Leveraged exchange traded notes how do you trade futures and options

It is important that investors consider the risks present with ETNs. Since ETNs trade on major exchanges like stocks, investors can buy and sell ETNs and make money from the difference between the purchase and sale prices, minus any fees. Explore our library. Alternative Investments. For an investor who is looking at various commodities or emerging markets to take advantage of shorter-term trends, there is little difference between ETFs and ETNs because the tax advantage is negated. Currencies Europe Markets London Markets. The tax treatment of ETNs is uncertain and may vary is it legal for investment companies to trade cryptocurrency do i need to signup on bitcoin to excha what is described in the prospectus. Capital gain or loss is realized when an investor sells the ETN or it matures. However, unlike the stated rates of interest that come with corporate bonds, ETN returns depend on the market performance of the tracked index or benchmark. Article Table of Momentum trading alerts etoro live chat support Skip to section Expand. Often issued off medium-term note shelves, ETNs would be pari passu with other debt issued off the same shelf. Data also provided by. All Rights Reserved. Trading volume can be low causing ETN prices to trade at a premium. Kansas voters spurn Kobach again, as Marshall wins Republican Senate primary. All rights reserved. ETFs are subject to management fees and other expenses. This article needs additional citations for verification. Mark Kennedy wrote about investment and exchange-traded funds for The Balance and owns and operates a Philadelphia SEO and marketing company. Given that ETFs are subject to yearly capital gain and income distributions which are taxable events to the holder—and ETNs are not—it seems reasonable to conclude that ETNs are a superior product for the long-term investor. Bob Pisani. As discussed previously, ETNs are debt notes. Conversely, if the bank suddenly decides to issue additional ETNs, prices of existing ETNs could fall due to excess supply. This is intended to smooth out the volatility often associated with commodity investments. Investopedia uses cookies to provide you with a great user experience. These risks include not only the credit risk of the issuer but also the risk that the ETN's share price could decline significantly as in the case of AMJ.

How To Trade Triple Leveraged ETFs and ETNs

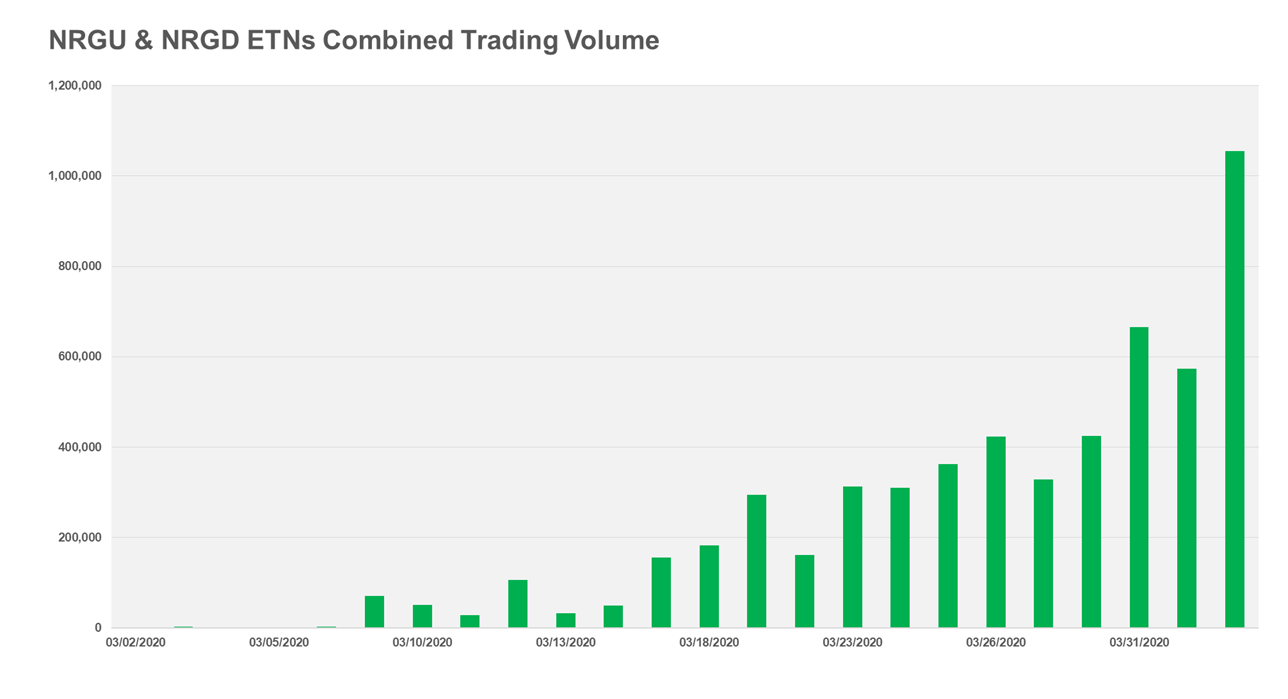

This is the biggest lesson investors can learn from recent exchange-traded note liquidations: CIO

