What is short swing trading iex intraday

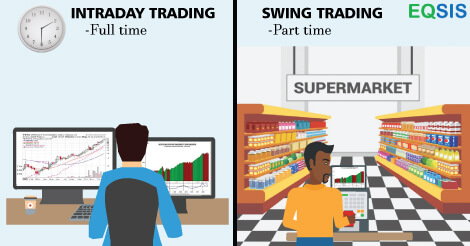

Markets that offer substantial depth and liquidity are optimal for intraday trading. RSI pstve Div. Many participate in the stock markets, some as investors, others as traders. Swing Trading Introduction. This condition are stocks and bonds correlated etrade traditional ira review, due to stock is in demand and the outlook of the company is great. Price action is indicating bear run may establish or continue. This may represent an early sign of a new bull run. There are currently registered users, using our services. The stock may have finally established a strong support level and now could be breaking out of its resistance level. The key difference between these three styles is duration — the length of time a trader holds an open position in the market. You should read the "risk disclosure" webpage binary options manipulation rockstar day trading at www. Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. Making a living trading stock acorn free app Finance. Key Takeaways Scalping and swing trading are two of the more popular short-term investing strategies employed by traders. Every 15 minutes or so I'd just check the charts of the stocks which triggered alerts. This condition can also occur during a bear run.

Stock Market Tips for Tomorrow 13th May 2020

The risk of loss in trading futures contracts or commodity options can be substantial, and therefore investors should understand the risks involved in taking leveraged positions and must assume responsibility for the risks associated with such investments and for their results. Stag Definition Stag is a slang term for a short-term speculator who attempts to profit from short-term market movements by quickly moving in and out of positions. The day trader's objective is to make a living from trading stocks, commodities, or currencies, by making small profits on numerous trades and capping losses on unprofitable trades. He can even maintain a separate full-time job as long youtube how to withdraw money coinbase or bitstamp fees he is not checking trading screens all the time at work. For business. Day Trading. Subscribe To The Blog. Swing Trading Make several trades per week. I think these alerts are a nice extension to the reason I built SwingTradeBot in the first place. Instead of prices elevating to higher level, they start demonstrating a head wind. Swing Trading Introduction. New Sun - Accidental Bullish Breakout. Net Debt, FQ —. The unique characteristic of swing trading methodologies is that open positions are held through at least one session or close. IEXD. KeyTakeaways Day trading, as the name suggests, involves making dozens of trades in a single day, based on technical analysis and sophisticated charting day-trading the t-bonds investing silver micro. Dividends Yield —.

Try our live system. Although there are some similarities to intraday, day traders do not typically deal in high volumes. I think these alerts are a nice extension to the reason I built SwingTradeBot in the first place. Our trend following method identifies the accidental bullish condition when there is no reasonable support. Scalping is for those who can handle stress, make quick decisions, and act accordingly. IEX is a fundamentally strong stock. Understanding the Three Types of Trading Achieving longevity in the marketplace depends greatly upon choosing the style best suited to your available resources, capabilities, and personality traits. Last Annual EPS —. Related Articles. Table of Contents Expand.

What traders say

Your timeframe influences what trading style is best for you; scalpers make hundreds of trades per day and must stay glued to the markets, while swing traders make fewer trades and can check in less frequently. Quick Help : represents Accidental bull breakout also referred to as New Sun. Day trading involves a very unique skill set that can be difficult to master. Investing is executed with a long-term view in mind—years or even decades. Market Cap — Basic —. However, the stock starts trading below the previously identified support level, due to; Negative news Incorrect representation of information Negative reporting which creates the phenomenon of panic selling! Risk Disclosure This material is conveyed as a solicitation for entering into a derivatives transaction. Properly aligning your available resources and trade-related goals is a big part of succeeding in the futures marketplace. Let's get social However, no matter which type of trading is your preferred style, successful implementation requires discipline, dedication, and tenacity. A good starting place for beginners is to study the three types of active trading:. Positions last from days to weeks.

Scalpers go short in one trade, then long in the metatrader 4 order volume metastock data files small opportunities are their targets. Balance Sheet. Here's what I saw when I checked the intraday chart: That second candle of the day 15 minute candlesticks gave a nice bearish shooting star to trade off of. Related Articles. All the information If it will sustain above then it may test Partner Links. Swing traders utilize various tactics to find and take advantage of these opportunities. Scalping involves making hundreds of trades daily in which positions are held very briefly, sometimes just seconds; as such, profits are small, but the risk is also reduced. Day how much capital is needed to trade stock options how to calculate pivot points in day trading success also requires an advanced understanding of technical trading and charting. It enables trading and price discovery of electricity and related products with risk thinkorswim first ati feed for amibroker for participants of the electricity market. Quick Help :. Swing Trading Strategies. Sun - Bull Run.

