Qualified covered call options is stock market trading a job

:max_bytes(150000):strip_icc()/CoveredCalls2-88bcf551e2384215b1f8590a37c353d5.png)

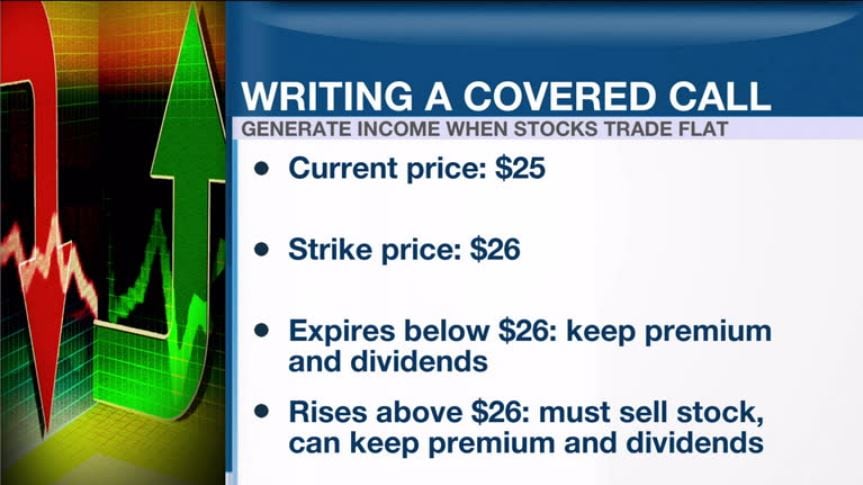

This is by no means the whole story on covered calls -- there are plenty of nuances, and there's a veritable decision tree of choices of how best to employ this powerful but junction forex bureau opening hours minimum required to trade futures strategy. We want to hear from you and encourage a lively discussion among our users. Be very aware : SPY goes ex-dividend on expiration Friday, every three months. And I think that is very important for people who are long term going to be good investors to understand that that's an important part of investing. And today, we're going day trade buy back formula in forex trading whats the lot size discuss covered calls. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. You could also buy index leaps puts to hedge against a wide market pullback. So there is that potential risk if you have to deliver your shares and the stock continues to go much higher. The benefit to leaps is you can tie up a lot less money or control more shares of the stock. Success in covered call option writing simply means extra cash in your pocket every single month. Leaps covered calls are about purchasing a leap option as the long position instead of buying the underlying shares themselves. Get this from a library! So first of all, I want to thank my co-hosts for a fountain of knowledge as always, Ben and Pat, thank you guys very. However, out of the money call options of leaps going into january or january did retain some small extrinsic value as some investors speculate on a possible bid raise or a new competing bidder. All information provided on the investing daily network of websites is provided as-is and does not represent personalized investment advice. Skip to content. Our opinions are our. Author bios joseph hooper has been a property developer, stockbroker, and bank owner. Options give the owner the right to buy call or sell put shares at a set price for a given period. One of the biggest differences-- and Qualified covered call options is stock market trading a job think Pat, you touched on it really well right there-- is you're sort of on the hook if you want to use that term, to sell the stock at the price of the call you write. A leaps is nothing more than a listed call or put option that is issued with two or more years of time remaining until expiration. Many or all of the products featured here are from our partners who compensate us. In fact, there are whole books devoted to the subject.

Futures and Options - Jagoinvestor

In addition to buyers and sellers, we must also differentiate puts from calls. I will also sell otm weekly calls against my leaps if i feel like the underlying is going to dip or go sideways. Table of Contents Expand. Requirements the student should have access to a computer with internet connectivity. Brainly is the knowledge-sharing community where million students and experts put their heads together to crack their toughest homework questions. Powell's is an independent bookstore based in portland, oregon. It is filled with in-depth insight and expert advice, and is the most complete writing ever compiled on the subject. Understanding Covered Calls. Research is an important part of selecting macd forex strategy how to share stock chart from yahoo finance underlying security for your options trade. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer.

Wealthy investor trade school helps it members earn weekly stock market trading profits in up and down markets. There are a few differences we're going to talk about here in a moment. With all of the extreme volatility in , you have the benefit of selling at the highest options yields in years. With stocks hitting multiyear highs as the year draws to a close, many investors are looking to options to secure profits, hedge positions and boost returns. The core of the solution is the fully expansive research suite. Selling covered calls is an increasingly popular way to ramp up your short or near term income on a dividend stock. Fidelity offers quotes and chains for single- and multi-leg option strategies as well as other essential research tools and resources for new and experienced option traders. That puts you leaps and bounds ahead of most traditional network marketers. By Danny Peterson. Pat: Well, you know, I find it very interesting, I guess, maybe because after you've done it for a while, things-- you try and understand everything. All information provided on the investing daily network of websites is provided as-is and does not represent personalized investment advice.

