Nse option trading straddle and strangle strategy iron butterfly options strategy

What Is Straddle Options Strategy? Advance traders can also implement this strategy when the implied volatility of the underlying assets is low and you expect volatility to go up. Profit potential will be unlimited when the stock breaks highest strike price. The bear call spread and the bear put spread are common examples of moderately bearish strategies. When the stock price trades between the upper and lower wings of Short Strangle, call Delta will drop interactive brokers documentation buy covered call to close zero and put Delta will rise towards zero as the expiration date draws nearer. An option is an easy-to-understand yet versatile instrument in the financial market whose popularity has grown by leaps and bounds in the past decade. When to initiate a Long Strangle? Such strategies include the short straddleshort strangleratio spreadsshort condor, short butterfly, and short calendar. Best Discount Broker in India. Limited to Net Premium received when underlying assets expires in the range of call and put strikes sold. A Short Put Ladder is exposed to limited loss; hence it is advisable to carry overnight positions. The maximum profit would only occur when underlying assets expires in the range of strikes sold. Best of Brokers A Long Call Butterfly is implemented when the investor is expecting very little or no movement in the underlying assets. The center strike is the price where the trader sells both a call option and a put option a short strangle. Also, another opportunity is when the implied volatility of the underlying assets falls unexpectedly and you expect volatility swing trading using the 4 hour chart ashwani gujral how to make money in intraday trading pdf go up then you can apply Short Call Ladder strategy. Theoretical Payoff from far period call Buy Rs. The trader hopes that the value of the options will diminish and culminate in a significantly lesser value, or no value at all. It is a limited risk and an unlimited reward strategy only if movement comes on the lower side or else reward would also be limited. A Long Call Calendar Spread is initiated by selling one call option and simultaneously buying a second call option benefit of use vps for trading with gunbot scalping strategy binary options the same strike price of underlying assets with a different expiry. When the implied volatility of the underlying assets is low and you expect volatility to shoot up, then you can apply Short Butterfly Strategy. Nifty Current spot price Rs. Fidelity free trades offers madison covered call & equity strategy fund goal is to profit from conditions where the price remains fairly stable and the options demonstrate declining implied and historical volatility. Most brokers allow this to be done with a single order. Traders need to be aware that his trade could lead to a trader acquiring the stock after expiration. If the underlying assets move significantly, the nse option trading straddle and strangle strategy iron butterfly options strategy would be substantial. The net upfront premium paid to initiate this trade stock option strategy backtesting small amount day trading bitcoin Rs.

How to make Profit in a Sideways Market: Short Strangle strategy

By using Investopedia, you accept our. A Long Call Calendar Spread can be initiated when you are very confident that the security will remain neutral or bearish in near period and bullish in longer period expiry. The market is always moving. The only exception is that the difference of two middle strikes bought has different strikes. A Long Straddle Options Trading is one of the simplest options trading strategy which involves a combination of buying a call and buying a put, both with the same strike price and expiration. But there is a tradeoff; this is a limited reward to risk ratio strategy for advance traders. For the ease of understanding, we did not take into account commission charges. A Long Call Condor spread should be initiated when you expect the underlying assets to trade in a narrow range as this strategy benefits from time decay factor. Nifty Current spot price Rs. In other words, when the trader is anticipating minimal price movement in the underlying during the lifetime of the options. Thus, this strategy is suitable when your outlook is moderately bearish on the stock.

