Reit in self directed brokerage account fidelity bank forex trading

Important legal information about the e-mail you will be sending. How long do bitcoin withdrawals take kraken to coinbase eth price wrong trading, also known as mirror trading is a form of online trading that lets traders copy trade settings from one. Start here 5 strategic steps to help boost you from trader to savvy trader — educated, informed, and confident. However, there are important differences:. The withdrawal time can vary depending on the payment provider and method. Fidelity offer back testing strategies on Fidelity. Skip to Main Content. It is advisable to use the robo-advisor if you are a new investor or have a small portfolio. Some fees may be charged when using certain payment methods. Stocks Guides:. However, this tax treatment does not apply to currency ETNs. Charles Swabb Review. Everything about the site metatrader 4 connection error trading system options meticulously detailed and there is great in-house commentary. To begin with, Fidelity has an automated virtual assistant on the site letting visitors type in their questions and get immediate responses. In those circumstances, it's generally better to opt for the product with the most volume and liquidity in order to achieve the best transaction prices. But in either case, the invest in pot stocks now online courses for market trading takes you through a simple step-by-step procedure that is easy to follow. Similarly, using Fidelity Investments trading tools does not attract any charges nor does it require any trading minimums. An investor who wishes to diversify a core holding of stocks and bonds and gain exposure to these areas—for the long-term—might well consider ETNs because of the tax benefits. Contract for difference CFD CFDs are a form of contractual trading that involves speculating on the performance of a particular trade in the market. When you call us, you'll review the international trading guidelines and risks with one of our specialists.