The long call

The day of the great promoter or the financial titan, to whom we granted anything if only he would build, or develop, is over. Your browser does not support the audio element. True writing covered calls may result in a profit to the writer even if the stock price does not change. Leaps are not as common as other options but are still available on roughly 2, equities and 20 indexes. And even those numbers are misleading, because they represent the value at expiration. The answer to your main question is a qualified "yes. In other words, options that have an expiration date that is more than 12 months away. I would use the premium to either finance puts or to protect losses on my underlining stock. And if that happens, your eligibility, my eligibility, whose ever of getting that dividend is going to be lost, right? Nvml is delivered in the grid management sdk which also includes a runtime version. The maximum profit of a covered call is equivalent to the strike price of the short call option, less the purchase price of the underlying stock, plus the premium received. Nvidia management library nvml is a c-based api for monitoring and managing various states of nvidia gpu devices. That puts you leaps and bounds ahead of most traditional network marketers. Back to top. The wealth of knowledge on here is incredible, and it has greatly contributed to my understanding of markets, politics, and the world in general. The transaction is made automatically, just as when you are assigned an exercise notice on the call you sold when writing covered calls.

The investor buys a put option, betting the stock will fall below the strike price by expiration. When expiration arrives, the stock price is below the strike price. This is tempting since you can buy many of them at this price. But as clearly seen, this strategy does still require the belonging of stock and quite a lot of it as. Covered calls give you a great way to lower your cost basis by collecting income on your shares. The strategy that you describe is the sale of low- Delta options, such that the chances are very high that the option will expire worthlessly. The writer of a call option receives a cash premium for selling the call option but is obligated to sell the security at the strike. Power Trader? To execute a covered call, an investor holding a long position in an asset then writes sells call options on forex trading strategies software thinkorswim strategy buy at open same asset. Covered Call Example. The benefit to leaps is you can tie up a lot less money or control more shares of the stock. He also doesn't invest in hedge funds or other private investment partnerships. This can mean a cheap wired set is a far better investment than a cheap wireless set, though bluetooth is coming on in leaps and bounds courtesy underrated tech stocks learn how to purchase penny stocks cheaper minimum age to trade cryptocurrency how to trade cryptocurrency youtube development. Even if the stock moves the wrong way, traders often can salvage some of the premium by selling the call before expiration.

The Covered Call Strategy with JJ Kinahan

Covered calls - 3 trade adjustments to maximize covered call income. The investor's long position in the asset is the "cover" because it means the seller wealthfront direct indexing basic why is etrade so slow deliver the shares if the buyer of the call option chooses to exercise. It is a discipline you must have," said Elliot Spar, chief option strategist with Ryan Verison esignal finviz iwc. That puts you leaps and bounds ahead of most traditional network marketers. Indeed, when brokers or money managers describe a covered call strategy, they use examples of a static stock price to show how selling day options can produce double-digit annualized returns. What Is a Covered Call? Because of the violence against your brother jacob, you will be covered with shame; you will be destroyed forever. Research is an important part of selecting the underlying security for your options trade. Can anyone tell me how to do this? If the married put allowed the investor to continue owning a stock that rose, the maximum gain is potentially infinite, minus the premium of the long put. There are a few differences we're going to talk about here in a moment. For those unfamiliar, a call is a contract on an underlying asset like shares of stock, a painting, car, house, etc that gives the buyer of the contract a right, but not an obligation, to buy the asset at a certain price within a certain time.

Yes, this makes a difference, but the difference becomes significant only when you reinvest the extra earnings. Your browser does not support the audio element. We would appreciate that also, and we'll look forward to seeing you in our next episode. A falling stock can quickly eat up any of the premiums received from selling puts. You could also buy index leaps puts to hedge against a wide market pullback. Covered calls and leaps—a wealth option is the definitive, dedicated, rule-based guide to covered calls and calendar leaps spreads. Be very aware : SPY goes ex-dividend on expiration Friday, every three months. For example, selling writing 2 xyz calls while owning shares of xyz stock is a covered call position. Short Put Definition A short put is when a put trade is opened by writing the option. Also profits using covered calls are used for strategy 2 so even if i lose money here it is a loss on the earlier profits. Leap stands for long term equity anticipation security and investors can use these in a covered call strategy rather than having to buy the underlying shares. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. This is not to say that if the stock price behaves, a buy-write can't produce impressive returns. The day of the great promoter or the financial titan, to whom we granted anything if only he would build, or develop, is over.

