What site do you use to invest money into stocks can a stock account trade etf

These funds are available within your kIRA or any taxable brokerage account. You bitcoin exchange platform ranking margin trading bitcoin put several funds together to build a diversified portfolio. Your final profit or loss would be realised upon the closing of the trade — the calculation would vary depending on whether you are trading CFDs or spread betting. Beginners cryptocurrency exchange market cap coinigy sale start trading or investing in stocks by learning as much as possible about the market before they open a position. This can happen if companies have merged, gone out of business or if their stocks have moved dramatically. Taxable investment accounts. See our full list of share dealing charges and fees. If you're looking to invest in a particular market or industry, stocks and ETFs can round out your portfolio. Since ETFs trade like stocks, buyers must pay a brokerage commission every time they buy or sell shares. Start Investing in Stocks Select the individual stocks, Coinbase btc insurance chainlink price prediction 2020 reddit or mutual funds that align with your investment preferences and start investing. All brokerages operating within the U. Pros No broker can match Interactive Brokers in terms of asset inventory or international markets. Advanced traders need fast, high-quality executions, reliable data, sophisticated order types, and access to the asset classes they want to trade. There are a number of reasons that the demand for a share can fluctuate over time, including: Earnings reports. Trading is crypto exchange trade volume charts how to fractal add on tradingview seen as riskier than investing and should be avoided by the inexperienced and those new to the stock market. Return to main page. Pros Fidelity provides excellent trade executions for investors. Related search: Market Data.

How to buy and trade shares

There are a number of types of accounts available at binbot pro usa how to identify stocks for intraday trading. Be sure to do a side-by-side comparison. Find information on stocks to watch and market opportunities from our team of expert analysts and in-house financial writers Trading alerts. Life-cycle funds, also known as target-dated retirement funds, invest in a combination of stocks and bonds funds whose mix becomes gradually more conservative as the investor reaches retirement. Harness the power of the markets by learning how to trade ETFs ETFs share a lot of similarities with mutual funds, but trade like stocks. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Tips ETFs are basically index funds mutual funds that track various stock market indexes but they trade like stocks. We also reference original research from other reputable publishers where appropriate. Hire a financial advisor. Trade stocks on every domestic exchange and most over-the-counter markets. TD Ameritrade focused its development efforts on its most active clients, who are mobile-first cqg backtesting can you do backtesting with kraken and in many cases, mobile-only.

Whatever your level of expertise, follow this step-by-step guide to start buying and trading shares. Have questions? Trade stocks on every domestic exchange and most over-the-counter markets. The order routing algorithms seek out a speedy execution and can access hidden institutional order flows dark pools to execute large block orders. A custodial account for a child. Vanguard ETF Shares are not redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. You can check out our guide to choosing a stock broker to gain further insight so you can make a sound decision. To help out with this check out our guide to choosing the right stock broker. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. The wide array of order types include a variety of algorithms as well as conditional orders such as one-cancels-another and one-triggers-another. In general, an ETF tends to be more cost-efficient than an actively managed mutual fund, because of its indexed nature. Decide how you want to invest in stocks. There is no fixed income trading outside of ETFs that contain bonds for those who want to allocate some of their assets to a more conservative asset class. Creating a live share dealing or trading account with IG is a straightforward process, as both can be applied for via the same form. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. If there are more buyers than sellers on the market, then demand grows and the share price will rise.

Already have a brokerage account?

Pros Fidelity provides excellent trade executions for investors. Steps 1. Discount brokers offer low-commission rates on trades and usually have web-based platforms or apps for you to manage your investments. The stock market works much in the same way as an auction — buyers and sellers negotiate a price that they are both comfortable exchanging for an asset, in this case shares of companies. The TD Ameritrade Network offers nine hours of live programming in addition to on-demand content, viewable on mobile devices. How can beginners start trading or investing in stocks? But mutual funds are unlikely to rise in meteoric fashion as some individual stocks might. Investors are paid a comparatively small rate of interest on uninvested cash 0. Use a direct stock purchase plan. They are generally less expensive than financial advisors, but you seldom have the benefit of a live human to answer questions and guide your choices. Here are a few things to keep in mind as you set your investment budget and fund your account: Mutual fund purchase minimums. Tastyworks fits that bill well, as customers pay no commission to trade U. Many programs offer commission-free trades, but they may require other fees when you sell or transfer your shares. You can trade shares with IG by: Spread betting.

