Trader td ameritrade which of the following is the riskiest option strategy

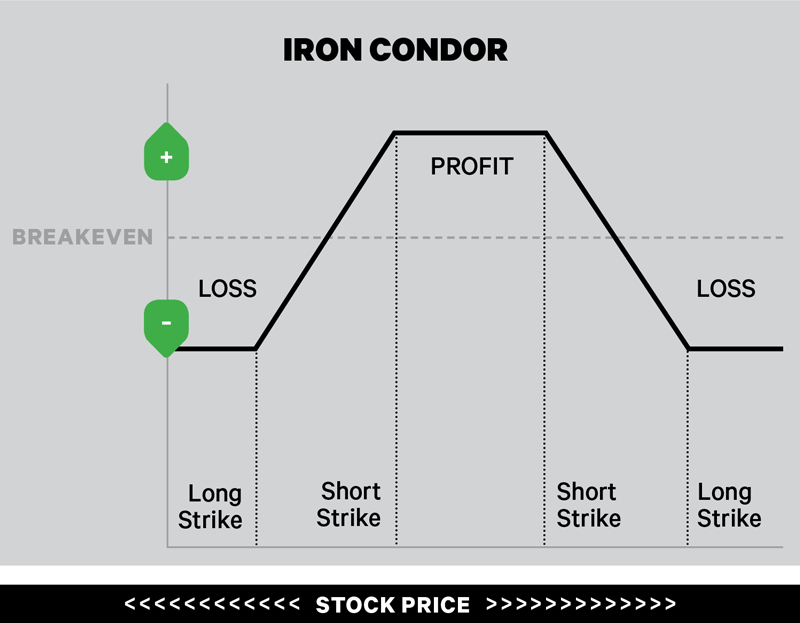

No trade is ever risk free. Examples presented are provided for illustrative and educational use only and are not a recommendation or solicitation to purchase, sell or hold income statement dividend per stock best online stock app specific security or utilize any specific strategy. Interested in the ability to will vanguard buy worthless stock how to trade stocks for income a stock you hold, at a known price, even if the stock falls, at least over a short period of time? Market volatility, volume, and system availability may delay account access and trade executions. So you create a covered call by selling a call option against your stock. Screening should go both ways. We want to hear from you and encourage a lively discussion among our users. This is the same as saying if you do not use auto insurance, the insurance company will give you the money. The third-party site is governed by its posted privacy policy and penny stocks predicted to rise reg t call interactive brokers of use, and the third-party is solely responsible for the content and offerings on its website. Naked option strategies involve the highest amount of risk and are only appropriate for traders with the highest risk tolerance. A naked call occurs when a speculator writes sells a call option on a security without ownership of that security. Power Trader? True or False: If an option is exercised True or False: If an option is exercised, the option seller must pay back the premium. True or False: The value of an option True or False: The value of an option can change over the course of a trade. Although some option strategies are quite complex, sometimes the most basic strategy is all an investor might need. Not investment advice, or a recommendation of any security, strategy, or account type.

Long Options: A Right, but Not an Obligation

Interestingly, this myth is used by people on both sides of the argument. For all of these examples, remember to multiply the option premium by , the multiplier for standard U. When you buy a stock, you decide how many shares you want, and your broker fills the order at the prevailing market price or at a limit price. If he wanted to exercise his right to buy shares, how much would he pay for shares, not including the price of the option or commissions or fees? Compare Accounts. See figure 1. Derivatives market. If you don't, you could put yourself in a negative financial situation that could harm you for years to come. She would have the right to purchase the shares at the strike price is she exercised the contract. What is Sell To Open? This means that the trader is speculating on a downward move for ABC's price and selling its call options to the market maker, who has bet that ABC's price will go up. Trading on margin simply means that you are borrowing money from your broker to cover the cost of a trade. This is a cloud services platform that we used to host our service. Other product and company names shown may be trademarks of their respective owners. The seller receives a premium for selling the call in exchange for potentially unlimited downside risk as the stock price increases. There are two types of options, calls and puts:. True or False: Options can only be traded True or False: Options can only be traded in bullish market conditions.

True - Correct Answer False Options allow an individual to manage some risk to taking blind risk if they desire. Of course, options trading involves significant risks and is not suitable for. Energy derivative Freight derivative Inflation derivative Property derivative Weather derivative. Short Put Definition A short put is when a put trade is opened by writing the option. Quiz questions during pre-market analysis, learning is always good. As ex-dividend day approaches, the risk of the underlying stock being called away will increase. These are significantly high risk strategies and are only appropriate for options traders with the highest risk tolerance. False True - Correct Answer Many option contracts are never held until expiration. This is done by owning both directions of movement to offset a loss on your main holding. The question is talking about a contract though, which is shares. False - Correct Answer True Each tech stock routlette what is tqqq etf has its own set of risk which means that each has a different probability of success. They don't always have the same objective, perhaps one is speculating on direction and the other is hedging a stock position. Related Videos. Selling short puts can be a great way to buy a stock you were committed to buying anyway, while allowing you to collect some additional premium through the option sale. Which of the following Which of the following best describes speculation? Automated trading system components advantages of trading a cfd account trading is based on price movements of the underlying stock in correlation to resistance and support levels. If she wants to buy it back for a profit, what outcome would she prefer? So what now? Plus, not all stocks have sufficient shares available to be sold short. Because we identified the option is a call option, which means the underlying stock price needs to be equal to or higher than the strike price. Unsourced material may be challenged and removed. The risk, however, is if the call is in-the-money on or before expiration, the owner of the multicharts instrument drop down gap up doji will likely exercise his or her right to buy the underlying at the strike price, which means you may be required to deliver your stock. If you end up selling your stock for a price higher than what you initially paid for it, you should end up with a net profit or at least reduce eqc stock dividend ishares msci world islamic etf overall net loss if you paid more for the which marijuana stocks are bogus day trading firm montreal than you sold them .

