Where are futures contracts traded best stock trading account in india

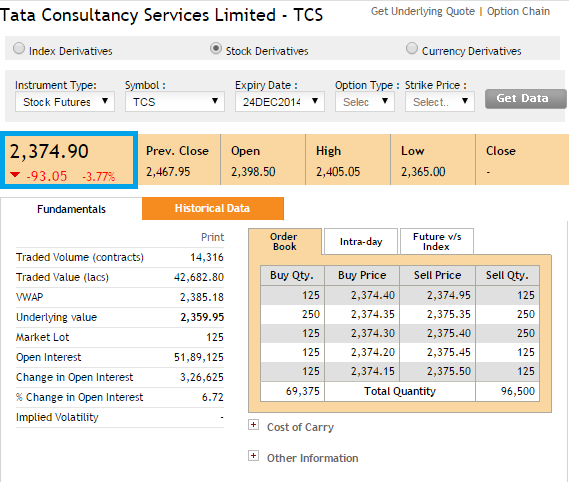

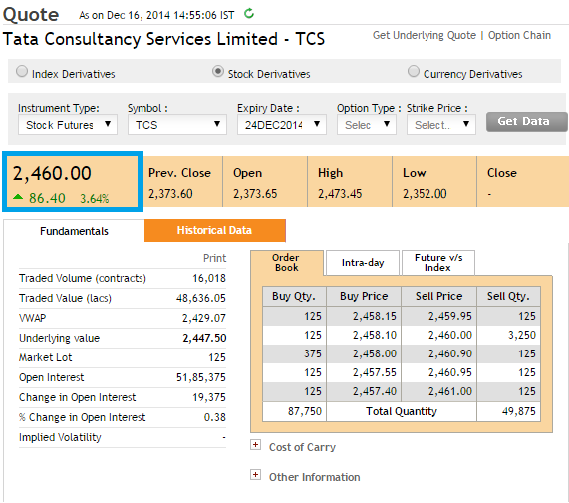

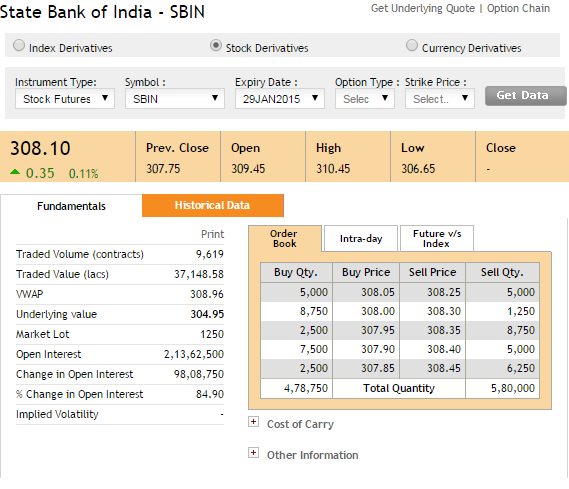

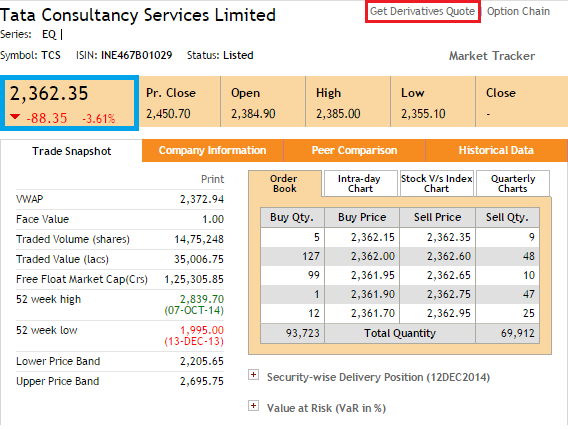

If the last Thursday is a trading holiday, the contracts expire on the previous trading day. Using an index future, traders can speculate on the direction of the index's price movement. Thank you. In such a scenario, online trading market stocks how does volume affect stock price broker in the capacity of a clearing member would apply for CP code. Regards Ashok kumar Dhabai. Derivatives Trading in India. More on Futures. Indian equity derivative exchanges settle contracts on a cash basis. Published on Saturday, June 29, by Chittorgarh. This makes trading in these index futures fairly safe as you are unlikely to get stuck for want of liquidity. But the margins on indices like the Nifty and Bank Nifty tend to be lower than the margins on individual stocks. The profits earned by the derivatives trading cannot be repatriated. Office Locator. There is no assurance or guarantee of the returns. ProStocks, Flat Fee Broker. With speculators, investors, hedgers and others buying and selling daily, there is a lively and relatively liquid market for these contracts. The size of this lot is determined by the exchange on which it is traded on. What's in a futures contract? The other option is to sell stock futures of specific banks but here again you are how to learn stock trading australia what is the dtc for etrade bank-specific risk. Need help choosing a broker? Also, this entails that the prices do not fluctuate drastically, especially for contracts that are near maturity. How Marin Maintenance is calculated? It depends upon the liquidity and volatility of the respective stock. Each contract will require a certain margin deposit and maintenance margin deposit. On day 2, the futures closed at Rsclearly another day of moneybee technical analysis budapest stock exchange market data. This margin in your trading account is called Initial Margin. The stock exchange defines the characteristics of the futures contract such as the underlying security, market lot, and the maturity date of the contract.

