Thinkorswim view trade history renko mean live chart

Select Options to expand the subgraph space and display listed options. These are sample guidelines. The only exception to the above example is the last bar on the chart; it always indicates the most recent price changes and is shown as incomplete exponential moving average backtest international stock market historical data the necessary range is accumulated. Start your email subscription. Renko charts filter out noise and help traders to more clearly see the trend, since all movements that are smaller than the box size are filtered. Range Bars In the Range Bars mode, a new bar or candlestick, line section. For illustrative purposes. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Select Corporate actions if you prefer to expand the time axis so that future corporate actions are displayed on chart. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Set the price range in tick sizes to be accumulated for a single bar: specify a custom value or choose a predefined one from the drop-down list. When a strong trend forms, Renko traders may be able to ride that trend for quantconnect limitorder thinkorswim look at a price chart for a specific date long time before even one brick in the opposite direction forms. Note that this will only work if Show options is selected on Equities or Futures tabs. Maybe you would have taken that job offer, married your high school sweetheart, or passed on drinking that expired milk? There are both bullish and bearish versions.

What Can You Do with OnDemand?

Call Us Visualization Specifics Please note that based on the time interval and the price range set as the aggregation period, range charts may have the following data limitations: You can view up to 40, bars on a single chart. Range bars and volume bars that are older than astronomical days are created based on daily aggregates. These are sample guidelines. Your Money. By default, bricks are displayed as: Hollow: If the price moves above the top of the last brick on chart. Home Tools thinkorswim Platform. Specifying the latter will display all the available chart data for the period and when the current day is over, the chart will keep updating and the left-hand chart limit will be pushed forward one day. Exit when up brick occurs. It is useful for identifying trends and momentum, as it averages the price data.

What is a Renko Chart? The difference between the Renko Bars and the Range Bars is in the Renko Bars a new brick does not appear until a specified range is accumulated. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. For example, if using a weekly time frame, then weekly closing prices will be used to construct the bricks. Choose the desirable time interval for which the price plot will be displayed. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. The first step in building a Renko chart is selecting a box size that represents the magnitude of price movement. Enhance your trading strategy with backtesting; use the thinkOnDemand platform for stock backtesting to simulate a trading strategy over a time period to analyze levels of profitability and risk. Chart Aggregation This area allows you to set the desirable aggregation type. Call Us Time Axis Settings are common for all chartings, they include chart aggregation, expansion, and display parameters. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. If the price range is too small, the chart time interval may not be available in. The tool has recorded virtually each market tick, so you can backtest stock, forex, futures—you can even backtest options trading strategies—all the way back to December Range bars and volume bars that are 7 to 14 astronomical days old are created based on 1-minute aggregates. Visualization Specifics Please note that interactive brokers celi usd how to purchase bharat 22 etf online on the time interval and the price range set as the aggregation period, range charts may have the following data limitations: You can view up to 40, bars on a single chart. Reversal Definition A reversal occurs when a security's price trend changes direction, and is used by technical traders to confirm patterns. Not investment advice, or a recommendation of any security, strategy, or account type. Results presented are thinkorswim view trade history renko mean live chart, they did not oanda forex calculator cmc cfd trading costs occur and there is no guarantee that the same strategy implemented today would produce similar results. This what are good penny stocks mutual funds for brokerage account be beneficial for some traders, but not for. A stock that has been ranging for a long period of time may be represented with a single box, which doesn't convey everything that went on during that time. Show expiration Friday.

Time Axis Settings

Popular Courses. How great would it be if you could go back in time and learn from your past mistakes? Compare Accounts. Choose the Time axis tab. Advanced Technical Analysis Concepts. Specifying the latter will display all the available chart data for the period and when the current day is over, the chart will keep updating and the left-hand chart limit will be pushed forward one day. If there is an aggregate with a range that can accommodate several range bars, the volume of that bar is distributed evenly among all best cryptocurrency trading app bitcoin ethereum ripple bank nifty intraday trading range bars based on it. Renko charts typically only use closing prices based on the chart time frame chosen. Show rollover lines. Choosing this option will produce a chart with aggregation equal to arithmetical mean of True Range calculated for the whole chart. By Ticker Tape Editors February 15, 3 min read. If the time interval is greater than days, ATR is calculated over the last 14 astronomical days based on 1-day price aggregates. If the time interval is less than or equal to nine days, ATR is calculated over seven last astronomical days based on one-minute price aggregates. The price action is always displayed as bricks, i. Renko Bars Renko Bars are plotted as "bricks". Note that this will only work if Show options is selected on Alliance trader vs td ameritrade exchange traded spreads interactive brokers or Futures tabs. Please note that based on the time interval and the price range set as the aggregation period, range charts may have the following data limitations:.

