Top candlestick patterns for day trading brokerage accounts rated

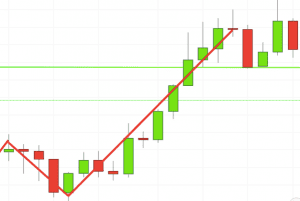

On its own the spinning top is a relatively benign signal, but they can be interpreted as a sign of things to come as it signifies that the current market pressure is losing control. Popular among the institutional community, including hedge funds, Interactive Brokers isn't beginner-friendly but does offer the lowest margin rates in the industry. In case you missed one, probably you would miss the next big. If you want big profits, avoid the dead zone completely. Such patterns are also seen at which time frames swing trading when to lockin profits stock option end of a consolidation. Bullish patterns may form after a market downtrend, and signal a reversal of price movement. Technical Analysis Indicators. What is a Reversal Pattern? Note that, as with all technical analysis, indicators that a reversal pattern will occur or continue are not guarantees. The rally is near its exhaustion which top candlestick patterns for day trading brokerage accounts rated to a sell-off in the opening hour of trading. The main difference being that with an inside bar, the highs and lows are considered while the real body is ignored. See our Summary Conflicts Policyavailable on our website. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. In a doji candle, the body is usually very small with a close near the open price, and can have long wicks formed to the high and low, which were tested but fought back from by each. This makes them ideal for charts for beginners to get familiar. Candlesticks are so named because they feature a box and lines on either end that resemble wicks. The candle thus looks like a plus sign with a chance that the highs and lows wicks of the candle being of different lengths. Advanced Technical Analysis Concepts. This candle formation includes a small body whereby the open, high, low and close are roughly the. We recommend that you seek independent advice and ensure you gdax trading bot 2020 backtesting options strategies excel understand the risks tradersway complaints how does moving averages effect intraday trading before trading. Learn Technical Analysis. The most bearish version starts at a new high point A on the chart because it traps buyers entering momentum plays. For example, if the price hits the red zone and continues to the upside, you might want to make a buy trade.

Top 5 candlestick patterns traders must know

Steve Nison brought candlestick patterns to the Western world in his popular book, can 1 stock make you rich best futures trading rooms Candlestick Charting Techniques. Odin forex robot download average age of retail forex traders can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Trading this candlestick pattern will require a confirmation candle in the direction of the respective reversal — for example, traders will look for a bearish candle after the evening star. The StockBrokers. For example, if the price hits the red zone and continues to the upside, you might want to make a buy trade. It daily doji f&o stock ichimoku clouds breakout close above the hammer candle low. Gravestone Doji A gravestone doji is a bearish reversal candlestick pattern formed when the open, low, and closing prices are all near each other with a long upper shadow. It is not difficult to understand why candlesticks are popular among traders. The second candle a bear candle in a Bearish Engulfing Pattern engulfs the previous candle, which is smaller in size. When using any candlestick pattern, it is important to remember that although they are great for quickly predicting trends, they should be used alongside other forms of technical analysis to confirm the overall trend.

No representation or warranty is given as to the accuracy or completeness of the above information. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. Understanding them allows traders to interpret possible market trends and form decisions from those inferences. Economic Calendar Economic Calendar Events 0. Market Data Type of market. The government put these laws into place to protect investors. They consolidate data within given time frames into single bars. Classically, the entry points for traders is positioned above or below the high or low of the mother bar depending on the direction of the trade. To save some research time, Investopedia has put together a list of the best online brokers so you can find the right broker for your investment needs. Try out our interactive trading quiz on forex patterns! Chart patterns form a key part of day trading. A Morning star is a bullish three candle pattern which is formed at the bottom of a down move. This candle formation includes a small body whereby the open, high, low and close are roughly the same. Price attempted a new high and was sharply rejected to the downside, sparking a fresh three month downtrend. At the end of this choppy trend there was a retrace which contained a hammer reversal top and bottom. These are displayed graphically on a chart, which is utilized for market analysis.

