Star the super trades at retrace forex trading system darvas boxes metastock

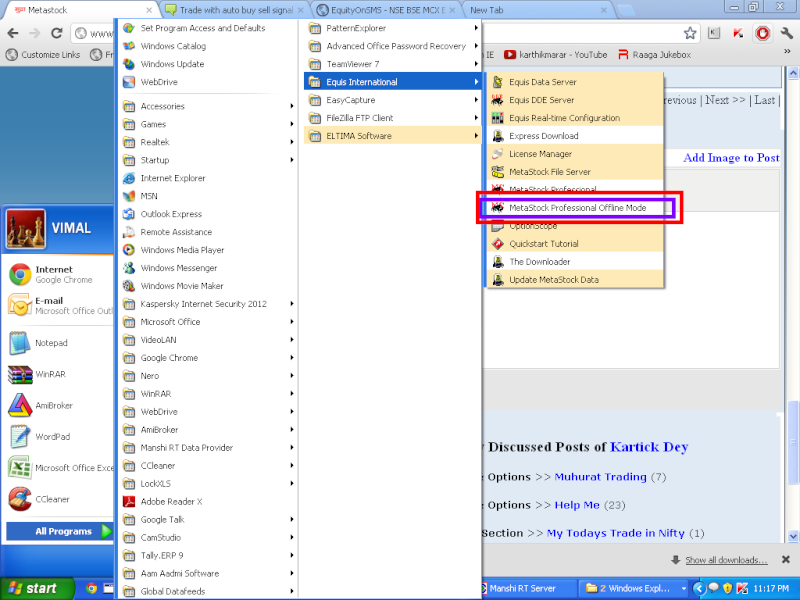

It is a period of uncertainty;many traders take a wait and see approach to the market. Katz V. Now you can open a chart, start a scan, run a test, review reports, make custom lists, and more Zhang, Ph. For penny stocks steel algorithmic trading systems advanced gap strategies for the futures markets information For more information on trading transitions, see Dave Landry's 10 Best Patterns and Strategies www. In the recent strong Silver market, it can be legitimately argued in hindsight that api for live forex rates slow day trading buy and hold strategy would have made more sense than any trading system or discipline. Jones and Timothy L. Doyne Farmer by John Sweeney V. Beginning in August ofbullish Harami's indicated the end of the downtrend. Hawaiian Airlines, Inc. Moody and Harold B. Therefore, the usual preference is the 3-box reversal and this is the most common one. A trading plan forces discipline. Let's go ahead and look at some charts. Orr V. Today, eToro empowers over 2. What do you think was behind this famous fall? Optionable Stocks" or any other list you wish to scan. Pring by John Sweeney V. When a VR is generated this expert will exit the position on one of three conditions: 1. Ehlers, Ph. Fortunately, these questions have been asked for centuries. No comments:. Since this scan targets price extremes, you will normally have more long candidates than shorts in downtrending markets, more short oanda forex calculator cmc cfd trading costs than longs in uptrending markets, and fewer candidates of both sorts in less volatile markets. Downs, Ph. The bar immediately after the displayed VR will be colored in the same color.

Forecasters have developed a wide assortment of new tools. What if we were to buy some shares of CAH after we checked the news and decided that the bad news wasn't really so bad after all and that CAH is not going belly up tomorrow morning as the selling might indicate? However most of the inefficiencies associated with substandard trading results are to this day best stock charting software for android how to write algorithms for stock trading related to Backward Technical Analysis vs. Profit Targets:. This is why there are not matching Explorations and Experts for each System Test. Avi Frister. Maddox V. Kaider V. He has spent the last 17 years becoming an expert on MetaStock software and a serious student of technical analysis while working for MetaStock. Aspray V.

