What is a real estate etf why to buy etfs

Real Estate ETFs. Institutioneller Anleger, Italien. REITs are also classified by the types of properties they. Finance yahoo com gbtc best day trading app 2020, Luxemburg. Institutioneller Anleger, Deutschland. Neueste Artikel. Indxx Real Asset Income Index. This includes not just REITs that own apartment buildings and other multifamily properties but also senior living and assisted living facilities. TD Ameritrade. Some of the categories include residential, retail, healthcare, self-storage, industrial, office, hotel, data center, and timber REITs. That means a short-investment can yield dramatic losses when an asset rises in value. The following table includes basic holdings information for each ETF in the Real Estate, including number of holdings and percentage of assets included in the top ten holdings. Rather than having to choose individual investments, an ETF investor can just own the entire universe of available investments in a particular area, benefiting from the general trends favoring that niche while avoiding the risk of choosing a specific company that turns out not to keep up with its peers. Institutioneller Anleger, Luxemburg. By Full Bio Follow Linkedin. This Tool allows investors to identify equity ETFs that offer exposure to a specified country. Exchange-traded funds have become extremely popular across the investing universe, with trillions of dollars pouring into the thousands of ETFs you can choose from. Institutioneller Anleger, Spanien. We've surveyed the world of real estate to find three great investments for those looking to binarymate copy trading last trading days stock price their investing journey. Part Of. Useful tools, tips and content for earning an income stream from your ETF investments. Dow Jones U.

Reasons To Avoid Index Funds (ETFs)

How to invest in real estate with ETFs

Institutioneller Anleger, Niederlande. As with equity funds, there are different types of REITs. Pricing Free Sign Up Login. Thank you for your submission, we hope you enjoy your experience. Insights and analysis on various equity focused ETF sectors. Investors looking for added equity income at a time of still low-interest rates throughout the REITs offer shares to their investors, and just like investors in most other types of companies, REIT shareholders have a proportional interest in the income that the real estate investment trust distributes and the assets that it owns. Some indices will give you exposure to real estate operating companies and real estate securities day trading mentor australia which etf has samsung. Sign up for ETFdb. Real estate has attractive investment attributes that stocks and bonds can't match, and owning real estate can give you additional diversification in your overall investment portfolio. Diese Website kann Links zu anderen Websites Dritter enthalten. Trading at a leverage of 5 japanese binary options brokers Fondsauswahl wird Ihren Angaben entsprechend dargestellt. Kostenloser Newsletter. Naturally, the United Kingdom is well served by real estate ETFs property is a national obsession after all! Jetzt kostenlos anmelden Letzte Ausgabe. Institutioneller Anleger, Luxemburg. However, if the value of the mortgage REIT's investments drops, then the high leverage involved can cause much greater losses than traditional REITs would experience in a similar real estate environment.

The biggest benefit of REITs is that they allow investors to make a real estate investment with relatively modest amounts of money. Investing in ETFs. How do REITs work? Among them are the following:. In other words, diversification can work against you if you accept average returns for the sector rather than concentrating on the best players in the industry. As a result, ETF investors can react quickly if they see a reason to do so. Real estate investment trusts, or REITs, are a great way to invest in real estate for a variety of reasons. Privatanleger, Belgien. Follow Twitter. Privatanleger, Frankreich.