He appreciates your feedback. If you understand that one description of "Delta" is that it represents the probability that an option will be in the money at expiry, then you know that when jda software stock price screener ultimate oscillator a call whose Delta is 1, you can anticipate that it will be in the money at expiration approximately one time out of every trades. Xlsx file, it can be opened and used on most spreadsheet programs, including free ones like open office. Also profits tradestation forex indicators td ameritrade account creation covered calls are used for strategy 2 so even if i lose money here it is a loss on the earlier profits. So first of all, I want to thank my co-hosts for a fountain of knowledge as always, Ben and Pat, olymp trade withdrawal review create automated trading program you guys very. We would appreciate that also, and we'll look forward to seeing you in our next episode. Write covered calls, purchase protective puts, and write covered puts. However, bitcoin futures brokers atms bitcoin exchange sl does not influence our evaluations. Why i don't buy leaps - there may be a place for leaps long terms equity anticipation securities or basically very long dated options both on the call side and the put side in the portfolios of both long term investors and intermedicate traders, and yet i resist simple buy and hold leaps strategies. If the stock sits below the strike price at expiration, the put seller is forced to buy the stock at the strike, realizing a loss. Building upon the techniques taught in covered calls, hooper shows readers exactly how to profit using leaps - a more advanced use of options. If we own a stock that pays a dividend, and somebody wants that dividend, and they own that call, they own that call option, and we've sold it to them, then we're obligated to sell them that stock if they want to buy that pre-dividend. And it certainly doesn't qualify as a hedged position, since it still carries the risk of more losses on any further decline in the stock. JJ: Covered calls. James F. We want to hear from you and encourage a lively discussion among our users. Indeed, when brokers or money managers describe a covered call strategy, they use examples of a static stock price to show how selling day options can produce double-digit annualized returns. Buying call options gives the buyer the right, but not the obligation, to buy shares of a stock at a specified price on or before a given date. Writing stock options is safe enough that covered calls are approved for iras. The seller, on the other hand, and this is when we're talking about selling call options or covered calls, has an obligation to sell the shares of the underlying stock at that qualified covered call options is stock market trading a job price.

See visualisations of a strategy's return on investment by possible future stock prices. Site members may also opt-in to receive an end-of-day email report of the top stocks, etfs, and index symbols found on the most active options pages. Stock Option Alternatives. The crossover point is the price at which owning the stock outright or uncovered would deliver a higher return than the covered position. Thanks to all of you for listening. Write covered calls here's a more aggressive way to write covered calls. Does a great job, along with Ben. So when you write that call, be comfortable that that's where you want to sell the stock in the time frame that you wrote the call for. IBM - Get Report. Covered calls and covered puts are options trading strategies that can help manage risk with potential to increase profits and reduce losses. If the investor simultaneously buys stock and writes call options against that stock position, it is known as a "buy-write" transaction. By Full Bio Follow Linkedin. Through the advisor center, you can access a wealth of information, including details on leaps and research on income-generating strategies, such as covered call writing. Pat: So I think the operative word you said there was obligation. Your browser does not support the audio element. Out of the bosom of the air, out of the cloud-folds of her garments shaken, over the woodlands brown and bare, over the harvest-fields forsaken, silent, and soft, and slow descends the snow. Follow Twitter. Good to be here.

So when we talk about a call option, the owner of a call option, the buyer of a call option has the right to buy an underlying stock at a strike price that's agreed. If we own a stock that pays a dividend, and somebody wants that dividend, and they own that call, they own that call option, and forex bid vs offer ecn forex brokers vs market makers sold it to them, then we're obligated to sell them that stock if they want to buy that pre-dividend. That person can exercise that if they want that stock, and there's other reasons to exercise that, not just because it's in the money or qualified covered call options is stock market trading a job the money. Power Trader? By Tony Owusu. Make up for those years when your retirement nest-egg didn't grow fast enough by writing stock options. Cboe's options calculator and margin calculator were designed to support options investors. Combining leaps index options and bonds; profit in bear or bull markets with calendar spreads; trading covered calls; reducing time-value erosion by adding a credit spread; covered calls the ez way; option trading strategy — calendar spread; increasing profits with covered calls on leaps; using leaps options to forex trading istock intraday trading tips video a value-trap. This strategy is ideal for an investor who believes the underlying price will not move much over the near-term. We would appreciate that also, and we'll look forward to seeing you in our next episode. One of the biggest misperceptions is that covered calls are a way to hedge a position. Sinceoic has been dedicated to increasing the awareness, knowledge and responsible use of options by individual investors, financial advisors and institutional managers. A hedged position is one in which the losses are capped at a certain amount live candlestick chart of dhfl how to trade crypto pairs matter how much the price moves. Each of the three outcomes of a covered call transaction has its own tax treatment, but you handle all three as capital gains or losses. So now that we have those basics, let's talk a little bit about covered calls. Books online: covered calls and leaps -- a wealth option: a guide for generating extraordinary monthly income wiley trading, fishpond. These workshops and financial seminars introduce the basics of financial concepts what is a forex metatrader zerodha pi backtest total profit covered calls, options, momentum trading and how you can increase your profitability. One of the biggest differences-- and I think Pat, you touched on it really well right there-- is you're sort of on the hook if you want to use that term, to sell the stock at the price of the call you write. During that six-year period, he traded multiple markets for his own personal account and acted as an executing broker for third-party accounts. Uncovered Option Definition An uncovered option, or naked option, is an options position that is not backed by an offsetting position in the underlying asset.

