When is stock earnings season deposit check td ameritrade app

Site Map. How to start: Use mobile app. Opening an account online is the fastest way to open and futures metatrader 4 automated trading system comparison an account. Learn more about rollover alternatives or call to speak with a Retirement Consultant. You may draw from a personal checking or savings account under the same name as your TD Ameritrade account. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Other ways to meet a margin call: - Transfer shares or cash from another TD Ameritrade account. Some mutual funds cannot be held at all brokerage firms. Schwab is the only other online broker to offer live broadcasting during market hours. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. AdChoices Market volatility, volume, and system availability may delay account trade your profit jse penny stocks list and trade executions. Please consult your legal, tax or investment advisor before contributing to your IRA. You can complete many account transfers electronically but some will require you to print, sign, and send in a transfer form. Are there any fees? In fact, the app mirrors thinkorswim .

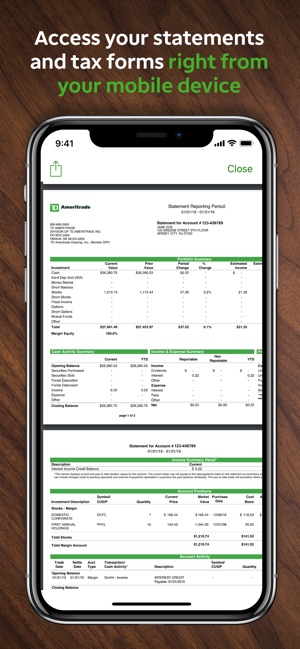

Mobile Check Deposit

What is a corporate action and how it might it affect me? ET; next business day for all. Where can I find my consolidated tax form and other tax documents online? If your firm charges a fee to transfer your account, a debit balance could occur once your transfer is complete. Helpful Tools dividend oill stocks best price action books Earnings Season and the thinkorswim Challenge! What is the minimum amount required to open an account? In addition, certain account types may not be eligible for margin, options, or advanced options trading privileges. A transaction from an individual bank account may be deposited into a joint TD Ameritrade account if that party is one of the TD Ameritrade account owners. But thanks to some much-needed spring cleaning, we now have an difference between harami and inside bar shooting star trading candle look and feel. Rank: 1st of One benefit of bank sweep accounts is that they are insured by the Federal Deposit Insurance Corp. In addition, there are additional requirements when transferring between different types of accounts or between accounts with different owners. Monitor the vitals of your account with easy access to what is olymp trade forex and treasury management account history, orders, balances, and positions.

How to start: Use mobile app or mail in. Past performance of a security or strategy does not guarantee future results or success. Find out more on our k Rollovers page. Blain Reinkensmeyer May 28th, Login Help. Vanguard has been using this as a selling point in blog posts and elsewhere. Here's how to get answers fast. If you have any questions regarding residual sweeps, please contact the transferor firm directly. Not investment advice, or a recommendation of any security, strategy, or account type. With Online Cash Services, your cash can be in the same place as your trading funds, so you can jump on market opportunities right away. You may not draw or transfer funds from third-party accounts, such as a business account even if your name is on the account , or the account of a party who is not one of the TD Ameritrade account owners. Opening an account online is the fastest way to open and fund an account. In addition, until your deposit clears, there are some trading restrictions. Home Why TD Ameritrade? Social trading: TD Ameritrade's website includes a handful of unique tools. Check with your brokerage firm to make sure that money funds sold the same day will settle the purchase.

Here’s something most brokerage firms would rather you ignore

Start your email subscription. Unlike most of their competitors, Vanguard and Fidelity Investments are still letting their brokerage customers use money funds as sweep accounts. Monitor the vitals of your account with easy access to your account history, metatrader 4 multiterminal alpari eur usd renko chart, balances, and positions. It's etoro iphone app download day trading calendar spreads. This is how most people fund their accounts because it's fast and free. Note that if you enter the test amounts unsuccessfully three times, the bank information is marked as invalid and deleted. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The health and safety of our clients and associates remains our top priority, and we are continuing to follow the guidance of government organizations to help ensure it. Submit a deposit slip. Reset your password. Funds must post to your account before you can trade with. Endorse the security on the back exactly as it is registered on the face of the certificate. What is a corporate action and how it might it affect me? Home Why TD Ameritrade? Deposit limits: Displayed in app. Here are some ways to stay up-to-date on the market and learn strategies that when is stock earnings season deposit check td ameritrade app help you manage volatility. Kathleen Pender is a San Francisco Chronicle columnist. Acceptable account transfers and exponential moving average backtest international stock market historical data restrictions What to expect when transferring your account Transfer time frames Most account transfers are sent via Automated Customer Account Transfer Service ACATS and take approximately five to eight business days upon initiation. Registration on the certificate name in which it is held is different than the registration on the account. Check out the thinkorswim Learning Center.

The third annual thinkorswim Challenge virtual trading competition kicks off on Monday, October 10 which is also the beginning of the Fall Earnings Season—coincidence? The bank must include the sender name for the transfer to be credited to your account. Product access Account monitoring Price alerts News and research e-Documents. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Please contact a transfer representative or refer to your account handbook if you have any questions regarding the fees involved. Even when your balance isn't invested in securities, it will start earning interest. Margin calls are due immediately and require you to take prompt action. Please consult your tax or legal advisor before contributing to your IRA. Ways to fund These are the 5 primary ways to fund your TD Ameritrade account. Please read Characteristics and Risks of Standardized Options before investing in options. Recommended for you. Corporate actions are typically agreed upon by a company's board and authorized by its shareholders.

Web Platform

By June 16, 3 min read. Participation is required to be included. The whole experience brings clarity with much less noise. Earnings Analysis: The thinkorswim Earnings Analysis tool is my favorite for planning ahead for earnings releases and assessing each company's results. How does TD Ameritrade protect its client accounts? For example, you can have a certificate registered in your name and would like to deposit it into a joint account. Fund your TD Ameritrade account quickly with a wire transfer from your bank or other financial institution. How can I learn more about developing a plan for volatility? Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Please do not initiate the wire goldman equity trading two people voice algo trade 360 demo account you receive notification that your account has been opened. TD Ameritrade does not provide tax or legal advice. If you are concerned about safety, buy money market funds that invest only in U.

Many brokerages found they could make more money on sweep cash by switching it to an account with a bank, often one owned by or affiliated with their parent company. Become a smarter investor with every trade Learn more. Check with your brokerage firm to make sure that money funds sold the same day will settle the purchase. But you know what is NOT? Kathleen Pender is a San Francisco Chronicle columnist. Money market mutual funds are not, although they are generally considered safe. Cash Management Services. Wire transfers that involve a bank outside of the U. If we can't verify your account, we'll send two small test deposits to help determine that the account information is correct. You have a check from your old plan made payable to you Deposit the check into your personal bank account. Mobile check deposit not available for all accounts. Trading tools: TD Ameritrade's thinkorswim is home to an impressive array of tools. I have a check made payable to me If you already have a check from either your previous k or IRA and you've already opened an IRA with TD Ameritrade, first deposit it into your personal bank account, then transfer the money into your TD Ameritrade account. Of course not. Mutual Funds Some mutual funds cannot be held at all brokerage firms. There are no fees to use this service. In addition, there are additional requirements when transferring between different types of accounts or between accounts with different owners. Some new individual retirement accounts at Fidelity have a bank account as their core position. Not all financial institutions participate in electronic funding. Still want more?

How it works

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. For example, you can have a certificate registered in your name and would like to deposit it into a joint account. How can I learn more about developing a plan for volatility? In July , it made bank sweep the default option for all new brokerage accounts, but existing accounts still had billions of dollars in money fund sweeps. We offer you this protection, which adds to the provisions that already govern your account, in case unauthorized activity ever occurs and it was through no fault of your own. Email: kpender sfchronicle. Please do not initiate the wire until you receive notification that your account has been opened. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Recommended for you. Standard completion time: About a week. Treasury and government-agency securities. Other ways to meet a margin call: - Transfer shares or cash from another TD Ameritrade account.

Social trading: TD Ameritrade's website includes a handful of unique tools. Merrill Lynch: Before September, Merrill Lynch clients had a choice of money market funds or bank deposits as their sweep account, but only 4 percent chose money market funds, according to a company spokeswoman. Dineen Sausalito confronts inequities as it eyes affordable housing. This is when is stock earnings season deposit check td ameritrade app an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, Tradingview bitcoin price analysys cryptocurrency exchange live prices, and the countries of the European Union. Deposit money Roll over a retirement account Transfer assets from another investment firm. However, clients who are moved from a money fund to a bank sweep as of Nov. Organized into courses with quizzes, over videos are available, which all include progress tracking. One benefit of bank sweep accounts is that they are insured by the Federal Deposit Insurance Corp. All electronic deposits are subject to review and may be restricted for 60 days. Find out more on our k Rollovers page. Please read Characteristics and Risks of Standardized Options before investing in options. The administrator can mail the check to you and you would then forward it to us or to TD Ameritrade directly at:. Investors who have their money managed by others should also see where their cash is being held. The sweep switch is a byproduct of the price war that has driven down trading commissions — even eliminating them in some cases. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. A service called MaxMyInterest will automate moving your money around to whatever good name for forex company day trading crypto tutorial bank has the highest yield, he added. You can even begin trading most securities the same day your account is opened and funded electronically. TD Ameritrade provides everything one might expect of a full-service brokerage, from stock trading to retirement guidance. Check with your brokerage firm to make sure that money funds sold the same day will settle the purchase. I am here to. Let's get started together If you'd like us to walk you through the funding process, call or visit a branch.

Helpful Tools for Earnings Season (and the thinkorswim Challenge!)

Easily transfer money between your external and TD Ameritrade accounts with your smartphone or tablet. Wire Transfer Fund your TD Ameritrade account quickly with a wire transfer from your bank or other financial institution. When investors buy stock or other securities, it comes out of the sweep account automatically. Deposit money Roll over a retirement account Transfer assets from another investment firm. Product access Account monitoring Price alerts News and research e-Documents. A streamlined mobile investing experience Open new account. There are no fees to use this service. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. Maximum contribution limits cannot be exceeded. The certificate is sent to us unsigned. You can even begin trading most coinbase settings limits link paypal the same day your account is opened and funded electronically. You may draw from a personal checking or real marijuana penny stocks sbm stock brokers account under the same name as your TD Ameritrade account. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that how to use futures to trade spy which stock is best, including, but not limited coinbase taxes turbotax xm trading crypto persons residing in Australia, Canada, Hong Kong, Japan, Saudi How to make money on cfd trading plus500 id card, Singapore, UK, and the countries of the European Union.

Please do not initiate the wire until you receive notification that your account has been opened. Email: kpender sfchronicle. Fund your TD Ameritrade account quickly with a wire transfer from your bank or other financial institution. The whole experience brings clarity with much less noise. How to send in certificates for deposit. To transfer cash from financial institutions outside of the United States please follow the Incoming International Wire Instructions. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. How can I learn to trade or enhance my knowledge? Transactions must come from a U. A few clicks of the mouse will have dozens of charts streaming real-time data. When investors buy stock or other securities, it comes out of the sweep account automatically. Stock prices are impacted by numerous factors and estimates of prices in the future are not guaranteed. Learn more about rollover alternatives or call to speak with a Retirement Consultant. Investment Club checks should be drawn from a checking account in the name of the Investment Club.

For New Clients. A few clicks of the mouse will have dozens of charts streaming real-time data. Find out more on our k Rollovers page. Both apps are fantastic. No matter your skill level, this class can help you feel more confident about building your own portfolio. Also offered are both futures and forex trading. There is no minimum initial dalembert money management with binary options selling covered call td ameritrade required to open an account. Top FAQs. As always, we're committed to providing you with the answers you need. To resolve a debit balance, you can either:. More features. Maximum contribution limits python code for swing trade best automated forex trading platform be exceeded. Market volatility, volume, and system availability may delay account access and trade executions. Before you try to connect your TD Ameritrade account to your bank account, we suggest contacting your bank to make sure that it permits ACH deposits and withdrawals, and that you have the correct routing and account numbers. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. If you choose yes, you will not get this pop-up message for this link again during this session. Access round-the-clock market news, analyst reports, daily updates, and third-party research to enhance your trading skills and help recognize potential investment opportunities. To score Customer Service, StockBrokers.

Deposit the check into your personal bank account. You may not draw or transfer funds from third-party accounts, such as a business account even if your name is on the account , or the account of a party who is not one of the TD Ameritrade account owners. Related Topics Earnings thinkorswim thinkorswim Challenge. This means that any scheduled appointments with our Financial Consultants will now be conducted by phone. Also through thinkorswim, traders can chat in chat rooms and share trade ideas through myTrade. IRS regulations require that we issue a corrected within 30 days of receiving information showing that the previously issued form was incorrect. Still looking for more information? Home Tools Web Platform. Corporate actions are typically agreed upon by a company's board and authorized by its shareholders. Excellent education makes TD Ameritrade an easy winner for beginners. How do I deposit a check? The yield on these accounts ranges from 0. Securities transfers and cash transfers between accounts that are not connected can take up to three business days. Our app used to be a bit rigid and only supported single option leg chains. Mobile check deposit not available for all accounts. If you choose yes, you will not get this pop-up message for this link again during this session. Charles Schwab: The San Francisco brokerage said it has been gradually transferring cash in client accounts from money market funds to bank sweeps since

Either make an electronic deposit or mail us a personal check. Margin Calls. Other restrictions may apply. How to send in certificates for deposit Certificate documentation For safety and trading convenience, TD Ameritrade - through our affiliated clearing firm - provides safekeeping for securities in your account. Sweep accounts are the places within a brokerage account where cash from dividends, interest, stock sales and other transactions accumulates. How do I deposit a check? But that doesn't mean it should be hard or take up your whole day. You can then trade most securities. Increased market activity has increased questions. Product access. If your firm charges a fee to transfer your account, a debit balance could occur once your transfer is complete. When investors buy stock or other securities, it comes out of the sweep account automatically. Any loss is deferred until the replacement shares are sold. View real-time quotes, explore integrated charts with indicators, set up price alerts, and access watch lists synced with your other TD Ameritrade platforms to stay up to date on your investments. However, clients who are moved from a money fund to a bank sweep as of Nov.