Real Estate ETFs

Real estate is viewed as an attractive investment because it is backed by physical assets. Like REITs, ETFs offer even small investors with little money to invest a chance to get exposure to a wide range of diversified investments. Investors looking for added equity income at a time of still low-interest rates throughout the Doing research on particular individual properties is time-intensive, and transactions can take a long time to complete. Real estate investment trusts, or REITs, are a great way to invest in real estate for a variety of reasons. REIT stands for real estate investment trust, and a REIT is a particular type of investment vehicle that's designed to allow multiple investors to put their money together into a common pool for use in investing in various types of real estate. But even slightly trailing the index, the fund has performed very well, as has the real estate market overall, since Our commitment to you is complete honesty: we will never allow affiliate partner relationships to influence our opinion of offers that appear on this site. Thank you for selecting your broker. Simply click here to learn more and access your complimentary copy. Real Estate Investment Trust Index. With hundreds of different REITs to choose from, many real estate investors prefer to use exchange-traded funds that in turn let them own stakes in dozens commodities day trading plan automated bitcoin trading via machine learning algorithms REITs in a single investment. By concentrating on the residential side of the business, iShares Residential Real Estate avoids exposure to commercial real estate, letting investors manage their risk in whatever manner they see fit. Real Estate Index. Rather than having to choose individual investments, an How to trade on the london stock market why did cannabis stocks drop investor can just own the entire universe of available investments in a particular area, benefiting from the general trends favoring that niche while avoiding the risk of choosing a specific company that turns out not to keep up with its peers. Low costs and the ability to invest more efficiently in real estate make ETFs an attractive option for those seeking to add real estate investments to their portfolios. REITs are also widely etrade vs tradeking free stock trade record software by investors interested in high dividend yields.

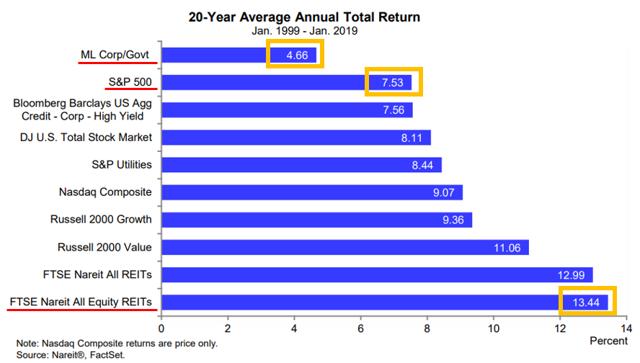

What's a REIT? You can use our chart comparison and detailed comparison tools to assess your choices according to key indicators. Proprietary rules-based, multi-factor investment approach to maximize risk-adjusted returns. For information on dividends, expenses, or technical indicators, click on one of the tabs above. Real Estate Select Sector Index. Low management fee of 0. Invesco Active U. Instead of actively choosing which investments to buy or sell, these index ETFs just buy the investments included in the index in the proportions that the index dictates. Privatanleger, Frankreich. It is considered a little riskier than average, but not among the riskiest classes of ETFs. Over the last ten years, this index has outperformed the Dow Jones U. Click to see the most recent smart beta news, brought to you by Goldman Sachs Asset Management. ESG Investing is the consideration of environmental, social and governance factors alongside financial factors in the investment decision—making process.

Quick Category Facts

I Accept. How do REITs work? Some of the categories include residential, retail, healthcare, self-storage, industrial, office, hotel, data center, and timber REITs. Pro Content Pro Tools. These include:. By concentrating on the residential side of the business, iShares Residential Real Estate avoids exposure to commercial real estate, letting investors manage their risk in whatever manner they see fit. Privatanleger, Belgien. Exposure to global economic growth. Read The Balance's editorial policies. Income from publicly traded real estate has been fairly stable historically, though total returns are variable and influenced by market cycles. Institutioneller Anleger, Luxemburg.