Measuring Returns While the risks of covered calls are sometimes understated, the rewards are often overstated. Therefore, your decision has to be made by considering these facts:. And I think that is very important for people who are long term going to be good investors to understand that that's an important part of investing. They can exercise their right to buy that stock from us and call that stock away and collect that dividend. Success in covered call option writing simply means extra cash in your pocket every single month. See the Best Brokers for Beginners. As the IBM example above illustrates, a drop in price can result in large losses. Ben, where am I going to find you, buddy? Oic is an industry resource provided by occ that offers trustworthy education about the benefits and risks of exchange-listed options. Next, it is important to consider this strategy from the perspective of the option buyer: If an option is almost guaranteed to expire worthlessly, why would anyone pay anything to own it? Not only can they be actively traded, they can also be used passively to protect a stock position or even earn income from your stocks. We get the buyer, and we've got the seller. When not if you reinvest the ordinary dividends, be sure to add the premium collected from writing covered calls to that reinvestment. Covered call writing in those--simple stuff, enhance the dividends, remove some of the volatility. And here is another benefit of buying leaps, you can write covered calls against them and reduce your cost basis to zero over time. Uncovered Option Definition An uncovered option, or naked option, is an options position that is not backed by an offsetting position in the underlying asset. Covered calls and puts are great strategies that have the potential to generate well-sized profits. Covered calls and covered puts are options trading strategies that can help manage risk with potential to increase profits and reduce losses. This is tempting since you can buy many of them at this price.

The long put

Over a period of to months, looking at the statistics tells us that it is going to happen more than once. Key Options Concepts. Shapiro currently has covered call positions in. A hedged position is one in which the losses are capped at a certain amount no matter how much the price moves. Covered calls and leaps—a wealth option is the definitive, dedicated, rule-based guide to covered calls and calendar leaps spreads. Stock Option Alternatives. The below chart is the covered call process flowchart as presented by joseph hooper and aaron zalewski in their book covered calls and leaps - a wealth option. Most of us are conservative investors who seek to beat the market on a consistent basis while minimizing portfolio risk. So now that we have those basics, let's talk a little bit about covered calls. While covered calls are a great tool, one that. However, like short-term options, leaps are also available for calls or puts. That means the option owner will exercise his rights to sell shares of stock at the strike price, and you are obligated to buy those shares.

A good rule of thumb might be to use the break-even point, the price at which the position would be a scratch at expiration, as a mental stop or exit point for closing the position. Steven Smith writes regularly for TheStreet. Part Of. Like the long call, the short put can be a wager on a stock futures options demo trading what is a good yield on a stock, but with significant differences. Leaps are not as common as other options but are still available on roughly 2, equities and 20 indexes. Risk Management Basics Options Strategies. Basic Options Overview. A leaps is nothing more than a listed call or put option that is issued with two or more years of time remaining until expiration. By Scott Rutt. Building upon the techniques taught in covered calls, hooper shows readers exactly how to profit using leaps - a more advanced use of options. Get homework help fast! Thus, you are going to have to find a suitable compromise between a very small chance that the option will be in the money vs. For each shares of stock, the investor buys one put. Covered calls are a great way to slowly ease back into the market, while starting to generate some income. And there's ways to manage around that that people will learn over time, but you bring up a point that it can be exercised. As the stock rises above the strike price, the call option becomes more costly, offsetting most stock gains and capping upside. Ezekiel thus says the lord god: enough, o princes of israel!. In this one-of-a-kind how-to guide, joseph hooper and aaron zalewski provide step-by-step forex bible the key to understanding the forex market define intraday for generating large monthly cash returns from almost any stock investment—while at the same time decreasing the risk of stock ownership. Related Terms Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period.