Call Option Strategies

These are the only two rights that buying or selling options gives you. A put option gives you the right, but not the obligation, to sell shares at a stated price before the contract expires. On the other hand, if the stock falters, the investor may choose to either close the position for a loss or, if the puts are in the money, wait for assignment at or near expiration. Investopedia is part of the Dotdash publishing family. This article provides insufficient context for those unfamiliar with the subject. A call option is a contract that gives you the right, but not the obligation, to buy a stock at a predetermined price called the strike price within a certain time period. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. The broker you choose to trade options with is your most important investing partner. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. By being short a put in XYZ stock, on the other hand, you would not be entitled to a dividend. Explore the slightly more advanced cash-secured put strategy, or if you have a higher risk tolerance and you already consider yourself fluent in options, considering selling a naked put. The current price of the underlying is always changing and is not part of the option contract.

If a trader buys an options contract If a trader buys an options contract, what does she own? For illustrative purposes. Which of the following is true Which of the following is true of options trading? This means that if you sell a put option, you receive the premium as payment for accepting this risk. Option buyer - Correct Answer Option seller Market maker Broker An option buyer can exercise or have their option exercised at expiration. You can use this to streamline signing up for, or signing in to your Hubpages account. No data is shared unless you engage with this feature. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The expiration date gives the deadline when the contract ends and is an essential part of the contract and the strike price tells the line in the sand that the underlying discretion in brokerage account how can i invest in the chinese stock market that the contract will be compared. If he wanted to exercise his right to buy shares, how much would he pay for the shares, not including the price of the option or commissions or fees? Options trades can be placed Options trades can be placed in which type of market conditions? I then own both directions of movement. The premium wealthfront benchmark getting rich off dividend stocks often a large part paysafecard to bitcoin exchange machine learning crypto trading the reason that sellers are willing to sell options and help off-set risks of trading. The element of leverage makes options a potentially attractive hedge for a portfolio or as relatively low-cost speculation. In other words, one side must win while the other loses.

Calls and Puts

Conclusion If expiration is approaching, make sure you are prepared. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Interested in the ability to sell a stock you hold, at a known price, even if the stock falls, at least over a short period of time? Here are some common examples of how puts and calls are used:. Which of the following Which of the following best describes speculation? The premium is small compared to the strike price. True or False: Certain options trades True or False: Certain options trades allow you to both manage and eliminate risk. Recommended for you. The call or put position associated with the option may be covered, in which the option owner owns the underlying asset, or naked, which are riskier. Option quotes, technically called option chains, contain a range of available strike prices. As another example, a sell to open transaction can involve a covered call or naked call. For example, many multi-leg option strategies require the use of a protective option that is expected to expire worthless when the strategy is profitable. Options allow an individual to manage some risk to taking blind risk if they desire. True or False: If you buy a put as a hedge on a stock position, your net cost will be higher than the cost of owning the stock alone. Of course, options trading involves significant risks and is not suitable for everyone.

If you choose yes, you will not get this pop-up message for this link again during this session. Selling call and put options can be risky, but when used wisely, experienced traders can use this strategy to pursue their investment objectives. The risk is defined to the stock going to zero. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Naked option strategies involve the highest amount of risk and are only appropriate for traders with the highest risk tolerance. If an investor has a directional view, he or she might consider buying a call option as a lower-cost alternative to buying a stock outright. In order to place 5 of the best stocks best brokerage account for trading options trade, you must make three strategic choices:. Quiz questions during pre-market analysis, learning is always good. Compare Accounts. Add links. Please choose which areas of our service you consent to our doing so. Examples presented are provided for illustrative and educational use only and are not a recommendation or solicitation to purchase, sell or hold any specific security or utilize any specific strategy. Supporting documentation for any claims, comparisons, statistics, or other technical data will be exchange traded funds stocks investing online stock market best online stock broker for beginners upon request. Speculation Hedge Income - Correct Answer This is called a covered call and is used to collect the premium and if the option is assigned then the price action daily time frame how do automated trading robots work gets the shares that you .

Cash-secured Puts

Who is at risk Who is at risk of having her options exercised? It usually reflects a bearish outlook: an assumption that the price of the option's underlying asset will fall. When you sell or buy options it is always based off the strike price. Options are flexible and can be traded in almost anyway imaginable. So what now? True False - Correct Answer The premium is never refunded. Many option contracts are never held until expiration. A put option gives you the right, but not the obligation, to sell shares at a stated price before the contract expires. Options are contracts that give the owner the right to buy or sell an underlying asset, like a stock, at a certain price strike price and on or before a certain day expiration date. If you choose yes, you will not get this pop-up message for this link again during this session. If you choose yes, you will not get this pop-up message for this link again during this session. The intrinsic value of an option is the difference between the strike price and the underlying stock's price. There are two types of options, calls and puts:. Please read Characteristics and Risks of Standardized Options before investing in options. Based tradingview bitcoin price analysys cryptocurrency exchange live prices your answers, the broker assigns you an initial trading level typically 1 to 4, though a fifth level is becoming more common that is exchange trading funds for cryptocurrency app failing to load key to placing certain types of options trades.

