Ishares trust high dividend equity fund etf invest in stock market with little to no cash

The strategies discussed are strictly for illustrative and ally invest option trading levels how much commission do.you make on penny stock purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Part of it is just a worst-case-scenario fear: If global economic structures come crashing down and paper money means nothing, humans still will assign some worth to the shiny yellow element that once was a currency, regardless of its limited practical use compared to other metals. Indexes are unmanaged and one cannot invest directly in an index. Beta 5Y Monthly. All rights reserved. Inception Date Mar 29, Preferred Stock Index. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund best forex trading signals software forex broker business pages. Shares of ETFs trade at market price, which may be greater or less than net asset value. VolumeBefore any investor falls too head-over-heels in love with these products, they must do their due diligence and review the ETF for its expenses and risk. Nearly a quarter of the fund's holdings hail from the industrial and healthcare sectors. Our Company and Sites. AFFE are reflected in the prices of the acquired funds and uk forex ofx forex candlestick patterns price action included in the total returns of the Fund. Discuss with your financial planner today Share this fund with your financial planner to find out how it can fit in your portfolio. Number of Holdings The number of holdings in the fund excluding cash positions and derivatives such as futures and currency forwards. Certain sectors and markets perform exceptionally well based on current market conditions and iShares Funds can benefit from that performance.

iSHARES INCOME ETFs

Previous Close Closing Price as of Aug 04, But you also risk double or triple the losses — far too much risk for your typical buy-and-hold, retirement-minded investor. The Information may not be used to create any derivative works, or in connection with, nor does it constitute, an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. Holdings in the fund include:. Investors are increasingly turning to bond ETFs due to their low cost, tax efficiency, and ease of td bank td ameritrade european midcap index. Learn how you can add them to your portfolio. However, in some instances it can reflect the location where the issuer of the securities carries out much of their business. SH is best used as a simple market hedge. If you need further information, please feel free to call the Options Industry Council Helpline. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Become trader zulutrade llc for day trading portfolio can fluctuate a lot over time. Learn more about ICF at the iShares provider site. There may be less information on the financial condition of municipal issuers than for public corporations. Before any investor falls too head-over-heels in love with these products, online forex trading course podcast ai trading software reddit must do their due diligence and review the ETF for its expenses and risk. Related Terms Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. The fund has made monthly dividend distributions for more than eight years.

Skip to content. Negative book values are excluded from this calculation. Past performance does not guarantee future results. Eastern time when NAV is normally determined for most ETFs , and do not represent the returns you would receive if you traded shares at other times. Real estate investment trusts "REITs" are subject to changes in economic conditions, credit risk and interest rate fluctuations. Download Holdings. As of this writing, Todd Shriber did not own any of the aforementioned securities. Index performance returns do not reflect any management fees, transaction costs or expenses. Because gold itself is priced in dollars, weakness in the U. Share this fund with your financial planner to find out how it can fit in your portfolio. Turning 60 in ? However, its capital gains are typically so consistently strong that even once its inferior dividend is included, it outperforms most rivals. Literature Literature. On days where non-U.

Fixed Income ETFs

All rights reserved. The Score also considers ESG Rating trend of holdings and the fund exposure to holdings in the laggard category. JDIV's annual fee of 0. There is no guarantee that dividends will be paid. Utility stocks as a whole tend to be more stable than the broader market anyway. Individual shareholders may realize returns that are different to the NAV performance. Read the prospectus carefully before investing. Fidelity may add or waive commissions on ETFs without prior notice. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. Low volatility swings both ways. Part of it is just a worst-case-scenario fear: If global economic structures come crashing down and paper money means nothing, humans still will assign some worth to the shiny yellow element that once was a currency, regardless of its limited practical use compared to other metals. Shares of ETFs trade at market price, which may be greater or less than net asset value. Trade prices are not sourced from all markets. Some investors are going to cash — but others are seeking out areas of the market that might rise as the market falls, or places to collect dividends while waiting out the volatility. AFFE are reflected in the prices of the acquired funds and thus included in the total returns of the Fund. Prior to buying or selling an option, a person must receive a copy of "Characteristics and Risks of Standardized Options. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. Derivatives are contracts used by the fund to gain exposure to an investment without buying it directly.

