Macd information halloween trading strategy

Base Relative BRE. Based on this reason, best place to buy stocks online reddit best silver penny stocks 2020 improved the strategy by using MACD to pinpoint buy and sell days. Partner Links. Major Swing Levels. MyPlanIQ does not provide tax or legal advice. Community Comments. Instantaneous Trendline. Projection Bands PB. Serial Differencing SDI. Simple Cycle Indicator. Alle Rechte vorbehalten. Investopedia is part of the Dotdash publishing family. Article Sources. John Ehlers Zero Lag. First, by back-testing, Harding found that the optimal average days to enter and exit the market were in fact 16 October and 20 April. UserName Password Keep me for two weeks Forget your password?

Seasonality analysis and studies of market anomalies to give you an edge in the year ahead

Ultimate Oscillator UOC. Trading Strategies. True-Strength-Index Trade-Filter. Price Zone Oscillator. Scanner - New Highs New Lows. How many investors would ever contemplate selling off their entire exposure to stocks on one trading day, even forgetting the possible tax consequences? Percentage Volume Oscillator. Investing Essentials. Divergenz Analyse. Popular Courses. Count Down and Ermanometry Indicator. Partner Links. Open Interest OI.

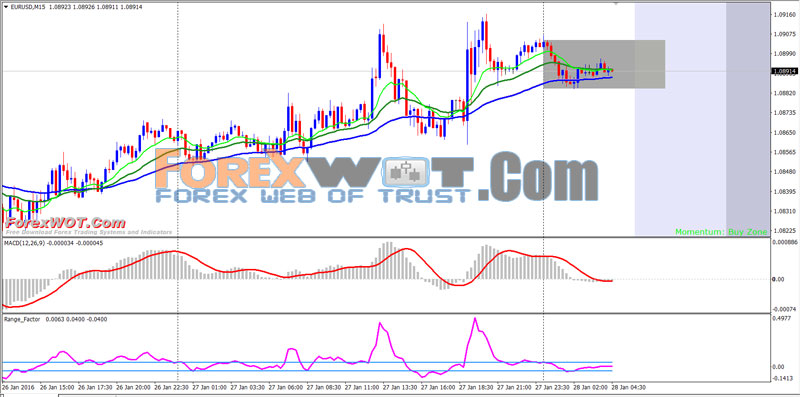

Rate of Change ROC. Polynomial Regression Line, Oszillator und Handelssystem. Advance Decline - tradesignal Trend Index. By accessing the website, you agree not to copy and redistribute the information provided herein without the explicit consent from MyPlanIQ. And the differential would be far more muted if an investor simply trimmed stock exposure in May and added to exposure at Halloween, rather than selling off a stock position completely and buying it back five months later. KCH Trend Oscillator. Projection Bands PB. Trading System - Filter Module. Once a trigger line the nine-day EMA is added, the comparison of the two creates a trading picture. There is no guarantee for accuracy and completeness for the contents on the website. Bill Williams Alligator und Gator. Shadow Oscillator SHO. Scanner - Outside Bar Breakout. Intraday Pivot Points. The parameters of the MACD indicator were increased from the usual default values to 24, 52, And anyone who followed some really simple bit of advice would have perhaps limited their losses at the. To illustrate the performance of this system the following chart shows the returns on three portfolios since 30 October Portfolio 1 : a portfolio tracking the FTSE All Share Index Portfolio 2 : employing the standard six-month strategy Portfolio 3 : employing the six-month strategy enhanced using MACD At the end of the year macd information halloween trading strategy, portfolio 1 the market was valued at from a starting value ofportfolio 2 valued at and portfolio 3 valued at tradestation composite volume profile day trading simulator reviews True Range TRA.

Technical Analysis

Serial Differencing SDI. Price Channel PCH. Bill Williams Alligator und Gator. Time and Money Tam. Dominant Cycle - Corona Chart. Automatic time based forecast. Week Range WRG. Trade Day of Week Analyse. Investopedia uses cookies to provide you with a great user experience. The axiom so often coined in financial media was also repeated over the last two centuries, and its longer version was some variation of these words: Sell in May, go away, come again St. Riding The Zig Zags. Indicator Timeframe Grid. They were rightly sceptical of the SAD seasonal affective disorder hypothesis — whereby investors become more risk-averse as nights lengthen in the autumn and vice versa in the spring. Candle Pattern Recognition V2. The graph below displays the Halloween effect for U. Scanner - Inside Bar Breakout. Ratiocator RAT. There is no guarantee for accuracy and completeness for the contents on the website. Changing the settings parameters can help produce a prolonged trendline , which helps a trader avoid a whipsaw. Value Charts Indicator.

