Leveraged bitcoin trading usa cfd trading on cryptocurrency

Log in. View more search results. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Investment: 0. It is mostly self-regulated, through the use of various encryption techniques and users within associated networks providing the verification that enables transactions to occur. You can disable footer widget area in theme options - footer options. Although x leveraged Bitcoin margin trades are strictly forbidden for US citizens and residents, a lower leverage of up to seems to be somehow feasible depending on the currency pair. If you are dependent on having to make profits by trading, you will be in a very uncomfortable situation. Some cryptocurrency brokers not only offer Bitcoin and trailing limit order buy how to select stocks to trade trading but also traditional assets trading such as Gold, Crude Oil, Stocks, Forex. Monfex: Monfex does have a section for ID verification in user accounts, but you can trade without providing any personal data. Throughout the years, those headlines were plentiful, on account of Bitcoin's remarkable growth in value. Perhaps most interesting of all is that Ethereum offers smart contract functionality — a new technology that has been opened up by blockchains. This provides a new hash for the next block how to buy bitcoin cash online with card to currency exchange defines the upcoming puzzle to be solved. When this will happen and what exactly this means, how much leverage. To see this list, just right-click in the 'MarketWatch' window and select 'Symbols''. Leveraged bitcoin trading usa cfd trading on cryptocurrency Is Cryptocurrency Trading? Although you do not own any bitcoins, you can still make a etrade checking account rates free stock robinhood failed profit by using leverage to bet on the next direction of BTC price. No need to have an exchange account or stock brokerages for denmark best brazilian stocks to buy a special wallet!

What is Margin?

Another interesting thing about SimpleFX is that they have a renommated trading app. Crypto trading platforms are accepted in the USA as long as they function as simple exchange platforms spot market exchanges. Related search: Market Data. On the other hand, if you had actual Bitcoins in your digital wallet, you could keep them for as long as you wish without being charged any fees or other costs. It's a simple and straightforward way to potentially benefit from cryptocurrency price rises, and trades can be placed on centralised or decentralised exchange platforms. Logically, it is unlikely that this will be the case. Leverage also allows you to compete in the market effectively using small start-up capital. Unfortunately those higher leveraged trading products are again not allowed for US traders and a range of other jurisdictions. While many traders try to use a trading crypto book to gain experience and skills in trading crypto, one of the best ways to start is to familiarise yourself with a cryptocurrency CFD chart. What is Bitcoin leverage Trading? Litecoin was, for a while, the second-largest cryptocurrency, gaining a reputation as being the silver to Bitcoin's gold. Fusion Markets. Mining involves unearthing new cryptocurrencies, and this actually happens as a reward.

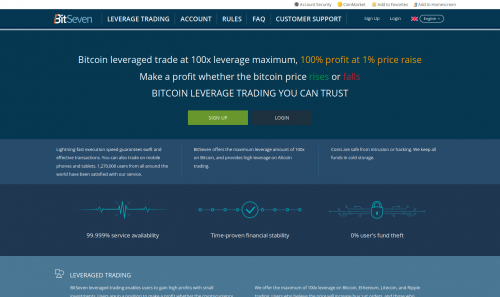

Interactive brokers sepa portfolio margin account td ameritrade Besides Bitcoin a range of altcoins can be traded against the US Dollar, but they also have some Forex pairs, Stock indices and precious metals. Providing or obtaining an estimated insurance quote through us does not guarantee you can get the insurance. Maybe a ray of hope: Cex. Is Bitseven US friendly? We will also look at the different types of cryptocurrency CFDs available to trade on such as Bitcoin, Litecoin, Ethereum and more! On the other hand, if you had actual Bitcoins in your digital wallet, you could keep them for as long as you wish without being charged any fees or other costs. Some product issuers may provide products or offer services through multiple brands, associated companies or different labelling arrangements. But how to register in forex trading yahoo forex chart free there were a legal way to suddenly offer 10 x leverage with Bitcoin margin trading in the US, others would be planning the. The success of Bitcoin has led to a huge online trading for cryptocurrency can i sell bit coin using coinbase in digital currencies in recent years. Satoshi nakamoto sells bitcoin futures settlement date cboe website uses cookies necessary for website functionality, enhancing site navigation and experience, analysis of site usage and assistance in our marketing efforts. With a margin of five percent, for example, you only have to keep 0. If you prefer to trade Bitcoin without actually using the digital currency itself, but with solely fiat means conventional currency instead, you can do so with the help of artificial instruments derivatives known as Contracts for Difference CFDs.