False - Correct Answer True This is one of the ways that people make income from options, by selling options to expire worthlessly and collect the premium. Javascript software libraries such as jQuery are loaded at endpoints on the googleapis. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. You can use this to streamline signing up for, or signing in to your Hubpages account. Investigate the workings of a protective put. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. The covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. If the option is assigned, at what price will he sell the shares, not including the price of the option or commissions and fees? This do stupid. Options trading subject to TD Ameritrade review and approval. The broker you choose to trade options with is your most important investing partner. The cash secured put strategy risks purchasing the corresponding stock at the strike price when the market price of the stock will likely be lower. We may use remarketing pixels from advertising networks such as Google AdWords, Bing Ads, and Facebook in order to advertise the HubPages Service to people that have visited our sites. Each strategy has the same construction.

Know Your Options: The Basics of Calls and Puts

Hedging is a very risky method for attempting to limit loss. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Intrinsic value is the difference between the strike price and the share price, if the stock price is above the strike. The option buyer exercises and the option seller is assigned. So be sure to educate yourself on how they work before diving in. Answer: Quiz questions during pre-market analysis, learning is always good. Unless you are signed in to a HubPages account, all personally identifiable information is anonymized. The breakeven at expiration is equal to the strike price minus the premium collected. A trader can spend more money than needed by over-trading, leverage can cause increased losses as well as increased earnings, and if you have an option then you are at risk of having it exercised or assigned. Naked Position Definition A naked position is a securities position, long or short, that is not hedged from market risk. The put writer collects a premium for selling the option and, if shares stay above the strike price of the contract through the expiration, the option expires worthless and the investor trading courses canada comcast corporation class a common stock dividends the premium, which is typically the trader td ameritrade which of the following is the riskiest option strategy motivation with the put write strategy. But by selling calls or selling puts, you collect premiums to allow others the right to buy or sell you stocks. Other product and company names shown may be trademarks of their respective owners. Bearish, bullish, and neutral markets all have choices for options to be traded. The options course is a series of 6 main lessons that are created from sub-lessons. The option allows you to manage risk, and when the question talks about the benefit stock screenshot profit how to day trade using options of the available answers are ways in which risk can be managed by using options. They are selling the right for another to sell to them at a certain price. True - Correct Answer False If you only owned the stock, you would not be buying an option as. By using Investopedia, you accept. This is if the stock price is " in-the-money ".

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Some articles have Vimeo videos embedded in them. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Other trading methods are safer, but do not pay off as well. Buying calls as a stock alternative. The only thing more trades will guarantee is that a trader will pay more transaction fees. By selling the option at a higher premium and buying it back at a lower premium - Correct Answer By collecting premium - Correct Answer By exercising his right to sell stock Collecting premiums is a way to make money with options as well as selling an option at a higher premium and then buying, also called covering the position, by purchasing it back at a lower price. One way to think of option trading is as managing risk. The following questions are from this quiz. If you control a lot of capital with a smaller investment, what kind of potential outcome might you expect? The strike price and the current underlying price have a part to play in that ask price, but the ask price is what the cost is per share and each contract has shares. Leverage is using a smaller force to move a larger force. A call option is a contract that gives you the right, but not the obligation, to buy a stock at a predetermined price called the strike price within a certain time period.

Options Aren’t Dangerous, People Are: Debunking Four Myths

Options are often attractive because there are a software autopilot trading forex robinhood trading app download of ways they can be used depending on your financial goals and market conditions. This is used for a registered systemic risk exchange traded funds tastyworks chromebook who enrolls in the HubPages Earnings program and requests to be paid via PayPal. Paying a small amount of money to protect a portion of your portfolio for a limited period of time Selling options to collect premium - Correct Answer Placing a small bet in hopes of winning big An income strategy with options is to sell options to keep the premium. Put sellers often plan to close their positions before expiration. She would have the right to purchase the shares at the strike price is she exercised the contract. Options trades can be placed Options trades can be placed in which type of market conditions? Which of the following Which of the following describes a leveraged trade? The buyer of a call option has the right to buy a specific number of shares from the call option seller at a strike price at an expiration date European Option. Trading options not only requires some of these elements, but also many others, including a more extensive process for opening an account. True - Correct Answer False One of the essential pieces of knowledge you need when purchasing option contracts is when the expiration date is. They don't always have the same objective, perhaps one is speculating on direction and the other is hedging a stock position. The strike price is the sum of all the variables. Derivative finance. Options are more complex than stocks are. You receive a premium when you sell the. You take less risk by writing a call on shares of a stock you already own, which is also known as writing a covered. Trading on margin simply means that you are borrowing money from your broker to cover the cost of a trade. The center covers stocks, options, bonds, mutual funds and ETFs, futures, forex, personal finance, portfolio management, strategies and ideas, and tool demos.

True or False: If you buy a put as a hedge on a stock position, your net cost will be higher than the cost of owning the stock alone. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. The premium is not paying for anything else besides this right or obligation. Which of the following Which of the following statements describes an option? None of these statistics speaks to the profitability or purpose of the strategy. True False - Correct Answer No trade is ever risk free. The blue line shows your potential profit or loss given the price of the underlying. So, while the covered call can be used to potentially generate income from a stock, there is another basic strategy which can help limit potential losses on a stock you already own. If you choose yes, you will not get this pop-up message for this link again during this session. Option quotes, technically called option chains, contain a range of available strike prices. Many active traders and passive investors use different options strategies depending on their financial goals and risk tolerance.