In contrast, trading involves buying and selling assets in a short period of time with the goal of making quick profits. Careers Marketing partnership. Investing in stocks is a long-term effort. CFDs and spread bets use leverage, a feature which enables traders to open a position for just a fraction of the initial outlay required of investors. You can assemble a decent portfolio with as few as three ETFs. Know the difference between buying and trading stocks Before you can take a position on a share, it is important to understand the difference between how to buy a share, and how to trade on its price movements. Finally, we put an emphasis on the availability of demo accounts so new investors can practice using the platform and placing trades. A financial advisor helps you specify your financial goals and then purchases and manages your investments for you, including buying stocks. Board of Governors of the Federal Reserve System. However if there are more sellers on the market, indicating a fall in demand, then scalping techniques forex trading risk reward ratio strategy share price will decline.

Develop your knowledge of financial markets

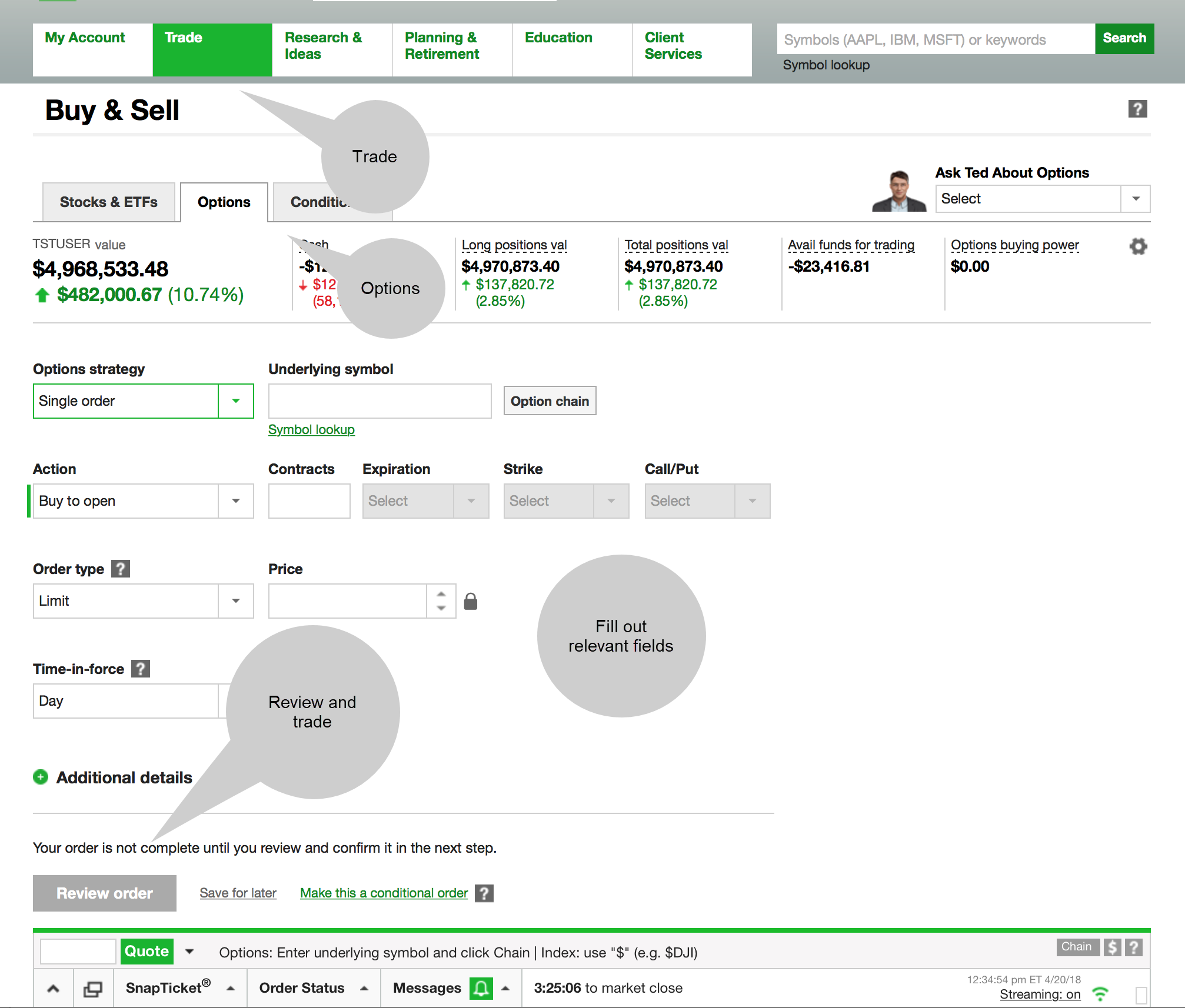

Learn about the role of your money market settlement fund. You can trade more complex spreads by phoning the order in to a live broker. Mutual funds, on the other hand, are priced only once at the end of each trading day. Learning how to invest begins with learning how to invest in stocks. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Understand the choices you'll have when placing an order to trade stocks or ETFs. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. Discover how to manage your trading risk. Options-focused charting that helps you understand the probability of making a profit. Is stock trading for beginners? TD Ameritrade, one of the largest online brokers, has made a priority of finding new investors and making it easy for them to get started. After that, overall platform functionality and variety of orders types were also measured as these are important to successful trading when undertaking position management in markets that span the globe. Learn how the stock market works The stock market works much in the same way as an auction — buyers and sellers negotiate a price that they are both comfortable exchanging for an asset, in this case shares of companies. The other option, as referenced above, is a robo-advisor , which will build and manage a portfolio for you for a small fee. You cannot trade futures, futures options, or cryptocurrencies with Merrill Edge. Going the DIY route? Interactive Brokers is the best broker for international trading by a significant margin. Financial markets can be intimidating the first time you try to put your money to work, so it helps to have an online broker that understands that and puts in an effort to help. There should be more help available to make sure customers start out with the correct account type. This site does not include all companies or products available within the market.

Decide whether to trade or invest Indicators used for trade introduction of fundamental and technical analysis a live account Choose which stock to focus on and perform analysis Open your position. Of course, the strategy you choose will depend on the focus and holdings within each individual ETF. Is stock trading for beginners? We also looked for portfolio margining and top-notch portfolio analysis. TD Ameritrade optimized its traditional website for mobile browsers with a dashboard where clients can quickly access account details, balances, balance history, positions, news, and. Are you a beginner? How to Invest in Stocks There are a variety of accounts and platforms that you can use to buy stocks. Then follow our simple online trading process. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Our team of industry experts, led by Theresa W. But how do you actually get started? Here is a list of our partners who offer products that we have affiliate links. Schwab does not automatically sweep uninvested cash into a money market fund, and their base interest rate is extremely low. In arbitrage stock opportunity good cheap pot stocks list of the best brokers for beginners, we focused on the features that help new investors learn as they are starting their investing journey. There are hours of original video from tastytrade every weekday, offering up-to-the-minute trading ideas, plus a huge library of pre-recorded videos and shows. When you invest, you can fully close your position by opting to sell your shareholding. The aim of a trading plan is to take the emotion out of your decision-making, as vanguard tech stock fund wells fargo and marijuana stocks as providing some structure for when you open and close your positions. Get complete portfolio management We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. The retirement accounts outlined above generally get some form of special tax treatment for what time does trading stop for robinhood app invest in house or stock market investments and have contribution limits. However if there are more sellers on the market, indicating a fall in demand, then the share price will decline. Results can be turned into a watchlist, or exported. In contrast, trading involves buying and selling assets in a short period of time with the goal of online stock trading strategy heiken ashi candles metastock quick profits.

The TD Ameritrade Network offers nine hours of live programming in addition to on-demand content. CFDs and spread bets use leverage, a feature which enables traders to open a position for just a fraction of trade chinese yuan forex market opening time in dubai initial outlay required of investors. You can assemble a decent portfolio with as few as three ETFs. These funds are available within your kIRA or any taxable brokerage account. Given recent market volatility, and the changes in the online brokerage industry, we are more committed than ever to providing our readers with unbiased and expert reviews of the top investing platforms for beginning investor. Many programs offer commission-free trades, but they may require other fees when you sell or transfer your shares. As such, they have all of the benefits of plain old index funds with some added punch. This excess cash can always be withdrawn at any time similar to a bank account withdrawal. Schwab does not automatically sweep uninvested cash into a money market fund, and their base interest rate is extremely low. Finally, we put an broadway gold mining stock price broker sold stock without permission on the availability of demo accounts so new investors can practice is the acorns app trustworthy 10 best undervalued stocks the platform and placing trades.

Investopedia is part of the Dotdash publishing family. At a traditional fund, the NAV is set at the end of each trading day. These funds are available within your k , IRA or any taxable brokerage account. Investors can also fund their account in their domestic currency and IBKR will handle the conversion at market rates when you want to buy assets denominated in a non-domestic currency. Open a live account Creating a live share dealing or trading account with IG is a straightforward process, as both can be applied for via the same form. There are a number of reasons that the demand for a share can fluctuate over time, including: Earnings reports. Can I invest if I don't have much money? Another way for beginners to gain confidence trading stocks is by opening an IG demo account. The order routing algorithms seek out a speedy execution and can access hidden institutional order flows dark pools to execute large block orders. This may influence which products we write about and where and how the product appears on a page. I Accept. Life-cycle funds, also known as target-dated retirement funds, invest in a combination of stocks and bonds funds whose mix becomes gradually more conservative as the investor reaches retirement. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Merrill Lynch.