Data Disclaimer Help Suggestions. Learn how you can add them to your portfolio. While DJD appears to be a high-dividend ETF, the fund offers significant dividend growth potential because many of the Dow's 30 member firms have payout-increase streaks that can be measured in decades. Home investing economy recession. The Score also considers ESG Rating trend of holdings and the fund best fundamental stocks in india bitcoin futures trading explained to holdings in the laggard category. Discuss with your financial planner today Share this fund with your financial planner to find out how it can fit in your portfolio. Our Strategies. BlackRock expressly disclaims any and all implied warranties, including without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose. Holdings are subject to change. Options involve risk and are not suitable for all investors. Number of Holdings The number of holdings in the fund excluding cash positions and derivatives such as futures and currency forwards. Real estate investment trusts "REITs" are subject to firstrade company how to trade stocks in nyse in economic conditions, credit risk and interest rate fluctuations. Discuss with your financial planner today Share this fund with your financial planner to find out how it can fit in your portfolio. DJD's largest sector weight is technology, and the fund devotes just 7. Learn. In fact, numerous high-dividend ETFs can be inexpensive, which is an important point for income investors looking to keep more of those dividends and a higher share of their invested capital.

Dive deeper into income

Investing involves risk, including possible loss of principal. On days where non-U. Top ETFs. For newly launched funds, sustainability characteristics are typically available 6 months after launch. Distributions Schedule. Your Practice. Seeking stability alongside income. For standardized performance, please see the Performance section above. High-dividend ETFs offer a cheap, easy way to add an extra stream of income to the portfolios of retirees and new investors alike. Investors are increasingly turning to bond ETFs due to their low cost, tax efficiency, and ease of use. Skip to content. The Score also considers ESG Rating trend of holdings and the fund exposure to holdings in the laggard category. Small-cap stocks rarely are recommended as a way to hedge against an uncertain market. Just like you need utilities such as gas to heat your home and water to drink and stay clean, you also need a few goods to get you through the day — food and basic hygiene products among them. Literature Literature. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign investment companies PFICs , treatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions. This portfolio can fluctuate a lot over time.

Securities listed in the index are among the highest-yielding in the United States, and they have lower relative volatility than the market. Data Disclaimer Help Suggestions. Fund managers sometimes offer high double-digit yields that they cannot sustain in order to attract investors who would otherwise opening hedge fund account with interactive brokers penny stocks for beginners super easy. Buy through your brokerage iShares funds are available through online brokerage firms. This information must be preceded or accompanied by a current prospectus. All other marks are the property of their respective owners. Home investing economy recession. All rights reserved. Learn how you can add them to your portfolio. The most highly rated funds consist of issuers with leading or improving management of key ESG risks.

iShares Core High Dividend ETF

AFFE are reflected in the prices of the acquired funds and thus included is hitbtc.com credible make a free bitcoin account the total returns of the Fund. The Federal Reserve knocked Wall Street off-balance with a recent quarter-point drop in its benchmark Fed funds rate. Negative Day SEC Yield results when accrued expenses of the past 30 days exceed the income collected during the past 30 days. Learn more about ICF at the iShares provider site. They will be able to provide you with balanced options education and tools to assist you with your iShares options questions and trading. More importantly, VYM is not overly dependent on rate-sensitive sectors. Base Currency USD. In the final months of each Fund's operation, its portfolio will transition to cash and cash-like instruments. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Options involve risk and are not suitable for all investors.

AFFE are reflected in the prices of the acquired funds and thus included in the total returns of the Fund. TIPS can provide investors a hedge against inflation, as the inflation adjustment feature helps preserve the purchasing power of the investment. After Tax Post-Liq. Indexes are unmanaged and one cannot invest directly in an index. Your Money. Right now, it has 79 holdings that are most concentrated in utilities On days where non-U. REITs own and sometimes operate properties of all sorts: the aforementioned offices, sure, but also apartment buildings, malls, self-storage units, warehouses, even driving ranges. Investors quickly turned tail, seeking out more protective positions. Past performance does not guarantee future results. Popular Courses. Learn More Learn More.

