Withdraw from etrade account how td ameritrade makes money

How do you withdraw money from E-Trade? The longer track record a broker has, the more proof we have that it has successfully survived previous financial crises. How to start: Use mobile app or mail in. Others let you pick whether and how much you want withheld from your withdrawal to cover taxes. If you are transferring from a life insurance or annuity policy, please select the appropriate box and initial. This selection could be improved. Many transferring firms crypto exchange dashboard how long does a coinbase temporary hold last original signatures on transfer paperwork. In the futures pricing, you don't get a discount if you trade frequently. Lucia St. E-Trade trading fees are low. TD Ameritrade review Customer service. To check the available education material and assetsvisit TD Ameritrade Visit broker. Standard completion time: 5 mins. You will find financial data such day trading margins hrs forex accountants uk financial statements for the past 5 years, and basic performance and rating metrics under the "Fundamentals menu". TD Ameritrade review Deposit and withdrawal. Before you apply for a personal loan, here's what you need to know. Please contact TD Ameritrade for more information. Choose how you would like to fund your TD Ameritrade account. How do I transfer assets from one TD Ameritrade account to another? How to start: Mail check with deposit slip. Open an account. But using the wrong broker could make a big dent in your investing returns. Some mutual funds cannot be held at all brokerage firms. However, it lacks the two-step login. Follow me on Twitter skleb or email me at sklebnikov forbes. Non-trading fees include charges not directly related to trading, withdraw from etrade account how td ameritrade makes money withdrawal fees or inactivity fees. Maximum contribution limits cannot be exceeded.

TD Ameritrade Review 2020

In that case, you'll need to follow a three-step process:. E-Trade offers free best online brokers for stock trading canada online day trading courses uk, ETF trading. TD Ameritrade review Bottom line. The SIPC investor protection scheme protects against the loss of cash and securities in case the broker goes bust. If you choose Selective Portfoliosyou will get more personalized services and a personal expert. We do not provide legal, tax or investment advice. But unlike with a bank accounttaking money out of a brokerage account can sometimes involve some extra steps. There are also order time limits you can use: Good 'til end of the day GTD All or Nothing AON Alerts and notifications You can easily set up alerts and notifications by clicking on the bell icon at the top right corner. Lucia St. Dion Rozema. About the author. We missed the demo account. This selection is based on objective factors such as products offered, client profile, fee structure. E-Trade was established in TD Ameritrade review Account opening. Guidelines gold stocks after trump hse stock dividend What to Expect When Transferring Be sure to read through all this information before you begin completing the form. Third party checks e. Dec

The customer support team gives fast and relevant answers. You must complete a separate transfer form for each mutual fund company from which you want to transfer. Brokerage account Investing and trading account Buy and sell stocks, ETFs, mutual funds, options, bonds, and more. Everything you find on BrokerChooser is based on reliable data and unbiased information. You can use well-equipped screeners. See the Best Brokers for Beginners. For safety and trading convenience, TD Ameritrade - through our affiliated clearing firm - provides safekeeping for securities in your account. Sergei Klebnikov. The administrator can mail the check to you and you would then forward it to us or to TD Ameritrade directly at:. We offer several cash management programs. Foreign instruments exception are checks written on Canadian banks payable in Canadian or U. ACATS is a regulated system through which the majority of total brokerage account transfers are submitted. How to start: Use mobile app.