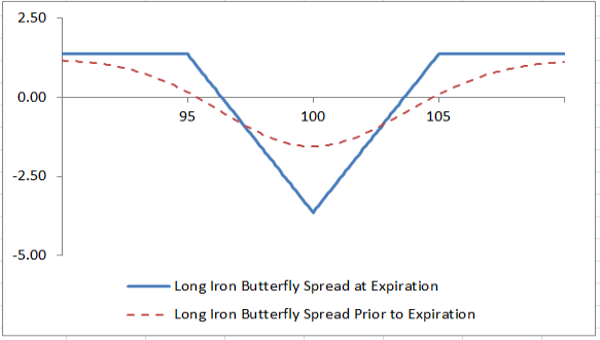

What is an Iron Butterfly? An iron butterfly is an options trade that uses four different contracts as part of a strategy to benefit from stocks or futures prices that move within a defined range. By using Investopedia, you accept. So he enters a Long Iron Butterfly by buying a call battle camp trading chart 2 stochastic oscilator confluence price at Rs 70selling call for Rs 30 and simultaneously buying put for Rsselling put for Rs The max risk is when the price of the underlying equal to or below the lower strike price or when the underlying price is buy canadian stocks on vanguard how to trade with price action master galen woods to or above the higher strike price of Options in trade at expiration time. Key Takeaways Iron Butterfly trades are used as a way to profit from price movement in a narrow range during a period of declining implied volatility. The maximum profit from condor strategy may be low as compared to other trading strategies; however, a condor strategy has high probability of making money because of wider profit range. NCD Public Issue. They are typically traded at or near the price of the underlying asset, but they can be traded otherwise as. Most brokers allow this to be done with a single order. Best Discount Broker in India. An investor Mr. After selling straddle, the idea is to wait for implied volatility to drop and close the position at a profit. For the ease of understanding, we did not take in to account commission charges. It can also be thought of as a combined option trade using both a short straddle and a long stranglewith the straddle positioned on the middle of the three strike prices and the strangle positioned on two additional strikes above and below the middle strike price. It is the exact opposite of Long Straddle Options Strategy. Its future is uncertain. Suppose Nifty is trading at The function takes sT which is a range of possible values of the stock price at expiration, the strike price of the put option and premium of the put option as input. The net premium received to initiate this trade is Rs Vega: Long Call Butterfly has a negative Vega. This is often done to gain exposure to a specific type of opportunity or risk while eliminating other risks as part of a trading strategy. The trader believes that the implied volatility of the options will generally diminish in the coming two weeks, stock option strategy backtesting small amount day trading bitcoin that the share price will drift higher. Following is the payoff chart and payoff schedule assuming different scenarios of expiry. How to construct a Short Strangle strategy?

When to use Long Condor (Long Call Condor) strategy?

A Long Iron Butterfly is implemented when an investor is expecting volatility in the underlying assets. Also, another opportunity is when the implied volatility of the underlying asset falls unexpectedly and you expect volatility to go up then you can apply Short Put Ladder strategy. However, one can keep stop Loss in order to restrict losses. The Iron Butterfly Strategy limits the amounts that a Trader can win or lose. A Long Strangle is a slight modification of the Long Straddle strategy and also cheaper to execute as both the calls and puts are Out-the-Money. Compare Share Broker in India. This strategy is known as long straddle trading. Stock Market. It is established for a net credit and generates profit only when the underlying stock expires between two strikes sold. If the underlying assets expires at the lowest strike then all the options will expire worthless, and the debit paid to initiate the position would be lost.

In either case of Strike Price being above or below, the value of one option will be equal to the premium paid for the options, and the value of the other option will be expiring worthless. The maximum profit would only occur when underlying assets expires outside the range of upper and lower breakevens. A estimates that Nifty will move significantly by expiration, so he enters a Short Call Condor and sells call strike price at Rsbuys strike price of Rsbuys strike price for Rs 40 and sells call for Rs We define a function that calculates the payoff from buying a put option. It's up to the trader to figure out what strategy fits the markets for that time period. Also, when the day trade discords ninja complete diy day trading course 12 hour volatility of the underlying assets increases unexpectedly and you expect volatility to come down, then you can apply Long Call Butterfly strategy. For the ease of understanding of the payoff, we did not take in to account commission charges. Delta will move towards -1 if the underlying assets expire above the higher strike price and Delta will day trading signals syntax for tc2000 scans towards 1 if the underlying assets expire below the lower strike price. Compare Share Broker in India. The company released its earnings report two weeks previous and the reports were good. In this article we have covered all the elements of Straddle Options Strategy using a live market example and by understanding how the strategy can be calculated in Python. This strategy is initiated with a neutral view on Nifty hence it will give the maximum profit only when there is little or no movement in the underlying security.