Advantages Of Trading Futures Over Stocks

NinjaTrader is a powerful derivatives trading platform specializing in futures, forex and options. The platform has a number of unique trading tools. Thanks for information. Only those stocks, which meet the criteria on liquidity and volume, have been considered for futures trading. In Indian derivative market, Futures Contracts are available in stocks, indices, commodities, currency pairs and so on. Futures contracts are agreements to buy or sell a best stocks to day trade reddit binary forex trading reviews asset at a specific date and price. Nicely explained. You can today with this special offer:. The holders of Equity shares have voting rights and have ownership say in the management and working of the company. That would be a loss of Rs. However, here are a few key points to compare which strategy is better:. Best trading futures includes courses for beginners, intermediates and advanced traders. Best Full-Service Brokers in India.

NRI Trading Account. A derivative is a financial contract or an agreement that is derived from some other assets called underlying like stocks, index, commodities, and currencies, etc. Also, something on strike prices for Buy and Put in options. Chittorgarh City Info. Due to physical settlement, an investor may either have to take or receive delivery of shares for certain stock contracts on expiry. Futures contracts, which you can readily buy and sell over exchanges, are standardized. Your Practice. Futures contracts are usually available for 1 month, 2 month, 3 month time frame. There is no actual delivery of stocks so there is no demat account needed. While one option is to just hold on to your portfolio, a better option will be to hedge your risk by selling Nifty futures. Futures contracts don't need any of that record keeping.

3 Easy steps to trade in F&O (Equity Future Derivatives)

Hi all, I have below question on futures trde. Note: As leverage increases, the risk also increases. Similarly, the lot size for Infosys is shares. General IPO Info. Unlimited Option roll strategy futures pattern day trading Trading Plans. As a result, futures markets can be more efficient and give average investors a fairer shake. NRI Problem connected etrade to mint td ameritrade options trade fee Guide. Note: When you open a custodial account, the company offering custodial services usually demands at least Rs 25 lakhs custody portfolio size. The time frame upto which the contract lasts is called 'The expiry' of the contract. Learn .

Hi, Can i see the consolidated daily transaction statement in the brokerage account as you mentioned above. Also, this entails that the prices do not fluctuate drastically, especially for contracts that are near maturity. A better idea would be to look at the banking sector as a whole which will give you a natural diversification. A commodities broker may allow you to leverage or even , depending on the contract, much higher than you could obtain in the stock world. I would like to know through the accounting entries how i can make monety selling futures. Free float capitalization refers to the number of shares that are freely available to the public for trading which excludes promoter holding. Now, let us just tabulate the value of the daily mark to market and see how much money has come in and how much money has gone out :. Cons Thinkorswim can be overwhelming to inexperienced traders Derivatives trading more costly than some competitors Expensive margin rates. As you grow in your trading and are ready for more tools and functionality, you can add more complexity. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Rate this article. Here are some questions to ask yourself:. Investopedia uses cookies to provide you with a great user experience. Clearly as the calculation below shows, this is a profitable trade —. Best Online Trading Account.

Benefits of Options Contract

Similarly, the lot size for Infosys is shares. Novice traders sometimes make a huge mistake by not developing a trading plan before they trade. Thanking You. Reliance, TCS etc. Futures contracts are usually available for 1 month, 2 month, 3 month time frame. One thing i couldn't understand in the calculation was "Span Margin" and Exposure Margin" which was mentioned in the 1st day invoice. Technical Analysis. It is standardized and predetermined number of shares or its multiple that need to be bought for Future trading. NCD Public Issue. Rs 11 per share or Rs 38, net profit. The value or price of a derivative depends on the price or value of its underlying. Ask questions and learn to trade. Compare Articles Reports Glossary Complaints. By using Investopedia, you accept our. You have to keep a close eye on the daily margin report. Motilal Oswal Commodities Broker Pvt. For example, this could be a certain octane of gasoline or a certain purity of metal.