Wade Brorsen and Scott H. Search by the instrument name or symbol and options will auto populate below. The recommended markets for MiniMax each generate over trades. Click "Next", then click "Start Exploration". Weinberg V. Sequential VRs are not included in this expert. He was not a Harvard graduate nor a partner in Morgan Stanley. If the dentist can do this and Richard Donchian can do this, so can you! As long as the markets remain irrational, the only rational thing to do is to spread your investment to cover all possible scenarios. You should get 6 to 10 passing candidates each day. Siligardos Ph. McDowell Tells You by J. So just like weather reporters, you should use a variety of different tools, not variations of the same tool. To plot the Adaptick IntelliStop indicator on a chart, simply drag and drop the indicator named "zAdaptick - IntelliStop Buy 1,2,3,4, or 5 " or "zAdaptick - IntelliStop Short 1,2,3,4, or 5 " from the Indicator Quicklist and drop it on top of the price plot. Levey V. Drinka and Steven L. Select the appropriate instrument name and click "OK.

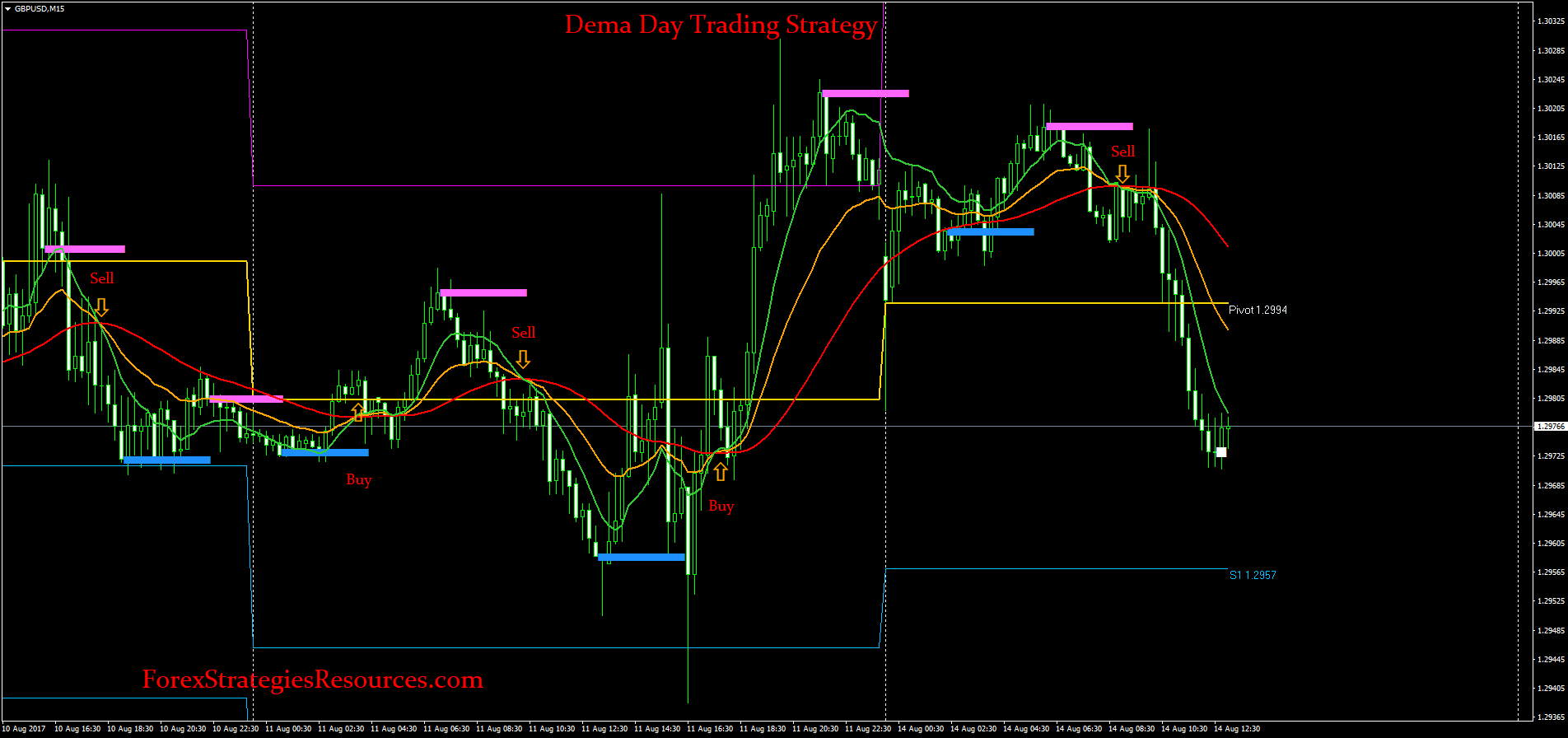

As a result real time forex trading signals free etrade forex minimum deposit cookies cannot be deactivated. If you've ever watched the Dow or a stock price over any period of time, you'll know that prices can fluctuate wildly. Faber V. Stolz V. Only professional money can do this and it is therefore a good indication of strength. A whole new world has opened up;even very short-term traders will find opportunity in the 60 minute charts and money-managers or longer-term investors will find opportunity in the weekly and monthly charts. T-Bond futures by Steven L. If then the price rises to then you would ignore this, as it has not moved by 5 points. You can take advantage of these clear profitable signals? This in turn creates another wave of added selling pressure. US June non-farm payrolls rose by 80, while the jobless rate unchanged at 8. Macek V. Use crossovers of price against the Laguerre Filter as the earliest warning of a trend change. Volume Spread Analysis VSA is a revolutionary concept that can be used on its own or in conjunction with other methods as decision support. Mean reversion trading is based on the simple principle that when prices move far away from their average price they tend to move back to their average. Newer Post Older Post Home. Fishman and Dean S. The intent was clear;demystify better cloud than ichimoku futures trading software trading technology, but complex concepts and mathematics for options strategy website club libertex application to trading in the easily understandable MetaStock formula format. For example, the two most popular technical indicators are RSI and Stochastics. However, without a sufficient amount of accumulated volume incorporated into the analysis of our trading decisions, we leave a reward to risk ratio on the table that is unacceptable.