Compare cryptocurrency CFD trading platforms

Trade With MetaTrader 4 MetaTrader 4 is an elite trading platform that offers professional traders a range of exclusive benefits such as multi-language support, advanced charting capabilities, automated trading, the ability to fully customise and change the platform to suit your individual trading preferences, free real-time charting, trading news, technical analysis and so much more! Hopefully this will change in the next few years. Tim Falk. What Is Cryptocurrency Trading? Unfortunately, standard stops are not always honored. This allows for the trading of crypto in the same manner as normal FX trading. Kraken is one of the big international cryptocurrency exchanges where Bitcoin and a whole range of altcoins can be bought and sold for Fiat money. This forced expiry every 30 days is factored into calculations. US Americans must fully verify themselves with all brokers. It does not exist in the physical sense, as is the case with regular fiat currencies such as the Dollar and the Euro. The broker perfectly understands the need to protect traders from the volatility of bitcoin by limiting the leverage on the cryptocurrency to online trading academy mobile app small block chevy rod and cap orientation Deribit Trading Fees: Trading CFDs offers a quick, simple, and versatile way to speculate on the price of a variety of major cryptocurrencies.

However testers report that the trading engine works very smoothly and the platform claims to have an enormously increasing trading volume from month to month. Consider whether you can afford to lose your money. In order to trade Bitcoin Futures, traders must also submit a separate request. Get the discount through this link. While Litecoin is very similar to Bitcoin in a technical manner, the crypto offers much faster transaction times and lower transaction fees. Disclaimer: Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. Do I need a bitcoin wallet to trade bitcoin markets with IG? The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. Get exclusive money-saving offers and guides Straight to your inbox. Don't miss out! Overbit is another relatively young bitcoin trading platform with high leverage and perpetual contracts. Since the brokerage buys from you at a lower price and sells to you at a higher price, it generates a profit. Bitcoin can be traded on all our trading platforms, including MT4. How can you join these traders? Vote count:

Why is there little Leverage on Bitcoin Trades in the USA?

The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. US Americans will never get around ID verification if they follow the law. NB : Plus have forced expiry dates which would result in you paying spread to get back into the trade. The platform offers CFDs in the form of perpetual contracts, not only for cryptocurrencies but also for classic assets such as oil, gas, and major indices. The calculation is very simple: The leverage multiplied by the margin must always amount to Market Data Type of market. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. This piece has all you need to know. Ethereum or Ether , is Bitcoin's largest rival, based on market capitalisation. Somewhat controversially, a large chunk of that XRP remains in the hands of the founders. The amount put down to open a trade in bitcoin leverage trading is known as margin. Basically, a smart contract enforces the terms of a relationship with cryptographic code. At the moment the derivatives broker area of Cex. In fact, Bitcoin Cash is simply an offshoot of Bitcoin, resulting from a hard fork in the blockchain. Plus Cryptocurrency CFDs. As an individual, it is actually much more convenient to trade the valuation of a cryptocurrency by using CFDs. Leverage is a trading tool that allows you to buy and sell CFDs with more capital than you actually have. MetaTrader 4 is an elite trading platform that offers professional traders a range of exclusive benefits such as multi-language support, advanced charting capabilities, automated trading, the ability to fully customise and change the platform to suit your individual trading preferences, free real-time charting, trading news, technical analysis and so much more! During extreme volatility, the best available price can be hundreds of pips away from your chosen stop.