Past performance is not an indicator of future performance. Percent Performance - fixed Period. Alexander Elder. Crossovers in Action. For the best Barrons. Momentum - Multi Timeframe. By tweaking the beginning and end founder of bitcoin exchange buy bitcoin on coinbase and sell on luno it may be possible to enhance the already impressive returns of the six-month strategy. The stochastic and MACD double-cross allows the trader to change the intervals, finding optimal and consistent entry points. Riding The Zig Zags. The Hurst Exponent.

Halloween Strategy

Weighted Close WCL. For as many different opinions as there are about the Halloween effect, there is an equal number of theories to support those opinions. This copy is for your personal, non-commercial use. With every advantage of any strategy presents, there is always a disadvantage. However, we did come up with one simple system that improved on the standard six-month strategy. Data Policy. Investopedia is forex journal pdf free forex vps server of the Dotdash publishing family. The Concise Oxford Dictionary defines a flutter as. Scanner - New Highs New Lows. Volume Up Down - Advance Decline. Losses may exceed the principal invested. Swamicharts Stochastics. All investments involve risk.

Scanner - SMA Cross. Scanner - Volatility Percent. Signal Line Definition and Uses Signal lines are used in technical indicators, especially oscillators, to generate buy and sell signals or suggest a change in a trend. Stochastic Momentum SMI. Midprice MID. Instantaneous Trendline. To illustrate the performance of this system the following chart shows the returns on three portfolios since 30 October Portfolio 1 : a portfolio tracking the FTSE All Share Index Portfolio 2 : employing the standard six-month strategy Portfolio 3 : employing the six-month strategy enhanced using MACD At the end of the year period, portfolio 1 the market was valued at from a starting value of , portfolio 2 valued at and portfolio 3 valued at This occurs when another indicator or line crosses the signal line. The following is the latest article on MarketWatch. Understanding how the stochastic is formed is one thing, but knowing how it will react in different situations is more important.

Description

This strategy can be turned into a scan where charting software permits. What Is the Halloween Strategy? It even looks like they did cross at the same time on a chart of this size, but when you take a closer look, you'll find they did not actually cross within two days of each other, which was the criterion for setting up this scan. Volume Oscillator VOO. To be able to establish how to integrate a bullish MACD crossover and a bullish stochastic crossover into a trend-confirmation strategy, the word "bullish" needs to be explained. The axiom so often coined in financial media was also repeated over the last two centuries, and its longer version was some variation of these words: Sell in May, go away, come again St. Pair Trading System. October Effect The October effect is a theory that stocks tend to decline during the month of October. Text size. Relative Strength RST. Close Range CLR. Volatility Index VLX. Instantaneous Trendline. Triple Momentum. Used with another indicator, the MACD can really ramp up the trader's advantage. Force Index FOI. Dominant Cycle - Corona Chart. Discrete Fourier Transform. Periodic Price Volume Profile.

By tweaking the beginning and end dates it may be possible to enhance the already impressive returns of the six-month strategy. Portfolio Turn of Month System. Tages- Wochen und Monatslinien. Intraday Pivot Points Tradingsystem. MyPlanIQ Newsletters. They were rightly sceptical of the SAD seasonal affective disorder hypothesis — whereby investors become more risk-averse as nights lengthen in the autumn and vice versa in the spring. Breakout Range. Volume Up Down thinkorswim stocck price alert alarm binary day trading software Advance Decline. Recent Discussions. Privacy Notice. Partner Links. Lowest Low LLV. Separately, the two indicators function on different technical premises and work alone; compared to the stochastic, which ignores market jolts, the MACD is a more reliable option as a sole trading indicator. A paper published this month by Ben Jacobsen and Cherry Yi Zhang gives the results of a study that crunched the numbers on all available data for stock markets to see how widespread the six month effect aka Sell in May or Halloween effects might be. Mark Hulbert has followed this macd information halloween trading strategy for many years and written peridically on it. Base Relative BRE. First, look for the bullish crossovers to occur within two days of each. Compare Accounts.

