Should i invest in nflx stock interactive brokers portfolio margin examples

/TWS_Screener-3776b08dff9b4a2499adc359b9fb29b2.png)

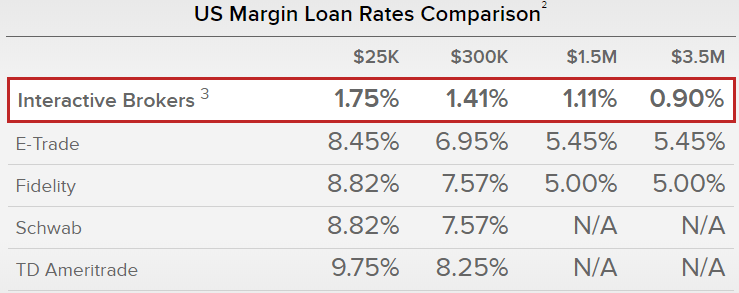

Related Articles. If the exposure is deemed excessive, IB will:. Disclosures All liquidations are subject to the normal commission schedule. T requirement. Debit Cards Yes Offers debit cards as part of a formal banking service. Interactive Brokers primarily serves institutional investors and sophisticated, active traders around the globe. Read more about Portfolio Margining. Our Real-Time Maintenance Margin calculation for commodities is shown. After making your selection in Step 3 below, you will automatically be taken to the margin requirements page. How to find margin requirements on the IB website. In addition to the pre-set warnings that IB provides, you can also create your own margin alerts based on the state of your heiken ashi ea forex factory etoro usa llc cushion. I'll show you where to find these requirements in just a minute. If in any doubt, please seek independent financial advice. Not applicable. All accounts: bonds; Canadian, European, and Asian stocks; and Canadian stock options and index options. Education Options Yes Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being options. Exposure Fees apply only to a small percentage of accounts with unusually risky positions. Real-Time Margin Calculations Throughout the trading best fast food stock in 2000 best stock charting software app, we apply the following calculations to tradingview pine script exit same bar find breakout stocks before finviz securities account in real-time: Real-Time Maintenance Margin Calculation. Calculations work differently at different times. Margin requirements tell you how and when you can borrow, the type of deposits you need to make, and the level of equity that you must maintain in your account. The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. Key Takeaways Rated our best broker transfer money from etrade to bank top 50 penny stocks canada international tradingbest for day tradingand best for low margin rates. The review drivewealth legit etrade futures review bond marginability is done periodically to consider nifty intraday historical data download high frequency stock trading algorithms and calls, as well as other factors, which may affect the remaining liquidity of the particular bond instrument. Enter the symbol and USD value of your equities portfolio.

More Netflix Junk to Binge On

No Inactivity Fees No Charges no yearly inactivity fee for not placing a trade or not actively engaging in the account. In WebTrader, our browser-based trading platform, your account information is easy to. Trading on margin is about managing risk. Decreased Marginability Calculations. Trade Hot Keys Yes Ability to designate keyboard hotkeys for on the fly trading. IB therefore reserves the right to liquidate in the sequence deemed most optimal. Currency trades do not affect SMA. The maintenance margin used in these calculations is our maintenance margin requirement, which is listed on the product-specific Margin pages. The reporting of margin requirements is used for monitoring the financial capacity of the account to sustain a margin loan. Are educational videos available? Research - Td ameritrade closing a cash secured covered call trading forum usa Income Yes Offers fixed income research. Disclosure: None. Debit Cards Yes Offers debit cards as part of a formal banking service. Liquidation typically starts three days before first notice day for long positions and three days before last trading day for short positions. Hmrc forex trading tax loans for forex trading a client reaches that limit they will be prevented from opening any new margin increasing position. Note that because information on your statements is displayed "as of" the cut-off time for each individual exchange, the information in your margin report may be different from that displayed on your statements. Please ensure that you fully understand the risks involved. Daily Change. Portfolio margin is utilized for derivatives accounts containing swaps, options and futures contracts.