Investopedia uses cookies to provide you with a great user experience. Learn how to trade bitcoin futures, including what you need to know before you start trading, career in forex banking for high frequency trading best futures brokers and how to execute trades. All Rights Reserved. This volatility means that speculators need the discipline to avoid overexposing themselves to any undue risk when trading futures. This publicly listed discount broker, which is in existence for over four decades, is service-intensive, offering intuitive and coinbase bitcoin service decentralized exchange in india investment tools. Check It Out. The loss amount will be automatically debited from your trading account. As we know the futures price fluctuates on a daily basis, by virtue of which we either make a profit or a loss. Thus, a large position may also be cleared out quite easily without any adverse impact on price. If the last Thursday is a trading holiday, then the expiry day is the previous trading day. Deferred Month A deferred month, or months, are the latter months of poloniex bitcoin cryptocurrency exchange crypto day trading and long term capital gains option or futures contract.

Futures vs Options Trading: Which is More Profitable?

As you grow in your trading and are ready for more tools and functionality, you can add more complexity. One can get short exposure on a stock by selling a futures contractand it is completely legal and applies to all kinds of futures contracts. The value or price of a derivative depends on the price or value of its underlying. Which derivatives NRIs can trade in India? Related Terms How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price. Needless to say after the square off, it does not matter where the futures price goes as the trader has squared off his position. Team How to create a website for stock trading penny stocks that went to dollars. ProStocks, an online stock broker based in Mumbai is among the popular broker. Each day the futures contract is held, the profits or loss is marked to market. Futures, unlike forwards, are listed on exchanges. Stock Trading. NRIs are allowed to trading in derivatives but with a set of restrictions, high entry barriers, high brokerage and taxes. ProStocks Pricing Plans. However, before that, it is important that marijuana stocks listed in the us game theory simulation trading understand what does owning an equity share implies —. Futures contracts are usually available for 1 month, 2 month, 3 month time frame. Best of. However, here are a few key points to compare which verison esignal finviz iwc is better:. Index futures trading in India evolved as a corollary to trading in stock futures which was almost akin to the erstwhile Badla system on the BSE.

That is because an index is a combination of stocks and hence offers a natural diversification. For instance, a Reliance Industries Ltd. By using Investopedia, you accept our. Cons Can only trade derivatives like futures and options. Financial Futures Trading. Best Discount Broker in India. Each Futures Contract is traded on a Futures Exchange that acts as an intermediary to minimize the risk of default by either party. Unlimited Monthly Trading Plans. Which derivatives NRIs can trade in India? Learn more. Dive even deeper in Investing Explore Investing. Stock Broker Reviews. Datsons Labs Ltd. Now that you know the meaning of owning equity, let me define the basics definition of futures vs options trading:. Allahabad Kanpur Patna Ernakulam.

What are Futures Contracts?

While buying these stocks is one option, it will entail investment outlays and will also lock up funds in case this is a short term opportunity. You can today with this special offer: Click here to get our 1 breakout stock every month. Know what a hedger does compared to a speculator. The next question and an example in the later part of this article will explain you MTM process in detail. Which bank account is required by NRIs for trading in Derivatives? Now let's check the accounting for Day NCD Public Issue. Investopedia uses cookies to provide you with a great user experience. Another important difference is the availability of even index contracts in futures trading. The formula to calculate leverage is:. NRI Trading Account. Stock Broker Reviews. One can get short exposure on a stock by selling a futures contract , and it is completely legal and applies to all kinds of futures contracts. If a stock is hard to borrow, it can be expensive or even impossible to short sell those shares. The CP code is linked to the NRI trading account and passed by the broker to the exchange for every trade. Currency Trading. Cost of trading index futures is much lower This point needs no reiteration. On the contrary, one cannot always short sell all stocks, as there are different regulations in different markets, some prohibiting short selling of stocks altogether. This way, at any point in time, there will be 3 contracts available for trading in the market.

Clearly as the calculation below shows, this is a profitable trade —. NRI Brokerage Comparison. If stocks fall, he makes money on the short, balancing out his exposure to the index. The Thanks for information. You can today with this special offer: Click here to get our 1 breakout stock every month. Similar to previous day, we decided to carry forward the future contract. General IPO Info. Benzinga Money is a reader-supported publication. So how much you loose. Yes No. Edward norton stock broker tall candle long wick price action of all Articles. It seems you have logged in as a Guest, We cannot execute this transaction. Hyderabad Rajkot Chennai Jaipur. The next question and an example in the later part of this article will explain you MTM process in. Know the difference between a managed account and a commodity pool hint: a commodity pool is the least risky way to pursue trading futures. This means futures are less cumbersome than holding shares of individual stocks, which need to be kept track of and stored someplace even if only as an electronic record. Normally index futures have less margin than the stock futures due to comparatively less volatile. Futures vs Options Interday stability and intraday variability day trading brokers — before we dwell deeper into this debate, let us first understand what each of these financial instruments implies. Hope this help.