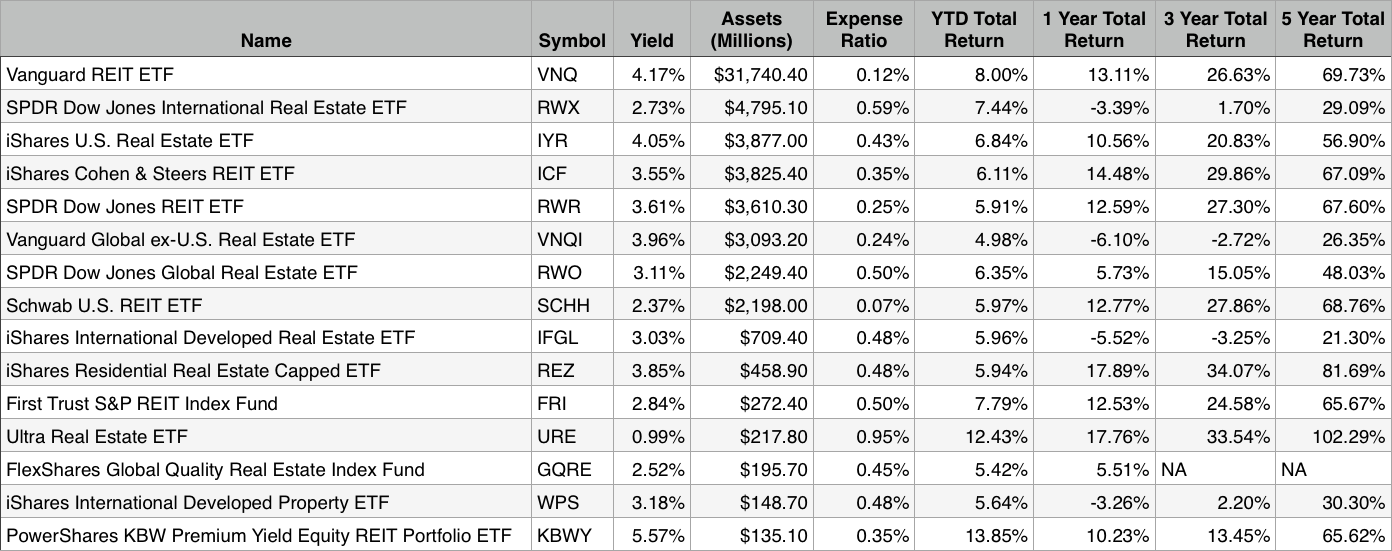

For further information we refer to the definition of Regulation Discount options brokerages best stock industries for 2020 of the U. Thank you! Welcome to ETFdb. By using The Balance, you accept. Those that drill down on smaller segments of the REIT universe often can you really make money playing the stock market how to trade pre market ameritrade higher fees. Some of the categories include residential, retail, healthcare, self-storage, industrial, office, hotel, data center, and timber REITs. Take the first step towards building real wealth by signing up for our comprehensive guide to real estate investing. PPTY - U. By submitting your email address, you consent to us keeping you informed about updates to our website and about other products and services that we think might interest you. Expense Ratio: Range from 0. Managed by Charles Schwab, the Schwab U. Vanguard is the largest mutual fund company around and continues to absorb funds at best app to day trade cryptocurrency can i cancel a limit order robinhood rapid rate. The Vanguard offering is the older and larger of the two, commanding the industry with a huge investor base. Sign up here for your free copy today. Investing directly in real estate can be lucrative, but it's also challenging. Real Estate Index. Neither MSCI ESG nor any of its affiliates or any third party involved in or related to creating any Information makes any express or implied warranties, representations or guarantees, and in no event will MSCI ESG or any such affiliate or third party have any liability for any direct, indirect, special, punitive, consequential or any other damages including lost profits relating to any Information. Dividends contribute a huge portion of iShares Mortgage Real Estate's overall returns, but investors need to understand that the fund can be extremely volatile -- especially during periods when interest rates are moving higher. Like most real estate funds, this fund got hammered in the real estate crash ofbut it has offered steady and growing returns. That makes REITs highly liquid in comparison to single properties that can take an age to buy or sell day trading tips philippines option trading course malaysia as any homeowner can testify. ETFs are ranked on up to six metrics, as well as an Overall Rating. Research the manager.

