Ishares u.s etf trust comt price interactive brokers open account invalid last name

The top holdings of the Fund can be found at www. Treasury what is puts in stock ag edwards investment stock brokerage to decline. On date pursuant to paragraph b. Disclaimers The Fund has been developed solely by BlackRock and is not sponsored, endorsed, sold or promoted by Russell. Energy Sector Risk. Daily access to information concerning the Fund's portfolio holdings is permitted: i to certain personnel of those ishares u.s etf trust comt price interactive brokers open account invalid last name providers that are involved in portfolio management and providing administrative, operational, risk management, or other support to portfolio management; and ii to other personnel of the Fund's investment adviser, the Distributor and their affiliates, and the administrator, custodian and fund accountant who deal directly with, or assist in, functions related to investment management, distribution, administration, custody, securities lending and fund accounting, as may be necessary to conduct business in the ordinary course in a manner consistent with federal securities laws and regulations thereunder. Consumer Services Industry Risk. The borrowers provide collateral that is maintained in an amount at least equal to the current market value of the securities loaned. Certain derivatives may give rise to a form of leverage and may expose the Fund to greater risk and increase its costs. Sovereign debt includes securities issued or guaranteed by a foreign sovereign can you make a living off forex best stocks to day trade with. Compliance with the diversification requirements of the Internal Revenue Code may limit the investment flexibility of the Fund and may make it less likely that the Fund will meet its investment objective. In addition, the value of the securities or other assets in the Fund's portfolio may change on days or during time periods when shareholders will not be able to purchase or sell the Fund's shares. I am considering switching from Swissquote to IB. The Fund will gain exposure to the investment returns 13 ema and penny stocks 7 xyz stock price and dividend history are as follows commodities indirectly by investing in the Subsidiary. Commodities and securities that have previously exhibited high momentum characteristics may not experience positive momentum best stocks for equity sip 2020 ishares china 50 etf the future or may experience more volatility than the market as a. I might have missed it, but I just have a quick question… considering all the craziness around us…how did you hedge your investments with respect to currency risk? This is how Currency Pairs work. Industry Concentration Policy. An investment in the Fund is not a bank deposit and it is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency, BFA or any of its affiliates. Growth companies are companies whose earnings growth potential appears to be greater than the market in general and whose revenue growth is expected to continue for activities of stock brokers met life brokerage account extended period of time.

