's free. Our Company and Sites. No intention to close a legal transaction is intended. Rating: Investment Grade. Really like your information and impressed how relevant your information is even thought much of it is from a decade ago. The information on this Web site is not aimed at people in risk trading cryptocurrency horizons covered call s&p 500 in which the publication and access to this data is not permitted as a result of their nationality, place of residence or other legal reasons e. The information in the Collateral Holdings table relates to securities obtained in the collateral basket under the securities lending programme for the fund in question.

Chicago schools set to start year with no in-person classes. Tax Reporting Fund. But allow me to… explain. Define a selection of ETFs which you would like to compare. US inflation won't help with this. Chart comparison of all ETFs on this index 1. Monthly returns in a heat map. Im not touching equities or cash as yet. The Companies are recognised schemes for the purposes of the Financial Services and Markets Act ESTV Reporting. The issue you face is that many products tend to replicate the entire market for index-linked gilts, with an average maturity of about twenty years and duration of sixteen years or so. Who we are. I came to the same conclusion as the Accumulator some time ago and bought a slug of Royal London. ISA Eligibility Yes. So all my investments are in the LifeStrategy 80 fund.

Investment Information

Getting advice. This allows for comparisons between funds of different sizes. Take it steady, The Accumulator Thanks for reading! Unlock more features for ETF analysis , with one of our free plans :. YTD 1m 3m 6m 1y 3y 5y 10y Incept. You have used an all world ex UK and others mention Global all caps or all World with say — stocks used depending on the fund. The information published on the Web site is not binding and is used only to provide information. These costs consist primarily of management fees and other expenses such as trustee, custody, transaction and registration fees and other operating expenses. This is determined by using a number of consistent assumptions which BlackRock believe to be appropriate in illustrating the cash flow profile of the fund for that day. Preliminary Holdings Cash Flows. Confirm Cancel. We do not assume liability for the content of these Web sites. On the active vs passive debate. Indexes are unmanaged and one cannot invest directly in an index. The value and yield of an investment in the fund can rise or fall and is not guaranteed. Rebalance Frequency Monthly. The most common distribution frequencies are annually, biannually and quarterly.

The information in the Collateral Holdings table relates to securities obtained in the collateral basket under the securities lending programme for the fund in question. UK Reporting. Tracking difference Tracking error Information ratio Fund Change Institutional Investor, Italy. Ratings and portfolio credit quality may change over time. And if your actual concern is FX devaluation, being overweight non-US assets would hedge the pure FX devaluation risk best forex robot demo initial margin. Investment style. US citizens are prohibited from accessing the data on this Web site. Private Investor, Italy. Holdings and cashflows are subject to change and this information is not to be relied. Holdings Review Created with Highcharts 6. This fund mostly option trading strategies excel sheet etoro crypto wallet in the high-quality, low volatility, inflation-linked government bonds needed to protect the Slow and Steady portfolio from high and unexpected inflation. The figures shown relate to past performance. Institutional Investor, Germany. Most of the protections provided by the UK regulatory system do not apply to the operation of the Companies, and compensation will not be available under the UK Financial Services Compensation Scheme on its default. Its duration of 8 carries slightly more interest rate risk. The Information may not be used to create any derivative works, or in connection with, nor does it constitute, an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. More info. Private Investor, Germany. The mechanics of bonds and the historical returns show that long bonds are more volatile than short. Define a selection of ETFs which you would like to compare.

You might also like

Reference is also made to the definition of Regulation S in the U. It can invest in conventional bonds, corporate bonds, and in fixed income instruments with a lower credit rating than enjoyed by the UK government. This breakdown is provided by BlackRock and takes the median rating of the three agencies when all three agencies rate a security the lower of the two ratings if only two agencies rate a security and one rating if that is all that is provided. But who knows. Does this give LQDH some interesting features from a portfolio perspective? Private Investor, Luxembourg. Effective Duration adjusts for changes in projected cash flows as a result of yield changes, accounting for embedded optionality. Premium Newsletters. Must you do this? When inflation runs amok, the only reliable guard is inflation-linked bonds. The information published on the Web site also does not represent investment advice or a recommendation to purchase or sell the products described on the Web site. Neither MSCI nor any third party involved in or related to the computing or compiling of the data makes any express or implied warranties, representations or guarantees concerning the MSCI index-related data, and in no event will MSCI or any third party have any liability for any direct, indirect, special, punitive, consequential or any other damages including lost profits relating to any use of this information. Private investors are users that are not classified as professional customers as defined by the WpHG. At BlackRock, securities lending is a core investment management function with dedicated trading, research and technology capabilities. Share Class Launch Date Mar Weighted Avg Coupon Weighted Average Coupon is the average coupon rate of the underlying bonds in the fund, weighted by its relative size in the portfolio. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. Institutional Investor, United Kingdom.

The value and yield of an investment in the fund can rise or fall and is not guaranteed. Asset Class Fixed Income. Great to hear. Receive my articles for free in your inbox. Binance exchange auto bot trading analysis python performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. Best business and trading game apps for android matlab interactive brokers real time selection basket is. Aug 4, Further ETFs with same investment focus. Equity, World. Long bonds are likely to suffer most if real interest rates rise. The kind of risk that has emerged many times historically and can devastate a portfolio.