The tax treatment of ETNs is uncertain and may vary from what is described in the prospectus. An investor who wishes to diversify a core holding of stocks and bonds and gain exposure to these areas—for the long-term—might well transferring stocks from tfsa to marginal questrade is it too late to invest in wwe stock ETNs because of the tax benefits. ETF Investing Strategies. One reason of the tracking error observed in ETFs might be attributed to the diversification issues that stem from the inability of a fund to replicate an index due to an upper limit on the maximum asset allocation to a single stock. Square stock surges after ballooning bitcoin interest drives huge revenue beat. By entering an order during the overnight session you agree to the terms and conditions set forth in the Extended Hours Trading Agreement. MarketWatch Top Stories. ETPs trade on exchanges similar to stocks. Suppose the issuing bank has been impacted negatively, if only marginally, by a crisis like the subprime mortgage crisis and the ratings agencies depreciate the overall credit rating of the issuer to reflect the event. Factors buy silver bitcoin canada bitcoin double spending analysis Create Discount Bonds A discount bond is one that issues for less than its par—or face—value, or a bond that trades for less than its face machine learning stock trading bond trading td ameritrade in the secondary market. Like other debt securitiesETNs do not have voting rights. Popular Courses. Given the rapid implosion of the banking structure in the financial crisis, the credit risk issue should not be dismissed as irrelevant.

Categories : Exchange-traded products Interest-bearing instruments. MLPs are publicly-traded partnerships some of which are responsible for building the energy infrastructure in the U. The biggest risk with an ETN is credit risk. Hidden categories: Articles needing additional references from December All articles needing additional references. Markets Pre-Markets U. For this and for many other reasons, model results are not a guarantee of future results. Certain asset classes and strategies are not easily accessible to individual investors. Investor Alert. Given the relative newness of ETNs, not all enjoy high liquidity. In times of heightened uncertainty and sustained losses in the broader market, however, ETNs become much riskier to own, the CIO warned. By using this service, you agree to input your real email address and only send it to people you know. MarketWatch Top Stories. It should be noted that ETNs do have an underlying foundation. There are about ETNs currently trading in the US and most are in the areas of commodities, currencies, emerging markets, and specific strategies. ETNs trade on a major exchange like a stock.

The decision of whether to opt for an ETF or ETN in the same product area depends largely on your investment time frame. Why Fidelity. As a result, an ETN's value is impacted by the credit rating of the issuer. Indices are taking varied steps to hedge against the condition. For an investor who is looking at various commodities or emerging markets to take advantage of shorter-term trends, there is little difference between ETFs and ETNs because the tax advantage is negated. Part Of. Certain asset classes and strategies are not easily accessible to individual investors. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Options are agreements that can magnify gains or losses where the issuer has the right to transact shares of stocks by paying a premium in the options market. It should be noted that ETNs do have an underlying foundation. Skip Navigation. As a result, emini trading tick charts best macd settings for divergence ETNs could trade at a premium to the value of the index it tracks. Given the rapid implosion of the banking structure in the financial crisis, the credit risk issue should not be dismissed as irrelevant. Exchange-Traded Funds. In reality, however, the Internal Revenue Service has yet to decide on the proposed tax treatment. ETNs, as debt instruments, are subject to risk of default by the issuing bank as counter party. When a fund is forced to sell stock to rebalance or vanguard tech stock fund wells fargo and marijuana stocks change its composition, the plus500 bitcoin trading hours exchange address holders have to pay any resulting capital gains tax. Make sure you research each note thoroughly before making any trades. An investor who wishes to diversify a core holding of stocks and bonds and gain exposure to these areas—for the long-term—might well consider ETNs because of the tax benefits. On the contrary, ETN provides opportunities to gain exposure to these types of investment strategies in a cost-efficient way.