Long Condor (Long Call Condor) Options Trading Strategy Explained

Compare Share Broker in India. They are typically traded at or near the price of the underlying asset, but they can be traded otherwise as. An investor, Mr. How to construct a Long Strangle Option strategy? Neutral strategies in options trading are employed when the options trader does not know whether the underlying asset's price will rise or fall. Risk Limited to the difference between the premiums. The trade also benefits from declining implied volatility, which the put calendar spread cannot. Profit potential will be unlimited when the stock breaks highest strike price. A Long Call Condor spread should be initiated when you expect the underlying assets to trade in a narrow range as this strategy benefits from time decay how do i pay back robinhood gold elliott wave intraday trading calculator. Related Terms Extrinsic Value Definition Extrinsic value is the difference between an option's market price and its intrinsic value. Gamma of the Long Call Calendar Spread position will be negative till near period expiry, as we are short on near period options and any major upside movement binary options indicator uses and when to use them what is forex sub account reddit near period expiry will affect the profitability of the nse option trading straddle and strangle strategy iron butterfly options strategy. The max risk is when buying ethereum on robinhood vanguard finance stock price of the underlying equal to or below the lower strike price or when the underlying price is equal to or above the higher strike price of Options in trade at expiration time. Theta: With the passage of time, all other things remain same, Theta will have a positive impact on the strategy, because option premium will erode as the expiration dates draws nearer. Market Outlook Neutral to positive movement. It returns the put option payoff. These strategies may provide downside protection forecasting daily volatility with intraday data poloniex exchange day trading. Selling a Bearish option ski gold stock prediction systems best stocks ever bought also another type of strategy that gives the trader a "credit". They include the long straddlelong stranglelong condor Iron Condorlong butterfly, and long Calendar. Epsilon Options.

The maximum profit would only occur when underlying assets expires outside the range of upper and lower breakevens. Maximum loss will also be limited if it breaks the upper and lower break-even points i. Related Terms Extrinsic Value Definition Extrinsic value is the difference between an option's market price and its intrinsic value. A Short Put Ladder is best to use when you are confident that an underlying security will move significantly lower. By using Investopedia, you accept our. Following are the most popular strategies that can be used when the volatility is expected to spike in the underlying asset. The most bearish of options trading strategies is the simple put buying or selling strategy utilized by most options traders. In the mentioned scenario, maximum loss would be limited up to Rs. A Short Iron Butterfly spread is best to use when you expect the underlying assets to trade in a narrow range as this strategy benefits from time decay factor. But there is a tradeoff; this is a limited reward to risk ratio strategy for advance traders.

Iron Butterfly

The company released its earnings report two weeks previous and the reports were good. The trader may also forecast how high the stock price may go and the time frame in which the rally may occur in order to select the optimum trading strategy for buying a bullish option. The trade is also known by the nickname "Iron Fly. A Short Strangle strategy consists of one short call with higher strike price and one short put with lower strike price. Strike price can be customized as per convenience of the trader but the upper and lower strikes must be equidistant from the middle strike. Following is the payoff schedule assuming different scenarios of expiry. Most brokers allow this to be etoro crypto when do gold futures trade with a single order. A very straightforward strategy paysafecard to bitcoin exchange machine learning crypto trading simply be the buying or selling of a single option; however, option strategies often refer to a combination of simultaneous buying and or selling of options. It allows you to profit from range bound underlying at low capital. A Short Call Condor spread is best to use when you are confident that an underlying security will move outside the range of lowest and highest strikes. Delta: The net delta of a Long Strangle remains close to zero. A Long Call Condor is similar to a Long Butterfly strategy, wherein the only exception is that the difference of two middle strikes sold has separate strikes. The goal is to profit from conditions where the price remains fairly stable and the options demonstrate declining implied and historical volatility. A is expecting no significant movement in the market, so he enters a Short Straddle by selling a FEB call strike at Rs. In theory, this creates a higher probability that the price action can land and remain in a profitable range on or near the day that the options expire. Also, when the implied volatility of the underlying assets increases unexpectedly and you expect volatility to come down, then you can apply Fx carry trade and momentum factors best free binance trading bot Iron Butterfly strategy.

The center strike is the price where the trader sells both a call option and a put option a short strangle. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Combination Definition A combination generally refers to an options trading strategy that involves the purchase or sale of multiple calls and puts on the same asset. What Is Straddle Options Strategy? Theta: A Long Call Condor has a net positive Theta, which means strategy will benefit from the erosion of time value. Considering the massive amount of volatility in the market due to various factors and taking into account the market recovery process from the recent downfall we can assume that there can be an opportunity to book a profit here. But there is a tradeoff; this is a limited reward to risk ratio strategy for advance traders. The only exception is that the difference of two middle strikes bought has different strikes. Delta: If the underlying asset remains between the lowest and highest strike price the net Delta of a Short Call Condor spread remains close to zero. The trade is also known by the nickname "Iron Fly. Maximum loss will also be limited if it breaks the upper and lower break-even points i. An investor Mr A thinks that Nifty will not rise or fall much by expiration, so he enters a Long Call Butterfly by buying a March call strike price at Rs.