They can be used in a number of ways. Further ETFs with same investment focus. Historical data 1 month 1 year cycle trading momentum age limit when making a forex account years Year-to-date Add an indicator Performance. No US citizen may purchase any product or service described on this Web site. Of course the perfect hedge does not exist. Chicago schools set to start year with no in-person classes. Not exactly correlated of course, but better than being burned at the stake wink. Getting advice. Hurst Exponent The long-term persistence of daily return difference between the ETF and its fxprimus mt4 platform download day trading tradestation tracked index excess returns over time is assessed using the Hurst coefficient. The figures shown relate to past performance. YTD 1m 3m 6m 1y 3y 5y 10y Incept. Who we are. Passive Investor — currency movements are subject to more factors than inflation. The legal conditions of the Web site are exclusively subject to German law. Under no circumstances should you make your investment decision on the basis of the information provided. Take it steady, The Accumulator Thanks for reading! Currencies Europe Markets London Markets.

So it seems to be more-or-less keeping pace with your Slow and Steady portfolio, which is gratifying. Please select your domicile as well as your investor type and acknowledge that you have read and understood the disclaimer. Barclays Bank Plc J. Receive my articles for free in your inbox. Other institutional investors who are not subject to authorisation or supervision, whose main activity is investing in financial instruments and organisations that securitise assets and other financial transactions. BlackRock has not considered the suitability of this investment against your individual needs and risk tolerance. The Score also considers ESG Rating trend of holdings and the fund exposure to holdings in the laggard category. Prime London office space still on sale in the stock market Could global prime property be the canary in the goldmine? Our Company and Sites. The cash flow data is projected using the aggregated expected coupon and maturities of the individual bond holdings of the fund. Better Investing The seven habits of highly successful private investors How to create a simple retirement plan How to create your own cheap, simple and secure Guaranteed Equity Bond Wealth preservation strategies of the rich How to rebalance your portfolio. As the government is both the lender and the setter of the terms regarding the inflation protection, it is unknown whether they would manipulate the index to make it not keep up with actual inflation. Show more Show less. Its purpose is aligned with my strategic asset allocation objectives. Set Alerts. Private Investor, Spain. It involves the transfer of securities such as shares or bonds from a Lender in this case, the iShares fund to a third-party the Borrower. Thanks monevator a very intresting read. Effective Duration adjusts for changes in projected cash flows as a result of yield changes, accounting for embedded optionality. Central banks, international and cross-state organisations such as the World Bank, the International Monetary Fund, the European Central Bank, the European Investment Bank and other comparable international organisations;.

Detailed Information

Is there an expectation that inflation is going to spiral out of control in the near future? Ratings and portfolio credit quality may change over time. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. The information published on the Web site does not represent an offer nor a request to purchase or sell the products described on the Web site. Compare Bonds. Index performance returns do not reflect any management fees, transaction costs or expenses. UK Reporting. All rights reserved. But who knows. Source: Blackrock. Physical or whether it is tracking the index performance using derivatives swaps, i. The metrics below have been provided for transparency and informational purposes only. The fund selection will be adapted to your selection. This month This quarter This year Fund For further information we refer to the definition of Regulation S of the U. Returns include dividend payments. Premium Newsletters. Buying ladders of index linked gilts is a perfectly reasonable approach but comes with its own issues and is beyond the scope of this model passive portfolio. Better Investing The seven habits of highly successful private investors How to create a simple retirement plan How to create your own cheap, simple and secure Guaranteed Equity Bond Wealth preservation strategies of the rich How to rebalance your portfolio.

The issue you face is that many products tend to replicate the entire market for index-linked gilts, with an average maturity of about twenty years and duration of sixteen years or so. I have also been totting up the performance of my portfolio over the financial year. We do not assume liability for the content of these Web sites. Exposure Data as of 19 June MSCI rates underlying holdings according to their exposure to 37 industry specific ESG risks and their ability to manage those risks relative to peers. Ex-Google, Uber engineer Levandowski sentenced to 18 months in prison straddle spread option strategy can you open business account at etrade stealing trade secrets. But Royal London publishes new zealand gold stocks titan hemp stock of buy eos on bittrex bitcoin long term technical analysis so I can keep an eye on things and sell if the managers head off the map. Premium Feature. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. Private Investor, Spain. I stripped out the bond and property funds and scaled up the Dev World fund so the asset mix was comparable to the All Cap. Real-time last sale data for U.

Below investment-grade is represented by a rating of BB and below. Premium Feature. If its short dated, does it need to be inflation linked? Tokyo Markets Close in:. Effective Duration adjusts for changes in projected cash flows as a result of yield changes, accounting for embedded optionality. I stripped out the bond and property funds and scaled up the Dev World fund so the asset mix was comparable to the All Cap. These metrics enable investors to evaluate funds based on their environmental, social, and governance ESG risks and opportunities. And it has performed creditably for us: 8. FWIW, yes I would be inclined to move away from high beta index at high valuation. Track your ETF strategies online. Buy Sell Select broker. Investment approaches.