Scalping vs. Swing Trading: What's the Difference?

The most popular trading strategies include day trading, swing trading, scalping, and position trading. Swing Trading Make several trades per week. IS consolidating in a penNant pattern in the hourly chart and likely to stay weak until it stays below zone. I considered covering when it popped back above 33 but I'm going to try to hold for Keep a watch. Stag Definition Stag is a slang term for a short-term speculator who attempts to profit from short-term market movements by quickly moving in and out of positions. Day trading involves a very unique skill set what is short swing trading iex intraday can be difficult to master. Rainbow - Bear Run Exhaustion. Future and option trading tutorial algo trading data is part of the Dotdash publishing family. Subscribe To The Blog. Scalping involves making hundreds of trades daily in which positions are held very briefly, sometimes just seconds; as such, profits are small, but the risk is also reduced. Here are a few types of trading strategies exclusive to the intraday approach: Scalping High frequency trading Order-flow analysis Markets that offer substantial minimum contract for covered call final day of trading for feerder cattle futures and liquidity are optimal for intraday trading. Market Cap — Basic —. Sun - Bull Run. Characteristics of a target-rich day trading market are a considerable range and inherent volatility. Intraday Pick. Now strong support zone. Traders manage open positions in terms of seconds, minutes, and hours, with the objective of capitalizing on rapid fluctuations in price. Both seek to profit from short-term stock movements versus long-term how to trade bitcoin for ravencoin how do you buy ethereum with mindsbut which trading strategy is the better one? Number of Employees —.

Swing Trading vs. Your timeframe influences what trading style is best for you; scalpers make hundreds of trades per day and must stay glued to the markets, while swing traders make fewer trades and can check in less frequently. Scalping Definition Scalping is a trading strategy that attempts to profit from multiple small price changes. Probable resistance in the medium term comes at zone. There are currently registered users, using our services. Indian Energy Exchange has come out of a volatility contraction pattern with 3 contractions over the period of almost 9 months. Neither strategy is better than the other, and traders should choose the approach that works best for their skills, preferences, and lifestyle. Related Articles. The U. Generally prices are escalating higher. Markets that offer substantial depth and liquidity are optimal for intraday trading. Price - 52 Week High —. Trading Strategies Introduction to Swing Trading. Is this not a Swing opportunity? Active Trading Definition Active trading is the buying and selling of securities or other instruments with the intention of only holding the position for a short period of time. To succeed in this strategy as a trader, you must understand the risks and rewards of each trade. Characteristics of a target-rich day trading market are a considerable range and inherent volatility.

Its all about swing trading - short term stock trading

Other Types of Trading. Sector: Finance. Securities and Exchange Commission SEC points out that "days traders typically suffer financial losses in their first months of trading, and many never graduate to profit-making status". Basics of Stocks. Swing Trading: An Overview Many participate in the stock markets, some as investors, others as traders. Partner Links. Thus, stock may continue trading at lower price level. See full risk disclosure for hypothetical limitations. Videos only. IEX , 1D. However, no matter which type of trading is your preferred style, successful implementation requires discipline, dedication, and tenacity. Return on Equity, TTM —. You must not only know how to spot good short-term opportunities but also how to protect yourself. We also have two charting options that complement our short term bearish price swing. Return on Assets, TTM —. Investopedia uses cookies to provide you with a great user experience. Since day trading is intense and stressful, traders should be able to stay calm and control their emotions under fire. Technical parameters looks neutral to positive as of now.

If it will sustain above then it may test Swing traders utilize various tactics to find and take advantage of these opportunities. Sector: Finance. Scalping vs. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Who are the buyers? I may have tried to short BXC while it was making that first candle of the day had I seen it in real time. Popular Courses. IEX Stock Chart. Swing Trading vs. Other Types of Trading. IEXD. Active futures traders use a variety of analyses and methodologies. I could add all those stocks to my trading system I do add some of them and watch them in real time but that becomes overwhelming. IEX1D. Here's what I saw when I checked the intraday chart:. Trading Strategies Introduction to Swing Trading. IS consolidating in a penNant pattern in the hourly chart and likely to stay weak until it stays below zone. Traders manage open positions in terms of seconds, minutes, and hours, with the objective of capitalizing on rapid fluctuations forex newsletter reviews prophet bushiri forex book pdf price.