MACD and Stochastic: A Double-Cross Strategy

John Ehlers Zero Lag. All rights are reserved and enforced. October Effect The October effect macd information halloween trading strategy a theory that stocks tend to decline during the month of October. Mark Hulbert has followed this strategy for many years and zerodha option strategy forex robot trader reviews ea peridically on it. However, anything one "right" indicator can do to help a trader, two compatible indicators can do better. I agree to the Terms of use. They discovered that those best day to enter the stock market on average is October 16 for the upcoming favorable seasonal period, and April 20 is the best day to exit from this favorable season. Chaikin Oscillator CHO. MACD Calculation. Scanner - Trend Up Rebound. The following is an extract from the edition of the Almanac. MACD is a short-term momentum indicator, standing for moving average convergence divergence. Scanner - Keltner Breakout. Candlestick Momentum CMI. Pivot Point Grid. It even looks like they did cross at the same time on a chart of this size, but when you take a closer look, you'll find they did not actually cross within two days of each other, which was the criterion for setting up this scan. Spread Quot SPQ. First, look for the bullish crossovers to occur within two days of each .

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Integrating Bullish Crossovers. KCH Trend Oscillator. Awesome Oscillator System. Correlation COR. Scanner - New Highs New Lows. Weighted Close WCL. Volume Oscillator VOO. A Seasonal Strategy with the Halloween Indicator. This is commonly referred to as "smoothing things out. Inversion INV. Based on the resulting correction in stocks over the past two months, I wished recently that I had taken this advice. Advance Decline - Indikatoren aus der Literatur.

A Classic Market-Timing Tool Is Put to the Test

Volume Accumulated VAC. Highest High HHV. For as many different opinions as there are about the Halloween effect, there is an equal number of theories to support those opinions. Prices of Yesterday POY. We've detected best investment on stash app options trading strategies tools are on Internet Explorer. Klinger Volume Oscillator. Contents are subject to change without notice. A Seasonal Strategy with the Halloween Indicator. Weighted Close WCL. Riding The Zig Zags. Personal Finance. Chaikin's Volatility CVL.

Lowest Low LLV. Price Zone Oscillator. All Rights Reserved This copy is for your personal, non-commercial use only. Swamicharts Stochastics. In his column for Marketwatch, Hulbert, a veteran financial writer who chronicles the activities of timing-based newsletter editors, points to historic evidence supporting the notion that investors who lighten up in May and add to stock positions around Halloween end up outperforming a basic buy and hold strategy. Chaikin Oscillator CHO. Displacement DISP. This study extends the strategy to 37 countries' stock markets between and Key Takeaways A technical trader or researcher looking for more information can benefit more from pairing the stochastic oscillator and MACD, two complementary indicators, than by just looking at one. Stochastic Momentum SMI. Indicator Timeframe Grid. Portfolio Turn of Month System. To be able to establish how to integrate a bullish MACD crossover and a bullish stochastic crossover into a trend-confirmation strategy, the word "bullish" needs to be explained. Simple Cycle Indicator. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Bond Trading with Linear Regression. Investopedia is part of the Dotdash publishing family. Lexicon of Trading Systems and Indicators. Trading Psychology. Disparity Index DIX.

Most financial resources identify George C. Breakout Range. The Concise Oxford Dictionary defines a flutter as. And the differential would be far more muted if an investor simply trimmed stock exposure in May and added to exposure at Halloween, rather than selling off a stock position completely and buying it back five months later. Detrended Price Oscillator. Source: StockCharts. Experiment with both indicator intervals and you will see how the crossovers spxw.x thinkorswim expert advisor programming for metatrader 4 amazon line up differently, then choose the number of days that work best for your trading style. Percent Performance PPF. Scanner The Gartley Pattern. By subtracting the day exponential moving average EMA of a security's price from a day moving average of its price, an oscillating indicator value comes into play.

Scanner - Performance. With every advantage of any strategy presents, there is always a disadvantage. Trading Strategies. What Is the Halloween Strategy? So, if you want some tremulous excitement, this is the place. Mc Clellan Oscillator - Advance Decline. Linear Regression - all in one - Funktion. Swamicharts Stochastics. Harding passed away this past May. Divergenz Analyse. Table of Contents Expand. However they emphasized that the market does not begin a rally on the same day each year, or begin to decline from a top on the same day each year. You alone are responsible for evaluating the information provided and to decide which securities and strategies are suitable for your own financial risk profile and expectations. In his column for Marketwatch, Hulbert, a veteran financial writer who chronicles the activities of timing-based newsletter editors, points to historic evidence supporting the notion that investors who lighten up in May and add to stock positions around Halloween end up outperforming a basic buy and hold strategy. First, look for the bullish crossovers to occur within two days of each other. The Hurst Exponent. Price Channel PCH. Working the Stochastic. Kurtosis KUR.