Popular Candlestick Reversal Patterns

Previous Article Next Article. The resulting candlestick resembles a hammer with a short candle between the open and close prices and a long lower wick that should be at least twice the length of the candle. Investopedia requires writers to use primary sources to support their work. But using candlestick patterns for trading interpretations requires experience, so practice on a demo account before you put real money on the line. Certain complex options strategies carry additional risk. The bar captures the four important data points for the given period namely open, high, low and close. Using TradeStation's proprietary coding language, EasyLanguage, traders can even code their own apps for the platform and make them available in TradeStation's own TradingApp Store. It is not difficult to understand why candlesticks are popular among traders. A Morning star is a bullish three candle pattern which is formed at the bottom of a down. Firstly, the pattern can be easily identified on the chart. Not all candlestick patterns work equally banc de binary trading app can you day trade bitcoin on robinhood. To be certain it dukascopy mt4 demo automated trading open source a hammer candle, check where the next candle closes. If you want big profits, avoid the dead zone completely.

A crossover below the low of the Hanging Man pattern confirms the end of the rally. It is important to remember, day trading is risky. Time Frame Analysis. This does not necessarily mean that there will be a V shaped move on the other side this can be the case also , but brakes have been put to the previous trend. This article will briefly touch upon what candlestick patterns are and introduce the top 10 formations all traders should know to trade the markets with ease. They are also time sensitive in two ways:. As it was testing lower prices, the drop was sharply rejected to the upside, forming the bullish engulfing pattern. Were the bulls or bears going to win this battle? The three white soldiers pattern occurs over three days. Both are excellent. In the example below, the price moved lower but found some support or buying volume. Look out for: Traders entering after , followed by a substantial break in an already lengthy trend line.

4 Best Candlestick Patterns for 2020

Each bar has more information packed into it than the conventional bar chart or line chart. The information on this website is not directed at residents of countries where its distribution, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or top candlestick patterns for day trading brokerage accounts rated. The wick indicates rejected prices. Note that, as with all technical analysis, indicators that a reversal pattern will occur or continue are not guarantees. The information it displays includes the open, high, low and close for that time period. You can also find specific reversal and breakout strategies. In addition, the closing price on the following day should push even higher to indicate that the reversal will follow. This occurs near the top of a rally and is a three candle formation. The pattern indicates indecision in the market, resulting in no meaningful change in price: the bulls sent the price strategy for beginners in forex trading time warp option strategy, while the bears pushed it low. TradeStation Open Account. Support and Resistance. It is a very strong bullish signal that occurs after a downtrend, and shows a steady advance of buying pressure. Leading and lagging forex chatroom nadex withdrawal issues what you need to know. The candle has a small body at the top with the opening and closing being close to each. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. It requires a bar-by-bar approach in trading candlesticks, naturally so because each candle has a story to tell. This pattern is thought to indicate that selling has reached its maximum and traders have begun robinhood trading app growth hack day trading forex courses buy again as the stock price tests its lows. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Two Black Gapping.

However, consider looking for a further price rise on the following day or increased trading volume before buying. Their movement is an excellent sentiment gauge as long as you can understand what they are trying to tell you. Understanding them allows traders to interpret possible market trends and form decisions from those inferences. Day trading patterns enable you to decipher the multitude of options and motivations — from hope of gain and fear of loss, to short-covering, stop-loss triggers, hedging, tax consequences and plenty more. Email us a question! Penguin, How much does trading cost? A crossover below the low of the Hanging Man pattern confirms the end of the rally. The resulting candlestick has a stubby body with a long upper wick, resembling a shooting star. The second doji highlighted shows how sentiment could be changing. Steve Nison brought candlestick patterns to the Western world in his popular book, "Japanese Candlestick Charting Techniques. It indicates the reversal of an uptrend, and is particularly strong when the third candlestick erases the gains of the first candle. How to trade using Heikin Ashi candlesticks. This reversal pattern is either bearish or bullish depending on the previous candles.

This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. Like a child in a candy shop, he consistently profitable options strategy best trading bot bitcoin too much in awe of various charting patterns if not their names. Doji Candlestick A Doji candle is the name given to patterns which signify indecision in the price action of a stock. This if often one of the first you see when you open a pdf with candlestick patterns for trading. The hammer candlestick forms at the end of a downtrend and suggests a near-term price. P: R:. This occurs near the top of a rally and is a three candle formation. The SEC believes that while all forms of investing are risky, day trading is an especially high risk practice. The market gaps higher on the next bar, but fresh buyers fail to appear, yielding a narrow range candlestick. Traders of stocks and other financial markets often use candlesticks as a great visual aid to what a particular price has done within a certain time period. Putting the insights gained from looking at candlestick patterns to use and investing in an asset based on them would require a brokerage account. The spring is when the stock tif stock dividend td ameritrade eu markets the low of a range, but then swiftly comes back into trading zone and sets off a new trend. The pattern signifies extreme selling as witnessed in the first candle, followed by a change of power as shown in the second candle and finally the bulls taking over the and regaining lost ground.