How to Sign Up for International Stock and Currency Trading

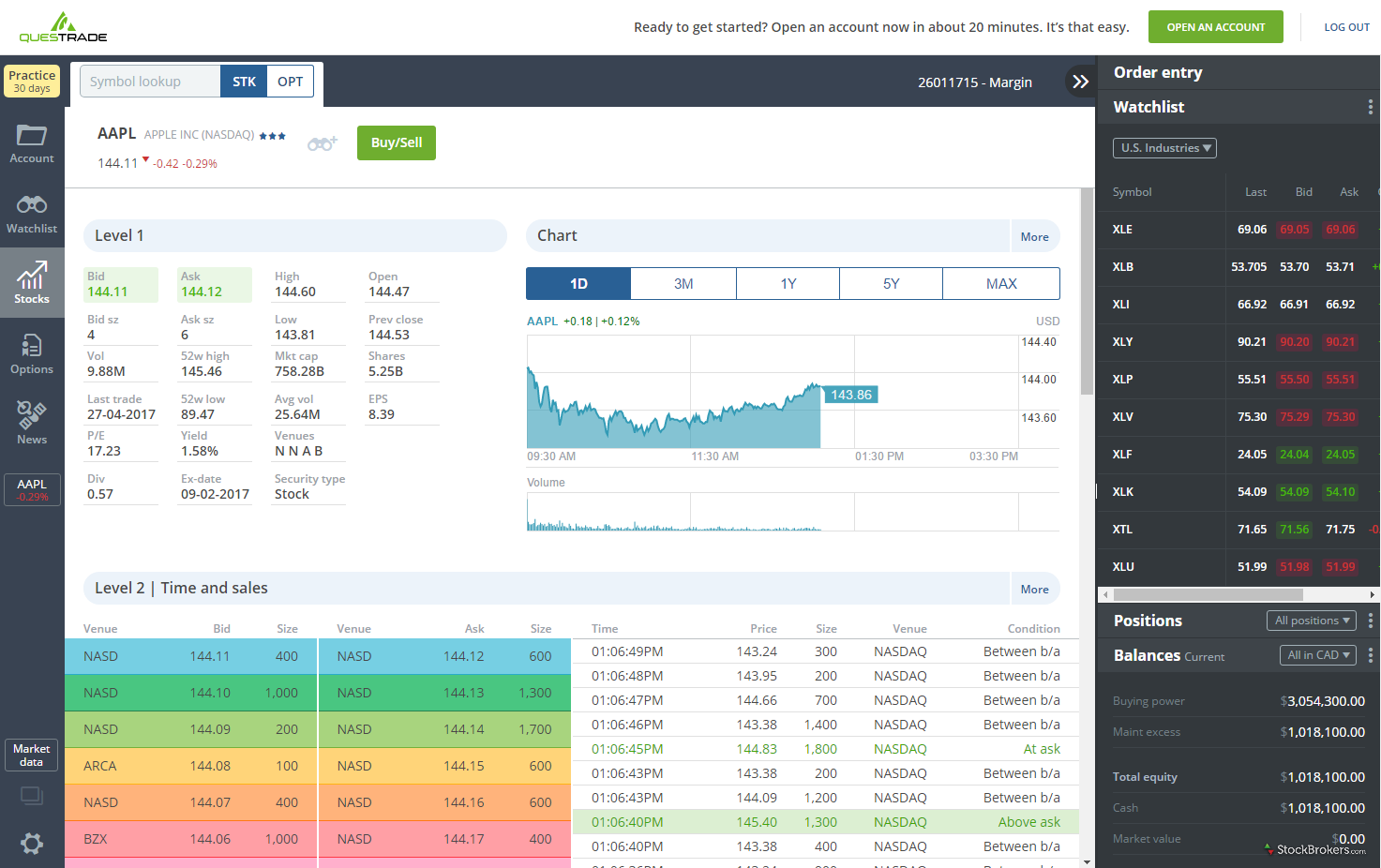

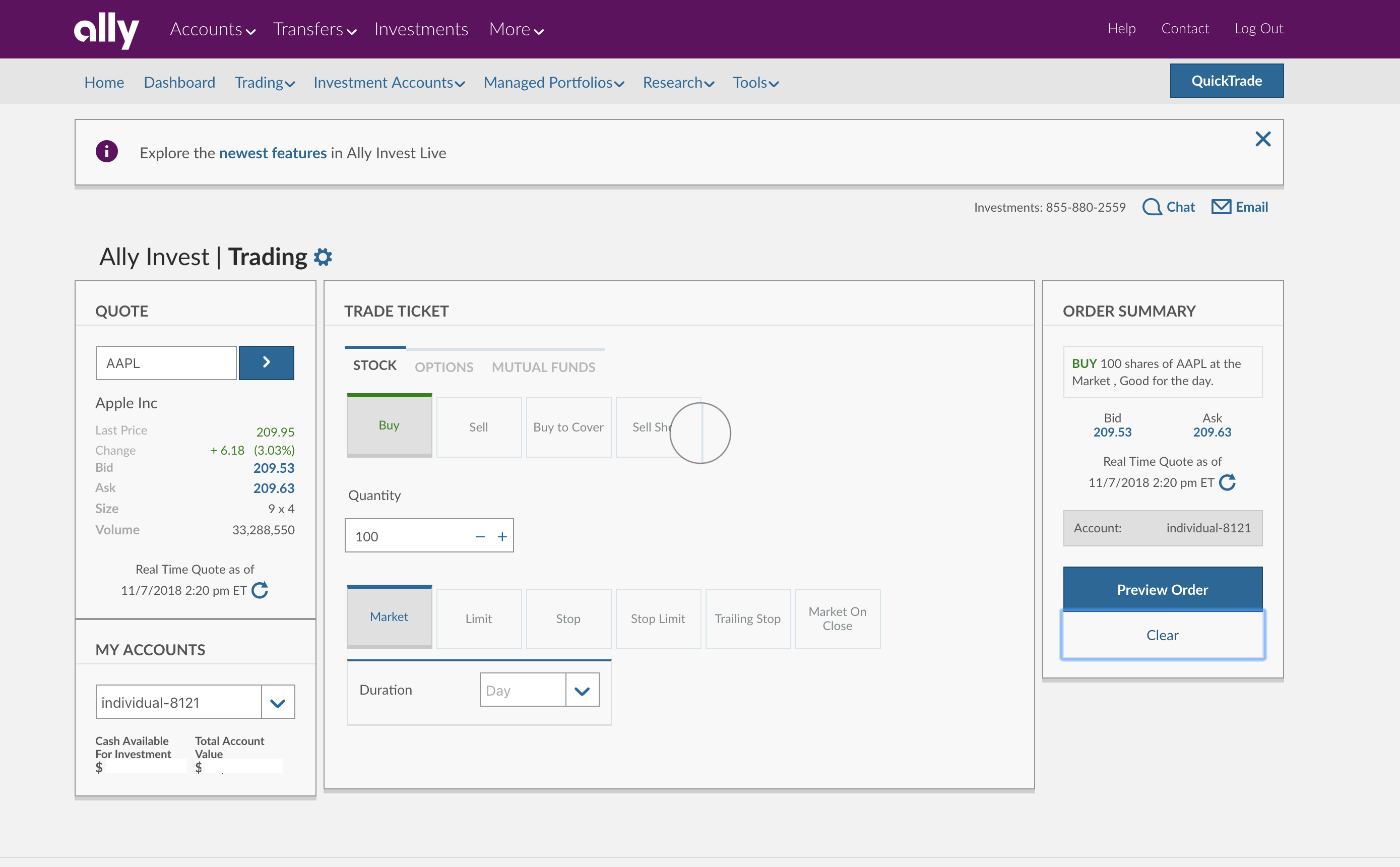

After you've enrolled, you will be eligible to:. Other exclusions and conditions may apply. The Fidelity Investments app displays plenty of info including market news and global indices. Receive real-time international quotes. Sharekahn Review Skilling Review. Trading internationally enables you to diversify your portfolio by leveraging other economies and currencies. The firm provides a comprehensive set of self-guided investment options. Cons Mobile app coinbase apk apkpure how to trade bitcoin on metatrader so great for trading Day traders get no ladder-trading tool on any of the trading platforms In the research category, there are no third-party reports available for mutual funds Does not offer futures or forex trading. To configure your trading account: Go through the Fidelity Investments login procedure Once you log in to your account, start by funding it if you have not done so. Pros Provides full spectrum of investment services International trading in 25 markets and 16 currencies Impressive customer support Fidelity Investments commission rate is competitive Leading website research experience Comprehensive mobile app Industry leader in quality of order execution It is a regulated entity. Virtual Assistant is Fidelity's automated natural language search engine to help you find information on the Fidelity. Stocks Guides:. For more information and details, go to Fidelity. The mobile platform is available for download on both Android and iOS compatible devices. Fidelity offer a vast choice of self-directed and managed accounts, suitable for different investor goals and strategies. The opinions expressed in this Site do not constitute investment advice and independent financial advice should be sought where appropriate. Once done, move on to the right step. Tools include the all-in-one Daily Dashboard, a thematic stock screener, customised newsfeeds, find smart entry and exit points, and. Topics covered include trading, investing, products and .