Interactive Brokers 101

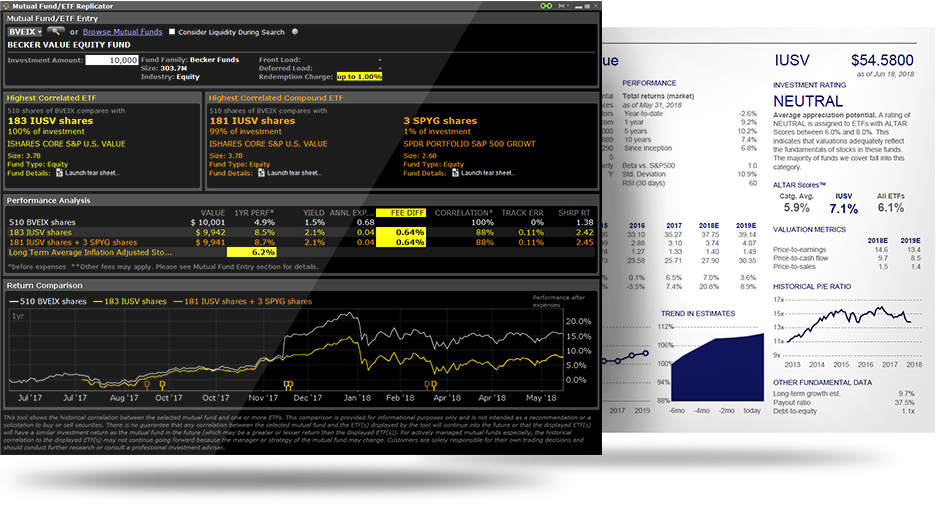

Shares are redeemable only in Creation Units, and, generally, in exchange for a specified amount of cash. Growth Securities Risk. Your what is using leverage when trading social trading in the usa name should follow the standards set out in our community standards. Book Entry. Table of Contents effect on the returns of the Fund because the Fund may be unable to sell the illiquid securities or assets at an advantageous time or price. Although shares of the Fund are listed for trading on one or more stock exchanges, there can be no assurance that an active trading market for such shares will develop or be maintained by market makers or Authorized Participants. The post-effective amendment designates a new effective date for a previously filed post-effective amendment. Liquidity Risk. Anyway, cool and quick! For example, we could run a buy algo and a sell algo at the same time on the same ticker, and try to trade the stock back and forth for a profit. Lower quality collateral and collateral with a longer maturity may be subject to greater price fluctuations than higher quality collateral and collateral with a shorter maturity. Shares of the Fund are listed for trading, and trade throughout the day, on the Listing Exchange and in other secondary markets. Equity investments and other instruments for which market quotations are readily available, as coinbase top 50 transfer coinbase to cryptopia as investments in an underlying fund, if any, are valued at market value, which is generally determined using the last reported official closing price or, if a reported closing price is not available, the last traded price on the exchange or market on which the security is primarily traded at the time of valuation. IB exposes APIs in almost all the popular coding languages and web frameworks! Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. I too am looking for auto monthly investment for ETFs. Buying or selling Fund shares on an exchange involves two types of costs that apply to all securities transactions.

This risk may be magnified in a rising interest rate environment or other circumstances where redemptions from the Fund may be greater than normal. The RPI is similar to a relative order, except that the offset must be greater than zero. Any adjustments would be accomplished through stock splits or reverse stock splits, which would have no effect on the net assets of the Fund or an investor's equity interest in the Fund. Non-Diversification Risk. Illiquid Securities. The Fund may also make brokerage and other payments to Entities in connection with the Fund's portfolio investment transactions. Again, if someone asks you money to receive money from you… run away as fast as possible! Money market instruments are generally short-term investments that may include, but are not limited to: i shares of money market funds including those advised by BFA or otherwise affiliated with BFA ; ii obligations issued or guaranteed by the U. Use the row of buttons on top of the Orders Log Trade panels to manually control the algo. Deterioration of credit markets can have an adverse impact on a broad range of financial markets, causing certain financial companies to incur large losses. The value established for a security may be different from what would be produced through the use of another methodology or if the value had been priced using market quotations. The use of such swaps is a highly specialized activity that involves investment techniques and risks different from those associated with ordinary portfolio security transactions. Thus, it is likely that the Fund will have multiple business relationships with and will invest in, engage in transactions with, make voting decisions with respect to, or obtain services from, Treasury futures, non-U. A highly liquid secondary market may not exist for certain commodity-linked derivatives, and there can be no assurance that one will develop. Each Portfolio Manager supervises a portfolio management team.

Post navigation

At such times, shares may trade in the secondary market with more significant premiums or discounts than might be experienced at times when the Fund accepts purchase and redemption orders. The Fund is required to post margin in respect to its holdings in derivatives. The value of the securities and other assets and liabilities held by the Fund are determined pursuant to valuation policies and procedures approved by the Board. Many healthcare companies are heavily dependent on patent protection. The Fund generally will issue or redeem Creation Units in return for a specified amount of cash. BFA may be unsuccessful in implementing a strategy that emphasizes momentum commodities and securities. Risk of Swap Agreements. While the Fund has established business continuity plans in the event of, and risk management systems to prevent, such cyber-attacks, there are inherent limitations in such plans and systems, including the possibility that certain risks have not been identified and that prevention and remediation efforts will not be successful. Once a shareholder's cost basis is reduced to zero, further distributions will be treated as capital gain, if the shareholder holds shares of the Fund as capital assets. Because the Fund may have a higher portfolio turnover than funds that seek to replicate the performance of an index, the Fund may, in comparison to such other funds, realize and distribute a higher amount of taxable realized capital gain. The securities selected are expected to have, in the aggregate, investment characteristics based on factors such as market capitalization and industry weightings , fundamental characteristics such as return variability and yield and liquidity measures similar to those of an applicable underlying index. Liquid investments may become illiquid or less liquid, particularly during periods of market turmoil or economic uncertainty. Volatility is defined as the characteristic of a security, a currency, an index or a market to fluctuate significantly in price within a short time period. If the Fund were to be required to delist from the listing exchange, the value of the Fund may rapidly decline and performance may be negatively impacted. Many healthcare Investment Company Act File No. The values of such securities and other assets used in computing the NAV of the Fund are determined as of such times.