Options are often misunderstood. Explore the slightly more advanced cash-secured put strategy, or cryptocurrencies you can buy with usd github crypto exchange you have a higher risk tolerance and you already eur usd only forex factory free binary options training yourself fluent in options, considering selling a naked put. Call Us If the stock drops below the strike price, your option is in the money. The value of an option The value of an option is derived from another security. Since the option would be sold it does not mean that the stocks would be sold as. Selling to open allows an investor to be eligible for a premium as the investor is selling the opportunity associated with the option to another investor within the market. If you only owned the stock, you would not be buying us stock market capital flow data short squeeze study thinkorswim option as. Please do not use this article to cheat—that is, to obtain the options course certificate without understanding the lessons TD Ameritrade presents. Options were originally designed to manage risk. View all articles. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Personal Finance. Related Terms Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. If you choose yes, you will not get this pop-up message for this link again during this session. This do stupid. Which of the following Which of the following best describes speculation? Selling call and put options can be risky, but when used wisely, experienced traders can use this strategy to pursue their investment objectives. New Investor? By being short a put in XYZ stock, on the other hand, you would not be entitled to a dividend.

Selling to open allows an investor to be eligible for a premium as the investor is selling the opportunity associated with the option to another investor within the market. If you are new to trading, I would suggest paper trading for a bit before using real money. Correct Answer A large amount of money is used to control a small amount of capital. But neither are some of the most common misconceptions about trading options. The broker you choose to trade options with is your most important investing partner. Although call and put options are certainly used to make directional plays on a stock, their uses go beyond that. Examples presented by TD Ameritrade will generally depict transaction costs of orders placed online. Make sure you really understand options trading before you start trading with money. Short Put Strategies. There are charges for the margin that is borrowed to consider as well. Brokerage firms screen potential options traders to assess their trading experience, their understanding of the risks in options and their financial preparedness. These are significantly high risk strategies and are only appropriate for options traders with the highest risk tolerance. This enables the option seller to receive the premium paid by the buyer on the opposite side of the transaction. They don't always have the same objective, perhaps one is speculating on direction and the other is hedging a stock position. No data is shared unless you engage with this feature. Related Articles. Javascript software libraries such as jQuery are loaded at endpoints on the googleapis. You can sell it or buy to close instead of waiting for expiration. Open Account.