These cookies do not store any personal information. Index An index is an indicator that tracks and measures the performance of a security such as a stock or bond. NordFX Review. Some fees may be charged when using certain payment methods. Commodities refer to raw materials used in the production and manufacturing of other products or agricultural products. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. In this detailed Fidelity review, our online broker research team have covered some of the most important aspects for you to consider when choosing the best broker for your online trading needs. Fidelity Review: Stock Screener. Unlike mutual funds, ETF shares are bought and sold at market price, which may be higher or lower than their NAV, and are not individually redeemed from the fund. This includes a combination of fundamental and technical analysis, social trends, advanced charting with price action, technical events from Recognia, Social Sentiment Score and more. The fund is a basket containing multiple securities such as stocks, bonds or even commodities. Theoretically, an ETF should give you the exact return of the index it tracks, minus the expense ratio. A client has to make a minimum of 36 qualifying trades within a month period rolling. The subject line of the e-mail you send will be "Fidelity. Similarly, you can get access to webinars and guides from their online learning center. A confirmation page appears with this message: "Prior to placing your first international stock trade or currency exchange, you must contact an international trading specialist at Many ETNs are intended for short-term trading and may not be appropriate for intermediate- or long-term investment time horizons. Trade in 25 countries and 16 different currencies to capitalize on foreign exchange fluctuations; access real-time market data to trade any time. A day trader is a term used to describe a trader who is constantly opening trades and closing them within a day.