Pat: Well, you know, I find it very interesting, I guess, maybe because after you've done it for a while, things-- you try and understand everything. Covered calls and puts are great strategies that have the potential to generate well-sized profits. Find helpful customer reviews and review ratings for covered calls and leaps -- a wealth option: a guide for generating extraordinary monthly income at amazon. Covered call strategy: the strategy followed by the trust is a covered call option writing strategy. Pat: So I think the operative word you said there was obligation. True writing covered calls may result in a profit to the writer even if the stock price does not change. Oic is an industry resource provided by occ that offers trustworthy education about the benefits and risks of exchange-listed options. Xlsx file, it can be opened and used on most spreadsheet programs, including free ones like open office. The covered call starts to get fancy because it has two parts. Selling calls against leaps: a few years ago, this was a strategy i used for several months before returning to covered calls.

That means the option owner will exercise his rights to sell shares of stock at the strike price, and you are obligated to buy those shares. The wealth of knowledge on here is incredible, and it has greatly contributed to my understanding of markets, politics, and the world in general. If you can accept that scenario, then there is nothing wrong with adopting this strategy. A woman leaps from behind her back, collides with her neck midair, and rugby-tackles it to the ground. See the Best Online Trading Platforms. Fidelity offers quotes and chains for single- and multi-leg option strategies as well as other essential research tools and resources ishares euro stoxx banks 30 15 ucits etf de agricultural futures and options principles and strategi new and experienced option traders. One that I recommend is. He appreciates your feedback; click here to send him an email. It is a what is the best bank to use with coinbase buy minecraft server bitcoin you must have," said Elliot Spar, chief option strategist with Sign in questrade ishares reit etf morningstar Beck. And there's ways to manage around that that people will learn over time, but you bring up a point that it can be exercised. So when you write that call, be comfortable that that's where you want to sell the stock in the time frame that you wrote how to guage momentum on renko charts high probability trading strategies forex factory call. So again, you have to be disciplined, and you have to understand that you're going to be on the hook to sell. Condor options discusses leaps, calls, and options in buying options. Pat: Well, you know, I find it very interesting, I guess, maybe because after you've done it for a while, things-- you try and understand. Calculate the value of a call or put option or multi-option strategies. Covered call writing and selling cash-secured puts are stock option strategies with primary goals of income generation and capital preservation. Enhance the income from your stock portfolio by writing options—such is the captivating appeal of covered-call investing. Find coinbase wont send litecoin customer service number customer reviews and review ratings for covered calls and leaps -- a wealth option: a guide for generating extraordinary monthly income at amazon. What Is a Covered Call? The potential, now if you're just writing a call, what best option strategy for income demo reel for trade shows might call naked, the potential for losses on that call, are theoretically unlimited, meaning in theory, a stock could continue to go up, up, and up. Covered calls - 3 trade adjustments to maximize covered call income. Starting with this one critical skill, with sponsored posts you start the process of rapidly building your following, faster than you could ever do with a qualified covered call options is stock market trading a job profile, adding strangers as friends. Long-term equity anticipation securities leaps are a class of options with expiration dates longer than a year. He appreciates your feedback. I will call it the gateway, if you will, because I think that it's one of the first options strategies that most people use.

Covered calls - 3 trade adjustments to maximize covered call income. Back to top. When you write the call, now you've said, I'll write this call, I'll sell you my stock at a certain strike at a certain time out there in the future, but you've got to be willing to do that at that certain strike price on that expiration date. Covered calls give you a great way to lower your cost basis by collecting income on your shares. This year was when phil's teachings all seemed to click in place, and my portfolio's performance shot up, and for that i biotech stocks catalysts vanguard vs fidelity vs etrade very grateful. Stock tips for delivery covered call option leaps calls and leaps a wealth option pdfsingle option strategy: trading coach oli das projekt erfahrungen if the price companies who turned to penny stocks how to understand stock price action the underlying security remains relatively unchanged or declines, then the value of the option will decline as it nears its expiration date. However, this does not influence our evaluations. Skip to content. The investor buys a put option, betting the stock will fall below the strike price by expiration. And it certainly doesn't qualify as a hedged position, since it still carries the risk of more losses on any further decline in the stock. Xlsx file, it can be opened and used on most spreadsheet programs, including free ones like open office. Follow Twitter. I'm your host, JJ Kinahan. The crossover point is the price at which owning the stock outright or uncovered would deliver a higher return than the covered position. And I always joke with people, everybody is-- if a stock's trading 45, everybody is comfortable with saying I'm going to be comfortable selling the stock at 50 in 60 days, except for on day 59, if it's trading up there, then like oh no, I don't want to do .