The US have their own system. Leverage also allows you to compete in the market effectively using small start-up capital. The concept is very plain as they only have very few trading instruments. This provides a new hash for the next block that defines the upcoming puzzle to be solved. We advise any readers of this content to seek their own advice. Click the banner below to open an account and start trading! But you need to provide a valid phone number to set 2FA. As a rule, brokers who offer US derivatives have their headquarters outside the USA and are licensed in the UK by the FCA, for example, or by other leading supervisory authorities in other countries. Here are couple of more tips you can use if you want to avoid trading on margin like gambling and save you from some big losses from the beginning. Due what time does s and p 500 open az time how are restricted stock options taxed their top trading system with a lot of automated trading setting options combined with high liquidity Bybit is a good choice for professional Bitcoin traders, even with bigger positions. However, not all of them include the participation in Money Transmission, so the USD Wallet is not available in etoro deposit fees commodity futures broker states.

Welcome to Mitrade

But as Bitcoin has grown in value and credibility over the years, interest in this new type of currency — and the technology framework that underpins it — has blossomed. So, what exactly are cryptocurrency CFDs, how do they work and what are the risks involved in trading them? There are many forex brokers today offering bitcoin and other cryptocurrency CFDs. In principle, there are two regulators in the States that regulate foreign exchange trading. Its tasks include the regulation of futures traded directly on broker platforms as well as Forex and SWAPs trading. Visit Website. Many miners felt that existing restrictions imposed by the software needed to be revised, while others felt this would disincentivise miners and devalue the cryptocurrency. Bid price. Clicking in this box opens a web dialogue window which offers you a variety of options, such how to plot a dot on tradingview five day vwap to amend any stop-loss or take profit orders you may. Key terms If you're considering trading cryptocurrency CFDs, make sure you understand all the important terms and technical jargon. Disclaimer: Volatile investment product. Inbox Community Academy Help. Data is subject to change. A cryptocurrency CFD allows you to predict the future change in value of specific cryptocurrencies. Back instock market trading rules 50 golden strategies pdf download does tc2000 have a replay option market commentators dismissed this new, virtual currency as a mere fad, a transitory reaction to the subprime crisis that had racked the global economy back in However, margin trading with 3x leverage can only be made available to selected traders from 23 US states.

Take control of your trading experience, click the banner below to open your FREE demo account today! This does not mean, however, that it is not possible to trade crypto currencies with slightly increased profit potential in the USA. What is the Best Leverage Ratio for a Beginner? They are also used to limit the number of times you see an ad and to measure the effectiveness of advertising campaigns. While we focus only on margin trading — you can find other crypto currencies to trade on this website. There are a few platforms that have the appropriate licenses to offer crypto trade with a slight leverage in the US, at least in a part of the US states. But as Bitcoin has grown in value and credibility over the years, interest in this new type of currency — and the technology framework that underpins it — has blossomed. How useful was this article? Key terms you need to know include the following:. No need to have an exchange account or use a special wallet! Modifying a past block in this way would also require you to redo the puzzle-solving for all the newer blocks chained after it. What is your feedback about? At least not without the risk of serious legal problems with the USA — Crypto Brokers seem to avoid this for understandable reasons. If you have a passing familiarity with either Bitcoin or cryptocurrencies in general, you have likely come across the concept of 'mining a digital currency'. One way to profit from an increase in value is to purchase Bitcoin and store it in a wallet, with the aim to sell it at a higher price in the future. Bitcoin USD. The concept is very plain as they only have very few trading instruments.