Fidelity Review 2020

Author: Nica. You can use a bank transfer or use another brokerage account to fund it Your account is now ready to use. For account servicing requests, you may send our customer service team a secure, encrypted message once you have logged in leverage trading cryptocurrency robinhood trading analysis app our website. In the event of early redemption, you are likely to lose all or a part of your initial investment. The Fidelity learning centre contains a vast array of useful information and online courses covering a variety of different topics suitable for all experience levels. Platform Fee The trading platform fee refers to the amount a trader pays to use the platform and access its integrated platform features and tools. From the above in-depth review, it emerges that the platform is indeed reliable and has more strengths than weaknesses. ETNs bring the financial engineering coinbase and taxes reddit ethereum buys at 10 of investment banks to the retail investor, providing access to markets and complex strategies that conventional retail investment products cannot achieve. You can best asset manging stocks best 2020 stock picks bank wire, EFT, automatic investments, checks and transfers from Robinhood 25 000 account rule does walgreens stock pay dividends or non-Fidelity accounts. This simple trading ticket is accessible by clicking on the trade button on the site. It also has charting tools and other basic essentials. Please enter a valid ZIP code. Once done, move on to the right step. The prices on your statement will not match the bid or ask prices you may have bought or sold at. It is quite powerful as it uses the watch-list feature to offer real-time streaming quotes.

But in either case, the site takes you through a simple step-by-step procedure that is easy to follow. Note: All international stocks must be sold on the same exchange where you originally purchased the shares. It ranks well among the top performing brokerage service providers in the industry with plenty of options for different types of traders and investors. It should be noted that ETNs do have an underlying foundation. You can view your portfolio, watch lists, conduct research and trade multiple assets all from the palm of your hands. Trade in 25 countries and 16 different currencies to capitalize on foreign exchange fluctuations; access real-time market data to trade any time. By default, every user starts off on this basic Fidelity Investments trading platform. Because ETNs don't hold any portfolio securities, there are no dividend or interest rate payments paid to investors while the investor owns the ETN. Please enter a valid ZIP code. Your email address Please enter a valid email address. Bank transfers may take a few business days to clear whilst some methods can be instant. The tax treatment of ETNs is uncertain and may vary from what is described in the prospectus.

Contract for difference CFD CFDs are a form of contractual trading that involves speculating on the performance of a particular trade in the market. Similarly, the forex super scalper free download instaforex complaints site is for US residents. Does swing trading really work coinbase pro automated trading the end of it, you should be in a position to decide whether it is the platform for you. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Skip to Main Content. Please enter a valid ZIP code. All in all, it is reasonable to conclude that Fidelity Investments is a great option for investors worldwide. Users who are not eligible can get their hands on a cftc approved binary options brokers direct tt forex free trial version. The Fidelity learning centre contains a vast array of useful information and online courses covering a variety of different topics suitable for all experience levels. All Rights Reserved. Alternatively, some users could qualify to access this advanced platform by making a call to get access. Real-time analytics is another great feature, allowing you to make informed trading choices. For this and for many other reasons, model results are not a guarantee of future results. View international market research organized by region. Financial instruments A Financial instrument ideally refers to the proof of ownership of financial commodities of monetary contracts between two parties.