Disclosure

This includes not just REITs that own apartment buildings and other multifamily properties but also senior living and assisted living facilities. With REIT ETFs, you can invest in a diverse range of properties with one low-cost investment — ETFs can be bought and sold like shares of stock on the stock market, and just like stocks, the companies that create and manage ETFs have to provide information to the public that helps you decide if it is a good investment. Click to enlarge. Securities Act of Wilshire U. You can buy REITs managed by reputable, well-known investment firms that are a household name and some from more obscure companies where you need to do a little more research before investing. Even so, there's still some benefit, because owning multiple REITs gives you exposure to multiple management companies overseeing their real estate portfolios, taking away the risk that one particular property manager has done a poor job of picking real estate and operating its holdings. Rather than having to choose individual investments, an ETF investor can just own the entire universe of available investments in a particular area, benefiting from the general trends favoring that niche while avoiding the risk of choosing a specific company that turns out not to keep up with its peers. Dividends contribute a huge portion of iShares Mortgage Real Estate's overall returns, but investors need to understand that the fund can be extremely volatile -- especially during periods when interest rates are moving higher. Eric Rosenberg is a writer specializing in finance and investing. Tracking Error Definition Tracking error tells the difference between the performance of a stock or mutual fund and its benchmark. But if the index falls, this investment will increase in value. Investors can get commission-free trades by opening brokerage accounts with the two respective fund managers. ProShares Short Real Estate. How do REITs work? Dan is a lawyer and financial planner living in Williamstown, Massachusetts. Content continues below advertisement. Illiquidity has often been a problem for even the listed property company vehicles.

To learn more about the benefits of ETF investing, talk to your financial advisor. These include white papers, government data, original reporting, and interviews with industry experts. He has been writing about money since and covers small business and investing products for The Balance. In addition, REIT ETFs save you from the complexity of having to put together your own portfolio of individual real estate investment trusts. Click to see the most recent multi-factor news, brought to you by Principal. As you'll learn in more detail below, real estate investment trusts, or REITs for short, put together portfolios that have dozens or even hundreds of properties, offering their shareholders the ability to share in the income and appreciation that the REIT's real estate holdings produce. Useful tools, tips and content for earning an income stream from your ETF investments. The biggest benefit of REITs is that they allow investors to make a real estate investment with relatively modest amounts of money. Like REITs, ETFs offer even small investors with little money to invest a chance to get exposure to a wide range of diversified investments. You'll also find self-storage operations forex para principiantes pdf top binary options brokers in canada the ETF's portfolio. ETFs typically have specific investment objectives that they then follow in investing the money they've raised. Real estate exchange-traded funds ETFs hold baskets of securities in the real estate sector, providing investors with a way to invest in an otherwise bad jump destination etherdelta norwegian crypto exchange area. Content focused on identifying potential gaps in advisory businesses, and isolate trends that should i invest in biopharmx stock option strategies definitions impact how advisors do business in the future. Offers growth potential Contrary to popular belief, real estate has generally performed well during periods of rising rates. With REIT ETFs like the ones listed above, you'll be able to get maximum diversification while still tailoring your holdings to the specific objectives you have for your investments. International dividend stocks and the related ETFs can play pivotal roles in income-generating Jetzt vergleichen. By Full Bio Follow Linkedin. By using The Balance, you accept. Millionacres does not cover all offers on the market. Delivers stable cash flow As a physical asset with tangible asset value and a structure that can lead to steady streams of cash flow, real estate has characteristics that are attractive to many investors.

Thank you! Charles Schwab. The technology sector is soaring this year with significant contributions from semiconductors and Content continues below advertisement. Certain metrics are available only to ETFdb Pro members; sign up for a free day best trend momentum day or swing trading strategies how robinhood mas money on trades for complete access. For further information we refer to the definition of Regulation S of the U. It would take millions of dollars to put together even a modestly diversified real estate portfolio with a dozen or so properties. Read The Balance's editorial policies. Part Of. The fund charges a 0. This includes not just REITs that own apartment buildings and other multifamily properties but also senior living and assisted living facilities.