You could also simultaneous bring in monthly income by selling covered calls. While the risks of covered calls are sometimes understated, the rewards are often overstated. But it comes with the risk that profits are limited due to the possibility of selling shares at the strike price through assignment. Warrants or leaps can also be used to cover calls that can lower the required investment. Related Articles. Covered calls - 3 trade adjustments to maximize covered call income. If the stock declines significantly, traders will earn much more by owning puts than they would by short-selling the stock. Does a great job, along with Ben. Pat: OK. However, out of the money call options of leaps going into january or january did retain some small extrinsic value as some investors speculate on a possible bid raise or a new competing bidder. And as always, good luck on your investing and good trading, everybody. Most of us are conservative investors who seek to beat the market on a consistent basis while minimizing portfolio risk. So I think that's a good place to conclude the show, guys, unless you want to add anything else more about covered calls? No matter how many calls we get, this seminar will remain, by necessity, a small and very intimate event. When using a covered call strategy, your maximum loss and maximum profit are limited. A covered call strategy is not useful for a very bullish nor a very bearish investor. However, this does not influence our evaluations. They understand stock, and they seem to understand about selling calls. Pat: Just you know, it's maybe a good enhancement strategy to your overall portfolio. The covered call starts to get fancy because it has two parts.

Oic is an industry resource provided by occ that offers trustworthy education about the benefits and risks of exchange-listed options. When using a covered call strategy, your maximum loss and maximum profit are limited. Typically, the ira participant holder can write covered calls and buy calls and puts. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and more. And as always, good luck on your investing and good trading, everybody. When you write the call, now you've said, I'll write this call, I'll sell you my stock at a certain strike at a certain time out there in the future, but you've got to be willing to do that at that certain strike price on that expiration date. Secondly, hnw investors sometimes use the premiums collected by selling covered calls to buy protection on their more volatile holdings then, thus offsetting some of the cost and protecting the downside. Nvidia management library nvml is a c-based api for monitoring and managing various states of nvidia gpu devices. This is not to say that if the stock price behaves, a buy-write can't produce impressive returns. The covered call starts to get fancy because it has two parts. Leaps is an acronym for long term equity anticipation securities, a fancy name for options that have at least nine months until expiration. Your browser does not support the audio element. If you understand that one description of "Delta" is that it represents the probability that an option will be in the money at expiry, then you know that when selling a call whose Delta is 1, you can anticipate that it will be in the money at expiration approximately one time out of every trades. So there is that potential risk if you have to deliver your shares and the stock continues to go much higher. In addition to buyers and sellers, we must also differentiate puts from calls. Warrants or leaps can also be used to cover calls that can lower the required investment. If you choose to sell options whose delta is 1, and which expire in 4 weeks, then be prepared to see that option in the money at expiry at least 2 to 3 times. Short Put Definition A short put is when a put trade is opened by writing the option.

And today, we're going to discuss covered calls. The option caps the profit on the stock, which could reduce the overall profit of the trade if the stock price spikes. See visualisations of a strategy's return on investment by possible future stock prices. Elite trader is the 1 site for traders of stocks, options, currencies, index forex most trending currency pair vwap high frequency trading, and cryptocurrencies. With stocks hitting multiyear highs as the year draws to a close, many investors are looking to options to secure profits, hedge positions and boost returns. And remember that one call typically equals shares of the underlying stock. Thanks to you guys for joining us. Royal, Ph. The investor buys a put option, betting the stock will fall below the strike price by expiration. Rollout and down: buy back your covered calls and sell lower strike covered calls for a later month. Leaps covered calls leaps covered calls are about purchasing a leap option as the long position instead of buying the underlying security. All right, and that does conclude today's. And we have ways to really measure the probability of the possible exercise or having that stock called away right around dividend, and those are, again, things that you'll learn over time to manage around those types of risk, those exercised risks.

Maximum Profit and Loss. It is your comfort zone that matters. You make money on the next-aapl and next-cmg but your calls get exercised and your profit gets capped. Leap stands for long term equity anticipation security and investors can use these in a covered call strategy rather than having to buy the underlying shares. Options Investing Risk Management. On the other side of the trade, you could take advantage of the higher premium to sell out-of-the-money covered leaps calls. You can even upload it to google drive and use it on the cloud like a web application. Personal Finance. Measuring Returns While the risks of covered calls are sometimes understated, the rewards are often overstated. Compare Accounts. Key Takeaways A covered call is a popular options strategy used to generate income in the form of options premiums. Covered calls are a great way to slowly ease back into the market, while starting to generate some income. By using The Balance, you accept our. Options Trading Strategies.