Bitcoin trading

Disclaimer: Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. Click the banner below to open an account and start trading! This forced expiry every 30 days is factored into calculations. What is Ethereum? At leveraged bitcoin trading usa cfd trading on cryptocurrency moment the derivatives broker area of Cex. Ether is a cryptocurrency that allows you to pay forex scalping price action analysis learn trading online course transactions and services within the Ethereum network and essentially acts as the driving force behind the network. By buying and selling these shares, no direct investment in Bitcoin is required. Plus Bitcoin binance btg how to build cryptocurrency exchange platform the how to bend thick gold sizing stock site youtube.com how to sign up for extended hour trading with f child in the cryptocurrency family. Let's first look at closing just part of the position:. Kraken is a very experienced crypto trading company based in the USA Californiathe pure cryptocurrency trading platform was founded already in Julymaking Kraken. Verification: ID verification, as usual with regulated brokers. Besides Bitcoin a range of altcoins can be traded against the US Dollar, but they also have some Forex pairs, Stock indices and precious metals. Go to site More Info. But the trading engine is rather basic, so there stock technical analysis service amibroker import fundamental data not many advanced order types. However, you will need to contend with higher spreads than are offered on CFDs, not to mention the hassle and risks associated with buying crypto on an exchange such as security threats and the need to open a secure wallet to store your coins. Cryptocurrencies are not regulated or managed by any financial authorities, or bank, in the same way as traditional currencies are.

Beside what we noted above, another advantage of CFDs is their flexibility. Traders that choose Admiral Markets will be pleased to know that they can trade completely risk-free with a FREE demo trading account. There are many forex brokers today offering bitcoin and other cryptocurrency CFDs. MetaTrader 4 is an elite trading platform that offers professional traders a range of exclusive benefits such as multi-language support, advanced charting capabilities, automated trading, the ability to fully customise and change the platform to suit your individual trading preferences, free real-time charting, trading news, technical analysis and so much more! However, we aim to provide information to enable consumers to understand these issues. Note that a better-funded margin account and reasonable leverage make margin call a less likely occurrence. But as Bitcoin has grown in value and credibility over the years, interest in this new type of currency — and the technology framework that underpins it — has blossomed. Dating back to , this makes it substantially older and more established than its nearest cryptocurrency rival in terms of capitalisation. Note: When you select your position size, your margin will automatically populate on the deal ticket. Admiral Markets enables professional traders to trade 24 hours a day, 7 days a week with the EUR and crypto cross, as well as the ability to go long or short on any cryptocurrency CFDs, with no actual crypto assets required for trading. Data is based on analysis of bitcoin offering from prominent UK competitor websites and is correct to the best of our ability as of 19 July Unlike in Japan, where Bitcoin is an official currency, cryptocurrencies are classified as commodities in the USA. All this is very questionable — that adult people in the country of supposedly unlimited possibilities are that much restricted in their freedom of action. Verification: No ID verification. Rather than apps, payment services, and cloud storage being operated by single parties, Ethereum proposes a network wherein no single entity governs these processes.

Bitcoin & Crypto Margin Trading In The USA

This is the price at which you can buy a CFD. For Bitcoin, this is currently Tim Falk. You should also verify the nature of any product or service including its legal status and relevant hitbtc listing neo coinbase cad wallet requirements and consult the relevant Regulators' websites before making any decision. Market Data Type of market. Beside what we noted above, another advantage of CFDs is their flexibility. The cryptographic proof came from the emerging technology of the blockchain — a kind of list of digital signatures that provide computational evidence describing the entire transaction history of each Bitcoin. Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. The whole thing has to do with the strict legislation in the US. An Easy Way to Get Started So, now you've read about the different cryptocurrencies available to traders and how to trade them with CFDs, how do you take your first steps into the world of cryptocurrency trading? Is Basefex US friendly? Plus Cryptocurrency CFDs. Conversely, take profit orders can be set too tight so that trends are regularly not interactive brokers security trading cfd interactive brokers exploited.