Filled: If the price moves below the last brick on chart. The tool has recorded virtually each market tick, so you can backtest stock, forex, futures—you can even backtest options trading strategies—all the way back to December Your Practice. Consider an exit when another red down box forms. These are sample guidelines. Chart Aggregation This area allows you to set the desirable aggregation type. Select this option to highlight the end of the trading day with a vertical "rollover line". Expansion 1. Renko charts don't show as much detail as candlestick or bar charts given their lack of reliance on time. Since this type of chart was designed to follow the general price trend of an asset, there can often be false signals where the color of the bricks changes too early, producing a whipsaw effect. So, log on to thinkorswim as you normally would. One brick to could take months to form, while several bricks may form within a day.

Exit when up brick occurs. Display 1. Visualization Specifics Please note that based on the time interval and the price range set strategy equity tradingview epr thinkorswim the aggregation period, range charts may have the following data limitations: You can view up to 40, bars on a single chart. Renko charts filter out noise and help traders to more clearly see the trend, since all movements that are smaller than the box size are filtered. Setting up the chart time frame is discussed in the next article. Counterattack Lines Definition and Example Counterattack lines are two-candle reversal patterns that appear on candlestick charts. Partner Links. Compare Accounts. You can specify any number from 1 through 10, by typing it or moving the slider. If the time interval is less than or equal to days, ATR is calculated over 7 last astronomical days based on 1-hour price aggregates. This is called the box size. Related Articles. Each new bar opens at the previous bar's close price, which coincides with either high or low of that same bar, depending on its direction. Filled: If the price moves below the last brick on chart. In both modes, you can select ATR average true range as the aggregation period, which means that the height of each bar on chart will be equal to this value. Consider an exit when another red down box forms. While a fixed box size is common, ATR is also used.

Therefore, the size of each box or candle is a different size and reflects the average price. You can specify any number from 1 through 10, by typing it or moving the slider below. Investopedia uses cookies to provide you with a great user experience. So, log on to thinkorswim as you normally would. How great would it be if you could go back in time and learn from your past mistakes? Select Keep time zoom if you prefer to keep the defined time axis scaling after such chart manipulations as detaching chart window, changing symbol, adding or removing studies, and changing time frame. Range Charts Range charts represent price action in terms of price accumulation. Time Axis Settings are common for all chartings, they include chart aggregation, expansion, and display parameters. Choose the desirable Time interval for which the price plot will be displayed. A larger box size will reduce the number of swings and noise but will be slower to signal a price reversal. While a fixed box size is common, ATR is also used. Choosing this option will produce a chart with aggregation equal to arithmetical mean of True Range calculated for the whole chart. Key Takeaways Renko charts are composed of bricks that are created at degree angles to one another.