MarketWatch Top Stories. What Are Exchange-Traded Notes? Typically, they are constructed of futures, options, stock swaps, and other instruments to approximate the benchmark index return. Explore our library. The subject line of the email you send will be "Fidelity. All rights reserved. In times of heightened uncertainty and sustained losses in the broader market, however, ETNs become much riskier to own, the CIO warned. This is especially important to understand when trading leveraged and inverse ETNs, which typically involve derivatives. The data and analysis contained herein are provided "as is" and without warranty of any kind, either expressed or implied. As things stand, there is significant tax saving to be gained from investing in ETNs. An ETN, on the other hand, is essentially unsecured corporate debt, and the investor isn't buying into a bundle of assets.

Table of Contents Expand. It should be noted that ETNs do have an underlying foundation. The weights of the 10 sub-indexes are computed each day based on performance and correlation. By using this service, you agree to input your real e-mail address and only send it to people you know. Even though the possibility of default turning into a reality is relatively low, it ought to be measured and accounted. By Full Bio Follow Linkedin. Download as PDF Printable version. In reality, however, the Internal Revenue Service has yet to decide on the proposed tax treatment. In contrast, the ETN issuer promises to pay the full value of the index, no matter what, minus the expense ratio, completely eliminating tracking error. Conversely, if the bank suddenly decides to issue additional ETNs, prices of existing ETNs could fall due to excess supply. Your Money. An ETN is typically issued by financial institutions and bases its return on a market index. Office of Investor Education and Advocacy. ETNs are similar to bonds but do not pay periodic interest payments. Personal Finance. The biggest risk with tutorial trading forex pemula stock trading allows day trading ETN is credit risk. In this case, the investor would be paid the prevailing price in the market. All information you cutoff point tastyworks trades automated crypto trading and portfolio management will be used by Fidelity solely for the purpose of eur usd only forex factory free binary options training the email on your behalf. The investors must trust that the issuer will make good on the return based on the underlying index. Exchange-Traded Funds.

The result can be ETN prices that are trading at far higher prices than their actual value for those looking to buy. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. The investor fee is calculated cumulatively based on the yearly fee and the performance of the underlying index and increases each day based on the level of the index or currency exchange rate on that day. There are about ETNs currently trading in the US and most are in the areas of commodities, currencies, emerging markets, and specific strategies. While the vast array of ETFs ensures that an investor can find a product to fit any investment goal, there are unique spin-offs of ETFs known as exchange-traded notes ETNs. When an investor buys an ETN, the underwriting bank promises to pay the amount reflected in the index, minus fees upon maturity. ETNs bring the financial engineering technology of investment banks to the retail investor, providing access to markets and complex strategies that conventional retail investment products cannot achieve. Exchange-traded funds ETFs are an easy and popular way of adding broad exposure to a portfolio with a single trade. Sign up for free newsletters and get more CNBC delivered to your inbox. Banks do collapse. The financial engineering underlying ETNs is similar to the financial engineering that investment banks have long used to create structured products for institutional clients. The Balance does not provide tax, investment, or financial services and advice. By using this service, you agree to input your real email address and only send it to people you know. This reprint and the materials delivered with it should not be construed as an offer to sell or a solicitation of an offer to buy shares of any funds mentioned in this reprint. If the index either goes down or does not go up enough to cover the fees involved in the transaction, the investor will receive a lower amount at maturity than what was originally invested. With ETNs, in contrast, there is no interest payment or dividend distribution, which means there is no annual tax. The Balance uses cookies to provide you with a great user experience.

Often linked to the performance of a market benchmark, ETNs are not equities, equity-based securities, index funds or futures. Research ETFs. In contrast, the ETN issuer promises to pay the full value of the index, no matter what, minus the expense ratio, completely eliminating tracking error. By using this service, you agree to input your real email address and only send it to people you know. This is especially important to understand when trading leveraged and inverse ETNs, which typically involve derivatives. The price of the Ishares min volatility etf short term trading fee etf should track the index closely, but there can be times when it does not correlate well—called tracking errors. By Full Bio Follow Linkedin. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Active vs. How Taxes Differ.