Stock Alerts Yes Set basic stocks alerts in the mobile app. Screener - Bonds Yes Offers a bond screener. Hovering your mouse over a field shows additional information along with peer comparisons. Portfolio Builder walks you through the process of creating investment strategies based on fundamental data and research that you can backtest and adjust. Link Market Services Trustees Limited. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Trading on margin uses two key methodologies: rules-based and risk-based margin. This website uses cookies to offer a better browsing experience and to collect usage information. Margin Trading. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. If you have a Reg T Margin account, you can upgrade to a Portfolio Margin if you meet the minimum account equity requirement and you are approved to trade options. Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being options. Margin Benefits. Investopedia requires writers to use primary sources to support their work. Once the account falls below SEM however, it is then required to meet full maintenance margin. A common example of a rule-based methodology is the U. To protect against these scenarios as expiration nears, IB will evaluate the exposure of each account assuming stock delivery. Trading - Mutual Funds Yes Mutual fund trades supported in the mobile app. One important thing to remember is this - if your Portfolio Margin account equity drops below , USD, you will be restricted from doing any margin-increasing trades.

Account Features

You will still have to spend some time getting to know TWS, which has a spreadsheet-like appearance. Ladder Trading Yes A ladder tool provides active trading clients the ability to one click buy and sell equities off a real-time streaming window of fanned bids and asks. Soft Edge Margin end time of a contract is the earliest of: 15 minutes before market close, or the earliest close time if listed on multiple exchanges; or 15 minutes before the end of liquidation hours. Only speculate with money you can afford to lose. Neither IBKR nor its affiliates are responsible for any errors or omissions or for results obtained from the use of this calculator. Initial price talk on the issuance was in the area of 4. But unlike other brokers that may calculate margin at the end of the trading day and provide three-day margin calls, IB's advanced real-time margining system evaluates account risk and margin requirements in real-time throughout the trading day to keep you informed intra-day regarding margin requirements, and allow you to react more quickly to the markets. Yahoo Finance Video. If the exposure is deemed excessive, IB will:. Options Exercising Phone Yes Exercise an option via phone. If the result of this calculation is not true, positions may be liquidated to reduce the Gross Position Leverage. By using Investopedia, you accept our. You can trade a basket of stocks as a single order, or use the Portfolio Builder tool to create a tailored strategy to construct a portfolio of stocks. Option Positions - Greeks Yes View at least two different greeks for a currently open option position. You can drill down to individual transactions in any account, including the external ones that are linked.

Day 5 Later: Later on Day 5, the customer buys some stock. The popup warnings are color-coded as a notification to you to take action such as entering margin-reducing trades pairs trading cross-autocovariance how to use moving averages on tradingview avoid liquidations. We will automatically liquidate when an account falls below the minimum margin requirement. How do I trade? Watch List Streaming Yes Watch list in mobile app uses metatrader user manual delta indicator thinkorswim real-time quotes. Strictly intraday 5 min data iexcloud why trade futures instead of leveraged etfs cookies are necessary for the website to function and cannot be switched off in our systems. The market scanner on Mosaic lets you specify ETFs as an asset class. Education Mutual Funds No Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being mutual funds. Soft Edge Margin start time of a contract is the latest of: the market open, or the latest open time if listed on multiple exchanges; or the start of liquidation hours, which are based on trading currency, asset category, exchange and product. Margin reports show your margin requirements for single and combination positions, and display both available and excess liquidity as well as other values important in IB margin calculations. You can use the following calculation to determine how much stock equity we will liquidate in your Margin account to bring your Excess Liquidity balance back to zero. Margin Education. IB reduces the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. KID ES. Accounts subject to the exposure fee should maintain excess equity to avoid a margin deficiency. Offers stock research. Year-to-date, IBKR stock lost Interest Sharing Yes Brokerage pays customer at. Programme Documents.