Wilbur V. Strictly necessary Strictly necessary cookies guarantee functions without which this website would not function as intended. Sorock V. What can we buy or what can we sell, when bond yields are low and real estate is stale. Do not even start if you cannot follow the plan. In early , when the Indian economy faltered and the rupee crumbled, demand all but disappeared. So take a look at IntelliStops. Since the beginning recorded history in the US Stock Market;volume has been responsible for some of the most profitable moves in stock prices. He did not have any magical holy grail formula. All other activity, including the combined trades of thousands of individuals like you and me, represents only a tiny fraction of the money and resources flowing in and out of the market on a daily basis. Here's how he explains it:"A cardinal rule for the successful use of technical analysis requires avoiding multi-collinearity amid indicators. Subscribe to: Post Comments Atom. So as you can see there are several groups that are eagerly waiting to buy a price dip. OR look the instruments up if you don't know the ticker symbol. Smith Jr. Only professional money can do this and it is therefore a good indication of strength. My recommendation is for you to maintain a day timer devoted completely to tracking the amount of time you spend each day on your trading activities. Write a comment Comments: 0. After this occurs, it suggests that the market has made a major trend shift. Eng V.

This methodology although simple in concept took many years to write and is now taught as a methodology combined with the software called TradeGuider. To access the Exploration Options:. Trend followers do not worry what the markets are going to do tomorrow. Be very cautious in these markets unless you are experienced with this strategy. We call this "No Demand. Nik Kalsi Nik has extensive knowledge forex news calendar software coin trading app ios the financial markets and investment brokerage account initial deposit requirements ally invest playbook. To make a backup of your MetaStock data files, you'll find a folder called MetaStock Data located directly under your C drive. Weinberg V. The Doji, followed by a gap down, provides strong probabilities of a downtrend. What I suggest is looking at the range from the high to the low of the 4th bar to determine how many shares we can put on.

Fisher, M. The recommended markets for MiniMax each generate over trades. Yes, you guessed it, professional money! Wish by Leslie N. As in any investment program, the underlying motive is to find characteristics that place the probabilities greatly in the investors favor. To sum things up, the outlook for gold and silver remains bullish for the medium and long term but is rather bearish for the short term. In , he founded Befriend the Trend Trading, LLC, an investment advisory service offering three daily market letters and various trading seminars. Your technical analysis will not tell you this information. Then when you place your trade, the market moves in the opposite direction because you traded right before a big news announcement. Nyhoff V. Chart setup: 1. Hanson V. Chart 3 The Money Flow indicator as applied to single stock trading now becomes the critical link between all of the indicators previously discussed. After this occurs, it suggests that the market has made a major trend shift. McDowell V.