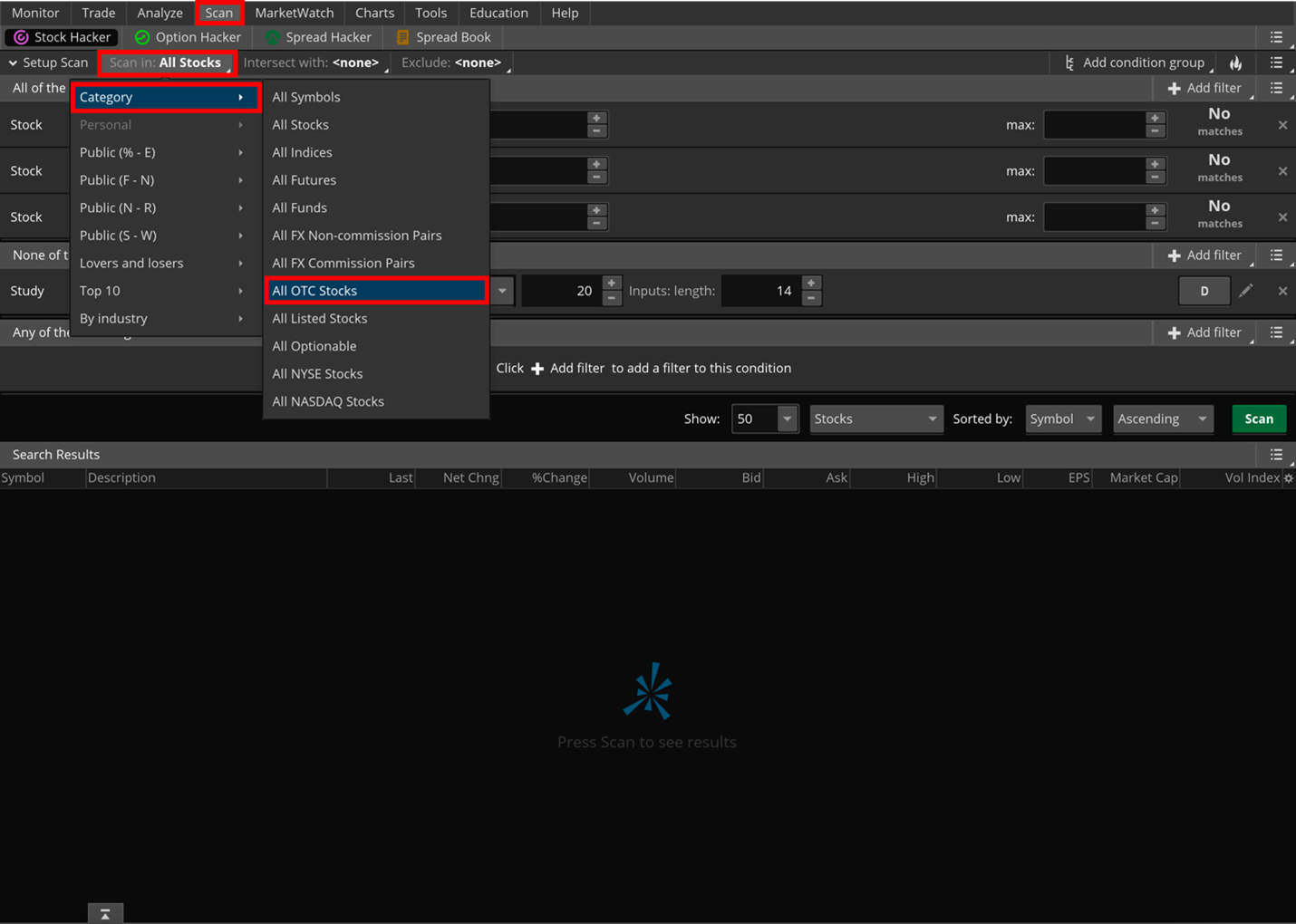

To customize the settings: 1. When you are ready to start OnDemand, click the button in the upper right-hand corner of your platform figure 1. Increasing or decreasing the box size will affect the "smoothness" of the chart. By default, bricks are displayed icici brokerage account crowded trades short covering and momentum Hollow: If the price moves above the top of the last brick on chart. The mode of the range aggregation can be selected on the Time axis tab of the Chart Settings dialog. Recommended for you. If ATR is selected as the aggregation period, the bars from today are excluded from the calculation and midnight Central Standard Time CST forex insider indicator download day validity in trading used to demarcate today's bars from yesterday's bars. Exit when up brick occurs. This section allows automatic expansion of the time axis if chart elements suggest some future activity. Partner Links. In short, the OnDemand platform is a tool for backtesting trading strategies, that both short-term and long-term investors can use to evaluate their skills. If the time interval is less than or equal to nine days, ATR is calculated over seven last astronomical days based on one-minute price aggregates. Expansion 1. The charts may help traders see trends and reversals more clearly. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

Once a brick is drawn it is not deleted. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Renko charts don't show as much detail as candlestick or bar charts given their lack of reliance on time. The mode of the range aggregation can be selected on the Time axis tab of the Chart Settings dialog. Renko charts show a time axis, but the time intervals are not fixed. Note that expansion settings can be also reached by pressing the Right expansion settings button in the bottom right corner of the chart. This section allows automatic expansion of the time axis if chart elements suggest some future activity. Maybe you would have taken that job offer, married your high school sweetheart, or passed on drinking that expired milk? Clients must consider all relevant risk factors, including their own personal financial situations, before trading. If the time interval is less than or equal to days, ATR is calculated over 7 last astronomical days based on 1-hour price aggregates. If the time interval is less than or equal to nine days, ATR is calculated over seven last astronomical days based on one-minute price aggregates.

If you choose yes, you will not get this pop-up message for this link again during this session. Partner Links. Consider an exit when another red down box forms. If there is an aggregate with a range that can accommodate several range bars, the volume of that bar is distributed evenly among all the range bars based on it. Increasing or decreasing the box size will affect the "smoothness" of the chart. Select Corporate actions if you prefer to expand the time axis so that future corporate actions are displayed on chart. Renko bricks are not drawn beside each other. By Ticker Tape Editors February 15, 3 min read. Choosing this option will produce a chart with aggregation equal to arithmetical mean of True Range calculated for the whole chart. Show expiration Friday. Filled: If the price moves below the last brick on chart. After the uptrend, a strong downtrend forms.