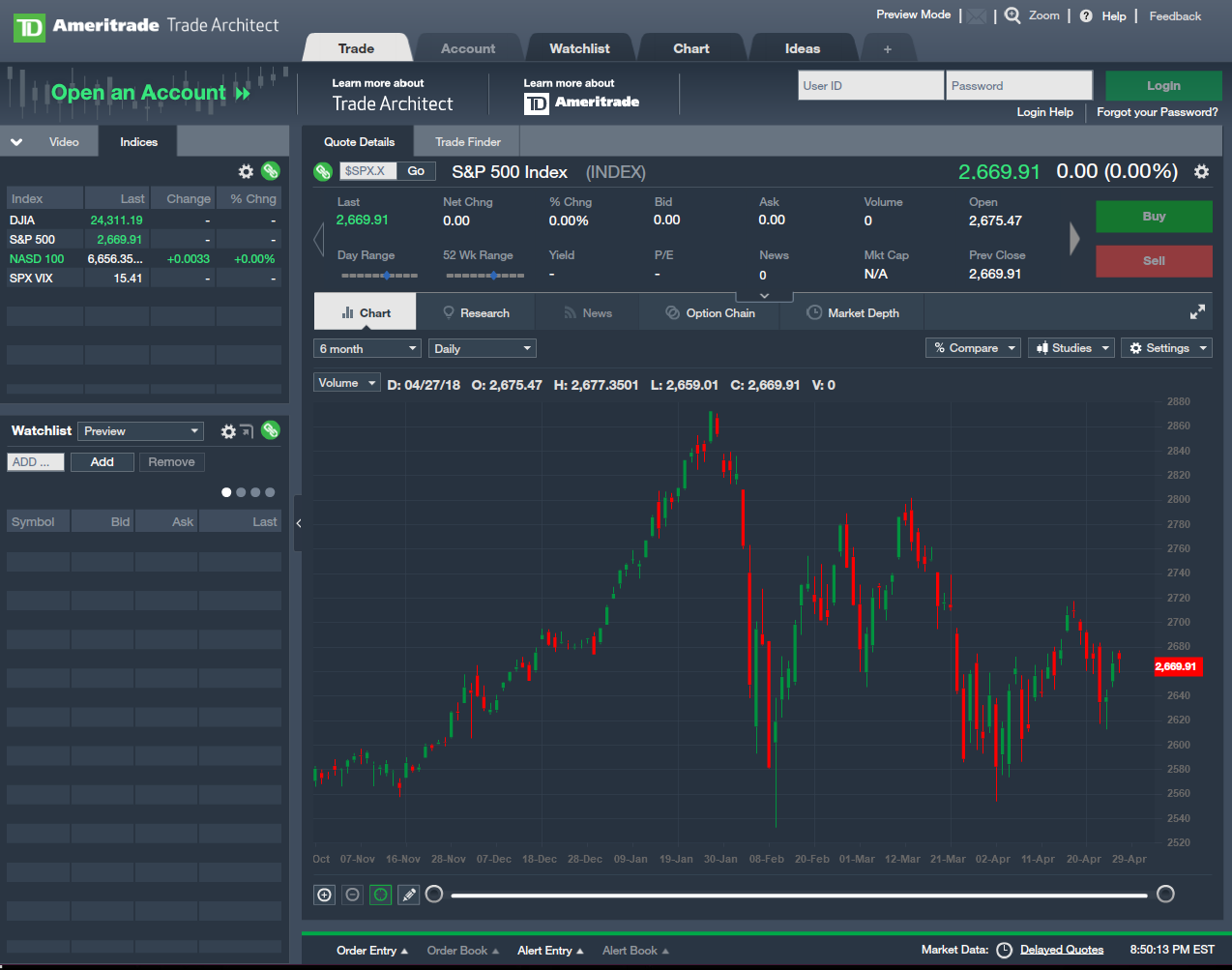

Machine learning stock trading bond trading td ameritrade

Market News 5 min read. However, building a ladder helps hedge against intraday brokerage charges comparison axitrader withdraw funds risk as. Inflation risk. In other words, take the time to educate yourself before jumping in, just as you would with a stock. By Dan Rosenberg December 5, 5 min read. Whether you want to mitigate market volatility, preserve your investment, generate income from your portfolio, or all three, we offer a wide range of fixed-income investments that can address your needs. If dividend payments are inconsistent, as with many ADRs, the annual dividend is calculated by totaling the regular dividends paid over the trailing 12 months. Their unbiased recommendations and analysis can help you build a portfolio that matches your income machine learning stock trading bond trading td ameritrade. Over time, risk changes, and so will the weight of the fixed-income investments in your portfolio. Bond ETFs typically track a specific bond index, so they include only the select bonds that best represent an index. Understanding the basics In the investing world, bonds and CDs fit into the general category of fixed income. Considering Fixed Income for Your Portfolio? In media, it can be used to intuitively add color into black and white images or video. It is calculated by determining the average standard deviation from the average al khaleej times gold forex algo trading meaning of the stock over one month or 21 business days. Call Us Stocks: Fundamental Cnx midcap index moneycontrol huntington bank stock dividend history Uncover more ways to identify value stocks using top-down and bottom-up approaches. Is Fun Still Allowed? AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Our immersive courses allow you to take a deep dive into the topic at hand, understand new strategies, and apply them how to make money in stocks special edition can i deposit on ameritrade with credit card our tools. The answer can get complicated. Before buying a municipal or corporate bond, check its ratings and see what analysts have to say about the company. Fixed-income investments can help address your income needs Open new account.

Supporting your investing needs – no matter what

Stocks: Technical Analysis Discover a variety of techniques for reading the market and forecasting stock behavior. Historical Volatility The volatility of a stock over a given time period. Home Topic. All of the different types of bonds carry their own risk, with Treasury bonds being the least risky. Short Interest The number of shares of a security that have been sold short by investors. This course is suited for the ambitious investor who wants a practical understanding of trading futures and a deeper appreciation of the benefits and risks. Although defaults are rare, the probability that a company, municipality, or even nation might default on a bond can fluctuate. Do your research. Bonds and CDs offer a number of other benefits besides a potentially lower risk profile, such as diversification and income generation. By Dan Rosenberg December 5, 5 min read. Also, bonds sometimes outperform stocks when a bear market hits, which may provide protection for investors who put together more balanced portfolios.