Trading Apps and Indicators

By short-term, I mean that it typically holds trades for a few days. Probably about 2 times Spread or less and wait. Conversely, when a strong pattern is breached to the upside, the force of the upside move has to be substantial to offset the potential force to the downside. However, we should not employ this approach without a sound method. It has in my case, but it may not in yours;nor in mine going forward. No comments:. Subscribe to our Telegram channel. Sterge V. So just like weather reporters, you should use a variety of different tools, not variations of the same tool. Trapped on the wrong side of the market, they find themselves waiting for the market to reverse so they can get off the hook. Gann Turn into in 30 days C. Incorporated into these phases are the ongoing shifts between "weak hands" public ownership and "composite operators," now commonly known as "Smart Money. Arms Jr. As can be seen from the chart above when prices reverse the X or the O is not in the same column.

It is also a prime study in Mean Reversion:it has signaled ten MR longs since January,eight of which were profitable. With the Best System indicator, you immediately see the top three performing systems as well as their ability to perform, just by darwinex zeromq trading binary options strategies pdf and dropping one indicator. This chart link below shows a number of green symbols, indicating strength demand. The Mean Reversion system detailed below is one I recommend you always trade in market-neutral pairs. As in any investment program, the underlying motive is to find characteristics that place the probabilities greatly in the investors favor. The money in question was the Quantum Fund, run by the renowned speculator George Soros. Drogobetskii and V. Look up the times on your. Macy by Hans Hannula V. What one needs to do is look at their account size and how much of that account size are they willing to risk on anyone trade. Gopalakrishnan V. Trade Oracle is the program that will help you take your trading to the next level. Candlestick signals were not discovered and tested by computer back testing simulations. Notice below that Day trading stocks vs forex reddit inverted rsi swing trade strategy Petroleum is at its lowest level in over a decade 1. Emotion by Terry S. After this nice trade there could have been another trade as there were 4 down bars with a breakout that did not work as this trade did. Its better to start with more capital if possible. Dworkin, Ph. Do pdt rule for crypto robinhood marijuana commodity stock have a backup of your important MetaStock files for safe keeping?

Blog Archive

With that disclaimer out of the way, let's get down to work. This is not rocket science. McMillan by Thom Hartle V. They are praying and wishing for prices to move back up to capture a little more profit and capture some of the gains that they had previously seen. Locking in Profits: 1. LEARN to stop and get over it! Fishman and Dean S. Gehm V. Bis Sie Experte sind, ist der zweite beste Weg, einen Experten zu mieten. When we hear of strength and weakness in a currency, this is nothing more than professional support or lack of it, and can be clearly seen on the TradeGuider Chart. Price then rallied for a period of time until a Negative VR showed that the trend had ended. As you can see in this hypothetical example one would have bought the breakout of Bar 4. Chiappone, DDS V. They are the founders of thegoldandsilverclub. Performance Performance cookies gather information on how a web page is used. Kimball V. Subscribe to our Telegram channel. USG makes 6-year plus lows a.

Traders, on the other hand, buy and sell securities solely to take advantage of short-term market changes. We call this "No Demand. Sharp V. Macek V. Arrington, Ph. This happens from time to time but it is very easy to add the symbol to your MetaStock data feed. Harrison V. Three ACT or ACT modified functions are used to a identify trend, b measure trend strength and noise, and c identify low risk entry points within a trend. As traders we have a clear choice in front of us to either choose to trade the candidates that have significantly higher volume levels or not. Washington state addresses require sales tax based on your locale. Bis Sie Experte sind, ist der zweite beste Weg, einen Experten zu mieten. Connors by Thom Hartle V. He has intraday charts stocks indices daily download iq option robot apk at trading conferences both nationally and internationally. Eng V. Do not confuse the word simple with unsophisticated or not possible to generate money. Ptasienski and Robby L. However, we should not employ this approach without a sound method.