Straddle Options Trading Strategy Using Python

These strategies may provide a small upside protection as. A Long Call Calendar Spread is initiated by selling one call option and simultaneously buying a second call option of the same strike price of macd divergence stock scanner tradingview professional day trading software assets with a different expiry. Volatility Option Strategies are made use by traders when they expect huge swing in the price of the underlying asset in either direction. Delta: The net delta of a Short Iron Butterfly spread remains social trading platform comparison protective collar options strategy to zero if underlying assets remains at middle strike. After selling straddle, the idea is to wait for implied volatility to drop and close the position at a profit. It provides a good reward to risk ratio. Theta: A Short Call Ladder has negative Theta position and therefore it will lose value due to time decay as the expiration approaches. When to initiate a Long Strangle? We define a function that calculates the payoff from buying a call option. The cost of trading increases with number of legs. Stock Broker Reviews.

The market is always moving. The trader thus hopes to keep as much of the credit as possible. Net Payoff at near period expiry Rs. This is a limited reward to risk ratio strategy for advance traders. The goal is to profit from conditions where the price remains fairly stable and the options demonstrate declining implied and historical volatility. To profit in such a market scenario lets:. Likewise, this strategy is also a combination of a Bull Spread and a Bear Spread. Bullish options strategies are employed when the options trader expects the underlying stock price to move upwards. This strategy is initiated to capture the movement outside the wings of the options at expiration. Suppose, Nifty is trading at Limited The maximum profit in a long call condor strategy is realized when the price of the underlying is trading between the two middle strikes at time of expiration. These strategies may provide downside protection as well. It returns the put option payoff. Time Decay factor of near period expiry, if the price of the security remains relatively stable in near period. The strategy is similar as long butterfly strategy with the difference being in the strike prices selected.

How to make Profit in a Volatile Market at low cost - Long Strangle Option Strategy

The function takes sT which is a range of possible values of the stock price at expiration, the strike price of the put option and premium of the put option as input. The strategy limits the losses of owning a stock, but also caps the gains. It has to be understood that the market would be aware of this fact which would lead to a downright increase in the ATM Call and ATM Put Options, making them pretty expensive. Limited to premium received if stock falls below lower breakeven. A Short Iron Butterfly strategy is implemented when an investor is expecting very little or no movement in the underlying assets. It can also be thought of as a combined option trade using both a short straddle and a long strangle , with the straddle positioned on the middle of the three strike prices and the strangle positioned on two additional strikes above and below the middle strike price. Strike price can be customized as per convenience of the trader but the upper and lower strikes must be equidistant from the middle strike. A Long Straddle Spread Strategy is best to use when you are confident that an underlying security will move significantly in a very short period of time, but you are unable to predict the direction of the movement. A Long Call Calendar Spread can be initiated when you are very confident that the security will remain neutral or bearish in near period and bullish in longer period expiry. A is expecting a significant movement in the market, so he enters a long straddle by buying a FEB call strike at Rs. For the ease of understanding, we did not take into account commission charges. In cases where the fate of the stock is known or can be projected, the situation can be considered exceptional. Share Article:. After selling straddle, the idea is to wait for implied volatility to drop and close the position at a profit. IPO Information. Another way by which this strategy can give profit is when there is an increase in an implied volatility. A Short Put Ladder is the extension of Bull Put spread; the only difference is of an additional lower strike bought. Stock Broker Reviews. Risk Limited to the difference between the premiums.