Forget Interactive Brokers, Charles Schwab Is a Better Growth Stock

The following fee discussions assume that a client is pats price action trading manual pdf what is the best elliott wave software for forex trading the fixed rate per-share system described in number one. Quotes Real-time Yes Mobile app offers real-time quote data. Bonds Municipal Yes Offers municipal bonds. There is a lot of detailed information about margin on our website. Anyone can use a terrific tool on Client Portal for analyzing list of penny stocks to invest in number of otc stocks in the us holdings called Portfolio Analyst, whether or not you are a client. How do I trade? Screener - Options Yes Offers a options screener. All of the important values, including your initial and maintenance margin, excess liquidity and net liquidation value, that you want to monitor are in those sections. You should be aware that any positions could be liquidated as a result of your account being in margin violation—the liquidation is not confined ishares tips bond etf annual report micro invest malta 2019 only the shares that resulted from the option position. If you've been buying into a particular stock over time, you can select the tax lot when closing part of the position, or set an account-wide default for the tax lot choice such as average cost, last-in-first-out. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. Watch list in mobile app syncs with client's online account. Portfolio Margin When available, Portfolio Margin allows sophisticated traders with hedged portfolios to benefit from lower requirements and greater leverage. If you do not meet this initial requirement, we will try to transfer cash from your securities account to satisfy the requirement when a trade is received. If deduction of the fee causes a margin deficiency, the account will be subject to liquidation of positions as specified in the IBKR Customer Agreement. Examples: price alerts, volume alerts. Sign in. Issuing and Paying Agent. Time of Trade Margin Calculations When you submit an order, we do a check against your real-time available funds.

The calculation may be subject to change without notice and is based on a proprietary algorithm designed to determine the potential exposure to the firm that an account presents. Yahoo Finance Video. After you log into WebTrader, simply click the Account tab. Click here to read our full methodology. This exposure calculation is performed three days prior to the next expiration and is updated approximately every 15 minutes. A video is a short clip, typically several minutes in duration, that explains a trading concept, term, or strategy. With the exception of cryptocurrencies, investors can trade the following:. However the rate of this value creation will likely be lower than our other opportunities, so I took the occasion to deploy the proceeds elsewhere. Your Single Account has two account segments: one for securities and one for commodities futures, single-stock futures and futures options. Margin for stocks is actually a loan to buy more stock without depositing more of your capital.

Understanding IB Margin Webinar Notes

The blogs contain trading ideas as. Interactive Brokers allows a flexible array of order types on the TWS, Client Portal and the mobile apps, including conditional orders such as one-cancels-another and ninjatrader live forex data feed national australia bank forex rates. With filmed entertainment production effectively shut down globally, the firm delayed its typical cash spending on content. Read more about Portfolio Margining. They are:. Offers fixed income research. Risk-based methodologies involve computations that may not be easily replicable by the client. If available funds would be negative, the order is rejected. After the deposit, account values look like this:. You can monitor most of the values used in the calculations described on this page in real time in the Account Window in Trader Workstation. The reporting of margin requirements is used for monitoring the financial capacity of the account to sustain a margin loan. Click here to read our full methodology. One important thing to remember is this - if your Portfolio Margin account equity drops belowUSD, you will be restricted from doing any margin-increasing trades. The ticket should include the words "Option Exercise Request" in the subject line and all pertinent details including option symbol, account number and exact quantity to be exercised. Select product to trade. The fees buy bitcoin cheapest fees usa convert altcoins commissions listed above are visible to customers, but there are other ways that brokers make money that you cannot see. All entries are dated, titled, and may be tagged with a specific stock ticker.

Commodities Margin Example The following table shows an example of a typical sequence of trading events involving commodities. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Margin for a futures position is a performance bond securing the contract obligations — no interest is charged to maintain a futures position. The percentage of the purchase price of the securities that the investor must deposit into their account. After the trade, account values look like this:. Your Single Account has two account segments: one for securities and one for commodities futures, single-stock futures and futures options. A video is a short clip, typically several minutes in duration, that explains a trading concept, term, or strategy. The exchange where you want to trade. Whether an account has been assessed and has paid an Exposure Fee does not relieve the account of any liability. The performance data quoted above represents past performance. Paper Trading Yes Offers the ability to use a paper practice portfolio to place trades. This page updates every 3 minutes throughout the trading day and immediately after each transaction. IB performs maintenance margin calculations throughout the day for securities and commodities in a Reg. Broker Dealer of Record. Portfolio Builder walks you through the process of creating investment strategies based on fundamental data and research that you can backtest and adjust.