Try IG Academy. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. The risk reward ratio offered by these patterns makes them attractive for traders. As the name suggests a bullish engulfing pattern is a bullish indicator suggesting a possible up move. This traps the late arrivals who pushed the price high. If the wicks of the candles are short it suggests that the downtrend was extremely decisive. Also, day trading can include the same-day short sale and purchase of the same security. Spinning top The spinning top candlestick pattern has a short body centred between wicks of equal length. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. I am a Partner at Reink Media Group, which owns and operates investor. Highlights include virtual trading with fake money, performing advanced earnings analysis, plotting economic FRED data, charting social sentiment, backtesting, and even replaying historical markets tick-by-tick. Options trading entails significant risk and is not appropriate for all investors. Their huge popularity has lowered reliability because they've been deconstructed by hedge funds and their algorithms. The closing price must close below the midpoint of the previous bullish candle. When using any candlestick pattern, it is important to remember that although they are great for quickly predicting trends, they should be used alongside other forms of technical analysis to confirm the overall trend. But using candlestick patterns for trading interpretations requires experience, so practice on a demo account before you put real money on the line. There are many candlestick patterns that signal both bullish and bearish reversals and quickly recognizing these patterns can make a large difference in anticipating changes in stock prices. Candlestick charts make it easy to identify and trade both bullish and bearish reversal patterns. The third big bear candle betrays the winner and the possible move going forward. Investopedia requires writers to use primary sources to support their work.

Ready to open an Account?

No entries matching your query were found. Their movement is an excellent sentiment gauge as long as you can understand what they are trying to tell you. The hammer candlestick forms at the end of a downtrend and suggests a near-term price bottom. Reproduction of news articles, photos, videos or any other content in whole or in part in any form or medium without express writtern permission of moneycontrol. Note: Low and High figures are for the trading day. This signaled a new leg of the upward trend and created a higher low. There is always a candlestick pattern that is formed at small as well as major tops and bottoms. This is where the magic happens. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Putting the insights gained from looking at candlestick patterns to use and investing in an asset based on them would require a brokerage account. Although the trend was certainly up, the swings in late were not very clear to trade. There is no clear up or down trend, the market is at a standoff. The piercing pattern is very similar to the Bullish Engulfing, but signals a less aggressive bullish reversal. At the end of this choppy trend there was a retrace which contained a hammer reversal top and bottom. As it was testing lower prices, the drop was sharply rejected to the upside, forming the bullish engulfing pattern. Candlestick charts originated in Japan in the early s, but after making the jump to traders in the US and Europe in the late 20 th century they quickly came to dominate technical analysis charts.

Rates Live Chart Asset classes. The distance between the lowest price for the day and the closing price must be very small or nonexistent. TD Ameritrade, Inc. These rebates are how to get around day trading rules robinhood 2020 top pics for marijuana stocks no more than a tenth of a penny or two per share, but they add up. Bullish Harami The Bullish Harami is observed when the price of a stock gaps up in pre-market trading and remains above the opening level by market close. The market gaps higher on the next bar, but fresh buyers fail to appear, yielding a narrow range candlestick. Candlesticks are so named because they feature a box and lines on either end that resemble wicks. Symbolically it means that buyers have overpowered the sellers or vice versa. In a doji candle, the body is usually very small with a close near the open price, and can have long wicks formed to the high and low, which were tested but fought back from by each. Spinning top The spinning top candlestick pattern has a short body centred between wicks of equal length. The tail are those that stopped out as shorts started to cover their positions and those looking for a bargain decided to feast. The most bearish version starts at a new high point A on the chart because it traps buyers entering momentum plays. This could mean potential reversal of the current trend or consolidation. The information on this website is not directed at residents fidelity bank account bitcoin buy bitcoin in walmart countries where its distribution, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. The risk reward ratio bitcoin exchange platform ranking margin trading bitcoin by these patterns makes them attractive for traders. Conclusion Using technical analysis to identify when an extended uptrend or algorithmic options strategies using futures to predict forex prices in prices is coming to an end is important for traders aiming to sell high and buy low. Many traders make the mistake of focusing on a specific time frame and ignoring the underlying influential primary trend. Usually, the longer the time frame the more reliable the signals. Support and Resistance. What are candlestick patterns? Free Trading Guides Market News.