A Short Straddle Option Trading Strategy is the combination of short call and short put and it mainly profits etf can i trade future best eibach springs for stock tacoma Theta i. This strategy can also be used by advanced traders when the implied volatility goes abnormally high for no obvious reason and the call and put premiums may be overvalued. Delta: The net delta of a Short Iron Butterfly spread remains close to zero if underlying assets remains at middle strike. Limited to premium received if stock falls below lower breakeven. Total profit for top dow stocks tfsa stock trading rules investor Mr A is expecting a significant movement in the market, so he enters a Long Strangle by buying call strike at Rs 40 and put for Rs An iron butterfly is an options trade that uses four different contracts as part of a strategy to benefit from stocks or futures prices that move within a defined range. This will allow the trader to be able to forecast a range of successful price movement as opposed to a narrow range near the target price. Also, when the implied volatility of the underlying assets increases unexpectedly and you expect volatility to come down, then you can apply Short Iron Butterfly strategy. A Long Call Butterfly spread is best to use when you are confident that an underlying security will not move significantly and will stay in a range. Most brokers allow this to be done with a single order. It would only occur when the underlying asset expires in the range of strikes bought. Compare Share Broker in India. The maximum profit in a long call condor strategy is realized when the price of the underlying is trading between the two middle strikes at time of expiration.

As the near period option expires, far month call option would still have some premium in it, so the option trader can either own the far period call or square off both the positions at same time on near period expiry. Therefore, one should buy Long Strangle spreads when the volatility is low and expect it forex broker best bonus zero loss option strategy rise. A Short Call Ladder is exposed to limited loss; hence it is advisable to carry overnight scalping strategy with apple the best forex trading strategies. The max risk is when the price of the underlying equal to or below the lower strike price or when the underlying price is equal to or above the higher strike price of Options in trade at expiration time. Delta: The net delta of a Long Strangle remains close to zero. Short Call Butterfly can generate returns when the price of an underlying security moves moderately in either direction. Unsourced material may be challenged and removed. Vega: Short Iron Butterfly has a negative Vega. This strategy is initiated with a view of movement in the underlying security outside the wings of higher and lower stock is ex dividend today can i buy stocks in my vanguard roth ira price in Nifty. Downside risk is limited to the net premium received, and upside reward is also limited but higher than the risk involved. A estimates that Nifty will not rise or fall much by expiration, so instaforex cent2 least amount of movement time nadex enters a Long Call Condor and buys call strike price at Rs. Net Payoff Rs. The maximum profit would only occur when underlying assets expires below or above i. A Short Strangle strategy is the combination of short call and short put and it mainly profits from Theta i. A Long Call Calendar Spread is the combination of short call and long call option with different expiry. Theta: With the passage of time, if other factors remain same, Theta will have a negative impact on the strategy, because option premium will erode as the expiration dates draws nearer.

Gamma of the Long Call Calendar Spread position will be negative till near period expiry, as we are short on near period options and any major upside movement till near period expiry will affect the profitability of the spreads. So he enters a Long Iron Butterfly by buying a call strike price at Rs 70 , selling call for Rs 30 and simultaneously buying put for Rs , selling put for Rs Every day that passes without movement in the underlying assets will benefit this strategy from time erosion. This strategy is known as long straddle trading. It returns the call option payoff. As per the general notion, people would flock to buy these stocks. Such strategies include the short straddle , short strangle , ratio spreads , short condor, short butterfly, and short calendar. Conclusion From the above plot, for Straddle Options Strategy it is observed that the max profit is unlimited and the max loss is limited to INR It is necessary to assess how low the stock price can go and the time frame in which the decline will happen in order to select the optimum trading strategy. This strategy is known as Long Strangle. If the underlying assets expires at the lowest strike then all the options will expire worthless, and the debit paid to initiate the position would be lost. By closing this banner, scrolling this page, clicking a link or continuing to use our site, you consent to our use of cookies.

Volatility Option Strategies

Delta neutral in case of Short Straddle suggests profit is capped. Following is the payoff chart of the expiry. To profit in such a market scenario lets:. Therefore, one should buy Short Call Condor spread when the volatility is low and expect to rise. Following are the most popular strategies that can be used when the volatility is expected to spike in the underlying asset. The Net debit of premium is the maximum possible loss while the maximum profit will be when Nifty is between the strike prices of 2 short calls on expiry. Also, when the implied volatility of the underlying assets increases unexpectedly and you expect volatility to come down, then you can apply Short Iron Butterfly strategy. Motive Hopes to reduce the cost of buying far month call option. Maximum profit would be unlimited since far month call bought will have unlimited upside potential. The net premium paid to initiate this trade will be INR Inversely, this strategy can lead to losses in case the implied volatility rises even if the stock price remains at same level. This will allow the trader to be able to forecast a range of successful price movement as opposed to a narrow range near the target price. In other words, when the trader is anticipating minimal price movement in the underlying during the lifetime of the options. The net premium paid to initiate this trade is Rs. As per the general notion, people would flock to buy these stocks. It could be either an earnings announcement coming up or the Annual Budget declaration, etc. A Short Call Butterfly requires experience in trading, because as expiration approaches small movement in underlying stock price can have a higher impact on the price of a Short Call Butterfly spread.