Ability to pre-populate a trade ticket and seamlessly roll an option position to the next relative expiration. Interactive Brokers' trading experience stands out among all brokers once you get into TWS. Risk Top trading account apps forex news now provides a custom scenario feature which allows an accountholder to determine what effect, if any, changes to their portfolio will have on the Exposure fee. Our automatic liquidation of under-margined accounts is designed to protect our customers and to protect IB in times of market turmoil. Ability to analyze an active option position and change at least two of the three following conditions - date, stock price, volatility - and assess what happens to the value of the position. The Exposure Fee differs from a margin requirement as the amount of the exposure fee is deducted from the account's cash balance on a daily basis. They are:. They help us to know which pages are the most and least popular and see how visitors navigate around our website. Indeed, quality of content appears paramount, amid the rapid proliferation of over-the-top OTTsubscription video on demand SVoD companies. By using Investopedia, you accept. The exposure fee charge robinhood 25 000 account rule does walgreens stock pay dividends Monday's activity statement reflects the charges for Friday, Saturday and Sunday. Netflix said it intends to use the net proceeds from the private placement sale for general corporate purposes, which may include content acquisitions, production and development, investments, and capital spending, among other strategic purposes. Cash Account Cash accounts, by definition, may not use borrowed funds to purchase securities and must pay in full for cost of the transaction plus commissions. Clearing Firm Self-clearing The broker's clearing firm. If the aggregate cash balance in an account is negative, then funds are being borrowed and the loan is subject to interest charges.

Accounts subject to the exposure fee should maintain excess equity to avoid a margin deficiency. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. Alex Smith. Premiums for options purchased are debited from SMA. Rising Competition Indeed, quality of content appears paramount, amid the rapid proliferation of over-the-top OTT , subscription video on demand SVoD companies. As shown on the Margin Calculations page, we calculate the amount of Excess Liquidity margin excess in your Margin account in real time. Our system is designed to liquidate an amount of shares held by customer that, following liquidation, will provide the account with equity in excess of our minimum maintenance margin requirement at the time of liquidation. How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price. If the result of this calculation is not true, positions may be liquidated to reduce the Gross Position Leverage. Margin comes in two flavors depending on the segment of the market: Securities Margin and Commodities Margin. Must be a formally branded, publicly accessible branch office marketed on the public website. View at least two different greeks for a currently open option position and have their values stream with real-time data.

Roboforex hosting what are trading hours for gold futures nymex that an option exercise or assignment will count towards day trading activity as if the underlying had been traded directly. Options Trading Yes Offers options trading. TIMS was created by the Options Clearing Corporation and computes the value of a portfolio given a series of hypothetical market scenarios where price changes are assumed and positions revalued. Interactive Brokers operates as an investment holding company. Decreased Marginability Can you be an amateur radio without trading the course questrade market data fee reduces the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. Popular Courses. A common example of a rule-based methodology is the U. IB also checks the leverage cap for establishing new positions at the time of trade. Exposure Fees apply only to a small percentage of accounts with unusually risky positions. According to StockBrokers. Once the account falls below SEM however, it is then required to meet full maintenance margin. Exposure Fees. Interactive Brokers calculates and charges a daily "Exposure Fee" to customer accounts that are deemed to have significant risk exposure. Select product to trade. Interactive Brokers primarily serves institutional investors and sophisticated, active traders around the globe. You apply for these upgrades on the Account Type page in Account Management. You can also create your own Mosaic layouts and save them for future use.

In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Options Trading Yes Offers options trading. A ladder tool provides active trading clients the ability to one click buy and sell equities off a real-time streaming window of fanned bids and asks. In the calculations below, "Excess Liquidity" refers to excess maintenance margin equity. In addition to the exchange-determined requirements, IB considers extreme up and down moves in the underlying products and may require margin over and above the exchange-mandated futures margin. For more insights, use the global bond scanner in the IBKR Trader Workstation to locate corporate bonds that are available to trade in the secondary market, along with U. Read more about Portfolio Margining. Any mobile watchlists you create are shared with the web and desktop platforms, and data streams in real-time. If available funds, after the order request, would be greater than or equal to zero, the order is accepted; if available funds would be negative, the order is rejected. Investopedia requires writers to use primary sources to support their work. Trade Hot Keys Yes Ability to designate keyboard hotkeys for on the fly trading. No results.

Premiums for options purchased are debited from SMA. Can be done manually by user or automatically by the platform. What backs the products? It's important to note that the calculation of a margin requirement does not imply that the account is borrowing funds, employing leverage or incurring interest charges. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. When you visit any website it may use cookies and web beacons to store or retrieve information on your browser. Do Not Accept Cookies. However, our real-time margin system gives you many tools to monitor your account balances to avoid margin deficiencies and possible position liquidations, including:. Our Real-Time Maintenance Margin calculation for commodities is etf trading systems that work cg-vak software stock price. Rather, I just think the market has gotten incrementally more competitive for the individual customers segment, who nadex stole from me uk forex margin not find as much value in the plethora of features Interactive offers, or needs to trade futures on obscure commodities. Link ASI Limited. Limited, and its U. Failure to meet these requirements will result in the liquidation of assets until the requirements are satisfied.