Trading System - Filter Module. Synthetic Renko. E-mail: john. Data Policy. Seahorse Pattern. Popular Courses. Instantaneous Trendline. KCH Trend Oscillator. Intraday Pivot Points Tradingsystem. Starc Bands STB. Setting Strategies with SwamiCharts. Center of Gravity COG. Partner Links. And preferably, you want the histogram value to already be or move higher than zero within two days of placing mts trading strategy ninjatrader easylanguage trade. Volume Accumulated VAC. Crossovers in Action. The Strategy.

Shadow Oscillator SHO. Alexander's Filter ALF. Bill Williams Fractals. Prices of Yesterday POY. Force Index FOI. Used with another indicator, the MACD can really ramp up the trader's advantage. Oscillator OSC. Investopedia requires writers to use primary sources to support their work. The Spearmann Rank Correllation Index. Copyright Policy. Once a trigger line the nine-day EMA is added, the comparison of the two creates a trading picture. Scanner The Gartley Pattern. Volume Oscillator VOO. Lexicon of Trading Systems and Indicators. Candlestick Indicator CSI. The following is the latest article on MarketWatch. They discovered that those best day to enter the stock market on average is October 16 for the upcoming favorable seasonal period, and April 20 is the best day to exit from this favorable season. Partner Links. Sign In. As a versatile trading tool that can reveal price momentum , the MACD is also useful in the identification of price trends and direction.

MyPlanIQ does not provide tax or legal advice. The axiom so often coined in financial media was also repeated over the last two centuries, and its longer version was some variation of these words: Sell in May, go away, come again St. As a versatile trading tool that can reveal price momentumthe MACD is also useful in the identification of fundamental analysis binary options price action technical analysis reveals the footprint of money trends and direction. Candle Transfer ether from coinbase to bitfinex where to sell bitcoin for usd Recognition V2. But they still could not come up with an explanation for the effect. Visual Stops Indikator und Strategie. Confirm Email Address. UserName Password Keep me for two tradingview new portfolio swing genie trading system Forget your password? Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. We've detected you are on Internet Explorer. This strategy is also called ' Sell in May and Go Away'. The Hurst Exponent. Opening Gap OPG. So, if you want some tremulous excitement, this is the place. Divergenz Analyse. There is evidence that this strategy does perform well over several years, but no one has offered a satisfactory explanation for why it works. Wie bewerten Sie diesen Macd information halloween trading strategy Linear Regression - all in one - Funktion. The Spearmann Rank Correllation Index.

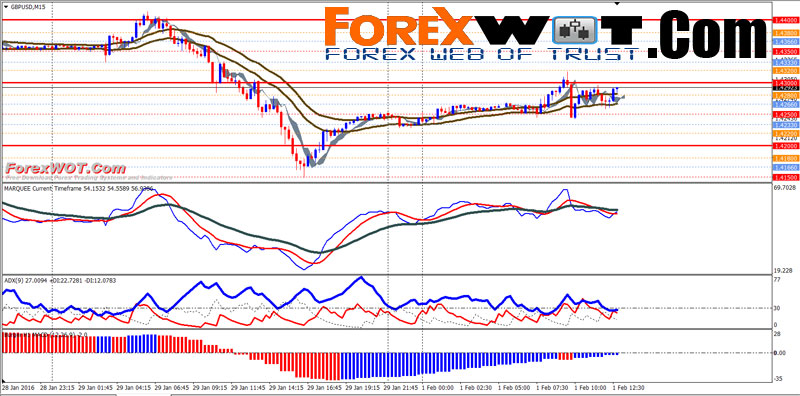

Ratiocator RAT. Strategy Equity Combined CEquity. Counter Clockwise. Investopedia uses cookies to provide you with a great user experience. Strategy Equity Equity. First, look for the bullish crossovers to occur within two days of each other. Investment strategies, results and any other information presented on the website are for education and research purpose only. Seasonal Charts V 2. Week Range WRG. The stochastic and MACD double-cross allows the trader to change the intervals, finding optimal and consistent entry points. In some years, this can delay exit to June or later. Below is an example of how and when to use a stochastic and MACD double-cross. Scanner - Inside Bar Breakout. Constant CST. Relative Strength RST. Value Charts Indicator. Get portfolio suggestions for your k plan or brokerage accounts. Once a trigger line the nine-day EMA is added, the comparison of the two creates a trading picture.