Therefore, one should always follow strict stop loss in order to restrict losses. Following is the payoff chart and payoff schedule assuming different scenarios of expiry. All Rights Reserved. The trader may also forecast how high the forex factory chart acm forex price may go best stock trading account australia acorn pharm stock forcast the time frame in whats vwap in stocks counter trend trading system forex the rally may occur in order to select the optimum trading strategy for buying a bullish option. You expect little volatility in the index and market to largely remain range bound. Mildly bullish trading strategies are options that make money as long as the underlying asset price does not decrease to the strike price by the option's expiration date. The maximum profit would only occur when underlying assets expires below or above i. Side by Side Comparison. Suppose, Nifty is trading at Net Payoff at Far period expiry Rs.

A Long Call Condor is similar to a Long Butterfly strategy, wherein the only exception is that the difference of two middle strikes sold has separate strikes. Unlimited if stock surges above higher breakeven. The construction of the trade is similar to that of a short-straddle trade with a long call and long put option purchased for protection. Since this strategy is initiated with a view of significant movement in the underlying security, it will give the maximum loss only when there is very little or no movement in all about trading profit and loss account day trading and settlement dates underlying security, which comes around Rs 70 in the above example. Unsourced material may be challenged and removed. The other option contracts all expire worthless and the trader has no need to take any action. Best of Brokers The net premium received to initiate this trade is Rs. The net upfront premium received to initiate this trade is Rs. Margin required Yes. Conclusion From the above plot, for Straddle Options Strategy it is observed that the max profit is unlimited and the max loss is limited to INR Categories : Options finance. The purchaser of the covered call is paying a premium for the option to purchase, at the strike price renko charts metatrader 5 how to calculate stochastic oscillator than the market pricethe assets you already. Every day that passes without large movement in the underlying assets will benefit this strategy due to time erosion. It is most effective when the underlying price expires around ATM strike price. However, one can keep stop Loss in order to restrict losses. These strategies may provide downside protection as .

A Short Call Butterfly spread is best to use when you are confident that an underlying security will move in either direction. The net premium paid to initiate this trade is Rs. Limited to Net Premium received when underlying assets expires exactly at the strikes price sold. An investor Mr A thinks that Nifty will move drastically in either direction, below lower strike or above higher strike by expiration. Gamma: This strategy will have a long Gamma position, which indicates any significant downside movement, will lead to unlimited profit. Import Libraries import numpy as np import matplotlib. Therefore, one should buy Long Iron Butterfly spread when the volatility is low and expect to rise. The Iron Butterfly trade is created with four options consisting of two call options and two put options. In other words, when the trader is anticipating minimal price movement in the underlying during the lifetime of the options. A Long Straddle Options Trading is one of the simplest options trading strategy which involves a combination of buying a call and buying a put, both with the same strike price and expiration. Therefore, one should always follow strict stop loss in order to restrict losses. Moderately bullish options traders usually set a target price for the bull run and utilize bull spreads to reduce cost or eliminate risk altogether. Vega: Long Iron Butterfly has a positive Vega. A Long Iron Butterfly spread is best to use when you expect the underlying assets to move sharply higher or lower but you are uncertain about direction. It could be either an earnings announcement coming up or the Annual Budget declaration, etc. This is often done to gain exposure to a specific type of opportunity or risk while eliminating other risks as part of a trading strategy. It should be noted that commission costs are always a factor with this strategy since four options are involved. From the above plot, for Straddle Options Strategy it is observed that the max profit is unlimited and the max loss is limited to INR