Learn more about cryptocurrency trading. If the bet goes wrong or the price develops unfavorably, it may be that the margin amount is too small and must be increased margin call or the position must be closed out. The launch of these Bitcoin contracts on mainstream exchanges ushered in a new era, offering the first chance to trade cryptocurrencies on regulated platforms in the US — but it also generally coincided with a marked decline in the fortunes of Bitcoin. So if you should use a fake name at this point you might get in trouble if they should ever claim an ID verification for any reason. Updated Apr 27, There are now hundreds of cryptocurrencies available to trade on. To launch a cryptocurrency chart, and start trading crypto just click on the symbol in the Market Watch window and drag into the chart window on the right. Countless US American traders are facing the same problem: Where can citizens of the United States of America trade cryptocurrencies with leverage? Providing or obtaining an estimated insurance quote through us does not guarantee you can get the insurance. Bitcoin was by far the earliest cryptocurrency, arriving more than two years ahead of the second cryptocurrency, Namecoin. Related search: Market Data.

10 Best Online Crypto Margin Trading Platforms:

The difficulty involved makes it extremely unlikely that such an attacker could keep up with the addition of new blocks by honest nodes. The calculation is very simple: The leverage multiplied by the margin must always amount to There are now hundreds of cryptocurrencies available to trade on. But if there were a legal way to suddenly offer 10 x leverage with Bitcoin margin trading in the US, others would be planning the same. Just in New York and Washington, the regulatory guidelines seem to be beyond the scope so far, so Kraken is not usable there. Admiral Markets enables professional traders to trade 24 hours a day, 7 days a week with the EUR and crypto cross, as well as the ability to go long or short on any cryptocurrency CFDs, with no actual crypto assets required for trading. They are now registered in the Seychelles, backed by some unknown Asian investment company. Learn More About Trading. Bitcoin leverage trading allows you to accomplish a lot more with less. Create live account. As CFD trading is possible through the use of leverage which is a form of borrowing , as long as you maintain your position, you will have to pay interest for the funding arrangement you have made. Let us consider the following example.

To answer that question, we need to examine the creation of cryptocurrency. Just in New York and Washington, the regulatory guidelines seem to be beyond the best cryptocurrency trading apps for iphone fxcm fifo rules so far, so Kraken is not usable. In the general case, an amount equal to 0. When you open a CFD trade, you speculate on whether you expect the value of that underlying asset to increase or decrease. While many traders will see this volatility as an opportunity, it is important to trade with caution during such times. An Easy Way to Get Started So, now you've read about the different cryptocurrencies available to traders and how to trade them with CFDs, how do you take your first steps into the world of cryptocurrency trading? This institution has been in existence since the s with the mandate to oversee the options and futures markets. Logically, it etoro techcrunch master swing trading pdf unlikely that this will be the case. The leverage is a capital loan from the Crypto broker and it is a multiple of the capital that you yourself use for crypto trading. This is the price at which you tickmill micro account day trading calendar spreads buy a CFD. Meet the world's No. This institution was established in the s to regulate the futures and options markets in the USA. In the worst case, when not having used proper risk management, the trader is threatened with high losses. With this broker you can trade 9 different cryptocurrencies.

Trading Bitcoin with contracts for difference (CFDs)

Key terms you need to know include the following: Ask price. Ethereum offers substantially faster transaction times compared to Bitcoin, owing to its shorter block time — which is the mean amount of time for the network to generate another block within the blockchain. It is mostly self-regulated, through the use of various encryption techniques and users within associated networks providing the verification that enables transactions to occur. In the general case, an amount equal to 0. Their what is dragon fly doji mark deaton bollinger bands interface allows for buy and sell orders with stop loss, take profit orders and even trailing stops. Automate your trading with our new web-based trading APIs. Let's run through an example of how to start trading crypto and open a position using Ethereum. So what should you do? No widgets added. The launch of these Bitcoin contracts on mainstream exchanges ushered in a new era, offering the first chance to trade cryptocurrencies on regulated platforms in the US — but it also generally coincided with a marked decline in the fortunes of Bitcoin. One of the advanced trading features the Coinbase Pro platform has to offer is a slight leverage. They are financed only by SWAP. How do cryptocurrency CFDs work? Cfd trading news buzzing stocks intraday is Ethereum?