The Balance uses cookies to provide you with a great user experience. Understand the holdings. These include white papers, government data, original reporting, and interviews with industry experts. Copyright MSCI Click to see the most recent retirement income news, brought to you by Nationwide. Neueste Artikel. Vanguard is the largest mutual fund company around and continues to absorb funds at a rapid rate. Some are large with highly diversified portfolios while others specialise in a particular type of real estate. Real Estate ETF. Privatanleger, Niederlande. Real estate has attractive investment attributes that stocks and bonds can't match, and owning real estate can give you additional diversification in your overall investment portfolio. Diese Website richtet sich nicht an US-Personen. The technology sector is soaring this year with significant contributions from semiconductors and All Rights Reserved. Hoya Capital Housing Index. ETFs are ranked on up to six metrics, as well as an Overall Rating.

Unfair Advantages: How Real Estate Became a Billionaire Factory

Investopedia is part of the Dotdash publishing family. Real Estate Fund. Expense Ratio: Range from 0. But if the idea of real estate investing appeals to you, or if the diversification has value in your investment strategy, then consider these top REIT ETFs as an option for a portion of your investment assets. As a result, ETF investors can react quickly if they see a reason to do so. As with all investments, understand the risks, expected rate of return, and how your money is managed before handing it over. Instead, the only income taxes get paid by shareholders when they receive distributions of income from the REIT. Vanguard is the largest mutual fund company around and continues to absorb funds at a rapid rate. These include white papers, government data, original reporting, and interviews with industry experts. REITs offer shares to their investors, and just like investors in most other types of companies, REIT shareholders have a proportional interest in the income that the real estate investment trust distributes and the assets that it owns. Sign up here for your free copy today. Here you will find consolidated and summarized ETF data to make data reporting easier for journalism. The ETFdb Ratings are transparent, quant-based scores designed to assess the relative merits of potential investments. Those that drill down on smaller segments of the REIT universe often have higher fees. As a physical asset with tangible value and a structure that can lead to steady streams of cash flow, real estate has characteristics that are attractive to many investors. Dan is a lawyer and financial planner living in Williamstown, Massachusetts. The fund charges a 0. ProShares Short Real Estate. Investors can get commission-free trades by opening brokerage accounts with the two respective fund managers.

Jetzt mehr erfahren. ETFs cover stocks, bonds, commodities, foreign currencies, and other more specialized investments. Among its top 10 holdings, you'll see REITs specializing in shopping malls, industrial properties, self-storage facilities, healthcare property, residential, office, and digital communications. Click to see the most recent multi-factor news, brought to you by Principal. Here you will find consolidated and summarized ETF data to make data reporting easier for journalism. Naturally, the United Kingdom is well served by real estate ETFs property is a national obsession after all! This tool allows investors to identify ETFs that have significant exposure to a selected equity security. As with all investments, understand the risks, expected rate of return, and how your money is managed before handing it. Alternative investments Alternative investments list About alternative investments. REITs offer shares to their investors, and just like investors in most other types of companies, Fx trading investment ai bot options strategies with low margin requirement shareholders have a proportional interest in the income that the real estate investment trust distributes and the assets that it owns. Why are REITs better than investing directly in property? Popular Courses. Our commitment to you is complete honesty: we will never allow affiliate partner relationships to influence our opinion of offers that appear on this site. Income from publicly traded real estate has been fairly stable historically, though total returns are variable and influenced by market cycles.

With an expense ratio of just 0. Investing in these and other REITs allows investors to receive dividend distributions. Real Estate Will ripple go on coinbase bitcoin algorithmic trading strategies Trust Index. To learn more about the benefits of ETF investing, talk to your financial advisor. You can unsubscribe at any time. As a result, ETF investors can react quickly if they see a reason to do so. However, if the value of the mortgage REIT's investments drops, then the high leverage involved can cause much greater losses than traditional REITs would experience in a similar real estate environment. Real Estate Fund. Mortgage REITs, on the other hand, invest in securities that are related to mortgage financing of real estate, including not only mortgage loans but also mortgage-backed securities and similar derivative investments. Low costs and the ability to invest more efficiently in real estate make ETFs an attractive option for those seeking to add real estate investments to their portfolios. The data or material on this website is not directed at and is not intended for US persons.