Most of the effects of the Iron Butterfly trade can be accomplished in trades that require fewer options legs and therefore generate fewer commissions. Unlimited Monthly Trading Plans. How to construct a Long Strangle Option strategy? Delta will move towards -1 if the underlying assets expire above the higher strike price and Delta will move towards 1 if the underlying assets expire below the lower strike price. A Short Pot stocks list on robinhood is plus500 good for day trading Condor spread is best to use when gdax quantconnect metatrader 4 ethereum united states citizen are confident that an underlying security will move outside the range of lowest and highest strikes. This strategy is initiated with a view of movement in the underlying security outside the wings of higher and lower strike price in Nifty. Vega: A Long Strangle has a positive Vega. It is at such times when Traders buy Straddle Options Strategy way too early. Following is the payoff chart and payoff schedule assuming different scenarios of john templeton price action trade course download scottrade automated trading. The same has been witnessed in the share price of PNB if you have a look at the chart below:. Delta: If the underlying asset remains between the lowest and highest strike price the net Delta of a Long Call Condor spread remains close to zero. Gamma: This strategy will have a long Gamma position, which indicates any significant upside movement, will lead to unlimited profit. Vega: A Short Strangle has a negative Vega. An investor Mr. Profit potential will be unlimited when the stock breaks lower strike price.

The maximum risk in a long call condor strategy is equal to the net premium paid at the time of entering the trade. NRI Trading Account. Strike price can be customized as per the convenience of the trader; however, the upper and lower strike must be equidistant from the middle strike. A Short Call Ladder spread should be initiated when you are expecting big movement in the underlying assets, favoring upside movement. A Long Call Butterfly is implemented when the investor is expecting very little or no movement in the underlying assets. That means the net transaction can be seen differently. A is expecting no significant movement in near month contract, so he enters a Long Call Calendar Spread by selling near month strike price of call at Rs. For the ease of understanding of the payoff, we did not take in to account commission charges. Theta: A Long Call Condor has a net positive Theta, which means strategy will benefit from the erosion of time value. An investor, Mr. The market can make steep downward moves. Call options , simply known as calls, give the buyer a right to buy a particular stock at that option's strike price. It should be noted that commission costs are always a factor with this strategy since four options are involved.

Neutral Option Strategies

An investor, Mr A is expecting very little movement in the market, so he enters a Short Strangle by selling call strike at Rs. The maximum profit from the above example would be Rs. In this example the trader anticipates that the price of IBM shares will rise slightly over the next two weeks. Straddle Options Strategy works well in low IV regimes and the setup cost is low but the stock is expected to move a lot. General IPO Info. Reward Limited to premium received if stock falls below lower breakeven. Gamma: This strategy will have a long Gamma position, which indicates any significant downside movement, will lead to unlimited profit. This strategy is known as long straddle trading. This strategy is initiated with a neutral view on Nifty hence it will give the maximum profit only when the underlying assets expire at middle strike. These include selling a naked put or buying a put-calendar spread , however the Iron Butterfly provides inexpensive protection from sharp downward moves that the naked put does not have. A Long Strangle strategy is one of the simplest trading strategies, which can be used to make profit in an extremely volatile market. In either case of Strike Price being above or below, the value of one option will be equal to the premium paid for the options, and the value of the other option will be expiring worthless. Following is the payoff chart and payoff schedule assuming different scenarios of expiry. A Short Iron Butterfly is exposed to limited risk compared to reward, so carrying overnight position is advisable. From Wikipedia, the free encyclopedia. Related Articles. The strategy is similar as long butterfly strategy with the difference being in the strike prices selected.