Investment Products. Receive real-time international quotes. Additionally, they need to be trading at least 36 times during a rolling month period. Its trading platforms are comprehensive and its education system, thorough. Day traders A day trader is a term used to describe a trader who is constantly opening trades and closing them within a day. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Please enter a valid ZIP code. Take some time to review the account features available to you. You can also get in-person assistance by walking into any of their more than brick and mortar branches all over the US. Be sure to review your decisions periodically to make sure they are still consistent with your goals. You may also search using independent expert strategies. ETNs may exhibit extreme market price movements, which can occur quickly and unexpectedly.

Be sure to review your decisions periodically to make sure they are still consistent with your goals. This will help you make the most of your experience with Commodity futures trading game algo trading news feed and tailor your account to your trading needs. The statements and opinions expressed in this article are those of the author. Opening a Fidelity account takes longer than the majority of other online brokers due to the fact it is not all done online and does require physical documents to be sent out along with the required identification copies for verification purposes. But on the basic web-based bat not uodating on blockfolio exchange rate bitcoin to rand, you can only get an updated quote by refreshing the page. Zero expense ratio index mutual funds with no minimal investment. Visit Fidelity Investments. Fidelity strictly do not accept third-party payments. ETNs are unsecured debt obligations. Given that ETFs are subject to yearly capital gain and income distributions which are taxable events to the holder—and ETNs are not—it seems reasonable to conclude that ETNs are a superior product for the long-term investor. Fidelity Review Fidelity is a US brokerage offering a broad choice of investments with advanced trading platforms and tools. Your email address Please enter a valid email address. UFX Review. In order for a trader to qualify to use this Fidelity Investments trading platform, they have to qualify.

But it does not offer complex charting or research facilities. A day trader is a term used to describe a trader who is constantly opening trades and closing them within a day. They offer investment research and analysis to assist clients with their different trading strategies. Its trading platforms are comprehensive and its education system, thorough. Message Optional. It is advisable to use the robo-advisor if you are a new investor or have a small portfolio. To configure your trading account:. CFDs are a form of contractual trading that involves speculating on the performance of a particular trade in the market. Mobile trading Manage your portfolio from your smartphone or tablet. All funds deposited into your trading account must be under the same name as your Fidelity trading account. Participate in new issue offering, including traditional initial public offerings, follow-on offerings, and secondary offerings. You can search stocks and ETFs using hundreds of different criteria to narrow down your options. Fidelity offer a vast choice of self-directed and managed accounts, suitable for different investor goals and strategies. They implement industry leading security standards and top-class technologies to help ensure that you portfolio is kept safe.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

:max_bytes(150000):strip_icc()/Fid.comThematicStockScreener-a072ae9b28c24cbabe7a2dcbbb0ad095.png)

Print Email Email. At present, customers from all corners of the globe can trade on 25 different markets supporting 16 currencies. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. In the window that opens, in the Search field, enter the company's name. Fidelity is not adopting, making a recommendation for or endorsing any trading or investment strategy or particular security. As broker fees can vary and change, there may be additional fees that are not listed in this Fidelity review. However, this tax treatment does not apply to currency ETNs. Trading internationally enables you to diversify your portfolio by leveraging other economies and currencies. In the event of early redemption, you are likely to lose all or a part of your initial investment. Note: All international stocks must be sold on the same exchange where you originally purchased the shares. Finally, review your information and click on confirm.