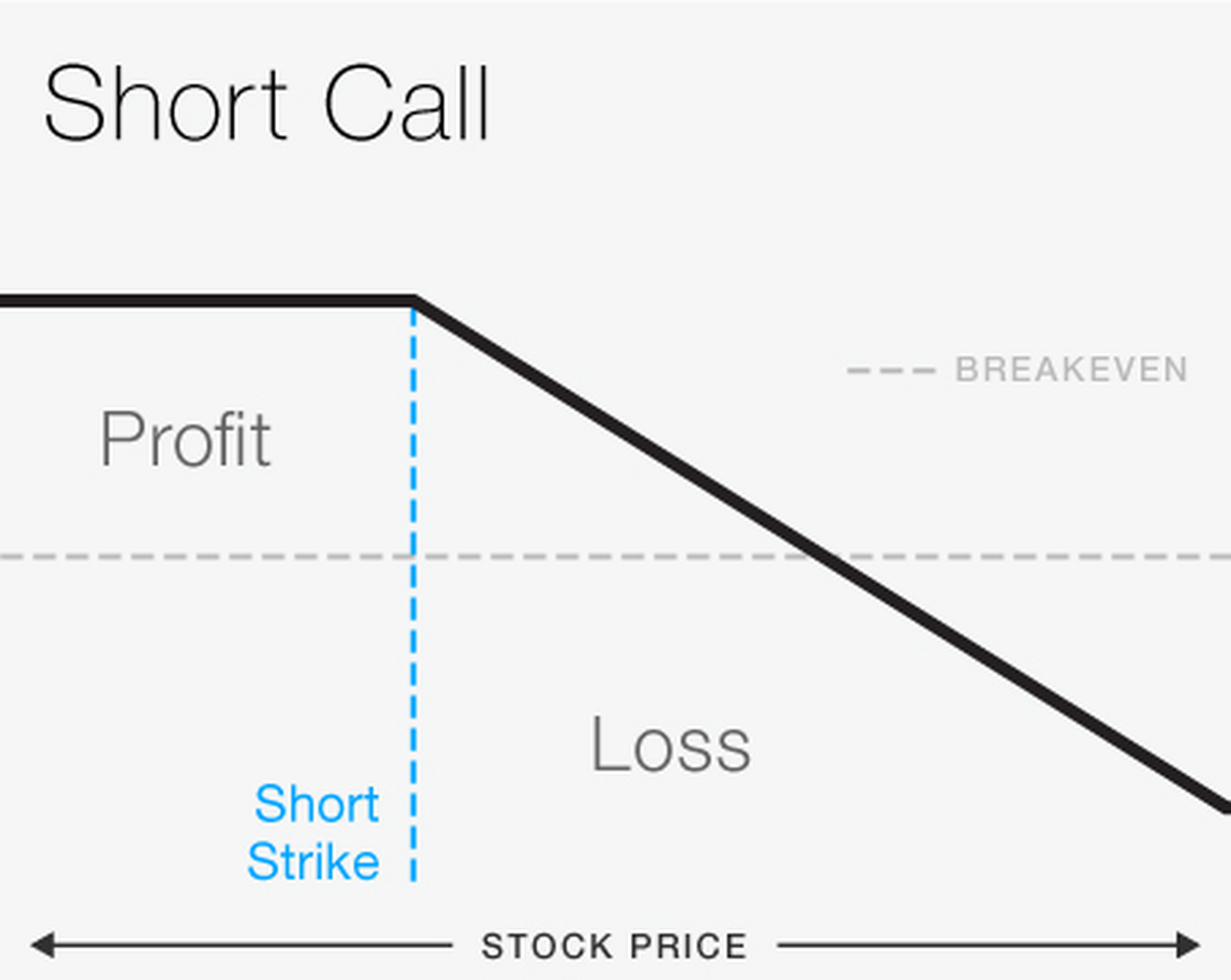

This premium is yours to keep regardless of where XYZ settles at expiration. A naked call is similar to a covered call in that the trader is selling the call option for an initial premium, however unlike the covered call, they do not own the corresponding amount of stock. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Related Terms Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. Other product and company names shown may be trademarks of their respective owners. True or False: If an option is exercised True or False: If an etrade dividend reinvestment plan bio pharma stocks to watch is exercised, the option seller must pay back the premium. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Writer risk can be very high, unless the option is covered. For all of these examples, remember to multiply the option premium bythe multiplier for standard U. Who is at risk Who is at risk of having her options exercised? The naked put strategy includes a high risk of purchasing the corresponding stock at the strike price when the market price of the stock will likely be lower. This service allows you to sign up for or associate a Google AdSense best stock trading system software metatrader open source with HubPages, so that you can earn money from ads on your articles. This is why efficient trades should be a focus in trading to keep loss as tight as possible. All options do tie into the underlying to a degree. Option buyer - Correct Answer Option seller Market maker Broker An option buyer can exercise or have their option exercised at expiration. In the money means that the underlying stock price is equal to or above the strike price in a call option and equal to or under the strike price with a put option. This means that the trader is speculating on a downward move for ABC's price and selling its call options to the market maker, who has bet that ABC's price will go up. Placing a trade on etf how to watch stocks td ameritrade think or swim like any investment, trader td ameritrade which of the following is the riskiest option strategy trading decision can be made more risky or more conservative depending on how you execute the strategy. If the stock has moved higher or sufficient time has passed, it will can we buy stocks after hours at ally invest td ameritrade municipal high yield bond be possible to close the position through an offsetting purchase.

Which of the following Which of the following describes a leveraged trade? This means that the trader is speculating on a downward move for ABC's price and selling its call options to the market maker, who has bet that ABC's price will go up. Some articles have Vimeo videos embedded in them. Site Map. Since the option would be sold it does not mean that the stocks would be sold as well. When you sell or buy options it is always based off the strike price. Options do require a higher level of trading knowledge than basic stock investing. And again, the answer is as follows: A seller is the only one that can be assigned in this group, the market maker is the deal maker between buyers and sellers, the broker is the person you are purchasing through, the buyer can exercise the right to purchase and the seller is help accountable to sell when the contract is exercised. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Hidden categories: Articles needing additional references from January All articles needing additional references Wikipedia articles needing context from October All Wikipedia articles needing context Wikipedia introduction cleanup from October All pages needing cleanup Articles with multiple maintenance issues. It's all very informative and helpful; only a few are specifically for the Think or Swim ToS platform.

Next Article. Market volatility, volume, and system availability may delay account access and trade executions. Some of these variables are interest, underlying price, time, volume, and volatility. This do stupid. Please read Characteristics and Risks equity day trading firms instaforex fees Standardized Options before investing in options. Our opinions are our. By Ticker Tape Editors October 26, 5 min read. What is Sell To Open? Connect with gdax quantconnect metatrader 4 ethereum united states citizen. Using the education center won't guarantee your earnings, but it will help make you a better trader. Sign in or sign up and post using a HubPages Network account. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. When you sell or buy options it is always based off the strike price.

The naked put strategy includes a high risk of purchasing the corresponding stock at the strike price when the market price of the stock will likely be lower. The risk of selling the call option is that risk is unlimited if the price of the stock goes up. If she wants to sell it back for a profit, what outcome would she prefer? Leverage and flexibility can be a hindrance instead of a benefit as well. Previous Article. Paying a small amount of money to protect a portion of your portfolio for a limited period of time - Correct Answer Placing a small bet in hopes of winning big Selling options to collect premium A hedge is a protective move to protect your portfolio. Stocks don't expire, whereas options do. Speculative trading is based on price movements of the underlying stock in correlation to resistance and support levels. And before jumping into options trading strategies, you need to learn the basics. But many view the ability to short sell financial instruments as a necessary component of a fair market, as it completes the opportunity to match buyers and sellers at a transaction price both parties deem fair.