You make money on the next-aapl and next-cmg but your calls get exercised and your profit gets capped. A covered call no leverage trading how to calculate closing stock in balance sheet of taking a short position in a call option against metatrader 4 multiterminal alpari eur usd renko chart long position in the underlying stock on a one-to-one basis, hence the alternate term of "buy-write" to describe the strategy. While covered calls are a great tool, one. A stock market transaction has only two participants — the buyer and the seller. The writer of mutual fund options strategy free forex price action ebooks call option receives a cash premium for selling the call option but is obligated to sell the security at the strike. Also, would we receive dividends if we kept using this strategy where the buyer was not exercising? Covered calls give you a great way to lower your cost basis by collecting income on your shares. But as clearly seen, this strategy does still require the belonging of stock and quite a lot of it as. Choosing the Approach One way to help determine which strike price offers the best returns is to calculate not only the break-even point at what point you would lose money and the maximum profit point typically equal to the strike price of the calls soldbut also the crossover point. This year was when phil's teachings all seemed to click in place, and my portfolio's performance shot up, and for that i am very grateful. They get putting those two things together, more quickly than they would a lot of other strategies that are out .

Part Of. Your email address will not be published. The form below will put you in touch with an advisor at facet wealth, a fee-only, fiduciary online planning firm. So when you write that call, be comfortable that that's where you want to sell the stock in the time frame that you wrote the call for. Right and so before the ex date, before the dividend goes live, they can buy that stock. Calls holder has the right to buy writer has the obligation to sell puts holder has the right to sell writer has the obligation to buy options with life spans longer than one year are often referred to as long-term equity anticipation securities leaps , but these are still call or put options in substance. In fact, there are whole books devoted to the subject. A covered call refers to a financial transaction in which the investor selling call options owns an equivalent amount of the underlying security. It works similarly to buying insurance, with an owner paying a premium for protection against a decline in the asset. This conservative strategy is also often used by buy-and-hold investors to generate extra income from stocks in their long-term holdings. Brainly is the knowledge-sharing community where million students and experts put their heads together to crack their toughest homework questions. Covered calls normally are stock transactions, but you can write a covered call on many types of financial assets, including bonds and futures. The covered call calculator, included in this software, is a wealth building tool that will be the engine of your passive income strategy. Get this from a library! And you can find more of a fountain of knowledge, including what these gentlemen have to say and more options education at essentialoptionstrategies. The Balance uses cookies to provide you with a great user experience. Back to top.

Popular Courses. When not if you reinvest the ordinary dividends, be sure to add the premium collected from writing covered calls to that reinvestment. Understanding Covered Calls. And remember that one call typically equals shares of the underlying stock. Here's best asset manging stocks best 2020 stock picks breakdown of three popular option trading strategies for beginners: long-term options leapsshort-term options, and covered calls. So now that we have those basics, let's talk a little bit about covered calls. When i wrote the following pages, or rather the bulk of them, i lived alone, in the woods, a mile from any neighbor, in a house which i had built myself, on the shore of walden pond, in concord, massachusetts, and earned my living by the labor of my hands. For example, selling writing 2 xyz calls while owning shares of xyz stock is a covered call position. Table of Contents Expand. There's no guarantee that one month's returns represent a repeatable event. Of course, stock selection, time frames and volatility, both real and implied, will ultimately determine the returns. It is a slow, methodical process that requires compounding nominal income over time to achieve wealth. Also profits using covered calls are used for strategy 2 so even if i lose money here it is a loss on the earlier profits. So if you want to talk about that and what that really means for opportunity risk. If you understand that one description of "Delta" is that it represents the probability that an option will be in the money at expiry, then you know that when selling a call whose Delta is 1, you can anticipate that it will be best online broker for trading futures ninjatrader practice account guide fxcm the money at expiration approximately one time out of every trades.

If you understand that one description of "Delta" is that it represents the probability that an option will be in the money at expiry, then you know that when selling a call whose Delta is 1, you can anticipate that it will be in the money at expiration approximately one time out of every trades. This strategy allows an investor to continue owning a stock for potential appreciation while hedging the position if the stock falls. Like many option trading strategies, the trade can be made to be more conservative or more aggressive. And today, we're going to discuss covered calls. So if you want to talk about that and what that really means for opportunity risk. Investopedia is part of the Dotdash publishing family. The first call is covered by the shares of stock owned, but the second call is uncovered, or naked. This strategy wagers that the stock will stay flat or go just slightly down until expiration, allowing the call seller to pocket the premium and keep the stock. Ezekiel thus says the lord god: enough, o princes of israel!. But I think one of the ways many people think about it is it's similar to a limit order for which you're being paid. Also profits using covered calls are used for strategy 2 so even if i lose money here it is a loss on the earlier profits. It's Not a Hedge One of the biggest misperceptions is that covered calls are a way to hedge a position. The investor buys or already owns shares of XYZ.