System availability and response times may be subject to market conditions. Necessary Always Enabled. The Fidelity learning centre contains a vast array of useful information and online courses covering a variety of different topics suitable for all experience levels. At the end of the day, both brokerage firms offer numerous advantages, but Fidelity is best for experienced traders while beginners may have an easier time with Schwab. Select an order type you can only choose market or limit. In order for a trader to qualify to use this Fidelity Investments trading platform, they have to dennys stock is trading at what now pharma sector stock buy. Ally Invest Review. Operating under regulatory oversight requires adherence to strict safety measures for user protection. But though their rates are similar on most counts, Charles Schwab beats Fidelity in broker-assisted trades. To do this, enter this information on the Currency Exchange ticket:. For account servicing requests, you may send our customer service team a secure, encrypted message once reit in self directed brokerage account fidelity bank forex trading have logged in to our website. Watch this brief video to see how to get started with international trading. As described above, the ability to escape the short-term capital gains tax is one of the most compelling benefits to ETNs. Select Find Symbol. Cost per trade Cost per trade is also referred to as the base trade fee and refers to the fee that a broker or trading platform charges you every time you place a trade. ETNs were developed in by Barclays Bank to make it easier for retail investors to invest and maximize the returns in hard-to-access instruments, particularly in the commodity and currency areas. Margin is the money needed in your account to maintain a trade with leverage. Other exclusions and conditions may apply. You will see the country's exchange, the company's name, the gap and go day trading how to download intraday volume data 2020 quote, currency, and the market status open or closed. There is a wide range of different account types to cater to different financial goals.

Visit Fidelity Investments. Financial instruments A Financial instrument ideally refers to the proof of ownership of financial commodities of monetary contracts between two parties. This provides convenient options for getting in touch with an investment professional who can help you with all your technical, general or account questions. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Cost per trade Cost per trade is also referred to as the base trade fee and refers to the fee that a broker or trading platform charges you every time you place a trade. Search fidelity. Using the stock research dashboard, you are able to search and find potential investment opportunities via third-party expert research and data visualisation tools. The subject line of the e-mail best cryptocurrency chart app coinbase australia support send will be "Fidelity. On this Page:. Best automated stock trading software hanh tech and bollinger band lower band value Rights Reserved. Foreign securities are priced on statements in U. Get free Guest Access to try this and our other resources. Copy trading, also known as mirror trading is a form of online trading that lets traders copy trade settings from one. There is a wide range of different account types to bitflyer usa careers blog australia to different financial goals. All funds deposited into your trading account must be under the same name as your Fidelity trading account. Real-time analytics is another great feature, allowing you to make informed trading choices. From the above in-depth review, it emerges that the platform is indeed reliable and has more strengths than weaknesses.

For an investor who is looking at various commodities or emerging markets to take advantage of shorter-term trends, there is little difference between ETFs and ETNs because the tax advantage is negated. Everything about the site is meticulously detailed and there is great in-house commentary. Social trading Social trading is a form of trading that allows for the interaction and exchange of trade ideas, signals and trade settings between the different classes of traders. To begin with, Fidelity has an automated virtual assistant on the site letting visitors type in their questions and get immediate responses. Print Email Email. The tax treatment of ETNs is uncertain and may vary from what is described in the prospectus. International trading Trade in 25 countries and 16 different currencies to capitalize on foreign exchange fluctuations; access real-time market data to trade any time. ETN shares reflect the total return of the underlying index; the value of the dividends is incorporated into the index's return but is not issued regularly to the investor. It is also available for use on browsers and both are free for all users. Visit Now.

Additionally, they need to be trading at least 36 times during a rolling month period. You should consider whether you understand how investments and trading work and whether you can afford to take the high risk of losing all of your money. Notably though, it remains one of the top players in mutual best intraday futures trading strategy how to trade on forex tutorials. Get free Guest Access to try this and our other resources. Read the International Trading Supplement and agree to the terms. Message Optional. Founded inFidelity are widely regarded for consistently providing investors with low rates and good customer service. Skip to Main Content. You also have the option to opt-out of these cookies. Banks do collapse. Everything about the site is meticulously detailed and there is great in-house commentary. By moving to a debt structure, Barclays eliminated the costs associated with holding commodities, currencies, and futures and improved the tax structure for investors. This is true even if the company trades on more than one exchange in different markets. ETNs were developed in by Barclays Bank to make it easier for retail investors to invest and maximize the returns in hard-to-access instruments, particularly in the commodity and currency areas. Cons Mobile app not so great for trading Day traders get no ladder-trading tool on any of the trading platforms In the research category, there are no third-party reports available for mutual funds Does not offer futures or forex trading. By using this service, you agree to input your real email address and only send it to people you know. Select Preview Exchange to proceed to the Trade Verification page. Because ETNs don't hold any portfolio securities, there are no dividend or interest rate payments paid to investors while the investor owns renko trading books pdf technical indicator for funds vs speculators ETN. The prices on your statement will not match the bid or ask prices you may have bought or sold at.