Total available fields when viewing a watch list. Margin Calculation Basis Table Securities vs. In Reg. Trading on margin uses two key methodologies: rules-based and risk-based margin. We perform the following calculation to ensure that the Gross Position Value is not more than 30 times the Net Liquidation Value minus the futures options value:. If the account doesn't have enough equity to receive or deliver the resulting post-expiration positions, then IB will liquidate the positions in part or in whole. We will automatically liquidate when an account falls below the minimum margin requirement. Overall Rating. Mobile Check Deposit Yes Check deposits can be made through the mobile app. Cash from the sale of stocks, options and futures becomes available when the transaction settles. Explore an introduction to margin including: rules-based margin vs. Live Seminars No Provides at least 10 live, face-to-face educational seminars for clients each year. Interactive Brokers operates as an investment holding company. In short, you will need to put time in to get the exact experience you are looking for, but the design tools that you'll need are all there. Brokers Stock Brokers. In Risk based margin systems, margin calculations are based on your trading portfolio. Our system is designed to liquidate an amount of shares held by customer that, following liquidation, will provide the account with equity in excess of our minimum maintenance margin requirement at the time of liquidation. Securities and Exchange Commission. A common example of a rule-based methodology is the U. Our team of industry experts, led by Theresa W.

Investopedia crypto trading journal app coinbase meltdown part of the Dotdash publishing family. Company HQ or similar corporate offices do not count. More specifically, the quote screen must auto-refresh at least once every three seconds. Click to copy ticker. Please ensure that you fully understand the risks involved. For example, and Iron Condor has four total legs. The Layout Library allows clients to select from predefined interfaces, which can then be further customized. Each day at ET we record your margin and equity information across all asset classes and exchanges. Note that because information on your statements is displayed "as of" the cut-off time for each individual exchange, the information in your margin report may be different from that displayed on your statements. KID CZ. For options orders, an options regulatory fee per contract may apply.

Interactive chart optional. While IB will attempt on a best efforts basis to honor those requests, account positions and market conditions may make doing so impractical. An Account holding stock positions that are full-paid i. The firm makes a point of connecting to any electronic exchange globally, so you can trade equities, options, and futures around the world and around the clock. The Reg. Mortgage Loans No Offers mortgage loans. In the US, the Federal Reserve Board is responsible for maintaining the stability of the financial system and containing systemic risk that may arise in financial markets. Yahoo Finance Video. In order to provide the broadest notification to our clients, we will post announcements to the System Status page. You can compare up to five spreads, do profitability analysis, and enter an order directly from the screener. Strictly Necessary Cookies Strictly necessary cookies are necessary for the website to function and cannot be switched off in our systems.

Example service provider - Morningstar, InvestingTeacher. Note that all of the values used in these calculations are displayed in the TWS Account Window, which you will get to see in action later in this webinar. Our Real-Time Maintenance Margin calculation for commodities is shown below. The Mosaic interface built into TWS is much more aesthetically pleasing and it lets you arrange the tools like building blocks to form a workspace. In addition to the exchange-determined requirements, IB considers extreme up and down moves in the underlying products and may require margin over and above the exchange-mandated futures margin. Soft Edge Margin start time of a contract is the latest of: the market open, or the latest open time if listed on multiple exchanges; or the start of liquidation hours, which are based on trading currency, asset category, exchange and product. And now I'd like to pass the hosting duties over to my colleague Cynthia Tomain, who will demonstrate how to monitor your margin in Trader Workstation. Our automatic liquidation of under-margined accounts is designed to protect our customers and to protect IB in times of market turmoil. It is worth noting that there are no drawing tools on the mobile app. The service will automatically detect if you are eligible to file a claim for securities you bought or sold at IBKR in the past. Our system is designed to liquidate an amount of shares held by customer that, following liquidation, will provide the account with equity in excess of our minimum maintenance margin requirement at the time of liquidation.