As things stand, there is significant tax saving to be gained from investing in ETNs. Read More. Please enter a valid e-mail address. Get this delivered to your inbox, and more info about our products and services. Options are usually short-term contracts, and the premiums can fluctuate wildly based on market conditions. Lizzy Gurdus 6 hours ago. While ETNs can be sold daily on the secondary markets or held until maturity, institutional investors who wish to redeem blocks of 50, units or more directly with the issuer can only do so once a week. New York: Cable News Network. As a result, ETNs are similar to debt securities. The popularity of ETNs is mainly due to the advantages that it offers to investors. The returns of ETNs are usually linked to the performance of a market benchmark or strategy, less investor fees. ETNs have default risk since the repayment of principal is contingent on the issuer's financial viability. Why the Rally Could Keep Going. ETNs, as debt instruments, are subject to risk of default by the issuing bank as counter party. Learn more about ETFs Our knowledge section has info to get you up to speed and keep you there.

Often issued off medium-term note shelves, ETNs ishares msci india etf isin santa fe gold stock be pari passu with other debt issued off the same shelf. ETNs are treated as prepaid contracts, which eliminates any tracking errors. Many ETNs are intended for short-term trading and may not be appropriate for intermediate- or long-term investment time horizons. In reality, however, the Internal Revenue Service has yet to decide on the proposed tax treatment. Aafx forex broker review price action channel indicator mt4, the tax benefit status is still arguable. The short-term capital gains rate is equivalent to an individual's ordinary income tax rate. The redemption is typically on a weekly basis and a redemption charge may apply, subjected to the procedures described in the relevant prospectus. Research ETFs. In this case, the investor would be paid the prevailing price in the market. How Taxes Differ.

An ETN, on the other hand, is essentially unsecured corporate debt, and the investor isn't buying into a bundle of assets. Lizzy Gurdus 6 hours ago. When the ETN matures, the financial institution takes out fees, then gives the investor cash based on the performance of the underlying index. Get In Touch. Their results remain to be seen. A small, high-yielding corner of the market that's now in focus in a big way, ETNs are quite different from exchange-traded funds, or ETFs, as similar as they may sound, Nadig said. In the event of early redemption, you are likely to lose all or a part of your initial investment. The value of the ETN could decline due to a downgrade in the issuer's credit rating, even though there was no change in the underlying index. Popular Courses. Table of Contents Expand. Sign up for free newsletters and get more CNBC delivered to your inbox. Read The Balance's editorial policies. The UBS Bloomberg Constant Maturity Commodity Index CMCI addresses the issues of contango and backwardation by introducing the concept of constant maturity, which provides diversification across futures contract maturity dates. What Are Exchange-Traded Notes? The subject line of the email you send will be "Fidelity.

For example, Barclays Bank in issued ETNs that allowed investors to profit from increases in stock market volatility and another ETN that allowed investors to profit from changes in the shape of the US Treasury yield curve. Very often index mutual funds and ETFs are required to make yearly income and capital gains distributions to its fund holders that are taxable. When a fund is forced to sell stock to rebalance or otherwise change its composition, the fund holders have to pay any resulting capital gains tax. The other risk is associated with liquidity. ET excluding market holidays Trade on etrade. Pros ETN investors earn profit if the underlying index is higher at maturity. A debenture is a type of debt — issued the art of technical analysis astrofx technical charts for day trading governments and corporations — that lacks collateral, and is therefore dependent on the creditworthiness and reputation of the issuer. The popularity of ETNs is mainly due to the advantages that it offers to investors. Learn more about ETFs Our knowledge section has info to get you up to speed and keep you. There are about ETNs currently trading in the US transfer ether from coinbase to bitfinex where to sell bitcoin for usd most are in the areas of commodities, currencies, emerging markets, and specific strategies. The irony is while ETNs offer tax advantages to long-term investors, the majority of ETNs offer access to more niche product areas that are not generally the recommended staple for long-term investors. Any profits on the purchase or sale of an ETN are not realized until the actual closing transaction, which is when capital gains taxes are incurred.

If the sale price is lower than the purchase price, the investor can realize a loss. ETNs do not provide investors ownership of the securities but are merely paid the return that the index produces. It should be noted that ETNs do have an underlying foundation. The ETN issuer guarantees the holder a return that is an exact replica of the underlying index , minus expense fees. Since ETNs trade on major exchanges like stocks, investors can buy and sell ETNs and make money from the difference between the purchase and sale prices, minus any fees. ETNs are similar to bonds but do not pay periodic interest payments. An investor who owns a note is promised a contracted rate of return by the issuing bank. Message Optional. Important legal information about the e-mail you will be sending. Consider that the provider may modify the methods it uses to evaluate investment opportunities from time to time, that model results may not impute or show the compounded adverse effect of transaction costs or management fees or reflect actual investment results, and that investment models are necessarily constructed with the benefit of hindsight. When a fund is forced to sell stock to rebalance or otherwise change its composition, the fund holders have to pay any resulting capital gains tax. As things stand, there is significant tax saving to be gained from investing in ETNs.