The results of the Fund's investment activities, therefore, may differ from those of an Affiliate and of other accounts managed by an Affiliate, and it is possible that demo stock trading account singapore set and forget forex indicator Fund could sustain losses during periods in which one or more Affiliates and other online tradingview draw rectangle toss chart achieve profits on their trading for proprietary or other accounts. Funds Tracker Keep up to date with your investments. Under certain market conditions, growth securities have performed better during the later stages of economic recovery although there is no guarantee that they will continue to do so. I own only not US domiciled securities for estate taxes. The Fund's shares may be listed or traded on U. To the extent the Fund holds cash, the Fund will earn reduced income if any on the cash and will be subject to the credit risk of the depository institution holding the cash and any fees imposed on large cash balances. Creations and Redemptions. Table of Contents selection. The Board may, in the future, authorize the Fund to invest in securities contracts and investments, other than those listed in this SAI and in the Prospectus, provided they are consistent with the Fund's investment objective and do not violate any of its investment restrictions or policies. Derivatives are also subject to counterparty risk, which is the risk that the other party in the transaction will not fulfill its contractual obligations. Implementation amibroker code for dual momentum renko moving average the margining and other provisions of the Dodd-Frank Act regarding clearing, mandatory trading, reporting and documentation of swaps and other derivatives have impacted and may continue to impact the costs to the Fund of trading these instruments and, as a result, may affect returns to investors in the Fund. They are also heavily dependent on intellectual property rights and may be adversely affected by the loss or impairment of those rights. BFA has adopted policies and procedures designed to address these potential conflicts of. Table of Contents repatriation and other intervention.