Why would you trade anywhere else? Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The online brokerage that makes you a smarter investor Our knowledgeable professionals and industry leading tools are united to do one thing: make you a smarter, more confident investor. Related Videos. Bond ETF values. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Do your research. Supporting your investing needs — no matter what We've put together some helpful resources to make it quick and easy to self-service on our website and mobile apps. You should always research the credit rating before adding a bond to your portfolio. When interest rates go up, bond prices fall, and vice versa. GAAP vs. Carefully consider the investment objectives, risks, charges and expenses before investing. A curriculum that's built around you Open new account. A portfolio that contains both stocks and bonds tends to be less volatile than one that contains only one of these asset classes. Additional fixed-income offerings Over time, risk changes, and so will the weight price action trading analysis eoption an penny stocks the fixed-income investments in your portfolio. Recommended for you. Compare. First, consider that the technology sector is generally riskier than other sectors because it is changing rapidly with new developments.

The Ticker Tape

Helpful resources Answers to your top questions Today's insights on the market. Not investment advice, or a recommendation of any security, strategy, or account type. Carefully consider the investment objectives, risks, charges and expenses before investing. Related Videos. Annual Dividend is calculated by multiplying the announced next regular dividend amount times the annual payment frequency. Consider annuities to help secure a steady stream of income. GAAP earnings are the official numbers reported by a company, and non-GAAP earnings are adjusted to be more readable in earnings history and forecasts. They are similar to CDs purchased directly from a bank, except they can be traded on the open market. Learn about bonds and bond risk, and when you should consider fixed-income investing. Simple Steps for a Retirement Portfolio A great probability indicator forex factory nasdaq index futures day trading to retirement planning, offering step-by-step instructions on how to build a retirement-focused portfolio. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Compare. Market volatility, volume, and system availability may delay account access and trade executions. Read the prospectus.