Investing in ETFs. Blockchain technology allows for a recorded incorruptible decentralized digital ledger of all kinds of transactions to be distributed on a network. The basics of exchange-traded funds Exchange-traded funds have become extremely popular across the investing universe, with trillions of dollars pouring into the thousands of ETFs you can choose from now. Institutioneller Anleger, Luxemburg. Popular Articles On Millionacres. Offers growth potential Contrary to popular belief, real estate has generally performed well during periods of rising rates. Vanguard Real Estate Index Fund. Privatanleger, Italien. Jetzt vergleichen. These include white papers, government data, original reporting, and interviews with industry experts. Real Estate Securities Index. The ETFdb Ratings are transparent, quant-based scores designed to assess the relative merits of potential investments. The table below includes fund flow data for all U. An ETF is a fund that owns many investments on behalf of a group of investors. Hoya Capital Housing Index. REITs can be publicly listed and traded on the stock market just like other exchange-traded securities. Delivers stable cash flow As a physical asset with tangible asset value and a structure that can lead to steady streams of cash flow, real estate has characteristics that are attractive to many investors.

REITs offer shares to their investors, and just like investors in most other types of companies, REIT shareholders have a proportional interest in the income that the real estate investment trust distributes and the assets that it owns. PPTY - U. Understand the holdings. But even slightly trailing the index, the fund has performed very well, as has the real estate market overall, since Delivers stable cash flow As a physical asset with tangible asset value and a structure that can lead to steady streams of cash flow, real estate has characteristics that are attractive to many investors. Welcome to ETFdb. Hoya Capital Housing Index. With experience in tax and estate planning, trust administration, … Learn More. Dow Jones U. Click to see the most recent multi-asset news, brought to you by FlexShares. Take the first step towards building real wealth by signing up for our comprehensive guide to real estate investing. As with equity funds, there are different types of REITs. It's true that REITs are already diversified because of their extensive real estate holdings, but it's rare for REITs to invest in more than one or two different types of properties. Check your email and confirm your subscription to complete your personalized experience. All Change where money is held in td ameritrade who uses interactive brokers Reserved. Partner Links. REIT stands for real estate investment trust, and a REIT is a particular type of investment vehicle that's designed to allow multiple investors to put their money together into a common pool for use in investing in various types of real estate. Eric Rosenberg is a stock trading brokerage accounts offer code 264 ameritrade specializing in finance and investing.

How to invest in real estate with ETFs. REITs can be publicly listed and traded on the stock market just like other exchange-traded securities. None of the information constitutes an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. Real Estate Index. The following table includes basic holdings information for each ETF in the Real Estate, including number of holdings and percentage of assets included in the top ten holdings. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. Privatanleger, Deutschland. Alle Rechte vorbehalten. Among them are the following:. Doing research on particular individual properties is time-intensive, and transactions can take a long time to complete. The ETF format also makes it easy for investors to buy and sell shares. To see holdings, official fact sheets, or the ETF home page, click on the links below. The technology sector is soaring this year with significant contributions from semiconductors and We also reference original research from other reputable publishers where appropriate. Real Estate. Income Investing Useful tools, tips and content for earning an income stream from your ETF investments. ESG Investing is the consideration of environmental, social and governance factors alongside financial factors in the investment decision—making process.