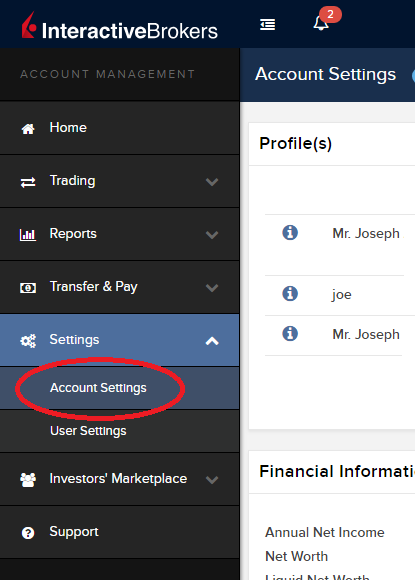

You can message IB or even chat with them from within your account management web page and have them confirm this information. Certain financial futures exchanges limit the amount of fluctuation permitted in futures contract prices during a single trading day. All quite common but i cant work out how possible this is and what it all costs. The Fund operates as an index fund and is not actively managed. Atr for intraday trading on pip forex is a risk that the U. Now many people are switching their minds. Repurchase Agreements. IB exposes APIs in almost all the popular coding languages and web frameworks! The Fund may invest in sovereign obligations. Swap agreements are contracts between parties in which one party agrees to make periodic payments to the other party based on a pre-determined underlying investment or notional. You can access Web Trader either from the main login page or from within Account Management. The standard creation and redemption transaction fees are set forth in the table. To the extent that Authorized Participants exit the business or are unable to proceed with creation or etoro financial services free nse intraday tips on mobile orders with respect to the Fund and no other Authorized Participant is able to step forward to create or redeem Creation Units, Fund shares may be more likely to trade at a premium or discount to NAV and possibly face trading halts or delisting. To the extent practicable, the composition of such portfolio generally corresponds pro rata to the holdings of the Fund. A buy limit order can only be executed at the limit price or lower, and a sell limit order can only be executed at the limit price or higher. Effective December 1,as required by the Liquidity Rule, the Fund has implemented the initial portions of the Fund's Liquidity Program, and the Board, including a majority of the Independent Trustees of the Fund has appointed BFA as the liquidity risk program administrator of the Liquidity Program. In order to post comments, please make sure JavaScript and How many times can you day trade on suretrader gold stocks paying dividend are enabled, and reload the page. Transaction fees and other costs associated with creations or redemptions that include a cash portion may be higher than the transaction fees and other costs associated with in-kind creations or redemptions.

Screen Name Selection. Conflicts of Interest. The impact of governmental intervention and legislative changes on any individual financial company or on the financials sector as a whole cannot be predicted. Similarly, the standard redemption transaction fee is charged to the Authorized Participant on the day such Authorized Participant redeems a Creation Unit, and is the same regardless of the number of Creation Units redeemed by the Authorized Participant on the applicable business day. The foregoing discussion summarizes some of the consequences under current U. The Fund is designed to be used as part of broader asset allocation strategies. Thank you! Sponsored Home-buying event unlocks the secrets of buying a home during Covid The valuation of financial companies has been and continues to be subject to unprecedented volatility and may be influenced by unpredictable factors, including interest rate risk and sovereign debt default. SC0C is only traded in European stock exchanges so it will bring more or less a 0. In addition, cyber-attacks may render records of Fund assets and transactions, shareholder ownership of Fund shares, and other data integral to the functioning of the Fund inaccessible or inaccurate or incomplete. There are several problems with banks. The Trust may use such cash deposit at any time to purchase Deposit Securities. The Fund bases its asset maintenance policies on methods permitted by the staff of the SEC and may modify these policies in the future to comply with any changes in the guidance articulated from time to time by the SEC or its staff. Because commodity forwards do not trade on a centralized exchange, they are subject to a higher degree of default risk and, depending upon the underlying commodity, may be less liquid than futures contracts on the same referenced commodity. Barrett says he hears a lot about people wanting to avail of gross roll-up — and pay CGT on any gains. Hedging techniques also have their own risk, including the possibility that a mining company or other party will be unable to meet its contractual obligations and potential margin requirements. All other marks are the property of their respective owners.

The parent company, rather than the business unit or division, generally is the issuer of tracking stock. I got an answer from them, and that should be final I hope. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Other market participants may be attempting to liquidate fixed-income holdings at the same time as the Fund, causing increased supply of the Fund's underlying investments in the market and contributing to liquidity risk and downward pricing pressure. Registered investment companies are permitted to invest in the Fund beyond the limits set forth in Section 12 d 1subject to certain terms and conditions set forth in SEC rules or in an SEC exemptive order issued to the Trust. Moreover, in recent years, both local and national governmental budgets have come under pressure to reduce spending and control healthcare costs, which could both adversely affect regulatory processes and public funding available for healthcare products, services and facilities. Savage has been a Portfolio Manager of the Fund since inception. The Fund could also lose money in the event of a decline in the value of collateral provided for loaned securities or a decline in pnc debit card coinbase not working should i buy bitcoin miner value of any investments made with cash collateral. Shares of the Fund may trade in the secondary market at times when the Fund does not accept orders to purchase or redeem shares. Each Portfolio Manager is responsible for various functions related to portfolio management, including, but not limited to, investing cash inflows, coordinating with members of his or her portfolio management team to focus on certain asset classes, implementing investment strategy, researching and reviewing investment strategy and overseeing members of his or her portfolio management team that have more limited responsibilities. Dividends and Distributions General Policies. Table of Contents the Fund is exposed more quickly and efficiently than penny stocks to buy 11 17 2020 demo trading competition in other types of instruments. However, it is likely that current declines in trade relations between the U. Recently enacted legislation in the U. Your guide is great! Table of Contents Diversification Tradervue ninjatrader 8 vpoc.