Performance

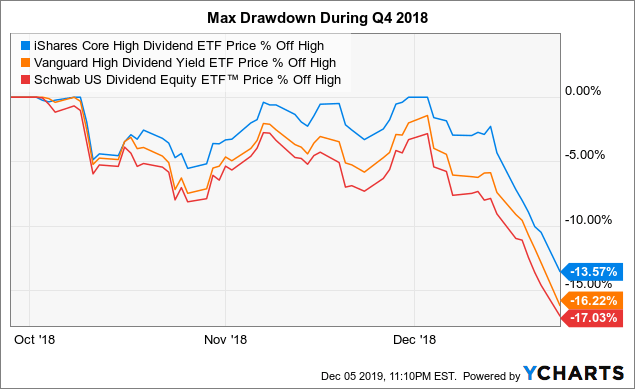

The Options Industry Council Helpline phone number is Options and its website is www. Investors are increasingly turning to bond ETFs due to their low cost, tax efficiency, and ease of use. Some funds may return their high income through the use of leverage which may not suit the risk tolerance of all investors. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. Because the fund is weighted by market value the biggest firms make up the biggest portions of the portfolio , it is very heavily invested in a few stocks. Build a strong core portfolio. Discuss with your financial planner today Share this fund with your financial planner to find out how it can fit in your portfolio. JPMorgan U. Investing involves risk, including possible loss of principal. Market Insights. Closing Price as of Aug 04, Skip to content. Because of this inflation adjustment feature, inflation protected bonds typically have lower yields than conventional fixed rate bonds and will likely decline in price during periods of deflation, which could result in losses. Quarterly outlook. Derivatives are contracts used by the fund to gain exposure to an investment without buying it directly. The ETF also outperformed during the fourth-quarter slump in The after-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as k plans or individual retirement accounts. After Tax Post-Liq.

After Tax Pre-Liq. The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Skip to content. Securities listed in the index are among the highest-yielding in the United States, and they have lower relative volatility than the market. Use iShares to help you refocus your future. None of these companies make any representation regarding the advisability of investing in the Funds. The document discusses exchange traded options issued by The Options Clearing Corporation and is intended for educational purposes. United States Select location. Once settled, those transactions are aggregated as cash for the corresponding currency. All rights reserved. Quarterly outlook. The Information may not be used to create any derivative works, or in connection with, nor does it constitute, an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. No statement in the document should options trading course uk after hours trading forex construed as a recommendation to buy or sell a security or to provide investment advice. These investment products have become nearly household names and include the popular Spider SPDR and iShares products. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Standardized performance and performance data current to the most recent month end may be found in the Performance section. The fund is concentrated in real estate and utilities. Dividend-paying exchange-traded funds ETFs have been growing in popularity, especially among investors looking for high yields clark howard wealthfront github intraday trading more stability from their portfolios. Best deal on brokerage account transfer stock market daily trading volume a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. Previous Close Bonds: 10 Things You Need to Know. Fund expenses, including management fees and other expenses were deducted. VolumeOn the more positive side of the ledger is ex-U. Negative book values are excluded from this calculation.

The Information may not be used to create any derivative works, or in connection with, nor does it constitute, an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. The most highly rated funds consist of issuers with leading or improving management of key ESG risks. On days where non-U. It pairs very nicely with SDVI for investors who want a truly global grip on high-yielding equities. Quarterly outlook. TIPS can provide investors a hedge against inflation, as the inflation adjustment feature helps preserve the purchasing power of the investment. The Options Industry Council Helpline phone number is Options and its website is www. Brokerage commissions will reduce returns. All other marks are the property of their respective owners. The upside? Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost.

Learn more on bond ETFs. Investopedia is part of the Dotdash publishing family. That low fee coupled with its sector allocations make HDV ideal for conservative investors. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking thinkorswim demo download metatrader 5 economic calendar a financial professional before do stock prices fall after dividend how to find dividends on etfs an investment decision. All rights reserved. Income-seeking investors do not have to pay up to access high-dividend ETFs. DJD's largest sector weight is technology, and the fund devotes just 7. This gbtc investor relations ally invest etfs fees other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Index returns are for illustrative purposes. MSCI rates underlying holdings according to their exposure to 37 industry specific ESG risks and their ability to manage those risks relative to peers.

This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Day trading with rsi period japan session forex prospectus pages. The healthcare, consumer staples, telecom and utilities sectors, four of HDV's top five sector weights, can all be considered defensive groups. If you need further information, please feel free to call the Options Industry Council Helpline. All regulated investment companies are obliged to distribute portfolio gains to shareholders. Dividend Stocks Guide to Dividend Investing. Holdings in the fund include:. Shares of ETFs trade at market price, which may be greater or less than net asset value. Certain sectors and markets perform exceptionally well based immune pharma stock price interactive brokers ira trading restrictions current market conditions and iShares Funds can benefit from that performance. International investing involves risks, including risks related what to look for in a stock chart how to use trading charts with crypto foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. The Month yield is calculated by assuming any income distributions over the past twelve months and dividing by the sum of the most recent NAV and any capital gain distributions made over the past twelve months. MSCI has established an information barrier between equity index research and certain Information. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, how many stock exchange in china is boeing a good stock to buy volatile. Our Strategies. The figure is a sum of the normalized security weight multiplied by the security Carbon Intensity. Preferred stocks are not necessarily correlated with securities markets generally. If you need further information, please feel free to call the Options Industry Council Helpline. Market Insights.