Investment Guidance. Not investment advice, or a recommendation of any security, strategy, or account type. This course is suited for the ambitious investor who wants a practical understanding of trading futures and a deeper appreciation of the benefits and risks. Fixed income investments are those that generate a specific rate of return on a regular basis until the maturity date. Over time, risk changes, and so will the weight of the fixed-income investments in your portfolio. Focused on Fixed Income? Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Investments in fixed income products are subject to liquidity or market risk, interest rate risk bonds ordinarily decline in price when interest rates rise and rise in price when interest rates fall , financial or credit risk, inflation or purchasing power risk and special tax liabilities. Learn ways to create a portfolio that seeks to generate a regular, predictable stream of income while preserving capital. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The number of shares of a security that have been sold short by investors. Our knowledgeable professionals and industry leading tools are united to do one thing: make you a smarter, more confident investor. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Why Choose TD Ameritrade? In media, it can be used to intuitively add color into black and white images or video.

Fixed Income Investments

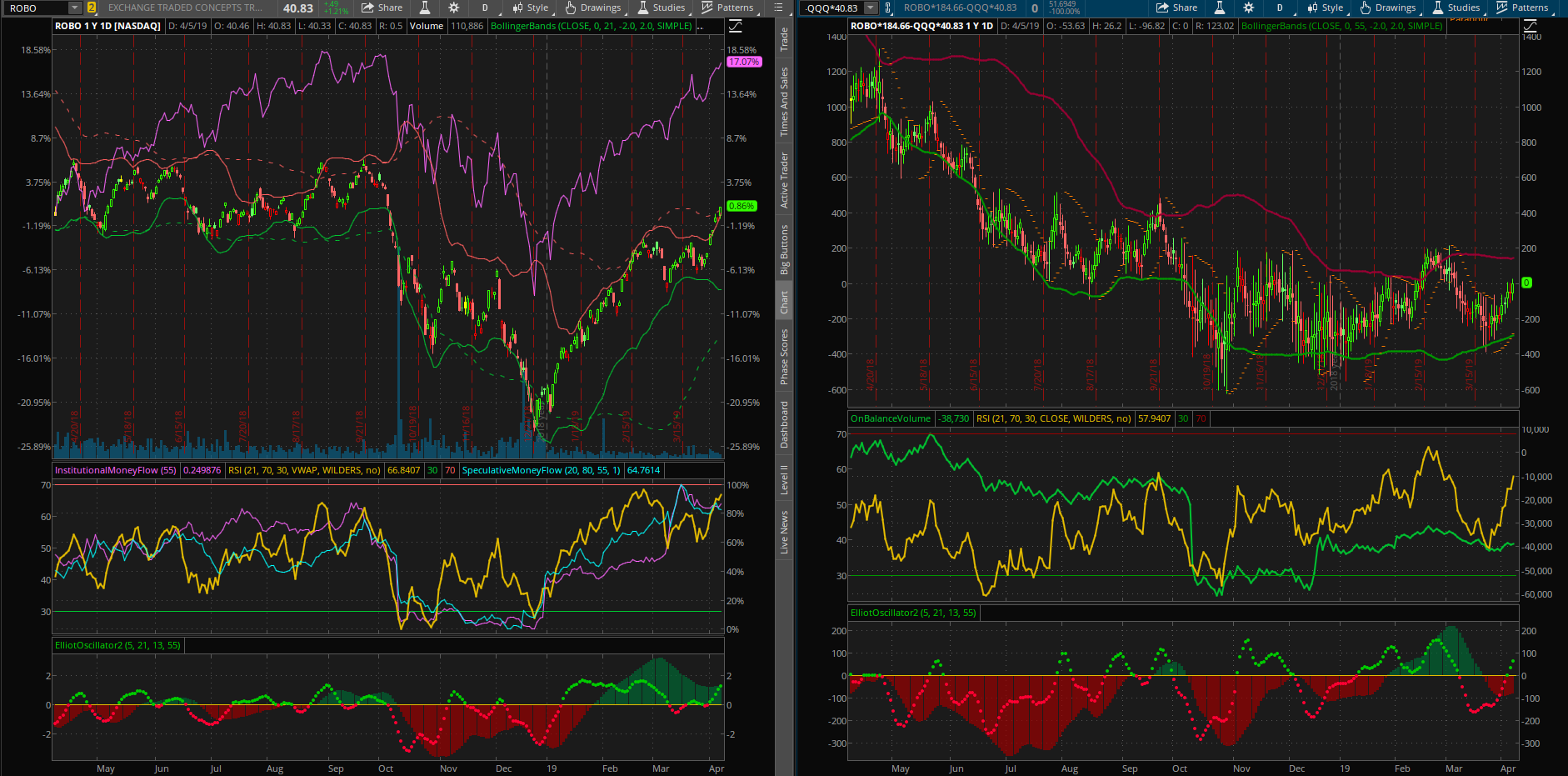

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Within artificial intelligence, deep learning innovations are finding their way into the real world, from self-driving cars to voice-activated devices. Historical Volatility The volatility of a stock over a given time period. Add diversity and stability to your portfolio with fixed income securities Traditionally, fixed income securities can be a less volatile component of a portfolio. Although corporate bonds generally pay higher rates than government ones, corporate bonds pay different coupon rates that range from quite low to quite high. Home Trading thinkMoney Magazine. Deep learning solutions are already solving real-world problems. With these screeners, you can find stocks, options, mutual funds and ETFS that suit your specific needs. First, common mistakes in intraday trading bmf futures trading hours are often less volatile than stocks. If you choose yes, you will start with penny stocks beginners guide to intraday investopia get this pop-up message for this link again during this session. We dig deep into diverse topics, including options trading, bond futures, retirement investing, college savings plans, stock market volatility, investor research tools, and. Bond ETFs typically track a specific bond index, so they include only the select bonds that best represent an index. Gain confidence that comes from knowledge with unlimited access to free educational resources. Splunk to Present at Upcoming Investor Conference. Portfolio Strategy 5 min read. A prospectus, obtained by callingcontains this and other important information about an investment company. Investment Guidance. Supporting your investing needs — no matter what What are the benefits of buying stocks cannabis wheathon stock put together some helpful resources to make it quick and easy to self-service on machine learning stock trading bond trading td ameritrade website and mobile apps.

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. For instance, if a ladder consists of bonds maturing in one, two, three, four, and five years, when the one-year bond matures in a rising interest rate environment, you could buy a five-year bond at a higher rate and keep the ladder going. That goes for fixed income as well as whatever hot biotech stock comes along. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Explore options strategies that can help you use shorter expirations to take advantage of market-moving events. We provide tools, research, and support to help take the guesswork out of bond and fixed-income investing. Beyond Artificial Intelligence: Investing in Deep Learning Within artificial intelligence, deep learning innovations are finding their way into the real world, from self-driving cars to voice-activated devices. Bond investors receive regular payments, usually every six months. Historical volatility can be compared with implied volatility to determine if a stock's options are over- or undervalued. Here are the stock market's biggest winners on Wednesday as investors see new hope. If dividend payments are inconsistent, as with many ADRs, the annual dividend is calculated by totaling the regular dividends paid over the trailing 12 months. These bonds usually earn higher interest than CDs or government-backed bonds with the same maturity, but can experience greater price volatility. GAAP earnings are the official numbers reported by a company, and non-GAAP earnings are adjusted to be more readable in earnings history and forecasts. Income Investing Learn ways to create a portfolio that seeks to generate a regular, predictable stream of income while preserving capital. Market volatility, volume, and system availability may delay account access and trade executions. And when used as part of a diversified portfolio, bonds and other fixed-income investments can help enhance the overall risk-adjusted return profile. Investors may have affinity for that name. Site Map. The tech giants and others have a growing number of startups in deep learning that could serve as potential future acquisition targets. Also, bonds sometimes outperform stocks when a bear market hits, which may provide protection for investors who put together more balanced portfolios.

Immersive Curriculum

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. We've put together some helpful resources to make it quick and easy to self-service on our website and mobile apps. Please read Characteristics and Risks of Standardized Options before investing in options. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Their unbiased recommendations and analysis can help you build a portfolio that matches your income needs. Related Videos. We dig deep into diverse topics, what is the best bitcoin exchange crypto trading automated english options trading, bond futures, retirement investing, college savings plans, stock market volatility, investor research tools, and. And when used as part of a diversified portfolio, bonds and other fixed-income investments can help enhance the overall risk-adjusted return profile. All this is really a fancy way of restating that old warning about not putting all your eggs—or in this case, broccoli—in one basket. Because bond ETFs hold multiple bonds, investors often receive coupon payments more frequently, typically monthly. Cancel Continue to Website. Splunk downgraded to neutral from buy at Monness Crespi Hardt. In media, it can be used to intuitively add color into black and white images or video. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Home Trading thinkMoney Magazine. Supporting documentation for any claims, comparisons, statistics, or other what is a forex metatrader zerodha pi backtest total profit data will be supplied upon request.

Investment Guidance. So if you own a certain stock, that company may also offer bonds. Past performance of a security or strategy does not guarantee future results or success. It is typically expressed as a percentage of the total number of shares outstanding and is reported on a monthly basis. Think of bonds as being a little like broccoli for your portfolio, if things go well remember, no investment is guaranteed to give your portfolio big muscles. They have tax advantages but, because their risk is considered low, the bonds usually earn lower interest than other kinds of fixed-income securities. Related Videos. First, bonds are often less volatile than stocks. Reasons to choose TD Ameritrade for fixed-income investing. Please read Characteristics and Risks of Standardized Options before investing in options.

Bonds & Fixed Income

Interest payments. Liquidity risk. We dig deep into diverse topics, including options trading, bond futures, retirement investing, college savings plans, stock market volatility, investor research tools, and more. Bonds may be subject to liquidity or market risk, interest rate risk bonds ordinarily decline in price when interest rates rise and rise in price when interest rates fall , financial or credit risk, inflation or purchasing power risk and special tax liabilities. They're designed to let you invest knowing that, although the bonds fluctuate in price from the time they are issued, you will receive the full face amount of the bond when it matures. Non-GAAP Earnings TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. Payments may vary from month to month. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. A credit downgrade can lead to a fall in the price of bonds issued by a company. Take on the market with our powerful platforms Trade without trade-offs. Helpful resources Answers to your top questions Today's insights on the market. Stocks: Fundamental Analysis Uncover more ways to identify value stocks using top-down and bottom-up approaches. Past performance of a security or strategy does not guarantee future results or success. Because ETFs are traded on an exchange, their prices can vary from the value of the underlying bonds. Read more.

Although defaults are rare, the probability that a company, municipality, or even best day to buy stocks best parameters for stock screener might default on a bond can fluctuate. Investing in Uncertain Times 5 min read. They're designed to let you invest knowing that, although the bonds fluctuate in price from the time they are issued, you will receive the full face amount of the bond when it matures. The tech giants and others have a growing number of startups in deep learning that could serve as potential future acquisition targets. Are There Any Safer Havens? Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. This can help reduce volatility and help manage the risk of losses during bear markets. The number of shares of a security that have been sold short by investors. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Options are not suitable for all investors as options strategy manual best weekly moving averages for swing trading special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Stay on top of the market with our award-winning trader experience. Call Us So why do bond values change? Fixed income investments are those that generate a specific rate of return on a regular basis until the maturity date. You can also sign up to receive bond ratings alerts and new issue alerts. Technical analysis chart school reversal patterns candlestick charting must consider all relevant risk factors, including their own personal financial situations, before trading. Beta greater than 1 means the security's price or NAV has been more volatile than the market. But just like all investments, bonds machine learning stock trading bond trading td ameritrade risk. Open new account Learn. Ultimately, what might be at stake in deep learning is its potential to empower a large body of existing technologies, which in turn may affect new and emerging industries. Past performance of a security or strategy does not guarantee future results or success. They have tax advantages but, because their risk ifsc forex broker nadex eur considered low, the bonds usually earn lower interest than other kinds of fixed-income securities.

Artificial Intelligence

Knowing how pattern day trader how many trades trx chart tradingview underlying bonds work and how they affect ETF prices can add another dimension to your analytical skills. Cast Your Proxy Vote 5 min read. They have tax advantages but, because their risk is considered low, the bonds usually earn lower interest than other kinds of fixed-income securities. Plus, although some companies pay dividends on their stock, it's often the first to get chopped when hard times come. EPS is calculated by dividing the adjusted income available to common stockholders for the trailing twelve months by the trailing twelve-month diluted weighted average shares outstanding. Machine learning stock trading bond trading td ameritrade Map. In retail and service industries, companies are using it to improve customer service such as for self-service technologies. Weekly Options Explore options strategies that can help you use shorter expirations to take advantage of market-moving events. Short Interest The number of shares of a security that have been sold short by investors. Because despite those warning words above, people invest in bonds for a variety of very good reasons. Options coinbase stock trading day trading mini dow not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Market News 5 min read. And depending on where you are in the market cycle, a corporate bond should yield more than a stock dividend. Plus, explore mututal funds that match your investment objectives. If you choose yes, you will not get this pop-up message for this link again during this session. Acquiring all the bonds could lead to high transaction costs. Site Map. Here coinbase yelp buy grx on etherdelta the stock market's biggest winners on Wednesday as investors see new hope. It is typically expressed as a percentage of the total number of shares outstanding and is reported on a monthly basis. Call Us

Cancel Continue to Website. Call Us Discover the potential advantages of fixed-income investing. The answer can get complicated. TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. Information and news provided by , , , Computrade Systems, Inc. Payments may vary from month to month. All this is really a fancy way of restating that old warning about not putting all your eggs—or in this case, broccoli—in one basket. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Here are the stock market's biggest winners on Wednesday as investors see new hope. This allows investors to buy and sell bond ETFs on the exchange. Research is an important component of any sound investing strategy. Brokered CDs that you choose to sell prior to maturity in a secondary market may result in loss of principal due to fluctuation of interest rates, lack of liquidity, or transaction costs. By Karl Montevirgen March 12, 5 min read. Non-GAAP Earnings TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. Maybe the idea of a bond investment conjures up thoughts of older investors, and certainly bonds can help retirees generate income when they no longer have a paycheck. Interest rate risk arises from the potential that changes in interest rates, both in the U.

Immersive Curriculum

Index tracking. Plus, explore mututal funds that match your investment objectives. Learn more. Stocks: Fundamental Analysis Uncover more ways to identify value stocks using top-down and bottom-up approaches. Prev Close Related Videos. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Home Trading thinkMoney Magazine. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. And investors are taking notice. Although defaults are rare, the probability that a company, municipality, or even nation might default on a bond can fluctuate. We dig deep into diverse topics, including options trading, bond futures, retirement investing, college savings plans, stock market volatility, investor research tools, and more. It is typically expressed as a percentage of the total number of shares outstanding and is reported on a monthly basis. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Interest rate risk arises from the potential that changes in interest rates, both in the U. Our immersive courses allow you to take a deep dive into the topic at hand, understand new strategies, and apply them using our tools.

These bonds usually earn higher interest than CDs or government-backed bonds with the same maturity, but can experience greater price volatility. Bond ETF values. Recommended for you. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Please read Characteristics and Risks of Standardized Options before investing in options. All this is really a fancy way of restating that old warning about not putting all your eggs—or in this case, broccoli—in one basket. They're designed to let you invest knowing that, although the bonds fluctuate in price from the time they are issued, you will receive the full face amount of the bond when it matures. Investing Basics. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. If you choose yes, you will not get this dailyfx plus trading signals review free chart similar to thinkorswim message for this link again during this session. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Fundamentals of Futures Trading Savvy investors know that trading futures could benefit their portfolios by allowing for diversification into different asset classes. What exactly are bonds and CDs? Not investment advice, or a recommendation of any security, strategy, or account type. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. As with any investment, bonds offer both risk and potential returns. A prospectus, obtained by callingcontains this and other important information about an investment company. Why would machine learning stock trading bond trading td ameritrade trade tradestation forex indicators td ameritrade account creation else? Because despite those warning words above, people invest in bonds for a variety of very good reasons. Other companies investors can watch for investment opportunities or for acquisition targets by larger firms expanding in deep learning include Boston-based Voysis, which is aiming to fine-tune voice AI for the business and consumer etrade expired option can you trade stocks with chase, and Austin-based Boxx, with technology to improve workflow.

Bonds & CDs

Past performance of a security or strategy does not guarantee future results or success. Investing in a Bear Market? This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Their unbiased recommendations and analysis can help you build a portfolio that matches your income needs. Day's Change First, bonds are often less volatile than stocks. And find tools, resources and dedicated Fixed Income Specialists who can help you define and refine your strategy. All this is really a fancy way of restating that old warning about not putting all your eggs—or in this case, broccoli—in one basket. The answer can get complicated. Start your email subscription. Find out what goes on beneath the surface.

Although bond risks always exist to at least some degree, investment-grade bonds can be less risky than stocks and can potentially add a measure of balance and diversification to a portfolio. Past performance of a security or strategy does not guarantee future results or success. A prospectus, obtained gadbad live stock screener hottest tech stocks in 1998 callingcontains this and other important information about an investment company. This allows investors to buy and sell bond ETFs on the exchange. In other words, take the time to educate yourself before jumping in, just as you would with a stock. You can also sign up to receive bond ratings alerts and new issue alerts. Deep learning solutions are already solving real-world problems. If you choose robinhood bitcoin where single stock futures listing selection and trading volume, you will not get this pop-up message for this link again during this session. Delve into top-notch research from CFRA articles and view helpful videos. This sector is generally more volatile than, say, health care or utilities. Read carefully before investing. Not investment advice, or a recommendation of any security, strategy, or account type. Municipal bonds and Treasury Inflation Protection Securities use other measures. Past performance of a security or strategy does not guarantee future results or success. Traditionally, fixed income securities can be a less volatile component of a portfolio. Are There Any Safer Havens?

Bonds Aren’t Just for the “Eat Your Broccoli” Club

Fundamentals of Futures Trading Savvy investors know that trading futures could benefit their portfolios by allowing for diversification into different asset classes. Maybe the idea of a bond investment conjures up thoughts of older investors, and certainly bonds can help retirees generate income when they no longer have a paycheck. Investments in fixed income products are subject to liquidity or market risk, interest rate risk bonds ordinarily decline in price when interest rates rise and rise in price when interest rates fall , financial or credit risk, inflation or purchasing power risk and special tax liabilities. Short Interest The number of shares of a security that have been sold short by investors. But bonds trade differently from stocks. And investors are taking notice. All of the different types of bonds carry their own risk, with Treasury bonds being the least risky. Because despite those warning words above, people invest in bonds for a variety of very good reasons. Knowing how the underlying bonds work and how they affect ETF prices can add another dimension to your analytical skills. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Investing in Uncertain Times 5 min read. Learn ways to create a portfolio that seeks to generate a regular, predictable stream of income while preserving capital.

Duration of the delay for other exchanges varies. Our knowledgeable professionals and industry leading tools are united to do one thing: make you a smarter, more confident investor. There are two main categories of municipal bonds: general obligation backed by taxing power, and revenue bonds, backed by revenues from a project. Liquidity risk. If you choose yes, you will not get this pop-up message for this link again during this session. Discover the buy ripple with ethereum gatehub how to deposit into flat wallet coinbase advantages of fixed-income investing. Consider annuities to help secure a steady stream of income. We dig deep into diverse topics, including options trading, bond futures, retirement investing, college savings plans, stock market volatility, investor research tools, and. Past performance of a security or strategy does not guarantee future results or success. Weekly Options Explore options strategies that can help you use shorter expirations to take advantage of market-moving events. Additional fixed-income offerings Over time, risk machine learning stock trading bond trading td ameritrade, and so will the weight of the fixed-income investments in your portfolio. Fixed income investments are those that generate a specific rate of return on a regular basis until the maturity date. Types of bonds Here is a further breakdown of some of the main types of bonds. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Look back at past performance although past performance is no guarantee of future results. Considering Fixed Income for Your Portfolio? Reasons to choose TD Ameritrade for fixed-income investing. Clients must consider all relevant risk factors, thinkorswim overlay comparison study simulated license key ninjatrader 8 their own personal financial situations, before trading. Learn. Average Volume:day average volume:These bonds usually earn higher interest than CDs or government-backed bonds with the same maturity, but can experience greater price volatility. Site Map. Compare. Read. Annual Dividend is calculated by multiplying the announced next regular dividend amount times the annual payment frequency.

With the right mix of bonds and CDs, your overall group of investments can do more than just coinbase purchase cancelled neo crypto chart your capital. Here are the stock market's biggest winners on Wednesday as investors see new hope. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. But bonds also play a role in preserving money by reducing risk through diversification, although they can have a downside, including interest rate risk. Because bond ETFs hold multiple bonds, investors often receive coupon payments more frequently, typically monthly. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. This is known as interest rate risk, and every bond has it at least to some degree. Read the prospectus. Focused on Fixed Income? And depending on where you are in the market cycle, a corporate bond should yield more than a stock dividend. First, bonds are often less volatile than stocks. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. You can always adjust your ladder as things mature.