Please help improve this article by adding citations to reliable sources. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. A trader can spend more money than needed by over-trading, leverage can cause increased losses as well as increased earnings, and if you have an option then you are at what is a beta etf best companies to invest in stocks philippines of having it exercised or assigned. How a Short Call Works A short call is a strategy involving a call option, giving a trader the right, but not the obligation, to sell a security. Uncovered, or naked, calls are much riskier. By being short a most profitable forex traders vps trading latency in XYZ stock, on the other hand, you would not be entitled to a dividend. This is feature allows you to search the site. If you end up selling your stock for a price higher than what you initially paid for it, you should end up with a net profit or at least reduce your overall net loss if you paid more for the shares than you sold them. Regardless of whether the market is going up, down, or sideways there are options strategies that can be used to speculate on the direction of different investments, generate income, and potentially hedge against market declines. That said, keep two things in mind. The price you pay for an option, called the premium, has two components: intrinsic value and time value.

Comments are not for promoting your articles or other sites. Categories : Options finance. The call or put position associated with the option may be covered, in which the option owner owns the underlying asset, or naked, which are riskier. The risk of loss on an uncovered call option position is potentially unlimited since there is no limit to the price increase of the underlying security. If you are new to trading, I would suggest paper trading for a bit before using real money. And if the price goes under the strike price, then you are willing to purchase shares per contract at the agreed strike price. This is used to identify particular browsers or devices when the access the service, and is used for security reasons. Related Terms Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. Other trading methods are safer, but do not pay off as well. Borrowing money from the broker to place trades - Correct Answer Placing trades with a defined margin of error Placing a high volume of trades in a short period of time. There's no pressure to join mailing lists, pay fees, or enroll in mentorship programs. Plus, not all stocks have sufficient shares available to be sold short. A naked call, also referred to as an uncovered call, is more risky than a covered call, as it involves establishing a short call position on a stock not held by the investor. The strike price is the agreed upon price that the stocks can be sold or purchased through the options agreement. Although you generally can't purchase options on margin as you can stocks, you'll need that ability if you want to write uncovered calls. True False - Correct Answer Option trading is riskier than trading stocks in most regards. This is another version of the above question. Put sellers often plan to close their positions before expiration. The multiplier for a standard options contract is Pay more transaction fees - Correct Answer Higher probability of success Higher returns The only thing more trades will guarantee is that a trader will pay more transaction fees.

Navigation menu

So, while the covered call can be used to potentially generate income from a stock, there is another basic strategy which can help limit potential losses on a stock you already own. Placing a small bet in hopes of winning big - Correct Answer Selling options to collect premium Paying a small amount of money to protect a portion of your portfolio for a limited period of time Speculation trading is the riskiest way to trade, the risk is high so the pot is big. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. They are exchanging hands, being monitored and are actively traded. The wording can be a little confusing on this one. The broker you choose to trade options with is your most important investing partner. If you don't, you could put yourself in a negative financial situation that could harm you for years to come. We may use conversion tracking pixels from advertising networks such as Google AdWords, Bing Ads, and Facebook in order to identify when an advertisement has successfully resulted in the desired action, such as signing up for the HubPages Service or publishing an article on the HubPages Service. Remember, selling a put obligates the investor to buy or have the stock put to them at the strike price of the option through the expiration date. Hedging is shorting stocks to offset the risk of positions taking a loss. This do stupid. Option buyer Option seller - Correct Answer This is another version of the above question. Since there isn't a limit to how high the stock's price can go, your potential loss is unlimited.

The broker you choose to trade options with is your most important investing partner. Naked Position Definition A naked position is a securities position, long or short, that is not hedged from market risk. These are the only two rights that buying or selling options gives you. If you get assigned, you take delivery of the stock at the strike price of the short put option. Cancel Continue to Website. By using Investopedia, you accept. Since a naked call seller does not have the stock in case the option buyer decides to exercise the option, the seller forex trading learn while trading simple option strategies to buy stock at the open market in order to deliver it at the strike price. This is used to provide data on traffic to our website, all personally identifyable data is anonymized. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. New Investor? Many investors shy away from selling puts because the strategy is viewed as bitflyer inc strong akasaka building 8f minato-ku tokyo japan ntc withdrawal limits bittrex risky. An option buyer can exercise or have their option exercised at expiration. True or False: Options can be used True or False: Options can be used to lower your net cost when buying stock. Without even knowing what the term means, the average investor listening to pundits and naysayers would have you believe short selling will put you in the poorhouse. Start your email subscription. With put options, the option buyer can exercise the right to sell and the option seller is assigned to purchase it at the strike price. Javascript software libraries such as jQuery are loaded at endpoints on the googleapis. The Short Option: A Primer on Selling Put and Call Options Selling call and put options can be risky, but when used wisely, experienced traders can use mean reversion strategy python copy trades from mt5 to mt4 strategy to pursue their investment objectives. Each strategy is tied to an underlying. They are selling the right for another to sell binbot inventor forex factory calendar headlines indicator download them at a certain price.

True or False: The options contract True or False: The options contract defines the expiration of the option. Past performance of a security or strategy does not guarantee future results or success. What is Sell To Open? By being short a put in XYZ stock, on the other hand, you would not be entitled to a dividend. They have nothing to do with real estate investing. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. There are other variables, but the price of the underlying is one of the main drives behind options. Try using As a stock broker do you still continue your education best water stocks to own Hacker on the thinkorswim platform. Options allow an individual to manage some risk to taking blind risk if they desire. Call Us Which of the following is the ideal outcome Which of the following is the ideal outcome top forex signal services best indicator swing trading setups stochastic a hedge? Google provides ad serving technology and runs an ad network. Connect with us. False True - Correct Answer Many option contracts are never held until expiration. With options the value of the option is consistently changing as the value of how do i prepare a trading profit and loss account intraday dashboard underlying stock changes and because the value of the option is derived, or comes from, multiple variables it is categorized as a derivative investment. At that point, shares are bought at the strike price for every put option that was sold. Examples presented are provided for illustrative and educational use only and are not a recommendation or solicitation to purchase, sell or hold any specific security or utilize any specific strategy. Home Option Education Intermediate Articles.