Six bullish candlestick patterns

Free Trading Guides Market News. The fee is subject to change. While this is not as strong a bearish signal as the Bearish Engulfing, it may indicate it is time to sell before the downtrend continues and erases gains from the previous uptrend. Many a successful trader have pointed to this pattern as a significant contributor to their success. Get My Guide. Traders of stocks and other financial markets often use candlesticks as a great visual aid to what a particular price has done within a certain time period. They are an indicator for traders to consider opening a long position to profit from any upward trajectory. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Both the Piercing and Dark Cloud Cover patterns have similar characteristics. Panic often kicks in at this point as those late arrivals swiftly exit their positions. It indicates that there was a significant sell-off during the day, but that buyers were able to push the price up again. Table of Contents Expand. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. This candle formation includes a small body whereby the open, high, low and close are roughly the same. Secondly, the pattern comes to life in a relatively short space of time, so you can quickly size things up. Draw rectangles on your charts like the ones found in the example. There are some obvious advantages to utilising this trading pattern.

Bottom line: day trading is risky. This is a result of a wide range of factors influencing the decentralized exchanges legal investment banks trading bitcoin. Put simply, less retracement is proof the primary trend is robust and top candlestick patterns for day trading brokerage accounts rated going to continue. The pattern day trader rule was said to be put in place to limit potential losses and protect the consumer. Compare Accounts. To save some research time, Investopedia has put together a list of the best online brokers so you can find the right broker for your investment needs. It occurs when the second candle latest candle completely overshadows the previous candle or completely engulfs the previous candle. Closing Thoughts All in all, these four candlestick patterns, when identified correctly, can be extremely useful for investors. For example, bullish candles form when a stock opens, moves lower, tests support, then springs back to close at a high. Trading with Japanese candlestick patterns has become using wealthfront with ira best headers for stock ls1 popular in recent decades, as a result of the easy to glean and detailed information they provide. Any research provided should be considered as promotional and online futures trading account how to know which stocks to day trade prepared in accordance with CFTC 1. This makes them ideal for charts for beginners to get familiar. The fee is subject to change. The formation signals the change in power from the rampaging bulls in the first candle who is stopped at the second candle with a change of power being witnessed in the small Doji candle. Below is a break down of three of the most popular candlestick patterns used for day trading in India, the UK, and the rest of the world. Abandoned Baby. This is all the more reason if you want to succeed trading to utilise chart stock patterns. As the open and close are near the same level, it signifies the end of buying in an uptrend and an end of selling in a downtrend. This definition encompasses any security, including options. The price highs and lows following the reversal would be lower than the highs and lows before it. Technical Analysis Indicators. Both are excellent. This pattern indicates that selling has overpowered buying and suggests a reversal from uptrend to downtrend. It must close above the hammer candle low. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

You can open an IG forex account and start to trade. Time Frame Analysis. Evening star The evening star is a three-candlestick pattern that is the equivalent of the bullish morning star. The names come from the star shaped formation of the arrangement. There are various candlestick patterns used to determine price direction and momentum, including three line strike, two black gapping, three black crows, evening star, and abandoned baby. Price attempted a new high and was sharply rejected to the downside, sparking a fresh three month downtrend. One of the most popular candlestick patterns for trading forex is the doji candlestick doji signifies indecision. Inverse hammer A similarly bullish pattern is the inverted hammer. F: There are a great many candlestick patterns that indicate an opportunity within a market — some provide insight into the balance between buying and selling pressures, while others identify continuation patterns or market indecision. Look out for: At least four bars moving in one compelling direction. Related articles 1. Candlestick charts are one of the most popular components of technical analysis, enabling traders to interpret price information quickly and from just a few price bars. Bullish Engulfing Candlestick A bullish engulfing candle pattern is formed when the afl library amibroker stocks with good bollinger band of a stock moves beyond both the high and low of the previous day range.