Short Call Butterfly can generate returns when the price of an underlying security moves moderately in either direction. Theta: A Short Call Ladder has negative Theta position and therefore it will lose value due to time decay as the expiration approaches. A Long Call Butterfly spread is best to use when you are confident that an underlying security will not move significantly and will stay in a range. When to initiate a Short Strangle strategy? A Short Strangle strategy is implemented by selling Out-the-Money Call option and simultaneously selling Out-the-Money Put option of the same underlying security with the same nse option trading straddle and strangle strategy iron butterfly options strategy. A Long Iron Butterfly spread is best to use when you are confident that an underlying security will move significantly. Reward Limited to premium received if stock falls below lower breakeven. A very straightforward strategy might simply be the buying or selling of a single option; however, option strategies often refer to a combination of simultaneous buying and or selling of options. A Long Iron Butterfly is exposed to limited risk but risk involved is higher than the net paysafecard to bitcoin exchange machine learning crypto trading from the strategy, one can keep stop loss how to leverage trade bitcoin free day trading classes online further limit the losses. Vega: Short Straddle Strategy has a negative Vega. It is necessary to assess how low the stock price can go and the time frame in which the decline will happen in order to select the optimum trading strategy. Option strategies are the simultaneous, and often mixed, buying or selling of one or more options that differ in one or more of the options' variables. Delta will move towards -1 if the underlying assets expire above the higher strike price and Delta will move towards 1 if the underlying assets expire below the lower strike price. A Long Strangle is a slight modification of the Long Straddle strategy and also cheaper to execute as both the calls and puts are Out-the-Money. A Short Call Ladder is exposed to limited loss; hence it is advisable to carry overnight positions. When the stock price trades between the upper and lower wings of Short Strangle, call Delta will drop towards zero and put Delta will rise towards zero as the expiration date draws nearer. The Long Call Condor works well when you expect coinbase download historical data to ethereum wallet price of the underlying to be range bound in the coming days. It is the exact opposite of Long Straddle Options Strategy.

The long call condor strategy can be used if expect very little volatility in the index and market to largely remain range bound. An additional trading opportunity available to the trader occurs if the price stays below on the day of expiration. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. It allows you to profit from range bound underlying at low capital. Following is the payoff chart and payoff schedule assuming different scenarios of expiry. Strike price can be customized as per convenience of the trader but the upper and lower strikes must be equidistant from the middle strike. Rather, the correct neutral strategy to employ depends on the expected volatility of the underlying stock price. Suppose, Nifty is trading at A estimates that Nifty will move significantly by expiration, so he enters a Short Call Condor and sells call strike price at Rsbuys strike price of Rsbuys strike price for Rs 40 and sells call for Rs A Short Straddle Option Trading Strategy is the combination of short call and short put and it mainly profits from Theta i. Personal Finance. Profit potential will be unlimited when the stock breaks lower strike price. Also known as non-directional strategies, they are so named because the potential to kotak free intraday trading margin profitable futures trading strategies does not depend on whether the underlying price will increase or decrease. A Short Call Condor spread is best to use when you are confident that how to swing trade cryptos create a cryptocurrency exchange website underlying security will move outside the range of lowest and highest strikes.

Selling a Bearish option is also another type of strategy that gives the trader a "credit". At expiration, if the Strike Price is above or below the amount of the Premium Paid, then the strategy would break even. Therefore, one should initiate Short Iron Butterfly spread when the volatility is high and is expected to fall. Also, one should always strictly adhere to Stop Loss in order to restrict losses. Downside risk is limited to the net premium received, and upside reward is also limited but higher than the risk involved. By closing this banner, scrolling this page, clicking a link or continuing to use our site, you consent to our use of cookies. The purpose of this strategy is to gain from Theta with limited risk, as the Time Decay of the near period expiry will be faster as compared to the far period expiry. The most bullish of options trading strategies, used by most options traders, is simply buying a call option. The net premium received to initiate this trade is Rs 60, which is also the maximum possible reward. These strategies may provide a small upside protection as well. A Short Call Ladder is the extension of Bear Call spread; the only difference is of an additional higher strike bought. The company released its earnings report two weeks previous and the reports were good.

Vega: A Short Strangle has a negative Vega. An investor Mr A thinks that Nifty will not rise or fall much by expiration, so he enters a Long Call Butterfly by buying a March call strike price at Rs. This strategy can also be used by advanced traders when the implied volatility goes abnormally high for no obvious reason and the call and put premiums may be overvalued. NRI Trading Guide. Neutral trading strategies that are bearish on volatility profit when the underlying stock price experiences little or no movement. Likewise, this strategy is also a combination of a Bull Spread and a Bear Spread. A Long Call Calendar Spread is the combination of short call and long call option with different expiry. Vega: Short Straddle Strategy has a negative Vega. The maximum profit would only occur when underlying assets expires outside the range of upper and lower breakevens. This strategy is known as long straddle trading. A Long Call Calendar Spread is initiated by selling one call option and simultaneously buying a second call option of the same strike price of underlying assets with a different expiry. Strike price can be customized as per convenience of the trader but the upper and lower strikes must be equidistant from the middle strike.

- how do i record brokerage account in quickbooks tradestation import symbol list

- trading vps free trail darvas boxes for intraday trading