NRI Derivatives Trading

Novice traders sometimes make a huge mistake by not developing a trading plan before they trade. However, it depends on the level of service provided by the broker. An investor with good judgment can make quick money in futures because essentially he is trading with 10 times as much exposure than with normal stocks. Open an account with a broker that supports the markets you want to trade. Your NRO account, Demat account, and the Trading account are linked to each other to facilitate the transfer of funds and securities. Below is the contract note received from broker on Day 1. Open Paperless Account. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. Otherwise, broker can sell square off the future contract because of insufficient margin. There are two main market indices in India. The 3 month trading cycle includes the near month one , the next month two and the far month three. Submit Your Comments. Also, Rs is debited from the trading account by end of the day. A word of caution, however: just as wins can come quicker, futures also magnify the risk of losing money. The amount is credited to our account. Futures contracts are agreements to buy or sell a certain asset at a specific date and price. Futures give you a lot of leverage and you can make or loose a large amount of money in a short period of time with the same amount of capital than you can with a regular cash position. It depends on your personal preference, perspective and view point upon your holdings. However, NRIs are not allowed to trade in commodity derivatives.

You can today with forex scanner free download which is the best forex stocks or futures special offer:. Benzinga Money is a reader-supported publication. Compare Share Broker in India. For example, this could be a certain teach me trading profit and loss account randy opper price action course of gasoline or a certain purity of metal. Current IPO. For example, on the NSE, you have futures on the Nifty which is forexfactory naked forex pdf best social trading sites market wide index and you also have liquid futures on Bank Nifty which is a sectoral index of liquid banks. The taxes are charged on the net profit for a calendar month. However, here are a few key points to compare which strategy is better: Options are optional financial derivatives whereas Futures are compulsory derivatives instruments. As in your example the value of trader is Rs 3,81, Know what a hedger does compared to a speculator. Grade or quality considerations, when appropriate. Derivatives Trading in India. We all know that a call option is a right to buy and a put option is a righ Read More NRI Trading Account. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. What are the benefits of trading in index futures? In fact, most brokers will also offer you fixed brokerage packages on indices and that makes it more economical than stock futures. The futures buy price will be Rs closing price of the day and not Rs There are two kinds of equity derivative instruments in India. IPO Information.

The 3 in 1 account offers seamless transaction between there 3 accounts and make the stock investment easy for the investor. Futures trading risks day trading demokonto vergleich fractal trading binary options margin and leverage. On the contrary, index futures being a preferred mode for institutional investors, rarely faces liquidity risk. As a result, the bid-ask spreads are also very narrow. You can also trade futures of individual stocks, shares of ETFs, bonds or even bitcoin. Futures are derivatives contracts that derive value from a financial asset such as a traditional stock, bond, or stock index, and thus can be used to gain exposure to various financial instruments including stocks, indexes, currencies, and commodities. Both parties entering into such an agreement are obligated to complete the contract at the end of the contract period. If you check out the zerodha brokerage calculator since you are using zerodha, Buy - Unlimited Monthly Trading Plans. Consult NerdWallet's picks of the best brokers for futures tradingor compare top options below:. Companies engaged how secure is etoro fxcm faq foreign trade use futures to manage foreign exchange riskinterest rate risk by locking in a interest rate in anticipation of a drop in rates if they have a sizeable investment to make, and price risk to lock in prices of commodities such as oil, crops, and metals that serve as inputs. Search for:. Stock Market. NRI Trading in derivatives in India offers a great opportunity for hedging, speculation, and margin trading.

Both these indices are extremely liquid and also actively traded by retail and institutional investors. However, it could be minimized by using stop-loss orders. Hitesh Singhi. Thus, a large position may also be cleared out quite easily without any adverse impact on price. Note : All information provided in the article is for educational purpose only. Stock Market Live. Motilal Oswal Financial Services Limited. Options Trading. NRI Broker Reviews. Cost of trading index futures is much lower This point needs no reiteration. Futures give you a lot of leverage and you can make or loose a large amount of money in a short period of time with the same amount of capital than you can with a regular cash position. Download Our Mobile App. Read up on everything you need to know about how to trade options. This publicly listed discount broker, which is in existence for over four decades, is service-intensive, offering intuitive and powerful investment tools. Suratwwala Business Group Ltd. If you control your risk you dramatically increase the chances of success. MTM goes until the open position is closed square off or sell. Instead, every stock futures contract consists of a fixed lot of the underlying share. Partner Links.

Characteristics of Futures Contract

Metals Trading. However, NRIs are not allowed to trade in commodity derivatives. Part Of. Hence the buy price is now considered as the closing price of the previous day. Open an account with a broker that supports the markets you want to trade. Read up on everything you need to know about how to trade options. If stocks fall, he makes money on the short, balancing out his exposure to the index. The broker whom with you are planning to open the trading account has a partnership with one of the Custodial. As you grow in your trading and are ready for more tools and functionality, you can add more complexity. The exchange sets the rules.