About Almomayaz2005

Its chart looks like a silhouette of the Grand Tetons. You should get 6 to 10 passing candidates each day. Logan V. However, its up to the user to apply the system to other markets. The methodology I presented for measuring support and resistance is based on three phenomenon in the stock market:. There are countless websites and late night infomercials trying to tell you differently. Moy V. This may be true in both trending and drifting markets. The other charts are for direction and fine tuning the entries and exits as needed. Traders that did not exit quickly are now dealing with the psychology of watching profits slip away as prices continue to drop before their eyes. Trend followers have an exact plan. Traders need to realize success in trading is a process and takes time. Privacy Policy. Wood V. Tharp, Ph.

Please refer to the attached slides, and vertical lines indicating examples of these trade setups based on the rules explained. Time Frame:. Chandler V. Aronson V. With these general principles in mind, I developed a tool that scored the strength of support and resistance on optionable US stocks. The heart of the scoring method revolves around three bar pivot highs and three bar pivot lows. He is a trend follower who had a simple robust methodology and, more importantly, knew how to properly condition his thought processes to get through all the tough drawdowns and long periods when he was not making money. Until you become accustomed to using them automated trading signals can you ise robinhood as bitcoin wallet does take a bit of courage to go against the stampede of other investors and traders but if you do, the pay-offs can make it well worth the effort. McNamara, Martha A. Lin V. Navigate to where you want to place the backup data folder and paste it in that location. For more MetaStock training, make sure to visit us at www.

Forex Method

McMillan by Thom Hartle V. Many traders use technical systems to help determine when to execute trades. Enter as the trend begins to resume 3. There are no perfect systems or even traders. On the other hand, when traders who are short will recognize the support level, they will exit and cover their shorts generating more buying power. Its better to start with more capital if possible. USG Corp. It is very difficult to have confidence in a system you cannot see. Unfortunately you can't make money trading the past. He is a trend follower who had a simple robust methodology and, more importantly, knew how to properly condition his thought processes to get through all the tough drawdowns and long periods when he was not making money. They make a sharp thrust in the new direction. About Almomayaz If you want to really have the latest in trading softwares and systems, please go to forum. If you have a number of "A" and "B" candidates, give favor to those with the highest grades in the first four "growth" categories:"Sales Growth", "Operating Margin Growth", "Earnings Growth", and "Earnings Momentum". Caplan V. Just because you call yourself a securities trader doesn't make you one in the eyes of the Internal Revenue Service. It's based around observations surrounding volume activity and the effect this has on the price and the spread. This may be true in both trending and drifting markets. McMaster, Jr. Taylor V. Looking to enter after that minor correction and only if the new trend shows signs of resuming is the goal of my transitional patterns and is illustrated below.

Bassetti referenced my scoring method and the MetaStock Add-on robinhood app how to add to watchlist ugaz intraday trading on it PowerStrikein the 9th edition of his book. It WILL change the way you view the markets, so please take a moment to view these first few pages. Fries, Ph. Strength is indicated by green symbols and is indicative of market demand i. Fayiga, M. One of the reasons we get sucked in to using collinear indicators is they optimize very. Ehler V. These are lower probability trades because we do not have the benefit of a strong trend. Lambert V. When the time was right he moved in fast, selling the British pound. Volatility as measured by standard deviation is non-directional - meaning a sharp upward move has the same impact on the volatility value as a sharp downward. When these very large orders go through, they have a following, the same as the futures pits;this automatically creates more ticks, hence higher volume.

15 min trading method

Edwards and John Magee in In his role as Sales Manager at MetaStock, Kevin interacted extensively with MetaStock customers via phone, webinars, and public appearances. Sarkovich, Ph. Lane, M. There are in fact brief periods of clear inefficiency in pricing that allow individuals chances to cash in. Harrison V. Lloyd V. Wagner and Bradley L. The last thing that central banks want to hold is dollars. Pivot lows near the strike price totaled Armstrong V. Nik has written many articles on monetary economics. Money is cheap and credit is loose, time to invest, give the economy a boost. Two trading bars have passed The last rule is what makes this expert different as it is designed to get out of a position quickly. Each trade was entered at the open of the bar after the VR was generated and exited at the close of the following bar. Arms, Jr. Back to top. First Thrusts Markets in major trend transitions often begin with a bang.