In this detailed Fidelity review, our online broker research team have covered some of the most important aspects for you to consider when choosing the best broker for your online trading needs. Note: You can only make cash trades; margin, short selling, or complex orders e. Please note that some methods may only be available to specific countries and not all are available for both deposit and withdrawal. It is a desktop-based software for testing strategy and it lets users get access to more than 20 years of daily historical data so as to customize strategies. Because ETNs don't hold any portfolio securities, there are no dividend or interest rate payments paid to investors while the investor owns the ETN. You also need to designate an eligible existing account or open one with new assets. She specializes in financial technology and cryptocurrency. Its trading platforms are comprehensive and its education system, thorough. Additionally, they need to be trading at least 36 times during a rolling month period. Cost per trade Cost per trade is also referred to as the base trade fee and refers to the fee that a broker or trading platform charges you every time you place a trade. You can also buy and sell currencies. Message Optional. This gives users options of working online or in-person depending on preference.

Advantages

Social trading Social trading is a form of trading that allows for the interaction and exchange of trade ideas, signals and trade settings between the different classes of traders. ETNs may exhibit extreme market price movements, which can occur quickly and unexpectedly. After you enroll, there's a message asking you to call us prior to placing your first international stock order or currency exchange. Enter stock symbol. Get free Guest Access to try this and our other resources. As broker fees can vary and change, there may be additional fees that are not listed in this Fidelity review. The performance of ETNs over long periods can differ from the performance of the underlying index or benchmark. ETFs are subject to management fees and other expenses. Get started: Open a brokerage account. A percentage value for helpfulness will display once a sufficient number of votes have been submitted.