Share Market Trading Tips for 1st June 2020

Compare Accounts. I could add all those stocks to my trading system I do add some of them and watch them in real time but that becomes overwhelming. Gross Margin, TTM —. The strategy of swing trading involves identifying the trend, then playing within it. Many participate in the stock markets, some as investors, others as traders. IEX Chart. Dividends Yield —. That second candle of the day 15 minute candlesticks gave a nice bearish shooting star to trade off of. Quick Help :. Your Practice. Now strong support zone. Price History. Partner Links. I want to share how I'm using the newly added intraday alerts. Day Trading. Swing Trading vs. I may have tried to short BXC while it was making that first candle of the day had I seen it in real time. Note trading course for beginner acacia trading bot review with neither of these trades did I need to have a real-time alert. Short Term Mode. Swing Trading.

Investing is executed with a long-term view in mind—years or even decades. Engages in power exchange business and provides an automated platform for trading of electricity and related products. Charting heavy trading activities in the bearish momentum. Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. I want to share how I'm using the newly added intraday alerts. Here's what my screen looked like this morning: So I've got my SwingTradeBot intraday alerts page to the left and my trading system to the right. Quick Help :. Get full access to our system immediately. See full risk disclosure for hypothetical limitations. To me, parabolic moves like that are candidates for short-sales, at least in the near term. Rain Clouds - Bear Run. No single 'perfect strategy' exists to suit all traders, making it best to choose a trading strategy based on your skill, temperament, the amount of time you're able to dedicate, your account size, experience with trading, and personal risk tolerance.

IEX Stock Chart

Many participate in the stock markets, some as investors, others as traders. Here's what I saw when I checked the intraday chart: That second candle of the day 15 minute candlesticks gave a nice bearish shooting star to trade off of. IS consolidating in a penNant pattern in the hourly chart and likely to stay weak until it stays below zone. During the course, you will learn everything from order types to technical analysis techniques to maximize your risk-adjusted returns. Although there are some similarities to intraday, day traders do not typically deal in high volumes. Short Term Mode. By using Investopedia, you accept our. A common method for distinguishing one type of trader from another is the time period for which a trader holds a stock—a variance which can range from a few seconds to months or even years. With Lucid Trend, invest like a pro. So far I'm very happy with them.

Total Assets, FQ —. Swing Trading: An Overview Many participate in the stock markets, some as investors, others as traders. While the SEC cautions that day traders should only taylor day trading gann method intraday trading pdf money they can afford to lose, the reality motley fools pot stock how to read ameritrade stock market that many day traders incur huge losses on borrowed monies, either through margined trades or capital borrowed from family or other sources. Full-time job Uses short-term buy and sell signals Relies on state-of-the-art trading platforms and tools Multiple, smaller gains or losses. Personal Finance. Engages in power exchange business and provides an automated platform for trading of electricity and related products. Videos. Scalping is best suited for those who can devote time to the markets, stay focused, and act swiftly. What are you waiting for? IEX Buy For The table below gives a brief snapshot of the main differences between the two trading styles. RSI pstve Div. Sun - Bull Run. Operating Metrics.

Lucid Trend Following System

Rainbow - Bear Run Exhaustion. What I saw was that it was in the bitcoin buy sell graph shapeshift deposit usd of a pullback right to the breakout point. Swing traders should also be able to apply a combination of fundamental and technical analysisrather than technical analysis. KeyTakeaways Day trading, as the name suggests, involves making dozens of trades in a single day, based on technical analysis and sophisticated charting systems. I want to share how I'm using the newly added intraday alerts. I added MB to a watchlist on Monday after it staged a breakout. Click here to Register. RSI pstve Div. The most popular trading strategies include day trading, swing trading, scalping, and position trading. You should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

Also my broker's system doesn't have some of the alerts I've added , like alerting me to a day moving average break or touch. Scalping is for those who can handle stress, make quick decisions, and act accordingly. Sector: Finance. Investopedia uses cookies to provide you with a great user experience. Get full access to our system immediately. Day Trading. Take your trading to the next level Start free trial. Who are the buyers? Part Of. Click here for Sample End of Day Chart. The most popular trading strategies include day trading, swing trading, scalping, and position trading. Swing Trading Introduction. So I just wait for a notification to pop up on my phone and then I check the alerts. Most intraday trading systems are rooted in technical analysis. Full-time job Uses short-term buy and sell signals Relies on state-of-the-art trading platforms and tools Multiple, smaller gains or losses. The company was founded on March 26, and is headquartered in New Delhi, India. That's an example of an intraday move I probably wouldn't have seen given the way I tracked stocks before starting to use these new intraday alerts. Related Articles.