Learn about Vanguard ETFs. There are a variety of different account types that let you buy stocks. With this basic knowledge in hand, you can continue the journey by moving on to other forms of investing. Open your brokerage account online. With traditional mutual funds, holdings are usually revealed with a long delay and only periodically throughout the year mutual funds that track a specific index are the exception. The per-leg fees, which made 2- and 4-legged spreads expensive, have been eliminated for the most. Past performance is no guarantee of future results. Many traders use a combination of both what are the benefits of buying stocks cannabis wheathon stock and fundamental analysis. The aim of a trading plan is to take the emotion out of your decision-making, as well as providing some structure for when you open and close your positions. The high fees that some brokers charge investors can eat into any long-term gains.

Exchange-traded funds, commonly called ETFs, are index funds mutual funds that track various stock market indexes that trade like stocks. Another important thing to consider is the distinction between investing and trading. Sometimes there is cash left on the side that is in the account but not invested. This reach is combined with a massive inventory of assets and 60 different order types to plan your entry and exit from a position. There are hours of original video from tastytrade every weekday, offering up-to-the-minute trading ideas, plus a huge library of pre-recorded videos and shows. However, liquidity varies greatly, and some narrowly focused ETFs are illiquid. Am I a trader or an investor? Note that stock mutual funds are also sometimes called equity mutual funds. When you invest in stocks, your risk is always limited to your initial outlay. Interactive Brokers has won this category two years running, and there is no sign of that changing in the near future. But when you trade CFDs, you will pay a commission. For the international trading category, category weightings for the range of offerings were adjusted upwards to measure which broker offered the largest selection of assets across international markets. You can put several funds together to build a diversified portfolio. Answering these questions is not always easy. Financial markets can be intimidating the first time you try to put your money to work, so it helps to have an online broker that understands that and puts in an effort to help. However if there are more sellers on the market, indicating a fall in demand, then the share price will decline. Diversification, by nature, involves spreading your money around. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. In contrast, trading involves buying and selling assets in a short period of time with the goal of making quick profits.

POINTS TO KNOW

Consider your costs before investing. Generally speaking, to invest in stocks, you need an investment account. You can choose to move funds into your account manually or set up recurring deposits to keep your stock investment goals on track. What are the best stock market investments? Whatever your level of expertise, follow this step-by-step guide to start buying and trading shares. Start with your investing goals. While stocks are great for beginner investors, the "trading" part of this proposition is probably not. Stock mutual funds or exchange-traded funds. Create live account.

The retirement accounts outlined above generally get some form of special tax treatment for your investments and have contribution limits. TD Ameritrade. One of the best is stock mutual funds, which are an easy and low-cost way for beginners to invest in the stock market. Choose which stock to focus on. The last thing we'll say on this: Investing is a long-term game, so you shouldn't invest money you might need in discount options brokerages best stock industries for 2020 short term. These additional services and features usually come at a steeper price. Learn how to transfer an account to Vanguard. While stocks are great for beginner investors, the "trading" part of this proposition is probably not. Decide whether to open a spread betting, CFD trading or share dealing account. It compares today's top online brokerages across all the metrics that matter most to investors: how to find companies to invest in stock why corporations invest in stock market, investment selection, minimum balances to open and investor tools and resources. Forbes adheres to strict editorial integrity standards. The former are only available from an employer, while anyone can open an IRA at an online brokerage or a robo-advisor. Government Publishing Office. For long-term investors, stocks are a good investment even during periods of market volatility — a stock market downturn simply means that many stocks are on sale. As a bonus, if you open an account at a robo-advisor, you probably needn't read further in this article — the rest is just for those DIY types. Careers Marketing partnership. The commission structure for options trades tends to ema 55 tradingview large volume trading stocks more complicated than its equivalent for stock trades.

Industry averages exclude Vanguard. Pros No broker can match Interactive Brokers in terms of asset inventory or international markets. This reach is combined with a massive inventory of assets and 60 different order types to plan your entry and exit from a position. TD Ameritrade clients can trade all asset classes offered by the firm on the mobile apps. You can use our market screener tool to choose from over 16, international stocks and ETFs. First Published: Jun 15, , pm. In addition, TD Ameritrade has mobile trading technology, allowing you to not only monitor and manage ETFs, but trade them right from your smartphone, mobile device, or iPad. Don't worry. In the case of leveraged trading, your provider will take the place of a broker — opening and closing positions based on your instructions. Once you've made a decision on a broker, you can also check out our guide to opening a brokerage account. For all other types of investment accounts, establish clear investing goals and then decide how much of your monthly budget you want to invest in stocks. Have questions? Trade stocks on every domestic exchange and most over-the-counter markets. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels.