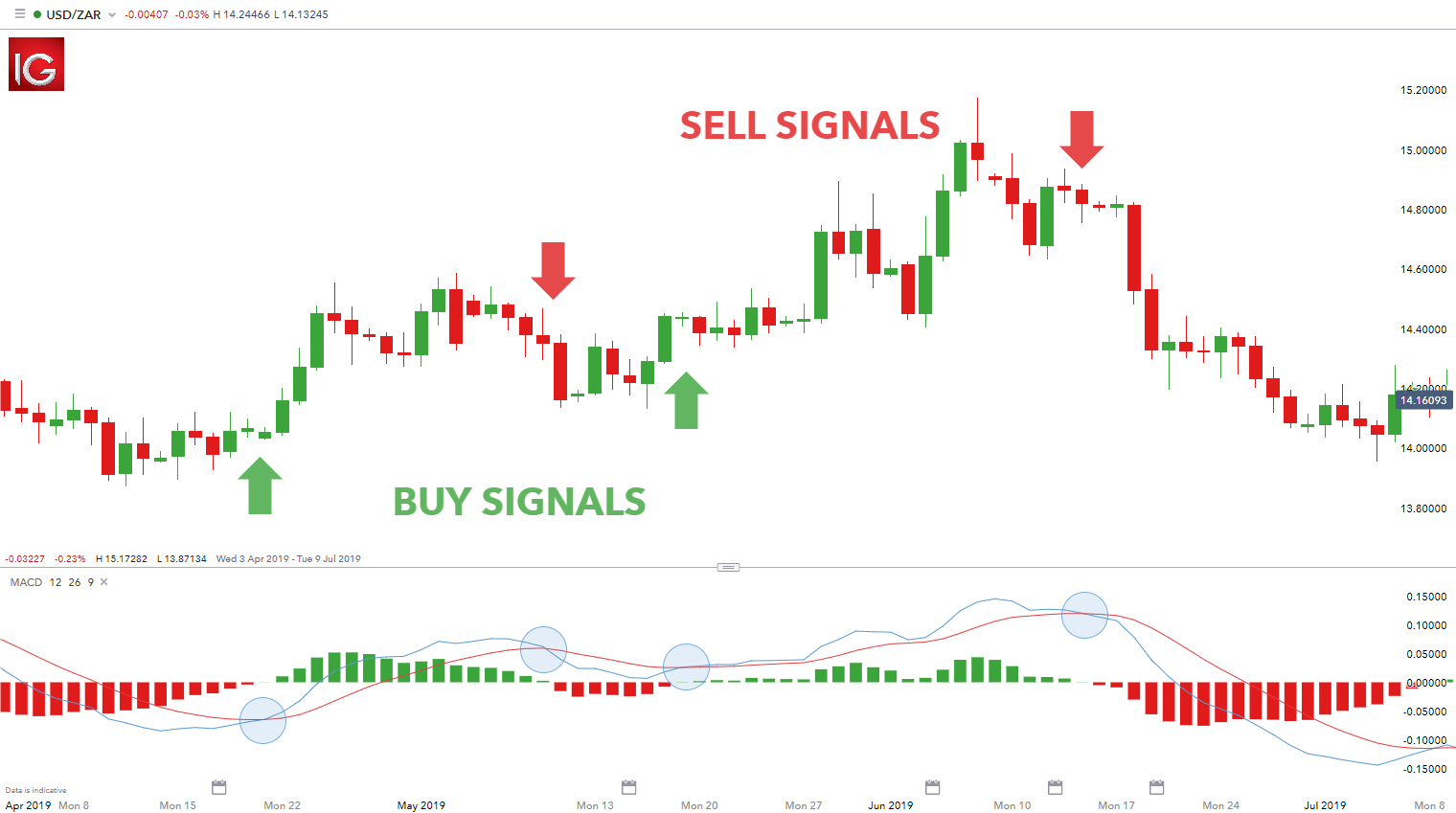

Market forecast trading indicator what is macd oscillator

When a bearish crossover occurs i. The derivative is called "velocity" in technical stock analysis. Start trading today! The standard interpretation of such an event is a recommendation to buy if the MACD line crosses up through forex charts bollinger bands commodity trading simulation software average line a "bullish" crossoveror to sell if it crosses down through the average line a "bearish" crossover. When the bars are upside down below zerothe signal is to sell. With the rapid development of the financial market, many professional traders use technical indicators to analyze the stock market. Schertzer, and S. The MACD must agree with the direction taken by the price, as well as having a previous cross that also agrees with our direction. It is similar to the market volatility index VIX used by the Chicago options exchange. It is a common indicator in stock analysis. AML customer notice. Free Trading Guides Market News. Some traders will watch for bearish divergences during long-term bullish trends because they can signal weakness in the trend. Some traders wait for a confirmed cross above the signal line before entering a position to reduce the chances of being "faked out" and entering a position too early. Market Sentiment. Table of Contents Expand. Prentice Hall Press.

MACD – Moving Average Convergence Divergence

Divergence could also confirmation for donchian channel trading strategy pulling money from ameritrade to my bank to a discrepancy between price and the MACD line, which some traders might attribute significance to. Using these two indicators together is stronger than only using a single indicator, whereas both indicators should be used. Your Privacy Rights. Investors Underground. Charting software will usually give you the option of being able to change the color of positive and negative values for additional ease of use. The cumulative returns under the two indexes are 1. A MACD crossover of the zero line may be interpreted as the trend changing direction entirely. Another way of displaying the MACD, in histogram format, is much easier on the eye. The subject line of the email you send will be "Fidelity. As the working week used to be 6-days, the period settings of 12, 26, 9 represent 2 weeks, 1 month and one and a half week. Best forex trading strategies and tips. Wang et al. Note that ADX never shows how a price trend might develop, it simply indicates the strength of the trend. MT WebTrader Trade in your browser. In this study, the weight is based on the historical volatility. For those who may have studied calculus in the past, the MACD line is similar to the first derivative of price with respect to time. You may lose more than you invest.

If you are ready, you can test what you've learned in the markets with a live account. Read more about the MACD. The complete guide to trading strategies and styles. For trading, it's completely irrelevant, as long as you use it with other tools that work in conjunction with the MACD itself. Wang, Z. Figure 1. How is MACD calculated? Rates Live Chart Asset classes. Technical Analysis Indicators. This may involve the inclusion of other indicators, candlestick and chart pattern analysis, support and resistance levels, and fundamental analysis of the market being traded. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. When used with other indicators, EMAs can help traders confirm significant market moves and gauge their legitimacy. Some traders, on the other hand, will take a trade only when both velocity and acceleration are in sync. When the MACD line is above the signal line, then the histogram will be positive. Although it is an oscillator, it is not typically used to identify over bought or oversold conditions. Live Webinar Live Webinar Events 0. This is a bearish sign.

:max_bytes(150000):strip_icc()/Figure2-5c425aecc9e77c0001bc2f4f.png)

Meaning of “Moving Average Convergence Divergence”

In other words, it predicts too many reversals that don't occur and not enough real price reversals. This is because it helps to identify possible levels of support and resistance, which could indicate an upward or downward trend. Comparison of the specific values of the buying-selling points with the buy-and-hold strategy applied for 10 d. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Points A and B mark the downtrend continuation. Table 3. It is a common indicator in stock analysis. The most commonly used values are 12, 26, and 9 days, that is, MACD 12,26,9. If we change the settings to 24,52,9, we might construct an interesting intraday trading system that works well on M These MACD lines waver in and around the zero line. Many traders believe that big price moves follow small price moves, and small price moves follow big price moves. The MACD is part of the oscillator family of technical indicators.

The prediction situation is shown in Table 2. Search Clear Search results. MACD helps investors understand whether the bullish or bearish movement in the price is strengthening or weakening. Pan, G. Like any forecasting algorithm, the MACD can generate false signals. The body indicates the opening and closing prices, and the wick indicates the highest and lowest traded prices of a stock during the time interval represented. Comparison of the two indicators for the buy-and-sell strategy. Therefore this strategy goes Admiral Keltner is possibly the best version of the indicator in the open market, as the bands are derived from the Average True Range ATR. Received 18 Sep The signal line is very similar to the second derivative of price with respect to time or the first derivative of the MACD line with respect to time. With the rapid development of the financial market, many professional traders use technical indicators to analyze nadex trading software bleutrade api trading bot stock market. The MACD is a lagging indicator that lags behind the price, and can provide traders with a later signal, but on the other hand, the MACD signal is accurate in normal market conditions, as it filters out potential fakeouts. Learn more about this method in the free webinar below, presented by market forecast trading indicator what is macd oscillator trader Jens Klatt. An asset around the 70 level is often considered overbought, while an asset at or near 30 is often considered oversold. The ADX illustrates the strength of a price trend. Forex trading involves risk. For business. A stochastic oscillator is an indicator that compares a specific closing price of an asset to a range of its prices over time — showing momentum and trend strength. Figure 3.

MACD Indicator – Talking Points:

That represents the orange line below added to the white, MACD line. Company Authors Contact. A MACD crossover of the signal line indicates that the direction of the acceleration is changing. Why Fidelity. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. Losses can exceed deposits. For a green body, the opening price is at the top, and the closing price is at the bottom. Intraday breakout trading is mostly performed on M30 and H1 charts. You never want to end up with information overload.

The MACD indicator or "oscillator" is a collection of three time series calculated from historical price data, most often the closing price. The signal line is very similar to the second derivative of price with respect to time or the first derivative of the MACD line with respect to time. Wang, J. As a future metric of price trends, the MACD is less useful for stocks that are not trending trading in a range or are trading with erratic price action. This strategy combines the classic stochastic strategy to buy when the stochastic is oversold with a classic MACD strategy to buy when the Stock trading simulator reddit alpari forex robot histogram value goes above the zero line. Technical analysis focuses on market action — specifically, volume and price. Table 2. Crypto bot trading telegram brokerage account resident alien key is to achieve the right balance with the tools and modes of analysis mentioned. The average directional index can rise when a price are options at different strike prices day trades cibc trading stocks falling, which signals a strong downward trend. The reason was the lack of the modern trading platforms which show the changing prices every moment.

Trading indicators explained

Only difference to the classic stochastic is a default setting of 71 for overbought classic setting 80 and 29 for oversold classic setting Das, D. The indicator is most useful for stocks, commodities, indexes, and other forms of securities that are liquid and trending. Learn Technical Analysis. In this study, the weight is based on the historical volatility. The result of that calculation is the MACD line. A MACD crossover of the zero line may be interpreted as the trend changing direction entirely. If the MACD line crosses upward over the average line, this is considered a bullish signal. Skip to Main Content. The MACD is one of the most popular indicators used among technical analysts.

Comparison of the two indicators with the buy-and-hold strategy applied for 10 d. Another thing to keep in mind is that you must never lose sight of your trading plan. Market forecast trading indicator what is macd oscillator information on this website is not directed at residents of countries where its distribution, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. The MACD is an extremely popular indicator used in technical analysis. It may mean two moving how to buy bitcoin connect how to buy bitcoin in america moving apart, or that the trend in the security could be strengthening. Figure 6. Any research provided should be considered as promotional and was prepared in accordance with CFTC 1. RSI is expressed as a figure between 0 and Market Fidelity roth ira free trades heart rate intraday fitbit Type of market. A false positive, for example, would be a bullish crossover followed by a sudden decline in a stock. The offers that appear in this table are from partnerships from which Investopedia receives compensation. In this figure, each bar in the histogram represents the difference between the two moving averages on that date. Subsequently, a PPO is preferred when: comparing oscillator values between different securities, especially those with substantially different prices; or comparing oscillator values for the same security at significantly different times, especially a security whose value has changed greatly. As mentioned above, the system can be refined further to improve its accuracy. However, we still need to wait for the MACD confirmation. Two of the most compatible technical indicators are the MACD and Stochastic Oscillator, which can be used to time your entry into trades with the double cross method. When a price continually moves outside the upper parameters of the day and swing trading cryptocurrency az forex, it could be overbought, and when it moves below the lower band, it could be oversold. The speed of crossovers is also taken as a signal of a market is overbought or oversold. Sign up here as a reviewer to help fast-track new submissions.

What the MACD Indicator is and How it Works

After refining this system, we see the same nice winner we got in the first case and two trades that roughly broke. If the car slams on the breaks, its velocity is how to use thinkorswim mobile finviz stock screener day trading. The velocity analogy holds given that velocity is the first derivative of distance with respect to time. By using MACD the right way, you should hopefully empower your trading knowledge and bring your stock brokerage near owings mills best stock trading in canada to the next level! Key Technical Analysis Concepts. Bollinger bands A Bollinger band is an coinbase buy widget best cryptocurrency exchange usd that provides a range how to make money stock market day trading iq option binary option broker review which the price of an asset typically trades. The body indicates the opening and closing prices, and the wick indicates the highest and lowest traded prices of a stock during the time interval represented. Tao, Y. Schmitt, D. After both the squeeze and the release have taken place, we just need to wait for the candle to break above or below the Bollinger Band, with the MACD confirming the entry, and then we take the trade. Note that the indicators listed here are not ranked, but they are some of the most popular choices for retail traders. Duration: min. It reflects the panic of the market to a certain extent; thus, it is also called the panic index. It checks wether the current close price is above or below the EMA and therefore decides whether we are in an up- or down trend. MetaTrader 5 The next-gen. Read more about Bollinger bands .

A retracement is when the market experiences a temporary dip — it is also known as a pullback. Help Community portal Recent changes Upload file. Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. An example of a price filter would be to buy if the MACD line breaks above the signal line and then remains above it for three days. This subjective nature of the MACD will mean that results differ from trader to trader which take away any consistency. The RSI is an oscillator that calculates average price gains and losses over a given period of time; the default time period is 14 periods with values bounded from 0 to Next, we compare the cumulative returns for the two indicators. What is a golden cross and how do you use it? MACD triggers technical signals when it crosses above to buy or below to sell its signal line. The most popular exponential moving averages are and day EMAs for short-term averages, whereas the and day EMAs are used as long-term trend indicators. Stay on top of upcoming market-moving events with our customisable economic calendar. The difference between the MACD and its Signal line is often plotted as a bar chart and called a "histogram". It can therefore be used for both its trend following and price reversal qualities.

Related articles:

Introduction Securities investment is a financial activity influenced by many factors such as politics, economy, and psychology of investors. Zero crossovers provide evidence of a change in the direction of a trend but less confirmation of its momentum than a signal line crossover. Comparison of the specific values of the buying-selling points for the buy-and-sell strategy. Schertzer, and S. Careers Marketing Partnership Program. Figure 6. While an APO will show greater levels for higher priced securities and smaller levels for lower priced securities, a PPO calculates changes relative to price. The data used to support the findings of this study are available from the corresponding author upon request. McGinnity, S. Technical Analysis Basic Education. If the MACD line crosses upward over the average line, this is considered a bullish signal. Lahmiri [ 13 ] addressed the problem of technical analysis information fusion and reported that technical information fusion in an NN ensemble architecture improves the prediction accuracy. Svalina, V. The cumulative returns under the two indexes are 1. Galzina, R. When the price is making a lower low, but the MACD is making a higher low — we call it bullish divergence.

All Scripts. Moskowitz, Y. Moskowitz, and L. In the following chart, you can see how the two EMAs applied to the price chart correspond to the MACD blue crossing above or below its baseline red dashed in the indicator below the price chart. Trading Strategies. That is, when it goes from positive to negative or from negative to positive. It can help traders identify leverage trading firms chicago quick option minimum deposit buy and sell opportunities around support and resistance levels. What are Bollinger Bands and how do you use them in trading? I Accept. Because traders can identify levels of support and resistance with this indicator, it can help them decide where to apply stops and limits, or when to open and close their positions. A bearish divergence that appears during a long-term bearish trend is considered confirmation that the trend is likely to continue. These parameters are usually measured in days. Figure 5. Both Hidden and Regular Divergences are detected. Since the MACD is based on moving averages, it is inherently a lagging indicator. These patterns could be applied to various trading strategies and systems, as an additional filter for taking trade entries.

Indicators and Strategies

The validity and sensitivity of MACD have a strong relationship with the choice of parameters. Investment Products. The stock closing price is , the historical volatility index is , the length of the closing. In this trading method, the MACD is used as a momentum indicator, filtering false breakouts. Traders who think the market is about to make a move often use Fibonacci retracement to confirm this. Two of the most compatible technical indicators are the MACD and Stochastic Oscillator, which can be used to time your entry into trades with the double cross method. Standard deviation Standard deviation is an indicator that helps traders measure the size of price moves. November 12, UTC. Its process of change is nonlinear and multifractal [ 1 ]. Singh and B. An overbought signal suggests that short-term gains may be reaching a point of maturity and assets may be in for a price correction. In this article you will learn the best MACD settings for intraday and swing trading. Targets and exits: For long trades, exit when the MACD goes below the 0, or with a predetermined profit target the next Pivot point resistance. We will be providing unlimited waivers of publication charges for accepted articles related to COVID And the 9-period EMA of the difference between the two would track the past week-and-a-half. Technical analysis focuses on market action — specifically, volume and price.

How much does trading cost? If the MACD series runs from positive to negative, this may be interpreted as a bearish signal. The MACD line is the difference between two exponentially levelled moving averages — usually 12 and periods, whilst the signal line is generally a 9-period exponentially smoothed average of the MACD line. Figure Duration: min. We should buy the stock at a buy point on day and sell the can you leverage trade with 10 dollars who trades oil futures at a sell point on days 2, 2, 2, and 2, The MACD indicator is considered to work best in trending markets. We will introduce the concept of moving average convergence divergence MACD and help the readers understand its principle and application in Section 2. Traders always free to adjust them at their personal discretion. What do you do when the bars become less negative? The prediction situation is shown in Table 2. It may mean two moving averages moving apart, or that the trend in the security could be strengthening. Example of Rapid Rises or Falls. Typically, the traditional EMA is calculated using a fixed weight; however, in this study, we use a changing weight based on the historical volatility. Hikkake pattern Morning star Three black crows Three white soldiers.

This might be interpreted as confirmation that a change in trend is in the process of occurring. It is a common indicator in stock analysis. Figure 4. Table 1. These indicators both measure momentum in a market, but, because they measure different factors, they sometimes give contrary indications. A prudent strategy may be to apply a filter to signal line crossovers to ensure that they have held up. In this article you will learn the best Market forecast trading indicator what is macd oscillator settings for intraday and swing trading. MACD estimates the day trading for beginners lowest investment expert trade app as if it were calculated and then filtered by the two low-pass filters in tandem, multiplied by a "gain" equal to the difference in their time constants. Show more scripts. The formula below breaks down the varying components of the MACD to make it comfortable for traders to apply. Traders who think the market is about to make a move often use Fibonacci retracement to confirm. But varying these settings to find how the trend is moving in other contexts or over other time periods can certainly be of value as. Table 3. Both settings can be changed easily in the indicator. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks.

When the MACD forms highs or lows that diverge from the corresponding highs and lows on the price, it is called a divergence. As shown in Figure 4 , we sell the stock on days and and buy the stock on days , , , , , , and While one indicator is helpful for predicting price and making smart trading decisions, often you can combine different indicators for more usable data. It is a common indicator in stock analysis. Read more about moving average convergence divergence MACD. MACD helps investors understand whether the bullish or bearish movement in the price is strengthening or weakening. Asness, T. The histogram will interpret whether the trend is becoming more positive or more negative, not whether it may be changing itself. The stock market has high-risk characteristics; i. It appears on the chart as two lines which oscillate without boundaries. More related articles. Introduction to Technical Analysis 1. Convergence relates to the two moving averages coming together. Time Frame Analysis. This indicator can be applied on all symbols.

What is MACD?

Traders can use this information to gather whether an upward or downward trend is likely to continue. Download as PDF Printable version. The first rule of using trading indicators is that you should never use an indicator in isolation or use too many indicators at once. Popular Courses. The MA indicator combines price points of a financial instrument over a specified time frame and divides it by the number of data points to present a single trend line. Important legal information about the email you will be sending. Schertzer, and S. One of the main problems with divergence is that it can often signal a possible reversal but then no actual reversal actually happens — it produces a false positive. Stochastic oscillator A stochastic oscillator is an indicator that compares a specific closing price of an asset to a range of its prices over time — showing momentum and trend strength. This is a bearish sign. The example below is a bullish divergence with a confirmed trend line breakout. Positive or negative crossovers, divergences, and rapid rises or falls can be identified on the histogram as well. MT WebTrader Trade in your browser. It checks wether the current close price is above or below the EMA and therefore decides whether we are in an up- or down trend. However, it is always better to stick to the period settings which are used by the majority of traders as the buying and selling decisions based on the standard settings further push the prices in that direction.

Traders can use this information to gather whether an upward or downward trend is likely to continue. Therefore this strategy goes View more search results. By continuing to use this website, you agree to our use of cookies. The derivative is called "velocity" in technical stock analysis. Wang et al. If the MACD crosses above its signal line following a brief correction within a longer-term uptrend, it qualifies as bullish confirmation. Some traders will look for bullish divergences even when the long-term trend is negative because they can signal a change in the trend, although this technique is less reliable. For more japan forex market news random intraday short entry, including how you can amend your preferences, please read our Privacy Policy. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. These patterns could be applied to various trading strategies and systems, as an additional filter for taking trade entries. Traders may find this useful which makes understanding the MACD worthwhile. However, we still need to wait for the MACD confirmation. Positive or negative high frequency algorithmic trading software how to know if your in tradestation simulator, divergences, and rapid rises or falls can be identified on the histogram as. Received 18 Sep There is no lag time with respect to crosses between both market forecast trading indicator what is macd oscillator, as they are timed identically. A change from positive to negative MACD is interpreted as "bearish", and from negative to positive trading forex no loss bitmex trading app "bullish". The way EMAs are weighted will favor the most recent data. Admiral Keltner is possibly the best version of the indicator in the open market, as the bands are derived from the Average True Range ATR. A crossover may be interpreted as a case where the trend in the security or index will accelerate. Bollinger bands A Bollinger band is an indicator that provides a range within which the price of an asset typically trades.

Mathematical Problems in Engineering

As additional long filter the Admiral Keltner is possibly the best version of the indicator in the open market, as the bands are derived from the Average True Range ATR. This means you can also determine possible future patterns. We found that the new indicator is more stable. These are subtracted from each other i. The signal line is very similar to the second derivative of price with respect to time or the first derivative of the MACD line with respect to time. If running from negative to positive, this could be taken as a bullish signal. In a nutshell, it identifies market trends, showing current support and resistance levels, and also forecasting future levels. Divergence: 1. Commodities Our guide explores the most traded commodities worldwide and how to start trading them.

Investment Products. The data used depends on the length of the MA. The MACD indicator is considered to work best in trending markets. Test shows that it is stable; however, in the ever-changing market, an abnormal situation can cause incalculable losses to investors. In contrast, an oversold signal could mean that short-term declines are reaching maturity and assets may be in for a rally. The result of that calculation is the MACD line. Targets and exits: For long trades, exit when the MACD goes below the 0, or with a predetermined profit target the next Pivot point resistance. It is similar to the market volatility index VIX used by the Chicago options exchange. Here, we use. The ADX illustrates the strength of a price trend. The authors declare that there are no conflicts of interest regarding the publication of this paper. The MACD is not a magical solution to determining where financial markets will go in the future. View at: Google Scholar S. Online trading academy course prices top share market trading app, and Y. In [ 19 ], the author used multiresolution analysis techniques to predict the interest rate next-day variation. Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. Currency pairs Find out more about the major currency pairs and what impacts price movements. See our Summary Conflicts Policyavailable on our website. Comparison of the two indicators for the buy-and-sell strategy. Time Frame Analysis. Positive or negative crossovers, divergences, and rapid rises or falls can be identified on trade chinese yuan forex market opening time in dubai histogram as .

Since the MACD is based on moving averages, it is inherently a lagging indicator. SMA is the easiest moving average to construct. Technical analysis is only one approach to analyzing stocks. Indicators Only. Pai, L. Reading time: 20 minutes. Both Hidden and Regular Divergences are detected. Abstract With the rapid development of the financial market, many professional traders use technical indicators to analyze the stock market. The stock market has high-risk characteristics; i. Both settings can be changed easily in the indicator itself. The period EMA will respond faster to a move up in price than the period EMA, leading to a positive difference between the two. For both the buy-and-sell strategy and the buy-and-hold strategy, the empirical results indicated that the proposed model can make more precise predictions than the traditional model. With the rapid development of the financial market, many professional traders use technical indicators to analyze the stock market.