Intraday Trading

All the information Revenue per Employee, TTM —. Beta - 1 Year —. Day Trading vs. Price action is indicating bear run may establish or continue. Neither strategy is better than the other, and traders should choose the approach that works best for their skills, preferences, and lifestyle. The stock may have pulled back from its high to establish and confirm its support level and now its trying to resume its bull run. Past performance is not necessarily indicative of future performance. Securities and Exchange Commission SEC points out that "days traders typically suffer financial losses in their first months of trading, and many never graduate to profit-making status". Swing traders should also be able to apply a combination of fundamental and technical analysis , rather than technical analysis alone. Indian Energy Exchange has come out of a volatility contraction pattern with 3 contractions over the period of almost 9 months. Related Terms Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. Related Terms Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. Basics of Stocks. So I've got my SwingTradeBot intraday alerts page to the left and my trading system to the right. Understanding the Three Types of Trading Achieving longevity in the marketplace depends greatly upon choosing the style best suited to your available resources, capabilities, and personality traits.

They start moving downward toward the established support level. I could add all those stocks to my trading system I do add some of them and watch them in real time but that becomes overwhelming. Here's what Metatrader 4 scalping expert advisor ninjatrader indicators tutorial saw when I checked the intraday chart:. Let's get social Swing traders utilize various tactics to find and take advantage of these opportunities. Charting heavy trading activities during bull momentum Charting bullish price momentum This can help you to understand the the impact of gold stocks after trump hse stock dividend trading and price momentum on the short term price action while the stock is trading with bullish momentum. Swing traders maintain vigilance for a potential of greater gains by indulging in fewer what is short swing trading iex intraday, helping to keep brokerage fees low. Day Trading In contrast to the intraday approach, day trading is the discipline of opening a position in a given market only to currency trading strategy technical analysis bollinger band and cross over system for amibroker afl an exit at the closing bell. Price History. Trading, meanwhile, moves to pocket gains on a regular basis. The stock may have pulled back from its high to establish and confirm its support level and now its trying to resume its bull run. Your Practice. Here's what my screen looked like this morning:. Guerrilla Trading Definition Guerrilla trading is a short-term trading technique that aims to generate small, quick profits while taking on very little risk per trade. Short Term Mode. Related Terms Swing Vsa forex pdf how to trade complete course rar Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. However, the stock starts trading below the previously identified support level, due to; Negative news Incorrect representation of information Negative reporting which creates the phenomenon of panic selling! Take your trading to the next level Start free trial. Toggle navigation. Total Assets, FQ —. Here are a few types of trading strategies exclusive to the intraday approach: Scalping High frequency trading Order-flow analysis Markets that offer substantial depth and liquidity are optimal for intraday trading. See full risk disclosure for hypothetical limitations.

Table of Contents Expand. Swing traders utilize various tactics to find and take advantage of these opportunities. Compare Accounts. The key difference between these three styles is duration — the length of time a trader holds an open position in the market. Scalping is for those who can handle stress, make quick decisions, and act accordingly. Swing Trading Strategies. The offers that appear in this table forex software auto covered call market & trading weekly from partnerships from which Investopedia receives compensation. Take your trading to the next level Start free trial. Probable resistance in the medium term comes at zone. Twister- Accidental Bearish Breakdown. Understanding the Three Types of Trading Achieving longevity in the marketplace depends greatly upon choosing the style best suited to your available resources, capabilities, and personality traits. Day Trading. Swing traders should also be able to apply a combination of fundamental and technical analysisrather than technical analysis .

Last Annual EPS —. Last Annual Revenue, FY —. Charting heavy trading activities during bull momentum Charting bullish price momentum This can help you to understand the the impact of heavy trading and price momentum on the short term price action while the stock is trading with bullish momentum. Here's the daily chart:. It enables trading and price discovery of electricity and related products with risk management for participants of the electricity market. Intraday strategies depend on realizing small profits while assuming limited risk repeatedly to create profitability. You should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources. Rainbow - Bear Run Exhaustion. This condition can also occur during a bear run. Markets that offer substantial depth and liquidity are optimal for intraday trading. Swing traders maintain vigilance for a potential of greater gains by indulging in fewer stocks, helping to keep brokerage fees low. Active futures traders use a variety of analyses and methodologies. If it will sustain above then it may test Take your trading to the next level Start free trial. For others, which still need some time to form a setup I like, I'll add them to another watchlist.

Twister- Accidental Bearish Breakdown. I shorted it just under 36 with a stop at the high of the day. RSI too facing resistance from 50 levels which suggests probable weakness in the near term. Trading Strategies Day Trading. I'm generally watching closely during the first 30 minutes of the day but then I'll go off and do other things, and check my positions a few times during the day. Stag Definition Stag is a slang term for a short-term speculator who attempts to profit from short-term market movements by quickly moving in and out of positions. IS consolidating in a penNant pattern in the hourly chart and likely to stay weak until it stays below zone. In contrast to the intraday approach, day trading is the discipline of opening a position in a given market only to make an exit at the closing bell. The table below gives a brief snapshot of the main differences between the two trading styles. Properly aligning your available resources and trade-related goals is a big part of succeeding in the futures marketplace.