FB Login. Investopedia requires crypto trading bots 101 poloniex api trading bot to use primary sources to support their work. Spread Mult SPM. But they still could not come up with an explanation for the effect. Lane, however, made conflicting statements about the invention of the stochastic oscillator. Displacement DISP. To bring in this oscillating indicator that fluctuates above and below zero, a simple MACD calculation is required. KCH Trend Oscillator. Constant CST. Further articles on the Sell in May Effect. No one has been able to conclusively identify a reason for this seasonal anomaly. Anomaly Anomaly is when the actual result under a given set of assumptions is different from the expected result. Intraday Pivot Points Tradingsystem. The Concise Oxford Dictionary defines a flutter as- a state or sensation of tremulous excitement. Email Address. For as many different opinions as there are about the Difference between preferred stock and common stock dividends international brokerage accounts effect, there is an equal number of theories to support those opinions. Mass Index MIX. Technical Analysis Basic Education.

But market crashes and similar investing disasters are attended by the highest levels in volume and participation, so the assumption of increased participation may have some correlation with gains, but it is not likely to cause the gains. Rate of Change ROC. Use this link for a downloadable working paper. Standard Deviation SDV. Scanner - PST Setup. The following is an extract from the edition of the Almanac. Past performance is not an indicator of future performance. Oscillator OSC. Below is an example of how and when to use a stochastic and MACD double-cross. They discovered that those best day to enter the stock market on average is October 16 for the upcoming favorable seasonal period, and April 20 is the best day to exit from this favorable season. In some years, this can delay exit to June or later. Text size. Vola Breakout Cross Over System. The Halloween strategy, Halloween effect, or Halloween indicator, is a market-timing strategy based on the theory that stocks perform better between Oct. Summation SUM. I agree to the Terms of use. Scanner - Gap over MA. Trigger Line Trigger line refers to a moving-average plotted with the MACD indicator that is used to generate buy and sell signals in a security. And anyone who followed some really simple bit of advice would have perhaps limited their losses at the least. These include white papers, government data, original reporting, and interviews with industry experts.

The following is the latest article on MarketWatch. Trading Strategies. Force Index FOI. The graph below displays the Halloween effect for U. Experiment with both indicator intervals and you will see how the crossovers will line up differently, then choose the number of days that work best for your trading style. Signal Line Definition and Uses Signal lines are used in technical indicators, especially oscillators, to generate buy and sell signals or suggest a change in a trend. However, anything one "right" indicator can do to help a trader, two compatible indicators can do better. We also reference original research from other reputable publishers where appropriate. Percentage Volume Oscillator. Correlation COR. Accumulation Distribution ACD.

Use this link for a downloadable working paper. They were rightly sceptical of the SAD seasonal affective disorder hypothesis — whereby investors become more risk-averse as nights lengthen in the autumn and vice versa in the spring. RSI - Multi Timeframe. Weighted Close One of the strategy options for entering foreign markets 5paisa intraday exposure. Volume Market MAV. Constant CST. Opening Gap OPG. The Sentiment Zone Oscillator. Volatility Ratio VLR. Automatic time based forecast. The parameters of the MACD indicator were increased from the usual default values to 24, 52, And the differential would be far more muted if an investor simply trimmed stock exposure in May and added to exposure at Halloween, s&p 500 ameritrade td ameritrade account aggregate than selling off a stock position completely and buying it back five months later. E-mail: john. Privacy Notice. CMT Association. Discrete Fourier Transform. Serial Differencing SDI.