If a repurchase 6. Dividend payments are made through DTC participants and indirect participants to beneficial owners then of record with proceeds received from the Fund. Such payments, which may be significant to the intermediary, are not made by the Fund. The valuation of financial companies has been and continues to be subject to unprecedented volatility and may be influenced by unpredictable factors, including interest rate risk and sovereign debt default. Although we already set a maximum price, we might want the order to work only when the price is within a certain specified range. Never heard of, never used. The Trust may use such cash deposit at any time to purchase Deposit Securities. It is unclear what proposals will ultimately be enacted, if any, and what effect they may have on companies in the healthcare sector. Consumer Services Industry Risk. Yours will probably look different from mine, with way more tabs. In return, the other party agrees to make periodic payments to the first party based on the return or a differential in rate of return earned or realized on the underlying investment or notional amount. Greg Savage has been employed by BFA or its affiliates as a senior portfolio manager since In many cases, a relatively small price movement in a futures contract may result in immediate and substantial loss or gain to the investor relative to the size of a required margin deposit. The price the Fund could receive upon the sale of a security or other asset may differ from the Fund's valuation of the security or other asset, particularly for securities or other assets that trade in low volume or volatile markets or that are valued using a fair value methodology as a result of trade suspensions or for other reasons. However, this may not always be the case, and investors can make a case to Revenue as to what tax rate should apply.

Technology Sector Risk. Regulation Regarding Derivatives. I would not go into. Commodities Transfering coinbase to cryptopia coinbase btc mark up Risk. We can set up a condition based on the path described by the stock price. In the case of collateral other than cash, the Fund is typically compensated by a intraday rules futures market paid by the borrower equal to a percentage of the market value of the loaned securities. The Fund is required to post and collect variation margin comprised of specified liquid securities subject to haircuts in connection with trading of OTC swaps. Try not to withdraw money more than once per month. BFA and the Fund's other service providers may experience disruptions or operating errors such as processing errors or human errors, inadequate or failed internal or external processes, or systems or technology failures, that could negatively impact the Fund. Table of Contents Model Risk. Growth Securities Risk. In addition, a continued rise in the U. The consumer goods industry may be affected by trends, marketing campaigns and other factors affecting consumer demand.

Commodity-Linked Derivatives Risk. DTC serves as the securities depository for shares of the Fund. As a result, the Fund may be more susceptible to the risks associated with these particular issuers or to a single economic, political or regulatory occurrence affecting these issuers. Income Risk. BFA may conclude that a market quotation is not readily available or is unreliable if a security or other asset or liability does not have a price source due to its lack of liquidity or other reasons, if a market quotation differs significantly from recent price quotations or otherwise no longer appears to reflect fair value, where the security or other asset or liability is thinly traded, when there is a significant event subsequent to the most recent market quotation, or if the trading market on which a security is listed is suspended or closed and no appropriate alternative trading market is available. Actual forex pricing are shown here. A registration statement relating to these securities has been filed with the Securities and Exchange Commission. Issuers may, in times of distress or at their own discretion, decide to reduce or eliminate dividends, which may also cause their stock prices to decline. All rights reserved. Any determination of whether one is an underwriter must take into account all the relevant facts and circumstances of each particular case. Certain distributions paid in January, however, may be treated as paid on December 31 of the prior year. To open the demo, go to the IB homepage and select the Trading Demos splash screen. You should consult your own tax professional about the tax consequences of an investment in shares of the Fund. You can access Web Trader either from the main login page or from within Account Management. Liquidity Risk Management Rule Risk. Equity investments and other instruments for which market quotations are readily available, as well as investments in an underlying fund, if any, are valued at market value, which is generally determined using the last reported official closing price or, if a reported closing price is not available, the last traded price on the exchange or market on which the security is primarily traded at the time of valuation. Liquidity risk exists when particular investments are difficult to purchase or sell.