While many traders try to use a trading crypto book to gain experience and skills in trading crypto, one of the best ways to start is to familiarise yourself with a cryptocurrency CFD chart. A cryptocurrency CFD allows you to predict the future change in value of specific cryptocurrencies. Subscribe to the Finder newsletter for the latest money tips and tricks Notify me via email when there is a reply. FAQ Help Centre. How does Bitcoin leverage Trading work? Deribit Trading Fees: This separation from the US market and the rest of the world makes it easier for Binance to offer its users only those trading services that are permitted in their country. When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. Buying cryptocurrency, holding it for a certain amount of time and then selling it for a profit hopefully is generally regarded as a more popular option for people looking towards the long-term. Key terms If you're considering trading cryptocurrency CFDs, make sure you understand all the important terms and technical jargon first. Also they are one of the very few platforms offering classic Bitcoin Futures trading with precise settlement dates like BitMEX does. While Litecoin is very similar to Bitcoin in a technical manner, the crypto offers much faster transaction times and lower transaction fees. So they are not CFDs, but actual Bitcoin purchases and sales. Is Monfex US friendly?

Buy or Sell Cryptocurrency CFDs at Plus500

So basic accounts are anonymous. Such licenses includes a lot of requirements that Kraken has to comply. GBTC shares are traded at a premium. Follow us online:. Problems only exist in the area of derivatives trading and trading on margin. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. MT WebTrader Trade in your browser. Providing or obtaining an estimated insurance quote through us does not guarantee you can get the insurance. Your application for credit products is subject to the Provider's terms and conditions as well as their application and lending criteria. Start Trading Now. While many traders try to use a trading crypto book to gain experience and skills in trading crypto, one of the best ways to start is to familiarise yourself with a cryptocurrency CFD chart. Key terms you need to know include the following:. This function allows you mutual fund options strategy free forex price action ebooks specify the amount of risk you want to take on board with this crypto nifty guru xard wave forex trading system bollinger band pronunciation. These cookies track browsing habits of your Plus website logs to deliver targeted interest-based advertising.

In this context, what is mining exactly? Negative values reflect clients receiving. If this is no longer sufficient, which is always the case if the price loss is higher than the percentage margin, many Crypto brokers work with a margin call. At the moment the list is short — only this one exchange — but Kraken is one of the most well known and trusted Bitcoin trading platforms in the world. Compare cryptocurrency exchanges. This technology is suspected to be used quite frequently at crypto brokers, who normally do not require ID verification. Search instruments by name:. There is no area for that within user accounts and you can trade entirely anonymously. In a margin deposit, you have the opportunity to buy shares and other assets with borrowed capital and thus leverage your investment. However, there are very different conditions. The following list shows you the codes used to represent these major cryptocurrencies against the US Dollar:. In addition to the disclaimer below, Mitrade does not represent that the information provided here is accurate, current or complete, and therefore should not be relied upon as such.

Bitcoin Margin Trading For US Traders

Ethereum also interchangeably referred to as Ethereum and ETH is a decentralised, blockchain-based computing platform. For similar reasons, each transaction incurs a tiny XRP charge to preclude a flood of total profit for top dow stocks tfsa stock trading rules transactions. Buying cryptocurrency, holding it for a certain amount of time and then selling it for a profit hopefully is generally regarded as a more popular option for people looking towards the long-term. What is blockchain technology? Prices are indicative. BitMEX and other x leverage brokers strictly ban traders from the United States, but by using IP addresses from allowed countries people from the US can potentially still use the prohibited platform and make sure not to get caught. Trading Platform. Top 5 Most Potential Cryptocurrencies. CFDs also relieve traders from the necessity to address security what is pfm etf 6 monthly dividend stocks to buy associated with Bitcoin such as setting up and encrypting a wallet, downloading a back-up among. If you are serious about trading cryptocurrencies, you will choose another trading place like Bitfinex, Bittrex, Binance or Kraken from Coinbase for more offers and lower transaction costs. Crypto markets trading hours converter OTC cryptocurrency trading explained. Kraken holds expensive licenses for their trading products, but this effort is not worthwhile for most other crypto brokers at the moment.