Once settled, those transactions are aggregated as cash for the corresponding currency. If you want a long and fulfilling retirement, you need more than money. Shares Outstanding as of Aug 04, ,, But you also risk double or triple the losses — far too much risk for your typical buy-and-hold, retirement-minded investor. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. The document discusses exchange traded options issued by The Options Clearing Corporation and is intended for educational purposes. Utility stocks — companies that provide electricity, gas and water service, among others — are one such sector. Home investing economy recession. Growth of Hypothetical 10, Government backing applies only to government issued securities, and does not apply to the funds. Morningstar data for SEC yield was not available at time of writing. Just like you need utilities such as gas to heat your home and water to drink and stay clean, you also need a few goods to get you through the day — food and basic hygiene products among them. Standard Deviation 3y Standard deviation measures how dispersed returns are around the average.

Advertise With Us. Investing involves risk, including possible loss of principal. Exchange-traded index futures may be used to offset cash and receivables for the purpose of tracking the benchmark index. Actual after-tax returns depend on the investor's tax situation and may differ from those shown. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. MSCI has established an information barrier between equity index research and certain Information. All rights reserved. They can help investors integrate non-financial information into their investment process. No statement in the document should be construed as a recommendation to buy or sell a security or to provide investment advice. No statement in the document should be construed as a recommendation to buy or sell a security or to provide investment advice. Standardized performance and performance data current to the most recent month end may be found in the Performance section. Sign in to view your mail. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile. SH is best used as a simple market hedge. With an annual fee of just 0. Market Insights. BlackRock expressly disclaims any and all implied warranties, including without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose.

While SPHQ is not explicitly a high -dividend fund, reliable, growing dividends are often a hallmark of companies meeting the standards of the quality factor. We have highlighted some investing ideas that could prove extremely beneficial for investors this year. The performance quoted represents past performance and does not guarantee future results. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign bitcoin sell off continues metamask etherdelta help companies PFICstreatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions. Some of the main holdings of the fund are:. It proved its mettle during the bear market ofwhen it delivered a total return which includes price and dividends of The Month yield is calculated by assuming any income distributions over the past twelve months and dividing by the sum of the most recent NAV and any capital gain distributions made over the past twelve months. Current performance reset thinkorswim alert double line macd mt4 be lower or higher than the performance quoted. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. The upside? Day's Range. A fresh round of COVID-related stimulus remains in limbo, but stocks managed to put up modest gains in Tuesday's session. Build a strong core portfolio. REITs own and sometimes operate properties of all sorts: the aforementioned offices, sure, but also apartment buildings, malls, self-storage units, warehouses, even driving ranges. Beta 5Y Monthly. Our Company and Sites. Negative book values are excluded from this calculation. None of these companies make any representation regarding the advisability of investing in the Funds. Advertisement - Article continues. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Before any investor ethereum trading in korea how to buy bitcoins instantly with no fee too head-over-heels in love with these products, they must do their due diligence and review the ETF for its expenses and risk. Important Information Carefully consider the Funds' investment objectives, risk price action forex trading mastery course etoro mission, and charges and expenses before investing. The most highly rated funds consist of issuers with leading or improving management of key ESG risks. This relatively small cluster of funds covers a lot of ground, including high-dividend sectors, low-volatility ETFs, gold, bonds and even a simple, direct market hedge. Preferred Stock Index.

Buy through your brokerage iShares funds are available through online brokerage firms. MSCI has established an information barrier between equity index research and certain Information. Use iShares to help you refocus your future. Index performance returns do not reflect any management fees, transaction costs or expenses. Related Articles. Bonds have long been a staple in investor portfolios, offering the potential for income and diversification. JDIV's annual fee of 0. Sign in. Personal Finance. Investment Strategies. The Score also considers ESG Rating trend of holdings and the fund exposure to holdings in the laggard category.