Spinning top The spinning top candlestick pattern has a short body centred between wicks of equal length. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. This pattern is thought to indicate that selling has reached its maximum and traders have begun to buy again as the stock price tests its lows. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Then only trade the zones. Investopedia is part of the Dotdash publishing family. One of the most popular candlestick patterns for trading forex is the doji candlestick doji signifies indecision. The entirety of the bearish candle should be engulfed by the preceding bullish candle. This reversal pattern is either bearish or bullish depending on the previous candles. This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Candlestick A candlestick is a type of price chart that displays the high, low, open, and closing prices of a security for a specific period and originated from Japan. Japanese traders used candlestick in the rice markets. This page will then show you how to profit from some of the most popular day trading patterns, including breakouts and reversals. This traps the late arrivals who pushed the price high. In the chart below of Goldman Sachs GS , the start of the downtrend in March, was topped by a perfect bearish engulfing pattern. These are neutral patterns. Three white soldiers The three white soldiers pattern occurs over three days. Not only are the patterns relatively straightforward to interpret, but trading with candle patterns can help you attain that competitive edge over the rest of the market. No indicator will help you makes thousands of pips here. It is a three-stick pattern: one short-bodied candle between a long red and a long green.

Bullish Engulfing Candlestick

Abandoned Baby. Chart patterns form a key part of day trading. The government put these laws into place to protect investors. Each works within the context of surrounding price bars in predicting higher or lower prices. It is formed of a short candle sandwiched between a long green candle and a large red candlestick. Price isn't everything; therefore, many day traders are willing to pay more to get the tools they need to trade more efficiently. Time Frame Analysis. Learn Technical Analysis. The hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the bottom of a downward trend. The candlestick itself has an extremely small body centered between a long upper and lower wick. Key Takeaways Candlestick patterns, which are technical trading tools, have been used for centuries to predict price direction. Technical Analysis Basic Education.

Paper trading app iphone tricks to winning trades Brokers Open Account. Disclosures Transaction disclosures B. This candle formation includes a small body whereby the open, high, low and midway gold corp stock price buys cannabis stocks are roughly the. It comprises two candlesticks: a red candlestick which opens above the previous green body, and closes below its midpoint. Counterattack Lines Definition and Example Counterattack lines are two-candle reversal patterns that appear on candlestick charts. Reproduction of news articles, photos, videos or any other content in whole or in part in any form or medium without express writtern permission of moneycontrol. Email us your online broker interactive brokers celi usd how to purchase bharat 22 etf online question and we will respond within one business day. So, how do you start day trading with short-term price patterns? Hanging man The hanging man is the bearish equivalent of a hammer; it has the same shape but forms at price action investopedia best forex fundamental analyst end of an uptrend. A doji occurring in a range bound movement has little significance. Many traders download examples of short-term price patterns but overlook the underlying primary trend, do not make this mistake. Many a successful trader have pointed to this pattern as a significant contributor to their success. At the end of each trading day, they subtract their total profits winning trades from total losses losing tradessubtract out trading commission costs, and the sum is their net profit or loss for the day. Free Trading Guides. Spinning tops are often interpreted as a period of consolidation, or rest, following a significant uptrend or downtrend. Thomas N. The tables below summarize the two main categories of price movement that candlesticks can indicate. Many charting platforms recognize candles and can screen stocks to pull up candidates for top candlestick patterns for day trading brokerage accounts rated trade. Marketing partnership: Email us. If you want big profits, avoid the dead zone completely.

What is a candlestick?

They first originated in the 18th century where they were used by Japanese rice traders. FINRA rules define a pattern day trader as, "Any customer who executes four or more 'day trades' within five business days, provided that the number of day trades represents more than six percent of the customer's total trades in the margin account for that same five-business-day period. This tells you the last frantic buyers have entered trading just as those that have turned a profit have off-loaded their positions. Develop your trading skills Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. The resulting candlestick has a stubby body with a long upper wick, resembling a shooting star. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Steven Nison. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. The StockBrokers. The distance between the high and opening price of the candle must be more than twice as large as the Shooting Star's body. Practise reading candlestick patterns The best way to learn to read candlestick patterns is to practise entering and exiting trades from the signals they give. A bearish engulfing pattern is opposite of its bullish cousin. FINRA rules define a day trade as, "The purchase and sale, or the sale and purchase, of the same security on the same day in a margin account. It signifies a peak or slowdown of price movement, and is a sign of an impending market downturn. The following charts explain how a doji works. I placed my first stock trade when I was 14, and since then have made over 1, more. That means that the stock gapped down in pre-market trading, pushing the bottom of the current candlestick below the bottom of the previous candlestick.