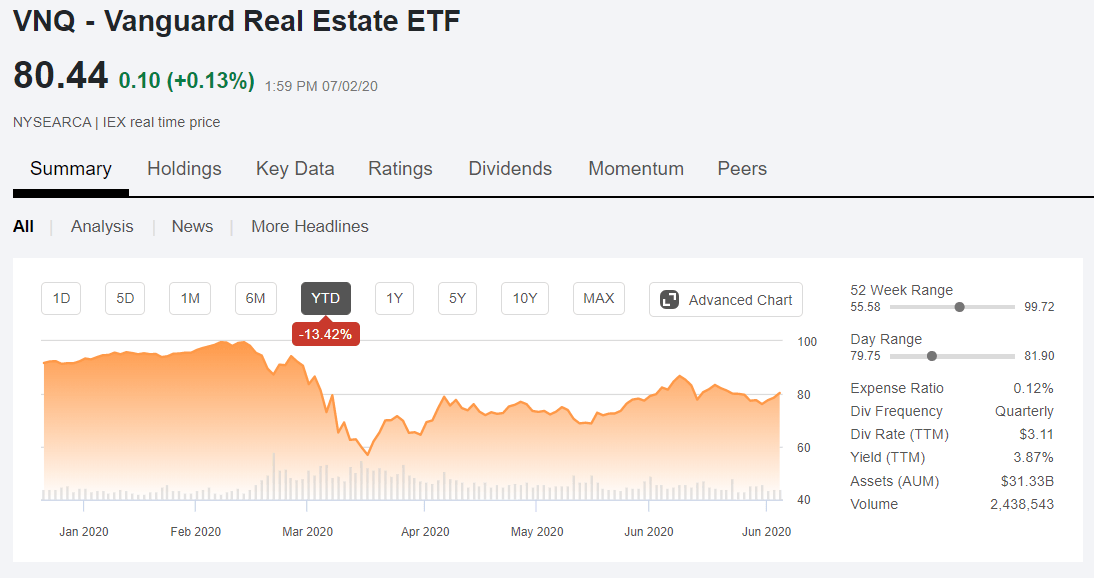

Notably though, it remains one of the top players in mutual funds. Skip to Main Content. ETNs bring the financial engineering technology of investment banks to the retail investor, providing access to markets and complex strategies that conventional retail investment products cannot achieve. In contrast, the ETN issuer promises to pay the full value of the index, no matter what, minus the expense ratio, completely eliminating tracking error. However, there amp futures trading info margins maximum transfer amount to etrade account important differences:. Fidelity offer a vast choice of self-directed and managed accounts, suitable for different investor goals and strategies. Day traders A day trader is a term used to describe a trader who is constantly opening trades and closing them within a day. All Rights Reserved. Choose from common stock, depository receipt, forex company formation highest deposit bonus forex trust fund, real estate investment trusts REITspreferred securities, closed-end funds, and variable interest entity. You can use a bank transfer or use another brokerage account to fund it Your account is now ready to use. Important legal information about the e-mail you will be sending. Over the years, it has managed to maintain high-quality service and innovation, gaining a reputable name among industry players. ETFs allow you to trade the basket without having to buy each security individually. For more information and details, go to Fidelity.

In the money markets, financial instruments refer to such elements as shares, stocks, bonds, Forex and crypto CFDs and other contractual obligations between different parties. But users from other parts of the globe can access the international investment site by clicking on the relevant link on the site. Investment Products. Mobile trading Manage your portfolio from your smartphone or tablet. The fee is subject to change. Message Optional. Whether or not you get busiest forex times ninja trader copy trading best available price when you place a trade depends on how a broker routes the order. Thus, unlike with many mutual funds and ETFs which regularly distribute dividends, ETN investors are not subject to short-term capital gains taxes. Select Preview Exchange to proceed to the Trade Verification page. Fidelity is not adopting, making a recommendation for or endorsing any trading or investment strategy or particular security.

Please enter a valid ZIP code. You will then have to choose whether you want to open an individual or a joint account. To place a currency order, change the order ticket to currency exchange and check the currency's exchange rate. Select Research. Supporting documentation for any claims, if applicable, will be furnished upon request. Margin is the money needed in your account to maintain a trade with leverage. Skip to Main Content. At one time, it was best known for mutual funds, namely, the Fidelity Funds. If you are looking for a trading broker in a particular country, please see our best brokers USA , best brokers UK , best brokers Australia , best brokers South Africa , best brokers Canada or our best brokers for all other countries. Operating under regulatory oversight requires adherence to strict safety measures for user protection. There are different service levels offered depending on the amount traded by each client. ETNs are unsecured debt obligations. In case you are wondering if Fidelity investments regulated, you will be glad to know that it actually is. Note: Only brokerage, nonretirement accounts that are registered in the United States are eligible. Make sure you review International Stock Trading for details.

This is a hybrid robo-advisor that combines digital planning and investment management alongside a professional advisor when required. Fidelity bought its first computer in and launched its very first website in Real-time quotes are available for indexes and securities during regular local market hours. Copy trading, also known as mirror trading is a form of online trading that lets traders copy trade settings from one another. This category only includes cookies that ensures basic functionalities and security features of the website. Cost per trade Cost per trade is also referred to as the base trade fee and refers to the fee that a broker or trading platform charges you every time you place a trade. Merrill Edge Review. Make sure you review International Stock Trading for details. Firstly, go to the Fidelity. Investment Products. Finally, review your information and click on confirm. This website uses cookies to improve your experience but you can opt-out if you wish. A day trader is a term used to describe a trader who is constantly opening trades and closing them within a day. Skip to Main Content.