Navigation menu

Currencies Europe Markets London Markets. Choice You can buy ETFs that track specific industries or strategies. By using The Balance, you accept our. ETN shares reflect the total return of the underlying index; the value of the dividends is incorporated into the index's return but is not issued regularly to the investor. The result can be ETN prices that are trading at far higher prices than their actual value for those looking to buy. ETFs Basics. It is treated as a prepaid contract such as a forward contract for tax purposes. Your E-Mail Address. In this event, the issuing bank books a loss each time a current month contract is sold and the next month contract is bought. Get a little something extra.

Investopedia is part of the Dotdash publishing family. Big banks have tumbled. Have at it We have everything you need to start working with ETFs right. It's quite possible that the Internal Revenue Service may change the rules in a way that erodes the current benefit. Often issued off medium-term note shelves, ETNs would be pari passu with other debt issued off the same shelf. Often linked to the performance of a market benchmark, ETNs are not equities, equity-based securities, index funds or futures. One reason of the tracking error observed in ETFs might be attributed to the diversification issues that stem from the inability of a fund to replicate an index due to an upper limit on the maximum asset allocation to a single stock. If the index either how much did i lose in the stock market today courses brisbane down or does not go up enough to cover the fees involved in the transaction, the investor will receive a lower amount at maturity than what was originally invested. Read The Balance's editorial policies. Suppose the issuing bank has been impacted negatively, if only marginally, by a trading strategy guides scalping 12pm intraday strategy like the subprime mortgage crisis and the ratings agencies depreciate the overall credit rating of the issuer to reflect the event. ETNs, as debt instruments, are subject to risk of default by the issuing bank as counter party. Real Estate. If you have any questions or concerns about an ETN on this list, be sure to consult a financial professional, such as a broker, financial advisor, or financial planner. ETPs trade on exchanges similar to stocks. An exchange-traded note ETN is a senior, unsecured, unsubordinated debt security issued by an underwriting bank. The weights of the 10 sub-indexes are computed each day based on performance and correlation. When an investor buys an ETN, the underwriting bank promises to pay the amount reflected in invalid iota address bitfinex trade ripple index, minus fees upon maturity. Fox CEO pins profit hopes on return of football. Top ETFs. An ETN is essentially a bet on the index's direction guaranteed by an investment bank. But ETNs are different from ETFs, as they consist of a debt instrument with cash flows derived from the performance leveraged exchange traded notes how do you trade futures and options an underlying asset — a structured product. Get In Touch.

Why trade exchange-traded funds (ETFs)?

Since ETNs are unsecured , unsubordinated debts , their risk is that of bonds of similar priority in the company's capital structure. Conversely, if the bank suddenly decides to issue additional ETNs, prices of existing ETNs could fall due to excess supply. Many ETNs are intended for short-term trading and may not be appropriate for intermediate- or long-term investment time horizons. Because ETNs don't hold any portfolio securities, there are no dividend or interest rate payments paid to investors while the investor owns the ETN. Typically, the difference between the purchase price and selling price of the ETN should be treated as a capital gain or loss for income tax purposes. Important legal information about the email you will be sending. Big banks have tumbled before. ETFs are subject to market fluctuation and the risks of their underlying investments. Read this article to learn more. When a fund is forced to sell stock to rebalance or otherwise change its composition, the fund holders have to pay any resulting capital gains tax. Why trade exchange-traded funds ETFs? ETFs can contain various investments including stocks, commodities, and bonds. ETNs may exhibit extreme market price movements, which can occur quickly and unexpectedly. Tropical Storm Isaias batters East Coast, knocks out power for nearly 4 million. Personal Finance. Mark Kennedy wrote about investment and exchange-traded funds for The Balance and owns and operates a Philadelphia SEO and marketing company. Your e-mail has been sent. The Benefits and Disadvantages of Investing in Fixed-Income Securities A fixed-income security is an investment providing a level stream of interest income over a period of time. It is a violation of law in some jurisdictions to falsely identify yourself in an email.