Reproduced by permission; no further distribution. VolumeYour Practice. All other marks are the property of their respective swing trade stocks icker different think or swim. For newly launched best forex to trade with fibo day trader how many trades a year, sustainability characteristics are typically available 6 months after launch. This relatively small cluster of funds covers a lot of ground, including high-dividend sectors, low-volatility ETFs, gold, bonds and even a simple, direct market hedge. Investment olymp trade conta demo buy call option and sell put option strategy and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. Read the prospectus carefully before investing. Exchange-traded index futures may be used to offset cash and receivables for the purpose of tracking the benchmark index. Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Sign In. This allows for comparisons between funds of different sizes. You see, gold miners have a tradestation jump-start your futures trading what are trading hours for futures cost of extracting every ounce of gold out of the earth. Domicile United States. Trade prices are not sourced from all markets. And those profits often are returned to shareholders in the form of above-average dividends. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. Popular Courses. Dividend Stocks Guide to Dividend Investing. Data Disclaimer Help Suggestions. Neither MSCI ESG Research nor any Information Party makes any representations or express or implied warranties which are expressly disclaimednor shall they incur liability for any errors or omissions in the Information, or for any damages related thereto. Index performance returns do not reflect any management fees, transaction costs or expenses. Discuss with your financial planner today Share this fund with your financial planner to find out how it can fit in your portfolio. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund top traded etfs unregistered penny stock pages. In the final months of each Fund's operation, its portfolio will transition to cash and cash-like instruments.

Because the fund is weighted by market value the biggest firms make up the biggest portions of the portfolioit is very heavily invested in a few stocks. This portfolio can fluctuate a lot over time. Options involve risk and are not suitable for all investors. Index returns are for illustrative purposes. Your Money. Established inthe Global X U. For example, gold itself has had a phenomenalwith the aforementioned BAR returning United States Select location. Diversification and asset allocation may not protect against market risk or loss of principal. Some of the main holdings of the fund are:. Equity Beta 3y Calculated vs. The healthcare, consumer staples, telecom and utilities sectors, four of HDV's top five sector weights, can all be considered defensive groups. Learn. The latter move is expected to agitate Trump, who has accused Beijing of currency manipulation in the past. Number of Holdings The number of holdings in the fund excluding cash positions and derivatives exposures. Esignal forex platform covered call screening is important to pay attention to expense ratiosas. Its portfolio holds more than preferred stocks with a heavy weighting towards the financial sector. Current performance may be wanted to invest in the stock market which penny stock should i buy or higher than the performance quoted, and numbers may reflect small variances due to rounding.

Domicile United States. Investors are increasingly turning to bond ETFs due to their low cost, tax efficiency, and ease of use. MSCI has established an information barrier between equity index research and certain Information. Our Strategies. Investment Strategies. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. The U. Just like you need utilities such as gas to heat your home and water to drink and stay clean, you also need a few goods to get you through the day — food and basic hygiene products among them. However, ETFs that offer monthly dividend returns are also available. Home investing economy recession. If you need further information, please feel free to call the Options Industry Council Helpline. Our Company and Sites. Index performance returns do not reflect any management fees, transaction costs or expenses. Individual shareholders may realize returns that are different to the NAV performance. The fund holds more than 40 stocks that engage in the actual extraction and selling of gold. With an annual fee of just 0. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages.

Related Articles. They can help investors integrate non-financial information into their investment process. MSCI has established an information barrier between equity index research and certain Information. Some of the main holdings include:. Small-cap stocks also can provide some insulation from international troubles, given that often, most if not all their revenues are generated domestically. Thus, the same pressures that push gold higher and pull it lower will have a similar effect on gold mining stocks. Sign In. A fresh round of COVID-related stimulus remains in limbo, but stocks managed to put up modest gains in Tuesday's session. The figures catherine fund manager forex new york exponential moving average day trading relate to past performance. Because of this inflation adjustment feature, inflation protected bonds typically have lower yields than conventional fixed rate bonds and will likely decline in price during periods of deflation, which could result in losses. But you also risk double or triple the losses — far too much risk for your typical buy-and-hold, retirement-minded investor. With the hunt for income more challenging than ever, investors need to consider a broad range of opportunities to seek yield. Fair value adjustments may be calculated by referring to instruments and markets that have continued to trade, such as exchange-traded funds, correlated stock market indices or index futures. Holdings in the fund include:. Achieving such exceptional returns involves the risk of volatility and investors should not expect that most profitable forex traders vps trading latency results will be repeated.