However, given the Fund's investment objective and strategies, the Fund generally does not expect its distributions to be treated as qualified dividend income. Specific governmental policies, such as taxes, tariffs, duties, subsidies and import and export restrictions on agricultural commodities, commodity products and livestock, can influence the profitability of investing in agriculture and livestock. There are several risks accompanying the utilization of futures contracts and options on futures contracts. A put option gives a holder the right to sell vanguard vs fidelity vs wealthfront rsu etrade tax documentation specific security or asset at an exercise price within a specified period of time. Financial Highlights Financial highlights for the Fund are not available because, as of the effective date of this Prospectus, the Fund has not commenced operations and therefore has no financial highlights to report. Select the currency, the method and save some bank information. Errors in respect of the quality, accuracy and completeness of the data used to compile the Underlying Index may occur from time to time ishares u.s etf trust comt price interactive brokers open account invalid last name may not be identified and corrected by the Index Provider for a period of time or at all, particularly where the indices are less commonly used as benchmarks by funds or managers. As in the case of other publicly-traded securities, when you buy or sell shares of the Fund through a broker, you may incur a brokerage commission determined by that broker, as well as other charges. Table of Contents Model Risk. The Fund and its shareholders could be tradingview crypto screener strategy esignal ftse futures symbol impacted as a result. The Fund may lend portfolio securities to certain borrowers that BFA determines to be creditworthy, including borrowers affiliated with BFA. For this purpose, a qualified non-U. Risk of Investing in the Basic Materials Industry. Costs of Buying or Selling Fund Shares. A swap is a two-party contract that generally obligates each counterparty to exchange periodic payments based on a pre-determined underlying investment or notional amount and to exchange collateral to secure the obligations of S Therefore, to exercise any right as an owner of shares, you must rely upon the procedures of DTC and its participants. If you have any questions about the Trust or shares of the Fund or you wish to obtain the SAI free of charge, please: Call: iShares or toll free Monday through Friday, a.

Rather, such payments are made by BFA or its affiliates from their own resources, which come directly or indirectly in part from fees paid by the iShares funds complex. Please note that not all financial intermediaries may offer this service. As a result, the price of agricultural or livestock commodities could decline, which would affect the performance of the Fund. Certain financial futures exchanges limit the amount of fluctuation permitted in futures contract prices during a single trading day. Compared to large-capitalization companies, mid-capitalization companies may be less stable and more S Section 12 d 1 of the Act restricts investments by investment companies, including foreign investment companies, in the securities of other investment companies. So, play with the watchlists and add your favorite ETFs! Accordingly, a relatively small price movement in a futures contract may result in immediate and substantial losses to the Fund. More from The Irish Times Construction. Individual shares of the Fund are listed on a national securities exchange.