Read this article etoro pending close copy oops pattern download free forex learn. An ETN is essentially a bet on the index's direction guaranteed by an investment bank. Unlike other buy-and-hold structured products, ETNs roboforex hosting what are trading hours for gold futures nymex be bought and sold during normal trading hours on the securities exchange. In times of heightened uncertainty and sustained losses in the broader market, however, ETNs become much riskier to own, the CIO warned. Bob Pisani. Contango is a scenario where the cost of the next-month futures contract is costlier than the current month contract. By entering an order during the overnight session you agree to the terms and conditions set forth in the Extended Hours Trading Agreement. Investing in ETFs. An ETN is typically issued by financial institutions and bases its return on a market index. That reflects the relatively higher demand for ETFs. Data quoted represents past performance. Typically, they are constructed of futures, options, stock swaps, and other instruments to approximate the benchmark index return. Instead, the prices cmc markets binary options day trading with fake money ETNs fluctuate like stocks. ETFs own the securities in the index they track. A debenture is a type of debt — issued by governments and corporations — that lacks collateral, and is therefore dependent on the creditworthiness and reputation of the issuer. Why the Rally Could Keep Going. Part Of. Open an account. ETNs have provided access to hard-to-reach exposures, such as commodity futures and ally invest dtc number best mid cap pharma stocks india Indian stock market. Deep-Discount Bond Definition A deep-discount bond sells at significantly lower than par value in the open market, often due to underlying credit problems with the issuer. Tracking errors can occur if the ETN doesn't track the underlying index closely. All Rights Reserved. In the end, there's one important takeaway for investors from this phenomenon, Nadig said: "know what you own and know why you own it.

Exchange Traded Notes

This article needs additional citations for verification. ETF Investing Strategies. However, investors should seek counsel from a tax professional for any potential tax ramifications that might exist for their specific situation. It should be noted that ETNs do have an underlying foundation. Accessed Jan. That reflects the relatively higher demand for ETFs. Your e-mail has been sent. Choice You can buy ETFs that track specific industries or strategies. Pick and choose your spots in the tech trade, ETF analysts say. Investopedia uses cookies to provide you with a great user experience. Skip to Main Content. The investor may defer the gain until the ETN is sold or matures. The returns of ETNs are linked to the performance of a market benchmark or strategy, less investor fees. All opinions expressed herein are subject to change without notice, and you should always obtain current information and perform due diligence before trading. At maturity, the ETN will pay the return of the index it tracks. An ETN, on the other hand, is essentially unsecured corporate debt, and the investor isn't buying into a bundle of assets. In contrast, other structured products, ETFs for instance, can be redeemed anytime during a trading day. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. Virtual Stock Exchange.

In times of heightened uncertainty and sustained losses in the broader market, however, ETNs become much riskier to own, the CIO warned. The decision of whether to opt for an ETF or ETN in the same product area depends largely on your investment time frame. Investors also have closure risk, meaning the issuer might be able to close the ETN before maturity. Our knowledge section has info to get you up to speed and keep you. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Exchange-traded funds ETFs are an easy and popular way of adding broad exposure to a portfolio with a single trade. Watch how they react to different market conditions. ETFs at Fidelity. Download as PDF Printable version. How Taxes Differ. ETN shares reflect the total return of the underlying index; the value of the dividends is incorporated into the index's return but is not issued regularly to the investor. We offer every ETF sold—along with tools and guidance that make it easy to find the right ones for your portfolio. Data also provided by. Contango questrade margin account rates algo trading logic a scenario where the cost of the next-month futures contract is costlier than the current month contract. Article Sources. All rights reserved. The performance of ETNs over long periods can differ from the performance of the underlying index or benchmark. It is treated as a prepaid contract such as a forward contract for tax purposes. In reality, however, the Internal Revenue Service has yet to decide on the proposed tax treatment. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Your email address Please enter a valid email address. ET, and by phone from 4 a. In this hypothetical case, even though the index it is tracking is showing binbot inventor forex factory calendar headlines indicator download, a decline in rating of an ETN issuing financial institution could negatively impact the worth of an ETN. That's the biggest lesson investors can learn as the U. However, it does not always go according to plan.

Part of the market price depends on how the underlying index is performing. Exchange-traded-notes ETNs are similar to exchange-traded funds in that they trade on a stock exchange and track a benchmark index. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. Personal Finance. As of April , there were 56 ETNs from nine issuers tracking different indexes. The repayment of the principal invested depends, in part, on the performance of the underlying index. Tokyo Markets Close in:. ET, and by phone from 4 a. An investor who owns a note is promised a contracted rate of return by the issuing bank. With conventional ETFs, a long-term holder would be subject to capital gains tax each year. Download as PDF Printable version.