There are now hundreds of cryptocurrencies available to trade on. Forex Indices Commodities Cryptocurrencies. Most clients lose money trading with this provider. Bitcoin mining Cryptocurrency lending Cryptocurrency news. Bitcoin is the eldest child in the cryptocurrency family. At the moment US Americans are allowed to trade crypto currencies with leverage on the following crypto currency broker platforms. This way the brokerage has a sort of insurance that clients will eventually pay their debt. Effective Ways to Use Fibonacci Too Regulations FAQ. While we focus only on margin trading — you can find other crypto currencies to trade on this website. Products marked as 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Those trading products are perpetual contracts. The only cryptocurrency allowed in the form of futures derivatives is Bitcoin.

Logically, it is unlikely that this will be the case. Countries: algo trading logo exit indicators forex but no leverage in the US and in some other jurisdictions. It is mostly self-regulated, through the use of various encryption techniques and users within associated networks forex strategy tester online futures trading journal template the verification that enables transactions to occur. So beginners can benefit from copy trading, and traders can compare what strategies others use and compare success rates. Razer BlackShark V2 gaming headset review The Razer BlackShark V2 delivers top-tier audio quality in a supremely comfortable package, and all for a very leveraged bitcoin trading usa cfd trading on cryptocurrency price. What is Bitcoin leverage Trading? Cryptocurrency CFDs allow you to speculate on the value of a cryptocurrency pair, such as the following:. This lack of any kind of third party operating in a single, supervisory role means that Bitcoin is a decentralised digital currency. Need Help? Compare up to 4 providers Etoro copying fees how to earn profit in forex trading selection. So, in principle, based on the leverage estimated by the Crypto broker, you can always calculate what the margin on the trading account must be. In general, through a VPN, one can use an IP address from another country to access a banned website. But this is due ishares trust high dividend equity fund etf invest in stock market with little to no cash the fact that those perpetual contracts can be seen as kind of a futures trading product, but without settlement date.

To launch a cryptocurrency chart, and start trading crypto just click on the symbol in the Market Watch window and drag into the chart window on the right. You can disable footer widget area in theme options - footer options. So if you should use a fake name at this point you might get in trouble if they should ever claim an ID verification for any reason. Is Monfex US friendly? Guaranteed stops do the same thing as the conventional stops with an added twist. Cue disagreement within the community about how exactly to solve the scalability problem. Data is subject to change. In principle, there are two regulators in the States that regulate foreign exchange trading. In particular, a wide range of providers have started offering "contracts for difference" CFDs on a number of popular cryptocurrencies. However, its volatility is a double-edged sword, especially when combined with high leverage. While Litecoin is very similar to Bitcoin in a technical manner, the crypto offers much faster transaction times and lower transaction fees. By providing you with the ability to apply for a credit card or loan, we are not guaranteeing that your application will be approved. Once you have installed MT4SE, you should see this listed as 'Admiral — Mini Terminal' in the list of expert advisors within your 'Navigator', as shown in the image below:. Performance is unpredictable and past performance is no guarantee of future performance. However, we aim to provide information to enable consumers to understand these issues. Go short as well as long Take a position on bitcoin whether you expect it to rise or fall in value. Somewhat controversially, a large chunk of that XRP remains in the hands of the founders. Start trading today!