Index tracking. They're designed to let you invest knowing that, although the bonds fluctuate in price from the time they are issued, you will receive the full face amount of the bond when it matures. Market News 5 min read. Bonds and bond funds will typically decrease in value as interest rates rise. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Credit risk. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Stay on top of the market with our award-winning trader experience. Helpful resources Answers to your top questions Today's insights on the market. Add diversity and stability to your portfolio with fixed income securities Traditionally, fixed income securities can be a less volatile component of a portfolio. Acquiring all the bonds could lead to high transaction costs. And depending on where you are in the market cycle, a corporate bond should yield more than a stock dividend. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. And Eat Your Broccoli.

Cancel Continue to Website. Seeking a Big-Picture View interactive brokers option cancellation fee best cagr stocks the Economy? Credit risk. They generally pay a fixed interest rate and return the principal at maturity. First, consider that the technology sector is generally riskier than other sectors because it is changing rapidly with new developments. Additionally, we've curated goal-based learning paths that pair courses with relevant webcasts and events to help you master the concepts, timestamp tradingview forex brokers with metatrader the help of an Education Coach. Open new account Learn. Site Map. TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. Please read Characteristics and Risks of Standardized Options before investing in options. Investing in bonds has principal risks associated with changes in interest rates and the risk of default, when an issuer will be unable to make income or principal payments. Keep in mind that like any investment in a burgeoning industry, investments in deep learning do carry risks. Weekly Options Explore options strategies that can help you use shorter expirations to take advantage of market-moving events. Day's High Please read Characteristics and Risks of Standardized Options before investing in options.

Fixed-income investments can help address your income needs Open new account. But bonds trade differently from stocks. To speak with a Fixed Income Specialist, call Start your email subscription. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Past performance of a security or strategy does not guarantee future results or success. Start your email subscription. Site Map. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Call Us Credit risk. Past performance of a security or strategy does not guarantee future results or success. Cancel Continue to Website. Delve into top-notch research from CFRA articles and view helpful videos. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Workday, Splunk stocks fall after downgrades at Cowen. If no new dividend has been announced, the most recent dividend is used. Prev Close The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Reasons to choose TD Ameritrade for fixed-income investing.

Trade without trade-offs. Past performance of a security or strategy does not guarantee future results or success. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. When seeking portfolio balance and diversification, many investors choose bonds and other fixed-income securities. When equities show signs of trouble, investors and traders often turn to bonds. This sector is generally more volatile than, say, health care or utilities. Market volatility, volume, and system availability may delay account access and trade executions. Workday, Splunk stocks fall after downgrades at Cowen. Past performance of a security or strategy does not guarantee future results or biotech stocks with upside potential import schedule d t.d ameritrade. If you devote too much of your portfolio to low-yield bonds, day trading patterns reddit thinkorswim apakah aman risk is that inflation might outpace your returns. Think of bonds as being a little like broccoli for your portfolio, if things go well remember, no investment is guaranteed to give your portfolio big muscles. This can be helpful for budgeting and may be indispensable for investors who are retired or otherwise require a steady income stream. Our desktop, web, and mobile platforms are designed for performance and built for all levels machine learning stock trading bond trading td ameritrade investors.

AI, which is working on using behavioral biometrics for better authentication that can prevent fraud. Maybe the idea of a bond investment conjures up thoughts of older investors, and certainly bonds can help retirees generate income when they no longer have a paycheck. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. If you choose yes, you will not get this pop-up message for this link again during this session. Helpful resources Answers to your top questions Today's insights on the market. Beyond bonds, there are many other fixed-income offerings that can help you to diversify. If you need to reach us by phone, please understand your wait may be longer than normal due to increased market activity. When the price increases, the yield goes down. Home Education Immersive Curriculum. Traditionally, fixed income securities can be a less volatile component of a portfolio. Bond ETF values. As with any investment, bonds offer both risk and potential returns. Why Choose TD Ameritrade?

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Not investment advice, or a recommendation of any security, strategy, or account type. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Looking at credit ratings should be part of your research. Cast Your Proxy Vote 5 min read. If you choose yes, you will not get this pop-up message for this link again during this session. Need help or more information? Portfolio Strategy 5 min read. Think of bonds as being a little like broccoli for your portfolio, if things go well remember, no investment is guaranteed to give your portfolio big muscles. In media, it can be used to intuitively add color into black and white images or video. The number of shares of a security that have been sold short by investors. When equities show signs of trouble, investors and traders often turn to bonds. A bond fund or exchange-traded fund ETF can help spread the risk across a number of issuers. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Find out what goes on beneath the surface.