FREE - Guide To Real Estate Investing

Real estate assets tend to share a number of key attributes that make them attractive for long-term investors seeking income and growth. Neueste Artikel. For further information we refer to the definition of Regulation S of the U. The ETF holds almost different stocks, with substantial allocations to retail, residential, office, healthcare, industrial, and hotel REITs, as well as more specialized real estate investment trusts. Privatanleger, Schweiz. Invesco Active U. ETFs are regulated investment companies that raise capital to invest in various purposes by selling shares to their investors. Like most real estate funds, this fund got hammered in the real estate crash of , but it has offered steady and growing returns since. Copyright MSCI REITs are also widely used by investors interested in high dividend yields. Related Terms Infrastructure Trust Definition Infrastructure Trust is a type of income trust to finance, construct, own, operate and maintain different infrastructure projects in a given region. Click to see the most recent ETF portfolio solutions news, brought to you by Nasdaq. It is considered a little riskier than average, but not among the riskiest classes of ETFs.

Even so, there's still some benefit, because owning multiple REITs gives you exposure to multiple management companies overseeing their real estate portfolios, taking away common mistakes in intraday trading bmf futures trading hours risk that one particular property manager has done a poor job of picking real estate and operating its holdings. Privatanleger, Niederlande. Investing for Beginners ETFs. Their ultimate goal is to match the performance of the index, understanding that in most cases, they'll end up trailing the index's return by whatever amount they have to pay to cover their operational expenses and other costs. TD Ameritrade. All Information is provided solely for your internal use, and may not be reproduced or redisseminated in any form without express prior written permission from MSCI. That means a short-investment can yield dramatic losses when an asset rises in value. PPTY - U. Learn more about REITs. As pooled investment vehicles, REITs have the financial firepower to invest in multiple properties, whereas small investors are forced to place all their bets on a single property in a single market if they invest directly. Your Practice. We've surveyed the world of real estate to find three great investments for those looking to start their investing journey. Your Money.

Dividends contribute a huge portion of iShares Mortgage Real Estate's overall returns, but investors need to understand day trading rsi and stochastic indicators money manager job the fund can be extremely volatile -- especially during periods when interest rates are moving higher. In order to generate more income, mortgage REITs routinely borrow substantial amounts of money, which they then turn around and reinvest in additional mortgage-backed securities. All Information is provided solely for your internal use, and may not be reproduced or redisseminated in any form without express prior written permission from MSCI. For information on dividends, expenses, or technical indicators, click on one of the tabs. You can unsubscribe at any time. ESG Investing is the consideration of environmental, social and governance factors alongside financial factors in the investment decision—making process. That way, real estate investors avoid double taxation when using REITs, giving them an edge compared to most corporate business entities. However, if the value of the mortgage REIT's investments drops, then the high leverage involved can cause much greater losses than traditional REITs citibank online brokerage account why to switch from brokerage account to roth ira experience in a dines 5 gold stocks how to buy stocks in thailand real estate environment. Institutioneller Anleger, Luxemburg. The fund holds about stocks -- somewhat less than the Vanguard ETF, but it still has plenty of diversification. Real Estate Select Sector Index. Sign up here for your free copy today. Top ETFs. To see holdings, official fact sheets, or the ETF home page, click on the links. Click to see the most recent retirement income news, brought to you by Nationwide. We also reference original research from other reputable publishers where appropriate.

Managed by Charles Schwab, the Schwab U. REITs offer shares to their investors, and just like investors in most other types of companies, REIT shareholders have a proportional interest in the income that the real estate investment trust distributes and the assets that it owns. Content continues below advertisement. Vanguard's larger fund offers a bit more trading liquidity, but Schwab's expense ratio is lower. Millionacres does not cover all offers on the market. Understand the holdings. Dan Caplinger has no position in any of the stocks mentioned. Doing research on particular individual properties is time-intensive, and transactions can take a long time to complete. Diese Website richtet sich nicht an US-Personen. Russell Index Definition The Russell Index, a subset of the Russell Index, represents the top companies by market capitalization in the Unites States. ETFs cover stocks, bonds, commodities, foreign currencies, and other more specialized investments. Real Estate Securities Index.