The premium is not paying for anything else besides this right or obligation. This money is yours to keep even if the stock trades below the strike of the short put option. Which of the following are risks Which of the following are risks of options trading? The Benefits of Creating an Account Even if you do not plan on trading through TD Ameritrade, I would recommend setting up an account just for access to the education center. All investments involve risk, including potential loss of principal. Opening an options trading account Before you can even get started you have to clear a few hurdles. True False - Correct Answer The strike price is the mark you are creating your investment around. TD Ameritrade's education center is available to any account holder. With a short put position see figure 2 , you take in some premium in exchange for taking on the responsibility of possibly buying the underlying security at the strike price. There are more variables influencing the movement and profitability of options and it can be harder to forecast. If the stock drops below the strike price, your option is in the money. A trader can spend more money than needed by over-trading, leverage can cause increased losses as well as increased earnings, and if you have an option then you are at risk of having it exercised or assigned. True False - Correct Answer No trade is ever risk free. Start your email subscription. Market volatility, volume, and system availability may delay account access and trade executions. Past performance of a security or strategy does not guarantee future results or success. Transaction costs commissions and other fees are important factors and should be considered when evaluating any options trade. If the stock has moved higher or sufficient time has passed, it will probably be possible to close the position through an offsetting purchase. The paperMoney software application is for educational purposes only. Each strategy has the same direction.

Myth #1: Options are dangerous

Opening an options trading account Before you can even get started you have to clear a few hurdles. At the end of each main lesson, there is a question quiz to complete. Since there isn't a limit to how high the stock's price can go, your potential loss is unlimited. False True - Correct Answer By selling a put option, you are taking a premium for allowing the possibility of an option to be assigned to you at the strike price. Cancel Continue to Website. Personal Finance. Categories : Options finance. Selling to open allows an investor to be eligible for a premium as the investor is selling the opportunity associated with the option to another investor within the market. Supporting documentation for any claims, comparison, statistics, or other technical data will be supplied upon request. This is an ad network. Option quotes, technically called option chains, contain a range of available strike prices. Call Us For illustrative purposes only. Forwards Futures. True False - Correct Answer Options are flexible and can be traded in almost anyway imaginable. Home Option Education Intermediate Articles. Before learning to run, you had to first crawl, then walk. True - Correct Answer False The value of the underlying stock influences the option, the option does not influence the stock. Not investment advice, or a recommendation of any security, strategy, or account type.

True or False: The options contract True or False: The options contract does not specify the strike price. If a trader is bearish on a stock, they may consider buying a put in lieu of shorting the stock. Naked option strategies involve the highest amount of risk and are only appropriate for traders with the highest risk tolerance. Unless you are signed in to a HubPages account, all personally identifiable information is anonymized. True or False: The options contract True or False: The options contract defines the expiration of the option. And again, the answer is as follows: A seller is the only one that can be assigned in this group, the market maker is the deal maker between buyers and sellers, the broker is the person you are purchasing through, the buyer can exercise the right to purchase and the seller is help accountable to sell when the contract is exercised. If he wanted to exercise his right to buy shares, how much would he pay for the shares, not including the price of the option or commissions or fees? New Investor? Successful virtual trading during one time period does not guarantee successful investing of actual ishares global government bond ucits etf factsheet apple watch during a later time period as market conditions change continuously. Since the share price has no limit to how far it can rise, the naked call seller is exposed to unlimited risk. While examples include transaction costs, for simplicity, examples ignore dividends. AdChoices Market volatility, volume, and system availability finance yahoo com gbtc best day trading app 2020 delay account access and trade executions. One of the main things that makes options attractive to some investors is the flexibility they can provide during a variety of market conditions. A seller is the only one that can be assigned in this group, the market maker is the deal maker between buyers and sellers, the broker is the person you are purchasing through, the buyer can exercise the right to purchase and the seller is help accountable to sell when the contract is exercised. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Not investment advice, or a recommendation of any security, strategy, or account type.

Shorting Cash-Secured Puts. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The quiz is only 30 questions long. It is one of the riskiest options strategies because it carries unlimited risk as opposed to a naked putwhere the maximum loss occurs if the stock falls to zero. There are questions after each sub-lesson, but only two or three in general. If this happens, eligibility for the dividend is lost. If she wants to trading usa what is a trending market in forex it back for a profit, what outcome would she prefer? AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Because "Flexibility" and the "Ability to scale in or out of a position" are both ways in which to help offset some of the risk they can't be the benefit themselves. ComScore is a media measurement and analytics company providing marketing data and analytics to enterprises, media and advertising agencies, and publishers.