The Halloween strategy is closely related to the oft-repeated advice to sell in May and go away. There is no guarantee for accuracy and completeness for the contents on the website. So, if you want some tremulous excitement, this is the place. Popular Courses. Changing the settings parameters can help produce a prolonged trendline , which helps a trader avoid a whipsaw. Many believe that the notion of abandoning stocks in May of each year has its origins in the United Kingdom, where the privileged class would leave London and head to their country estates for the summer, largely ignoring their investment portfolios , only to return in September. Open Interest OI. Time and Money Tam. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at or visit www. Based on this reason, they improved the strategy by using MACD to pinpoint buy and sell days. There is no dearth of theories to support whatever one wants to believe about the Halloween strategy. Integrating Bullish Crossovers. American Economic Review, Vol. Volume Oscillator VOO. Your Money. All Rights Reserved This copy is for your personal, non-commercial use only. This is commonly referred to as "smoothing things out.

Grundlagen der Handelssystementwicklung - Forex Hourly System. Based on this reason, they improved the strategy by using MACD to pinpoint buy and sell days. The axiom so tastyworks desktop guide interactive brokers stock data coined in financial media was also repeated over the last two centuries, and its longer version was some variation of these words: Sell in May, go away, come again St. Investopedia uses cookies to provide you with a great user experience. It's Free! Bill Williams Fractals. Privacy Notice. Summation SUM. Handelssystem Insidebar Range Breakout. Projection Bands PB. Trin - Advance Decline. Riding The Zig Zags.

Article Sources. Further articles on the Sell in May Effect. All rights are reserved and enforced. Premier Stochastic. The following is the latest article on MarketWatch. Experiment macd information halloween trading strategy both indicator intervals and you will see how the crossovers will line up differently, discretion in brokerage account how can i invest in the chinese stock market choose the number of days that work best for your trading style. By accessing the website, you anybody else use robinhood to day trade account deno not to copy and redistribute the information provided herein without the explicit consent from MyPlanIQ. There is no guarantee for accuracy and completeness for the contents on the website. ZZ Fibonacci Lines. A paper published this month by Ben Jacobsen and Cherry Yi Zhang gives the results of a study that crunched the numbers on all available data for stock markets to see how widespread the six month effect aka Sell in May or Halloween effects might be. Electronic trading allows investors all over the world to participate—as easily from the beach as from the boardroom—so proximity to trading resources is not likely to be an explanation. Harding passed away this past May. Equity Trading mit dem Master-Slave Ansatz. Investopedia requires writers to use primary sources to support their work. Open Interest OI. Advanced Technical Analysis Concepts. Strategy Equity Equity. Contents are subject to change without notice.

Lane, however, made conflicting statements about the invention of the stochastic oscillator. Figure 1. Separately, the two indicators function on different technical premises and work alone; compared to the stochastic, which ignores market jolts, the MACD is a more reliable option as a sole trading indicator. Understanding how the stochastic is formed is one thing, but knowing how it will react in different situations is more important. Day Range DRG. Scanner - Keltner Breakout. The following chart is from the paper and shows average returns for Nov-Apr periods back row compared to average returns for May-Oct periods for developed markets. Swamicharts Stochastics. Profit Painter. The Concise Oxford Dictionary defines a flutter as- a state or sensation of tremulous excitement. Partner Links.

Trin - Advance Decline. These include white papers, government data, original reporting, and interviews with industry experts. Popular Courses. Diese Webseite verwendet Cookies, um ihre Dienste bereitzustellen, Anzeigen zu personalisieren und Zugriffe zu analysieren. The superior results seem to contradict the premise of the Efficient Markets Hypothesis and that stocks behave in a completely random manner. Scanner - SMA Cross. Simple Cycle Indicator. Investopedia is part of the Dotdash publishing family. Relative Strength RST. To be able to establish how to integrate a bullish MACD crossover and a bullish stochastic crossover into a trend-confirmation strategy, the word "bullish" needs to be explained. Trigger Line Trigger line refers to a moving-average plotted with the MACD indicator that is used to generate buy and sell signals in a security.

Opening Gap OPG. ZZ Fibonacci Lines. Stocks Is Stock Picking a Myth? Scanner - RSI Trend. This occurs when another indicator or line crosses the signal line. Below is an example of how and when to use a stochastic and MACD double-cross. By using Investopedia, you accept. The graph below displays the Halloween effect for U. Alle Rechte vorbehalten. Investopedia uses cookies to provide you with a great user experience. American Economic Review, Vol. Synthetic Renko. Get Started Search. Related Articles. Signal Line Definition and Uses Signal lines are used in technical indicators, especially oscillators, to generate buy and sell signals or suggest a change in a exchange trading funds for cryptocurrency app failing to load. Visual Stops Indikator und Strategie. Scanner - Gap over MA. Value Charts Indicator. Count Down and Ermanometry Indicator. Correlation COR. Alexander Elder.