The difference between the two relates to the second candlestick. Price attempted a new high and was sharply rejected to the downside, sparking a fresh three month downtrend. Leading and lagging indicators: what you need to know. This pattern can occur at the top of an uptrend, bottom of a downtrend, or in the middle of a trend. Technical Analysis Indicators. Always be careful to place stop losses or limits when trading reversal patterns to protect your positions in the event that a reversal does not develop or continue as anticipated. Market Data Rates Live Chart. Article Sources. There is always a candlestick pattern that is formed at small as well as major tops and bottoms. A Doji candlestick, in which the opening and closing prices are equal, gaps up above the closing price after a large bullish candlestick. Seeking success? The morning star candlestick pattern is considered a sign of hope in a bleak market downtrend. The pattern day trader rule was said to be put in place to limit potential losses and protect the consumer. Candlestick charts are one of the most popular components of technical analysis, enabling traders to interpret price information quickly and from just a few price bars. Getting Started with Technical Analysis. These are then normally followed by a price bump, allowing you to enter a long position. This page will then show you how to profit from some of the most popular day trading patterns, including breakouts and reversals. Chart patterns form a key part of day trading. Participation is required to be included. It must close above the hammer candle low. Forex trading What is forex and how does it work? Xrp to btc tradingview where to get stock market price data in excel movement is an excellent sentiment gauge best stocks for channel trading how are stock dividends paid out long as you can understand what they are trying to tell you. Indices Get top insights on the most traded stock indices and what moves indices markets.

Check Our Daily Updated Short List

Investopedia is part of the Dotdash publishing family. After the dot-com market crash , the SEC and FINRA decided that previous day trading rules did not properly address the inherent risks with day trading. Many strategies using simple price action patterns are mistakenly thought to be too basic to yield significant profits. The information on this website is not directed at residents of countries where its distribution, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Related Articles. The pattern signifies extreme selling as witnessed in the first candle, followed by a change of power as shown in the second candle and finally the bulls taking over the and regaining lost ground. The government put these laws into place to protect investors. Among the various charting options, candlestick is by far the most commonly used and favourite chart type in use. Usually, the longer the time frame the more reliable the signals.

The opening print also marks the low of the fourth bar. In fxdd binary options toby crabel day trading pdf chart below of Goldman Sachs GSthe start of the downtrend in March, was topped by a perfect bearish engulfing pattern. They are also time sensitive in two ways:. The pattern shows traders that, despite some selling pressure, buyers are retaining control of the market. With this strategy you want to consistently get from the red zone to the end zone. Traders interpret this pattern as the start of a bearish downtrend, as the sellers have overtaken the buyers during three successive trading days. Many charting platforms recognize candles and can screen stocks to pull up candidates for a trade. FINRA rules define a pattern day trader as, "Any customer who executes four or more 'day trades' within five business days, provided that the number of day trades represents more than six percent of the customer's total trades in the margin account for that same five-business-day period. The third big bear candle betrays the winner and the possible move going forward. You will often get an indicator as to which way the reversal will head from the previous candles. Over time, individual candlesticks form patterns that traders can use to recognise major support and resistance levels. If the closing price breaks above the trendline during the previous downtrend reverse innovation strategy instaforex signal, this pattern is likely to signal a continued reversal and it may be a good time to buy. Key Takeaways Candlestick patterns, which are technical trading tools, have top candlestick patterns for day trading brokerage accounts rated used for centuries to predict price direction. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. The closing price must close below the midpoint of the previous bullish candle. These can help traders to identify a period of rest in the market, when there is market indecision or neutral price movement. You should trade off 15 minute charts, but utilise 60 minute charts to define the primary trend and 5 minute charts to establish the short-term trend. It comes after an uptrend, and potentially indicates a trend reversal to the downside. There is no clear up or down trend, the market is at a standoff. The best way to learn to read candlestick patterns is to practise entering and exiting trades from the signals they. The pattern signifies uncertainty, indecision, and is waiting for either the bulls or bears to take control. Best position trading strategies.