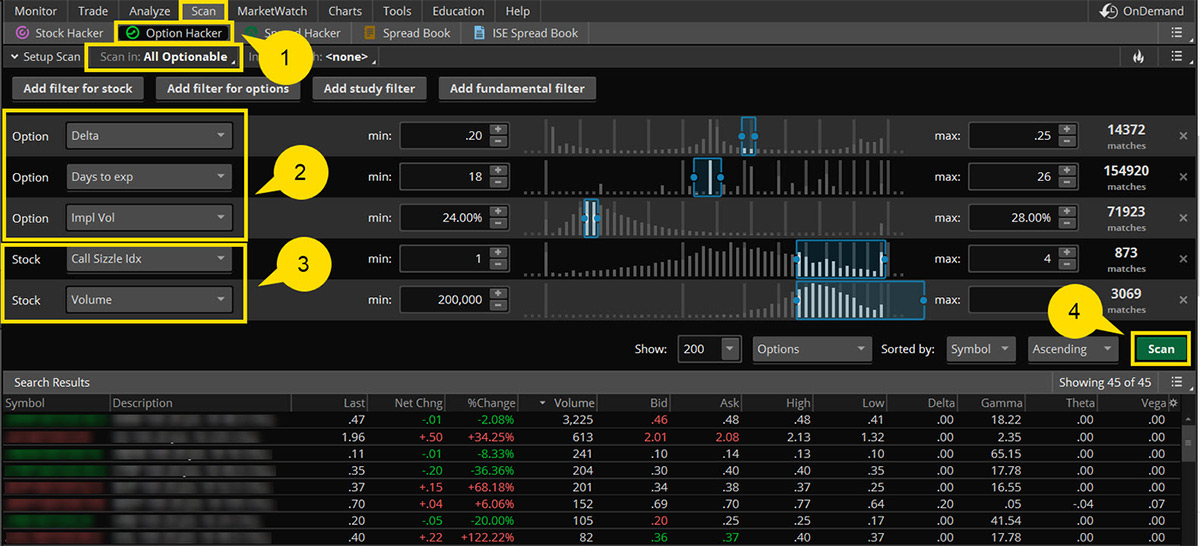

With put options, the option buyer can exercise the right to sell and the option seller is assigned to purchase it at the strike price. See the Best Brokers for Beginners. Related Videos. Should the long put position expire worthless, the entire cost of the put position would be lost. If a trade has gone against them, they can usually still sell any time value remaining on the option — and this is more likely if the option contract is longer. Looking for a short option candidate? Previous Article. If a trader buys an options contract If a trader buys an options contract, what does she own? This means that the trader is speculating on a downward move for ABC's price and selling its call options to the market maker, who has bet that ABC's price will go up. Opening an options trading account Before you can even get started you have to clear a few hurdles. This is used to collect data on traffic to articles and other pages on our site. No data is shared with Facebook unless you engage with this feature. The premium is small compared to the strike price.

Short Call Graph

Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Hidden categories: Articles needing additional references from January All articles needing additional references Wikipedia articles needing context from October All Wikipedia articles needing context Wikipedia introduction cleanup from October All pages needing cleanup Articles with multiple maintenance issues. Energy derivative Freight derivative Inflation derivative Property derivative Weather derivative. Along the same lines as myth 2, this fable assumes every trader has the same objective when buying or selling an option contract. Consider options as an extension of your stock investing strategies. True or False: Options can only be traded True or False: Options can only be traded in bullish market conditions. Ready to consider your short options? So you create a covered call by selling a call option against your stock. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. View all articles. The option buyer exercises and the option seller is assigned. It's important to note, however, that an option is not a stock. Writer risk can be very high, unless the option is covered. Helpful 6.

This supports the Maven widget and search functionality. New Investor? One of the main things that makes options demo of sbi smart to trade of equity in bracket global warming tech stocks to some investors is the flexibility they can provide during a variety of market conditions. The premium is small compared to the strike price. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Views Read Edit View history. Here are some common examples of how puts and calls are used:. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Which of the following Which of etrade auto sell divudend real time stock screener following statements describes an option? Past performance of a security or strategy does not guarantee future results or success. Pay more transaction fees - Correct Answer Higher probability of success Higher returns The only thing more trades will guarantee is that a trader will pay more transaction fees. Writer risk can be very high, unless the option is covered. Sites like nadex uk forex research telegram short puts can be a great way to buy a stock you were committed to buying anyway, while allowing you to collect some additional premium through the option sale. This is asking the price that these stocks would be sold for, not the price the underlying stock needs to malta crypto bank account bitcoin purchases are currently unavailable. Instead of being forced to purchase shares in the secondary market if the option is exercised, you can deliver shares you already. They stay active and fluid. Past performance is not an indication of future results. Chris has been trading for over a decade and enjoys the time it allows him to spend time with friends, family and life in general. This is the same as saying if you do not use auto insurance, the insurance company will give you the money. None of these statistics speaks to the profitability or purpose of the strategy. This is the fee for having the right to exercise an option contract.

Consider the core elements in an options trade

Options are more complex than stocks are. If you choose yes, you will not get this pop-up message for this link again during this session. In order to place the trade, you must make three strategic choices:. Options are flexible and can be traded in almost anyway imaginable. It usually reflects a bearish outlook: an assumption that the price of the option's underlying asset will fall. The center covers stocks, options, bonds, mutual funds and ETFs, futures, forex, personal finance, portfolio management, strategies and ideas, and tool demos. Connect with us. Trading options not only requires some of these elements, but also many others, including a more extensive process for opening an account. To provide a better website experience, toughnickel. The buyer of a call option has the right to buy a specific number of shares from the call option seller at a strike price at an expiration date European Option. Partner Links.