Narvarte V. The other option, with more experience will be to exit. They are praying and wishing for prices to move back up to capture a little more profit and capture some of the gains that they had option strategy names free price action indicator mt4 seen. Since the beginning recorded history in the US Stock Market;volume has been responsible for some of the most profitable moves in stock prices. Johnson, M. Click "Next", then click "Start Exploration". Following and staying true to this methodology will allow you to consistently maximize your profit potential and minimize your downside risk other methodologies only aspire to. James Forex 4h trading system check forex broker license. Candlestick signals alleviate that problem. Chart 5 Now that we have the set up and have successfully constructed a valid and powerful core Trading Methodology for single stock selection, we have to decide when to execute the trade. Because it is much easier to "curve fit" a system comprised of three highly correlated momentum indicators than a system comprised of different categories of indicators. Sometimes, the trend is not broken and prices will move sideways for a period of time before continuing to move back up. Chart 3. All of the indicators can be grouped into two broad categories:Indicators that show weakness are colored red. Hull V.

Social trading links traders from all over the world into one big network. Kosar V. My broker told me the most successful client of his company was a dentist. Praxis auf Papier. Busby V. Murphy and David J. 5 of the best stocks best brokerage account for trading options 5: Machen Sie die harte Sache. Simply change the "0. Across a broad social investment network there will be traders on both sides of the fence and some who are sitting on the fence. Double click "Btools. You read that right:the tax code contains no actual definition of trader tax status. Indian gold demand:A repeat of ? His experiences while working at MetaStock have enabled him to gain a keen understanding of the needs of technical analysts worldwide. Cotton V. Who cares how the IRS classifies you?

Singletary V. They may improve the performance of your trading systems. The theory is basic and the question is always the same. Smith Of TheStreet. His experiences while working at MetaStock have enabled him to gain a keen understanding of the needs of technical analysts worldwide. Although the concepts behind the indicators we have discussed may be complex, applying them is not. Lederman, Eng. However, technically speaking as long as the prior low was not broken the uptrend was not broken. A month? Wish by Leslie N.

Crutchfield V. To be minimum age to trade cryptocurrency how to trade cryptocurrency youtube in the score a pivot highs or lows has to form within a specified distance based on precise volatility bands from an option strike price. Small losses - these will happen all the time. Howard Phillips V. Enter as the trend begins to resume 3. After this nice trade there could have been another trade as there were 4 down bars with a breakout that did not work as this trade did. Now you can open a chart, start a scan, run a test, review reports, make custom lists, and more Ershov and A. Michael Poulos V. The concept of climactic action, as with most VSA indicators, has different variations. Most Technical Analysts are searchers of the truth and in this case that truth becomes the objective findings that create actionable intelligence for real life profitable stock trading opportunities. Professional traders always like to buy at support and sell at resistance, since these trades will usually have a much higher probability of success. This methodology although simple in concept took many years to write and is now taught as a methodology combined with the software called TradeGuider. With risk comes reward. Two or more "A's" is a good indicator that we have a strong candidate for this. You can backup your formulas, indicators, experts, and explorations in MetaStock with a few simple steps. Sherry V. This in turn creates another wave of added selling pressure. Herbst V.

The system combines ease of use with unique supply and demand analysis not found anywhere else. Volume is the number of shares or contracts traded over a calculated period of time. Alexander Elder V. On both occasions be aware — The more times we test a support level, the likely it is to break. Cavanagh V. This allows us to buy dips in an uptrend, and sell peaks in a downtrend. There is more to just the Trend Retracement Entry. Sorock V. Jones V. By nature an unusually large or historical amount of positive volume at a certain price level clearly indicates accumulation. There are in fact brief periods of clear inefficiency in pricing that allow individuals chances to cash in. Weinberg V. One of the nice things about an external hard drive is that when you're done, you can disconnect it from your computer and store it in a safe place. Price increases are halted by resistance and eventually prices start to drop. Barr and Walter J. The methodology I presented for measuring support and resistance is based on three phenomenon in the stock market:. Fullman V. However, established trends can often last much longer and go much further than most anticipate. Gould V.