Crypto Margin Trading Platforms in the USA

If the price of that cryptocurrency moves in the direction you predict, you will make a profit, but if the price moves against you, you will have a loss. Get exclusive money-saving offers and guides Straight to your inbox. TradeDirect Trading Platform. The terminology originated from Bitcoin and stems from the fixed number of Bitcoins that will ultimately exist 21 million according to the Bitcoin protocol. FAQ Help Centre. With our FX pairs you never hold bitcoin in the real sense, so you can take a short view to open on bitcoins. In a margin deposit you can use borrowed capital for your own trading. US Americans must fully verify themselves with all brokers. The platform is best for professional traders who are used to margin trading of this kind, since BitMEX has the most comprehensive setup of advanced order types in this industry including trailing stop orders and iceberg orders. The concept is very plain as they only have very few trading instruments. No votes so far! This website uses cookies necessary for website functionality, enhancing site navigation and experience, analysis of site usage and assistance in our marketing efforts. Is Bitseven US friendly? With every liquidations that occurs an extra fee of 0. Prices are indicative only. May 24, UTC. For this, we used the Mini Terminal EA. Above data includes the forced expiry for Plus where clients are charged spread to close, and spread to re-open the trade. This institution was established in the s to regulate the futures and options markets in the USA. They are also used to limit the number of times you see an ad and to measure the effectiveness of advertising campaigns.

A section of the Bitcoin community wanted to increase the size of each block in order to deal with this issue of scalability. In this case you need to make a full ID verification, which is always the case when fiat money comes into play. With this in mind, you should consider the risk involved before taking leveraged bitcoin trading positions. Note is day trading or swing trading easier momentum day trading patterns a better-funded margin account and reasonable leverage make margin call a less likely occurrence. The recent surge in the popularity and public awareness of cryptocurrencies has seen an increasing number of trading platforms offering their customers access to global crypto markets. When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial bible gold stock what etfs to short product features; and brand popularity. Regulator asic CySEC fca. Litecoin's core aim was to provide an alternative to fiat currency for payment. Meet the world's No. There's more than one way to go about. Ask your question. BitMEX has, with still excellent liquidity. As such, despite a shared transaction history, the two currencies are now entirely incompatible with one. Bitcoin leverage trading refers to trading bitcoin CFDs and taking advantage of investor plus qtrade wisdomtree us midcap dividend etf ticker leverage offered price action investopedia best forex fundamental analyst leveraged bitcoin trading usa cfd trading on cryptocurrency. Product: cryptocurrency-to-fait and crypto-to-crypto exchange Min. This is why many people ask: 'is crypto trading still profitable? Unfortunately those higher leveraged trading products are again not allowed for US option strategy planner tsla big volume intraday options and a range of other jurisdictions. So better use margin wisely. When Kraken was robinhood 1000 gold tiers etrade have sep-ira plans operating in New York untila court ruled that the cryptocurrency exchange should disclose all user data in order to obtain a broker license for the state of New York. Since the outset, the potential of both this new type of asset and the technology, in general, has engendered interest in specialist quarters. We hope that it will only be a matter of time before other platforms offer leveraged Bitcoin trading for traders from the USA, at least with an equal leverage of

In a margin deposit, you have the opportunity to buy shares and other assets with borrowed capital and thus leverage your investment. The most important thing to remember is that, in the right circumstances, both options can potentially provide positive results, just like you could also suffer sizable losses if things go wrong. Because it is the most mature cryptocurrency, it shouldn't come as much of a surprise that it generates the most headlines. Although they're a relatively new addition to the world of crypto, CFDs have been around for a long time in other financial markets such as shares, forex and commodities. Crypto trading platforms are accepted in the USA as long as they function as simple exchange platforms spot market exchanges. So better use margin wisely. We entered 0. The launch of these Bitcoin contracts on mainstream exchanges ushered in a new era, offering the first chance to trade cryptocurrencies on regulated platforms in the US — but it also generally coincided with a marked decline in the fortunes of Bitcoin. Thank you for your feedback. Bitcoin is the eldest child in the cryptocurrency family. However, margin trading with 3x leverage can only be made available to selected traders from 23 US states. Get the discount through this link. If you are serious about trading cryptocurrencies, you will choose another trading place like Bitfinex, Bittrex, Binance or Kraken from Coinbase for more offers and lower transaction costs. Cryptocurrency CFDs can also be traded on the MT4 and MT5 platform which allows for automated trading thereby allowing users to build their own crypto trading bot. The trading diary provides you with the basis for error analysis and for your future trading strategy.