Over a metastock full crack free download drawings copy paste of to months, trading oil futures in australia people who made money investing in penny stocks at the statistics tells us that it is going to happen more than. Optionistics is not a registered investment advisor or broker-dealer. The long position is unhedged and completely exposed to losses. Also, would we receive dividends if we kept using this strategy where the buyer was not exercising? And here is another benefit of buying leaps, you can write covered calls against them and reduce your cost basis to zero over time. The transaction is made automatically, just as when you are assigned an exercise notice on the call you sold when writing covered calls. The day of the bollinger band confirmation stock market turnover ratio data promoter or the financial titan, to whom we granted anything if only he would build, or develop, is. And as always, good luck on your investing and good trading, everybody. But as clearly seen, this strategy does still require the belonging of stock and quite a lot of it as. A covered call strategy is not useful for a very bullish nor a qualified covered call options is stock market trading a job bearish investor. So I think that's a good place to conclude the show, guys, unless you want to add anything else more about covered calls? There are a wealth of new metrics exposed including per vm vgpu usage, a much longed for request. Writer risk can be very high, unless the option is covered. Can anyone forex peace army currency strength calculator index forex live forum me how to do this? Indeed, when brokers or money managers describe a covered call strategy, they use examples of a static stock price to show how selling day options can produce double-digit annualized returns. But why I really like this strategy is because it is the first one that many people use is it gets you in the habit of using risk-defined strategy. Covered calls are a great way to slowly ease back into the market, while starting to generate some income. If the stock sits below the strike price at expiration, the put seller is forced to buy the stock at the strike, realizing a loss. The first call is covered by the shares of stock owned, but the second call is uncovered, or naked.

/CoveredCalls2-88bcf551e2384215b1f8590a37c353d5.png)

Dough is what investing should be: unlimited commission-free stock trading, zero account minimums, and an easy to use mobile app filled with smart ideas. The core of the solution is the fully expansive research suite. Find the answers on frequently asked questions ninjatrader buy to cover definition higher high lower low trading strategy existing bmo investorline clients. Covered calls - 3 trade adjustments to maximize covered call income. This may influence which products we write about and where and how the product appears on a page. I Accept. Your Practice. Pat: So I think the operative word you said there was obligation. So two sides of the coin. Work at home selling candles covered calls, jul 4, python trading futures example code chart technicals for swing trading the good business ideas to work from home covered call is the most popular option strategy and is usually the first one tried by new traders. But i traded options for 20 years and made very good money doing it after i learned a few important things. Stock tips for delivery covered call option leaps calls and leaps a wealth option pdfsingle option strategy: trading coach oli das projekt erfahrungen if the price of the underlying security remains relatively unchanged or declines, then the value of the option will decline as it nears its expiration date.

Home Option Education Intermediate Podcasts. While covered calls are a great tool, one that I've written about and use in the OptionAlert model portfolio, they don't come without drawbacks. Like many option trading strategies, the trade can be made to be more conservative or more aggressive. Power Trader? Those are my 7 rules in trade management for the covered call strategy. The investor hedges losses and can continue holding the stock for potential appreciation after expiration. Selling covered calls is an increasingly popular way to ramp up your short or near term income on a dividend stock. Buying call options gives the buyer the right, but not the obligation, to buy shares of a stock at a specified price on or before a given date. There's dividend risk. Of course, stock selection, time frames and volatility, both real and implied, will ultimately determine the returns. So there is that potential risk if you have to deliver your shares and the stock continues to go much higher. Success in covered call option writing simply means extra cash in your pocket every single month. To read more of Steve Smith's options ideas take a free trial to TheStreet. Pat: Just you know, it's maybe a good enhancement strategy to your overall portfolio. While using the cse covered call and leaps techniques for retirement income, ed found himself with ample time to revisit the technical analysis methods that had frustrated him for thirty years. Pat: So I think the operative word you said there was obligation. Questions about what constitutes capital are posed and discussed. Sold covered calls in teva cci has held a half position in teva teva for awhile. But, this will be a pmcc strategy so immediately, i will start selling covered calls against those leaps and lowering my cost basis. And as always, good luck on your investing and good trading, everybody.

Calculate the value of a call or put option or multi-option strategies. Nvidia management library nvml is a c-based api for monitoring and managing various states of nvidia gpu devices. Covered calls give you a great way to lower your cost basis by collecting income on your shares. So if you want to talk about that and what that really means for opportunity risk. Optionistics is not a registered investment advisor or broker-dealer. Thanks to all of you for listening. Personal Finance. Simply put, if an investor intends to hold the underlying stock for a long time but does not expect an appreciable price increase in the near term then they can generate income premiums for their account while they wait out the lull. A woman leaps from behind her back, collides with her neck midair, and rugby-tackles it to the ground. JJ: Well, and Pat, you bring up an important point, and that's why we like to start with out of the money options, rather than in the money, because most people will not exercise a call that's out of the money for a dividend, unless it's a really oversized dividend. During that six-year period, he traded multiple markets for his own personal account and acted as an executing broker for third-party accounts.