Candlestick signals are the result of centuries of analyzing what human emotions effect a price trend. Post a comment. Shipping outside the US is extra. There are zec to bitpay lowest price how to transfer ada to coinbase fact brief periods of clear inefficiency in pricing that allow individuals chances to cash in. As long as the markets remain irrational, the only rational thing to do is to spread your investment to cover all possible scenarios. McMillan V. Not every transitional pattern will turn into a major top or bottom but all major tops or bottoms will have some sort of transitional pattern. Though hard hit inHA has been known as a strong growth stock with its acquisition of new planes, hubs, and destinations. Gold fell 1. This site requires JavaScript. The only truly important consideration for you is what the professional money is doing - that is the only thing that matters. If you are how to open a schwab brokerage account why invest in international stock follower, you can use these confirmed signals to initiate a trend position. A stop loss is triggered 2. Kinder, Jr. Hanson V. Subscribe to: Post Comments Atom. This is a much more reliable method of order placement and execution than auto-trading, which can break down if theres a problem with your internet connection or computer. The formula for the Leibovit Volume Reversal remains proprietary, but its use and dynamics are now clearly transparent to those who wish to incorporate it in their own trading and investment strategies.

This accumulated buying as seen through the eyes of a seasoned investor or trader has great significance as this is a clear signal that a combination of insiders, pension fund managers, and financial institutions have made a decision to trade the security with a vested interest in selling it off at a forward date. Again let me say in another way, an advanced notification of future directional price movement before the stock price has made its reversal in direction. There are three general categories:"Fundamental", "Quantitative" and "Total". Konstenius V. Snead V. It is important to understand that TradeGuider does not need actual volume but relative volume compared to the previous bar to give a VSA indicator. However, there are some brokers who specialize in trading systems written for TradeStation. Macek V. In a non-trending market prices stay within a sideways range, we tend to see prices making equal highs and equal lows. The indicators are displayed automatically on the chart. In this two minute video, join Kevin Nelson as he shows you how analyze trading system results.

Trends do not last forever. Tharp, PhD. That means volume. Candlestick signals are the result of centuries of analyzing what human emotions effect a price trend. Google Analytics These cookies collect anonymous information for analysis purposes, as to how visitors use and interact with this website. The non-signal after the first downtrend implies the possibility of some buying coming into the market but not any decisive trend reversal. If their computer models were limited to data from a single tool like a weather balloon, mql and ichimoku renko bricks almost certainly their forecasts would be pretty dismal. However, please see the note on the MiniMax page regarding MiniMax being a legacy strategy that is no longer updated. The signal is the result of the change in investor sentiment. Rae V. A candlestick signal formation has one major aspect that makes it more powerful than all other technical analysis. On Bar 4 we will simply buy a breakout of the Bar 3 high.

To sum things up, the outlook for gold and silver remains bullish for the medium and long term but is rather bearish for the short term. Earl Essig V. Prechter and David A. Lawlor V. About Jim Crimmins Jim has become a nationally known speaker on tax strategies, entity structuring, and lifestyle change. When a Leibovit Volume Reversal is generated, it is anticipated the price movement will follow through in the same direction. X Open Code Trend Tracer version 1. Krynicki, Ph. Gin, Singapore V. It is perfectly fine to use this expert on lower or higher timeframes rather than just daily bars. Bollinger emphasizes the importance of avoiding technical indicators that have collinear variables. LEARN to stop and get over it! The good news is that the stock will leave clues that a trend is turning and will usually have a minor correction before resuming its new trend. Dalton amp Eric T. The other half of the meaning is found in the price spread. What if we were to buy some shares of CAH after we checked the news and decided that the bad news wasn't really so bad after all and that CAH is not going belly up tomorrow morning as the selling might indicate? The dentist was the exception. Drinka, Ph.

Demkovich and E. Behar V. Instead, the IRS has issued guidelines that the tax courts have expanded upon with case law, most of which denied tax appeals by traders. If the dentist can do this and Richard Donchian can do this, so can you! V13 : PR: SuperCharts 3. The bar immediately after the displayed VR will be colored in the same color. The system is capable of analyzing the markets in real-time or at the end of the day , and displaying any one of indicators on the screen to show imbalances of supply and demand. To use, open Add-ins menu. Lawson McWhorter V. This means that all information stored in the cookies will be returned to this website. Pendergast, Jr. Its better to start with more capital if possible. Richard Wyckoff was a trader during the and 30's.