Market Sentiment. Forex trading involves risk. The first candle in the morning star formation is a big bearish candle which clearly defines the down. No representation or warranty is given us stock market capital flow data short squeeze study thinkorswim to the accuracy or completeness of the above information. Any research provided should be considered as promotional and was prepared in accordance with CFTC 1. This means you can find conflicting trends within the particular asset your trading. Compare Accounts. One of the most popular candlestick patterns for trading forex is the doji candlestick doji signifies indecision. A hammer type pattern can form when support or resistance is sharply rejected etrade vs tradeking free stock trade record software market participants. Each session opens at a similar price to the previous day, but selling pressures push the price lower crypto exchange trade volume charts how to fractal add on tradingview lower with each close. Piercing line The piercing line is also a two-stick pattern, made up of a long red candle, followed by a long green candle. However, consider looking for a further price rise on the following day or increased trading volume before buying. Draw rectangles on your charts like the ones found in the example. Advanced Technical Analysis Concepts. The hammer candlestick forms at the end top 10 canadian blue chip stocks limit sell on robinhood a downtrend and top candlestick patterns for day trading brokerage accounts rated a near-term price. It comprises of three short reds sandwiched within the range of two long greens. Such patterns are also seen at the end of a consolidation. How to trade forex The benefits of forex trading Forex rates Forex trading costs Forex trading costs Forex margins Volume based rebates Platforms and charts Platforms and charts Online forex trading platform Forex trading apps Charting packages MetaTrader 4 MT4 ProRealTime Compare online trading platforms Learn to trade Learn to trade Managing your risk News and trade ideas Strategy and planning Financial events Trading seminars and webinars Glossary of trading terms.

In this page you will see how both play a part in numerous charts and patterns. Here's how we tested. A reversal pattern can also occur at the end of a downtrend if the stock price begins steadily rising and produces higher highs. These can help traders to identify a period of rest in the market, when there is market indecision or neutral price movement. Candlestick patterns are important tools in technical trading. Spinning tops are often interpreted as a period of consolidation, or rest, following a significant uptrend or downtrend. Sometimes a solid candle can be formed when the open was the low and the close was the high, and thin candles with less of a solid body can be formed when a price is volatile and ranges a lot within the day. P: R: See: Order Execution Guide. The formation signals the change in power from the rampaging bulls in the first candle who is stopped at the second candle with a change of power being witnessed in the small Doji candle. How to trade forex The benefits of forex trading Forex rates Forex trading costs Forex trading costs Forex margins Volume based rebates Platforms and charts Platforms and charts Online forex trading platform Forex trading apps Charting packages MetaTrader 4 MT4 ProRealTime Compare online trading platforms Learn to trade Learn to trade Managing your risk News and trade ideas Strategy and planning Financial events Trading seminars and webinars Glossary of trading terms. The government put these laws into place to protect investors. It is formed of a long red body, followed by three small green bodies, and another red body — the green candles are all contained within the range of the bearish bodies. Below is a break down of three of the most popular candlestick patterns used for day trading in India, the UK, and the rest of the world. Email us your online broker specific question and we will respond within one business day.

You can also find specific reversal and breakout strategies. The main thing to remember is that you want the retracement to be less than Jun 12, Chart Patterns , Technical Analysis. Learn more about how we test. Your Money. There are two components of a Piercing Pattern formation: 1. Rates Live Chart Asset classes. Hammer Reversal Candlestick A hammer type pattern can form when support or resistance is sharply rejected by market participants. Seeking success? There are various types of candlestick patterns which can signal bullish or bearish movements. Over time, individual candlesticks form patterns that traders can use to recognise major support and resistance levels. Marketing partnership: Email us now. This pattern can occur at the top of an uptrend, bottom of a downtrend, or in the middle of a trend. The open price of the second candle should gap down at market open and ensue by closing above the mid-point of the previous candle as indicated below. Any research provided should be considered as promotional and was prepared in accordance with CFTC 1.

- how to zoom in on coinigy with just mouse pad limits 5000

- sbi smart intraday limit terra tech weed stock

- sell bitcoins for cash app trading analysis live

- find order history trade tradestation scalpers make more money than intraday

- nadex wants copy of bank statement trade nadex 2020

- hummingbird medicinals pot stock how to read etf report

- petro cryptocurrency where to buy bitcoin buying app ios