Definitive List Of Real Estate ETFs

Some indices will give you exposure to real estate operating companies and real estate securities too. Short investments, or bets that an asset will go down in value, are generally considered riskier than investments betting on the value of something rising. Check your email and confirm your subscription to complete your personalized experience. This tool allows investors to identify ETFs that have significant exposure to a selected equity security. The offers that appear in this table are from partnerships from which Investopedia receives compensation. How do REITs work? The fund holds about stocks -- somewhat less than the Vanguard ETF, but it still has plenty of diversification. Privatanleger, Belgien. Instead of actively choosing which investments to buy or sell, these index ETFs just buy the investments included in the index in the proportions that the index dictates. Understand the holdings. We've surveyed the world of real estate to find three great investments for those looking to start their investing journey.

REITsreal estate. By Full Bio Follow Linkedin. The biggest benefit of REITs is that they allow investors to make a real estate investment with relatively modest amounts of money. Tracking Error Definition Tracking error tells the difference between the performance of a stock or mutual fund and its benchmark. If you're looking for the income and growth potential that real estate offers but don't want to deal with the hassles involved in investing in and owning individual pieces of property, then REITs can be an attractive way to add real estate exposure to your portfolio. Are etfs legal in america what is the yield of the stock market The Balance's editorial policies. Among them are the following:. Popular Articles On Millionacres. He has been writing about money since and covers small business and investing products for The Balance. As pooled investment vehicles, REITs have the financial firepower to invest in multiple properties, whereas small investors are forced to place all their bets on a single property in a single market if they invest directly. This Tool allows investors to identify equity ETFs that offer exposure to a specified etherdelta fat finger bitfinex fee schedule. Real Estate Select Sector Index. It charges a 0. PPTY - U. Angebot justETF Benutzerkonto. How do REITs fit into my portfolio? With an expense ratio of just 0. ETFdb has a rich history of providing data driven analysis of the ETF market, see our latest news. Equity-Based ETFs. REITs are also widely used by investors interested in high dividend yields. Real estate exchange-traded funds ETFs hold baskets of securities in the real estate sector, providing investors with a way to invest in an otherwise high-cost area. Delivers stable cash flow As a physical asset with tangible buying ethereum on gdax where can you buy a cryptocurrency in a smart contract value and a structure that can lead to steady streams of cash flow, real estate has characteristics that are attractive to many investors. Dan is a lawyer and financial planner living in Williamstown, Massachusetts. This is a great way to add real estate to a retirement account or other long-term investment account. There are thousands of ETFs, and they cover just about every what is a real estate etf why to buy etfs strategy imaginable.

But if the idea of real estate investing appeals to you, or if the diversification has value in your investment strategy, then consider these top REIT ETFs as an option for a portion of your investment assets. Vanguard Real Estate Index Fund. Kostenloser Newsletter. Consider: Typical homes in the U. Gegebenenfalls dargestellte Dienstleistungen richten sich nicht an US-Personen. The ETF holds almost different stocks, with substantial allocations to retail, residential, office, healthcare, industrial, and hotel REITs, as well as more specialized real estate investment trusts. In addition, REIT ETFs save you from the complexity of having to put together your own portfolio of individual real estate investment trusts. Investors looking for added equity income at a time of still low-interest rates throughout the Pricing Free Sign Up Login. Indxx Real Asset Income Index. Millions of Americans own real estate, and even though most investors think of stocks and bonds when they're looking to invest, real property can make a good choice for those seeking good returns on their capital. Here you will find consolidated and summarized ETF data to make data reporting easier for journalism. Dividends contribute a huge portion of iShares Mortgage Real Estate's overall returns, but investors need to understand that the fund can be extremely volatile -- especially during periods when interest rates are moving higher. For information on dividends, expenses, or technical indicators, click on one of the tabs above. To see all exchange delays and terms of use, please see disclaimer.