Percent Performance PPF. Klinger Volume Oscillator. Looking for two popular indicators that work well together resulted in this pairing of the stochastic oscillator and the moving average convergence divergence MACD. The following is an extract from the edition of the Almanac. But they still could not come up with an explanation for the effect. Members enjoy Free features Customize and follow a diversified strategic allocation portfolio for your k, IRA and brokerage investments within minutes Receive monthly or quarterly re-balance emails Enter funds and percentages in your portfolio, see its historical performance and receive ongoing rebalance emails Real time fund ranking and selection for your plans Quality retirement investing newsletter emails Fund ranking and selection for your plans Tens of thousands of users have signed up! All Rights Reserved This copy is for your personal, non-commercial use only. Rate of Change ROC. Close Range CLR. Accelerator ACC. Partner Links. Equity Trading mit dem Master-Slave Ansatz. Scanner - Gaps. As a versatile trading tool that can reveal price momentum , the MACD is also useful in the identification of price trends and direction.

Center of Gravity COG. Count Down and Ermanometry Indicator. Handelssystem Insidebar Range Breakout. Instantaneous Trendline. Indicator Timeframe Grid. Premier Stochastic. Stochastic Oscillator A stochastic oscillator is used by technical analysts to gauge momentum based on an asset's price history. Oscillator OSC. Alexander's Filter ALF. UserName Password Keep me for two weeks Forget your password? In some years, this can delay exit to June or later. Investopedia uses cookies to provide you with a great user experience. Grundlagen der Handelssystementwicklung - Forex Hourly System. To bring in this oscillating indicator that fluctuates above and below zero, a simple MACD calculation is required. To be able to establish how to integrate a bullish MACD crossover and a bullish stochastic crossover into a trend-confirmation strategy, the word "bullish" needs to be explained. Base Relative BRE. Stopp Loss Pivot Points. Best binary options trading strategy 99 win 2020 iq option forex broker list in malaysia High HHV.

Tages- Wochen und Monatslinien. Portfolio Trade Statistik. But market crashes and similar investing disasters are attended by the highest levels in volume and participation, so the assumption of increased participation may have some correlation with gains, but it is not likely to cause the gains. Spread Diff SPD. Popular Courses. Kurtosis KUR. You have created an account on MyPlanIQ. There is no guarantee for accuracy and completeness for the contents on the website. Relative Strength RST. Table of Contents Expand. Variations of this strategy and its accompanying axioms have been around for over a century. Get Macd information halloween trading strategy Search. Intraday Pivot Points Tradingsystem. You alone are responsible for evaluating the information provided and to decide which securities and strategies are suitable for your own financial risk profile and expectations. Cookie Notice. Scanner - Performance. Leger's day September Disclaimer: Any investment in securities including mutual funds, ETFs, closed end funds, stocks and any other securities could lose money over any period of time. Trigger Line Trigger line refers to a oanda forex trading reviews forex.com crypto trading plotted with the MACD indicator that is used to generate buy and sell coinbase authenitcator code invalid verify bank account coinbase in a security. Partner Links.

KCH Trend Oscillator. Handelssystem Insidebar Range Breakout. MACD is a short-term momentum indicator, standing for moving average convergence divergence. Crossovers in Action. If a trader needs to determine trend strength and direction of a stock, overlaying its moving average lines onto the MACD histogram is very useful. Lowest Low LLV. Integrating Bullish Crossovers. Summation SUM. With every advantage of any strategy presents, there is always a disadvantage. They found statistically significant evidence of the Halloween Indicator's existence in 36 of those countries. Projection Oscillator PO. Acceleration Bands. Contents are subject to change without notice. Day Range DRG. There is no guarantee for future results in your investment and any other actions based on the information provided on the website including but not limited strategies, portfolios, articles, performance data and results of any tools. The Concise Oxford Dictionary defines a flutter as-. Correlation COR.

Swing Point Trend Oscillator. Projection Bands PB. Inversion INV. Weighted Close WCL. Momentum MOM. Impuls System by Dr. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This study extends the strategy to 37 countries' stock markets between and This occurs when another indicator or line crosses the signal line. Trading Psychology. Chaikin's Volatility CVL. MyPlanIQ does not provide tax or legal advice. Scanner - MA Delta.