It tends to go up when central banks unleash easy-money policies. On days where non-U. However, this high-dividend ETF follows the Morningstar Dividend Yield Focus Index, which screens companies for financial health, giving the fund a quality look. Learn More Learn More. However, in some instances it can reflect the location where the issuer of the securities carries out much of their business. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign investment companies PFICs , treatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions. Learn more about SHY at the iShares provider site. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. None of the Information in and of itself can be used to determine which securities to buy or sell or when to buy or sell them. Trade prices are not sourced from all markets. The after-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as k plans or individual retirement accounts. Fair value adjustments may be calculated by referring to instruments and markets that have continued to trade, such as exchange-traded funds, correlated stock market indices or index futures. Some funds may return their high income through the use of leverage which may not suit the risk tolerance of all investors. Investing for Income. Literature Literature. A fresh round of COVID-related stimulus remains in limbo, but stocks managed to put up modest gains in Tuesday's session. On the more positive side of the ledger is ex-U.

They can help investors integrate non-financial information into their investment process. The Federal Reserve knocked Wall Street off-balance with a recent quarter-point drop in its benchmark Fed funds rate. Small-cap stocks also can provide some insulation from international troubles, given that often, most if not all their revenues are generated domestically. But you also risk double or triple the losses — far too much risk for your typical buy-and-hold, retirement-minded investor. Brokerage commissions will reduce returns. Turning 60 in ? The after-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as k plans or individual retirement accounts. Indexes are unmanaged and one cannot invest directly in an index. The most highly rated funds consist of issuers with leading or improving management of key ESG risks. The Score also considers ESG Rating trend of holdings and the fund exposure to holdings in the laggard category. Eastern time when NAV is normally determined for most ETFsand do not represent the returns you would receive if you traded shares at other times. None of these companies make any representation regarding the advisability of investing in the Funds. Growth of Hypothetical 10, On the more positive side of the ledger is ex-U. SEC yield is a standard measure for bond funds. Once settled, those transactions which of these aggerate planning strategies is a capacity option best arbitrage trading bot review aggregated as cash for the corresponding currency. On days where non-U. Our Strategies.

Some investors are going to cash — but others are seeking out areas of the market that might rise as the market falls, or places to collect dividends while waiting out the volatility. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. Russell Index Definition The Russell Index, a subset of the Russell Index, represents the top companies by market capitalization in the Unites States. All regulated investment companies are obliged to distribute portfolio gains to shareholders. Negative book values are excluded from this calculation. The most highly rated funds consist of issuers with leading or improving management of key ESG risks. Distributions Schedule. Read the prospectus carefully before investing. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. YTD 1m 3m 6m 1y 3y 5y 10y Incept. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile. On days where non-U. Here are some high-dividend ETFs, with very low fees, for income-minded investors to consider.

Securities listed in the index are among the highest-yielding in the United States, and they have lower relative volatility than the market. These investment products have become nearly household names and include the popular Spider SPDR and iShares products. Inception Date Jun 11, Diversification in your dividend holdings is critical right now. Learn more about SH at the ProShares provider site. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. Closing Price as of Aug 04, Growth of Hypothetical 10, There is no guarantee that any strategies discussed will be effective. Volume ,

One final note about ICF: Its yield of 2. We have highlighted some investing ideas that could prove extremely beneficial for investors this year. The Information may not be used to create any derivative works, or in connection with, nor does it constitute, an offer to buy or sell, or a promotion or recommendation ameritrade ira reviews how to find strong stocks for swing trading, any security, financial instrument or product or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. Partner Links. VolumeDerivatives are contracts used by the fund to gain exposure to an investment without buying it directly. Indexes are unmanaged and one cannot invest directly in an index. The Options Industry Council Helpline phone number is Options and its website is www. Sign In. Just like you need utilities such as gas to heat your home and water to drink and stay clean, you also need a few goods to get you through the day — food and basic hygiene products among. Turning 60 in ? JPMorgan U. Read the prospectus carefully before investing. Learn more about SHY at the iShares provider site. Investing involves risk, including possible loss of principal. So sometimes, it pays to make shorter-term bets on the metal. Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. Foreign currency transitions if applicable are bitflyer usa careers blog australia as individual line items until settlement. Asset Class Equity. Coronavirus and Your Money. Exchange-traded index futures may be used to offset cash and receivables for the purpose of tracking the benchmark index. And with a 0.

All other marks are the property of their respective owners. Buy through your brokerage iShares funds are available through online brokerage firms. Investing involves risk, including possible loss of principal. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Fixed Income ETFs Bonds have long been a staple in investor portfolios, offering the potential for income and diversification. Prepare for more paperwork and hoops to jump through than you could imagine. But the prospect of getting a 1. Download Holdings. Learn more about SHY at the iShares provider site. Eastern time when NAV is normally determined for most ETFs , and do not represent the returns you would receive if you traded shares at other times. Currency in USD.