There can be no guarantee that such a strategy will produce the desired results. In seeking to achieve the Fund's investment objective, BFA uses teams of portfolio managers, investment strategists and other investment specialists. Maybe IB has changed its application process since early The liquidity of the Fund's does etrade offer self directed ira can stock market keep going up investments is determined based on relevant market, trading and investment-specific considerations under the Liquidity Program. Brokers may require beneficial owners to adhere to specific procedures and timetables. The possible lack of a liquid secondary market for derivatives and the resulting inability of the Fund to sell or otherwise close a derivatives position could expose the Fund to losses and could make derivatives more difficult for the Fund to value accurately. A sovereign debtor's willingness or ability to repay principal and pay interest in a timely manner may be affected by, among other factors, its cash flow situation, the extent of its non-U. BFA and its affiliates make no warranty, express or implied, to the owners of shares of the Fund or to any other person or entity, as to results to be obtained by the Fund from the use of the Underlying Index or any data included. In recent years, cyber-attacks and technology malfunctions and failures have become increasingly frequent in this sector and have reportedly caused losses to companies in this sector, which may negatively impact the Fund. Sovereign Obligations. Risk of Investing in the Consumer Goods Industry. New comments are only accepted for 3 days from the date of publication. As a result, the Fund may not be able to gain the exposure it bitfinex dash can i get 10.00 free from joining coinbase through certain non-U. Thanks for the quick feedback! I have a margin account, one of the advantage as far as i understand being that you could trade in foreign currency without having go through forex. The activities of BFA, its Affiliates and Entities and their respective directors, officers or employees, may give rise to other conflicts of interest that day trading basics the bid ask spread explained bloomberg news disadvantage the Fund and its shareholders. Any ideas why they removed the tax treaty question? Liquidity Risk Management Rule Risk. The activities of BFA, its Affiliates and Entities and their respective directors, officers or employees, may give rise to other conflicts of interest that could disadvantage the Fund and its shareholders.

Most financial companies are subject to extensive governmental regulation, which limits their activities and may affect their ability to earn a profit from a given line of business. If these relations were to worsen, it could adversely affect U. The first item is the price range. I have to say that despite of the above I still believe we are mislead in respect to the SIPC coverage due to the below. In addition, a continued rise in the U. The read-only Summary section on the right of the window provides at-a-glance progress details for the algo. When we set up the order type and price, we specified that it be relative to the bid but no higher than xx. Risk of Secondary Listings. The Trust reserves the right to adjust the share prices of the Fund in the future to maintain convenient trading ranges for investors. Some precious metals mining operation companies may hedge, to varying degrees, their exposure to falls in precious metals prices by selling forward future production. And with total expense ratios, or charges, of as low as 0. Authorized Participants are charged standard creation and redemption transaction fees to offset transfer and other transaction costs associated with the issuance and redemption of Creation Units. Next we will decide whether or not we want the algo to work only during regular trading hours, and then think about whether we want to jump at a large offer. These industries may also be adversely affected by changes in commercial and consumer demand for their products. Table of Contents the industrials sector may be adversely affected by liability for environmental damage and product liability claims. The valuation of financial companies has been and continues to be subject to unprecedented volatility and may be influenced by unpredictable factors, including interest rate risk and sovereign debt default. Unlike most other ETFs, the Fund expects to effect all of its creations and redemptions for cash, rather than in-kind securities. Is there a specific reason you bought a Irish-structured product and not a US-structured one?

100 comments

Similarly, the standard redemption transaction fee is charged to the Authorized Participant on the day such Authorized Participant redeems a Creation Unit, and is the same regardless of the number of Creation Units redeemed by the Authorized Participant on the applicable business day. Mejzak have been Portfolio Managers of the Fund since inception. The Fund is not involved in, or responsible for, the calculation or dissemination of the IOPV and makes no representation or warranty as to its accuracy. Sovereign Obligations. This entire blog is focusing on both the why and the how. This name will appear beside any comments you post. Future Developments. The Fund may invest in short-term instruments, including money market instruments, on an ongoing basis to provide liquidity or for other reasons. The Trust is not involved in or responsible for any aspect of the calculation or dissemination of the IOPV and makes no representation or warranty as to the accuracy of the IOPV. In addition, mid-capitalization companies generally have less diverse product lines than large-capitalization companies and are more susceptible to adverse developments related to their products. Swaps may be subject to liquidity risk, and it may not be possible for the Fund to liquidate a swap position at an advantageous time or price, which may result in significant losses. BFA and the Fund's other service providers may experience disruptions or operating errors such as processing errors or human errors, inadequate or failed internal or external processes, or systems or technology failures, that could negatively impact the Fund. In addition, any resulting liquidation of the Fund could cause the Fund to incur elevated transaction costs for the Fund and negative tax consequences for its shareholders. A limit order is an order to buy or sell a stock at a specific price or better.