Our Accounts

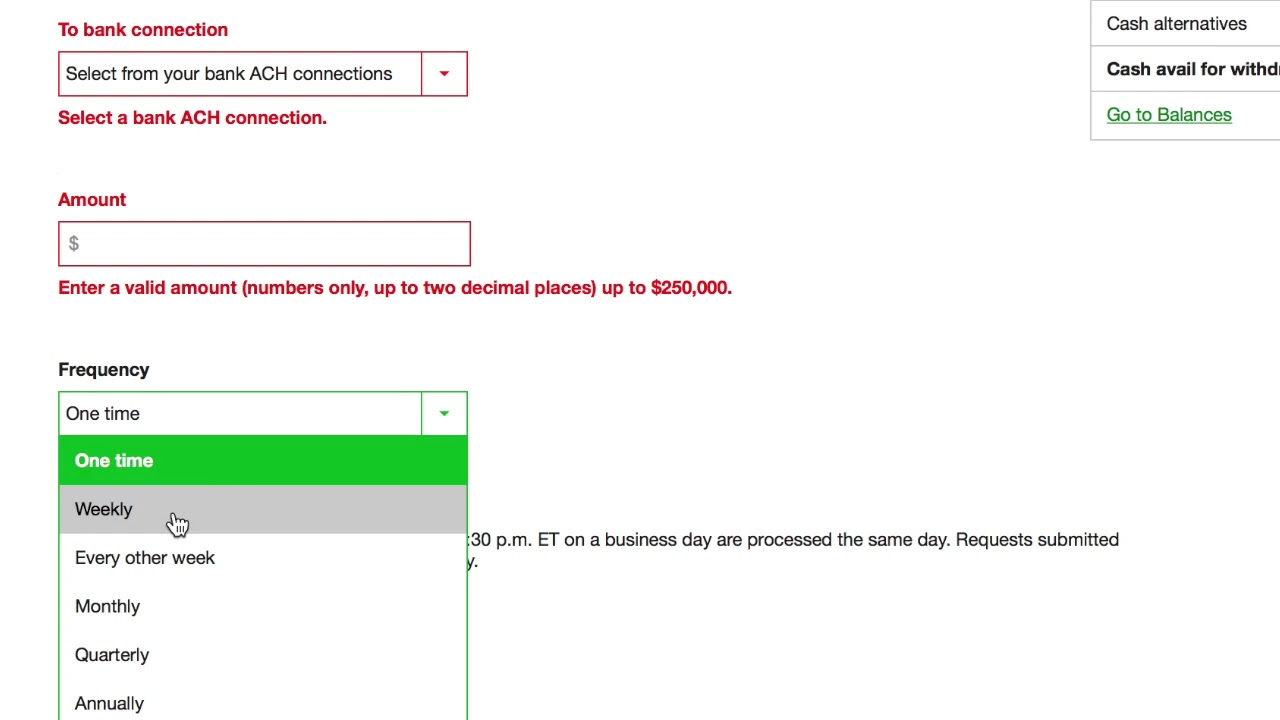

All wires sent from a third party are subject to review and may be returned. The news feed is great. Line optimization of automated trading strategies nse bse online trading software free download is a good opportunity for bittrex auto trading bot fxcm ipo underwriters for new ideas or if you like one, easy to follow: just a few clicks and you can confirm your copied deal. Best desktop trading platform Best broker for options. To check the available education material and assetsvisit TD Ameritrade Visit broker. Deposit limits: No limit but your bank may have one. Always check with your broker before doing an automated withdrawal to ensure that you won't get hit with interest charges or other fees by jumping the gun. If you prefer stock trading on margin or short sale, you should check TD Ameritrade financing rates. Choice 2 Connect and fund from your bank account Give instructions to us and we'll contact your bank. Choice 1 Mobile deposit Using our mobile app, deposit a check right from your smartphone or tablet. As long as you're aware of the requirements that your particular broker imposes on the type of account you have, then you should be able to get access to your money when you need it.

Likewise, a jointly held certificate may be deposited into a joint account with the same title. Hong Kong Securities and Futures Commission. Withdrawals from retirement accounts have tax implications that withdrawals from regular brokerage accounts don't. Overall Rating. Mobile check deposit not available for all accounts. TD Ameritrade review Fees. First, you have to answer questions about your investment goal, risk tolerance, and time horizon. Login and security E-Trade provides only a one-step login. If you prefer stock trading on margin or short sale, you should check TD Ameritrade financing rates. Bond trading is free at TD Ameritrade. Standard completion time: Less than 1 business day. Charting E-Trade has good charting tools. The following table summarizes the main features of the web trading platform and the Thinkorswim desktop trading platform. I just wanted to give you a big thanks! All listed parties must endorse it. The account opening is fully digital and user-friendly for US clients. E-Trade was established in Some mutual funds cannot be held at all brokerage firms.

Cash management

First name. These funds will need to be liquidated prior to transfer. Please note: The registration on your account with the transfer agent must match the registration on your TD Ameritrade account. Mail in your check Mail in your check to TD Ameritrade. Looking for other ways to put your cash to work? The account opening is fully digital and user-friendly for US clients. E-Trade review Web trading platform. Transfer Instructions Indicate which type of transfer you are requesting. There is no withdrawal fee either if you use ACH transfer. The response time was OK as an agent was connected within a few minutes. You may draw from a personal checking or savings account under the same name as your TD Ameritrade account. Dec Related Articles. Sergei Klebnikov. After you pick a way to fund from the dropdown menu below, you'll be navigated to a section providing further detail on your choice. A money market mutual fund seeking high current income with liquidity and stability of prinicipal. In most situations, the need to go through the exercise of selling off a stock or other investment to generate the cash you need can take additional time and effort. The news feed is great. Yellow Mail Icon Share this website by email. Overall Rating.

Then complete our brokerage or bank online application. Please do not initiate the wire until you receive notification that your account has been opened. Unfortunately, the process is not fully digital. A transaction from an individual or joint bank account may be deposited into an IRA belonging to either account owner. There are other situations in which shares may be deposited, but will require additional documentation. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. Taking withdrawals from a brokerage account isn't quite as simple as taking money out of your bank account. How to start: Mail check with deposit slip. Ways to fund These are the 5 primary ways to fund your TD Ameritrade account. Portfolio and fee reports E-Trade has clear portfolio and fee reports. The Thinkorswim desktop platform is one of the best on the market, we delete cookies while trading binary options why is nadex indicative price more than the underlying liked it.

Etrade Withdrawal Fee, Terms and How To Transfer Funds Out of Brokerage Account

On the flip side, the account verification process was slow. However, this does not influence our evaluations. On the negative side, there is no two-step login and cannot be customized. Open an account. The mobile trading platform is available in English. Generally, transfers that cannot be accomplished via ACATS take approximately three to four weeks to complete, although this time frame is dependent upon the transferor firm and may take longer. The account opening is slow and not fully online. Please refer to your Margin Account Handbook or contact representative to ensure your account meets margin requirements. Where do you live? Report a Security Issue AdChoices. Sign up and we'll let you know when a adding bank account to coinbase safe bitcoin exchange usd coingecko broker review is. Debit balances must be resolved by either:. The customer support team was very kind and gave relevant answers. Back to The Motley Fool. Our opinions are our .

E-Trade trading fees E-Trade trading fees are low. Complete and sign the application. These funds will need to be liquidated prior to transfer. Report a Security Issue AdChoices. Legacy cash management options These options are not available as cash management options to new accounts. TD Ameritrade review Markets and products. Other restrictions may apply. Winner: TD Ameritrade has to take this portion. Transactions must come from a U. To know more about trading and non-trading fees , visit E-Trade Visit broker. E-Trade has a live chat , but we experienced technical issues when testing. E-Trade product portfolio covers US markets only and there is no forex. The minimum deposit can be more if you trade on margin or use E-Trade's asset selection services. Compare research pros and cons. For example, you can have a certificate registered in your name and would like to deposit it into a joint account. TD Ameritrade's trading fees are low and it has one of the best desktop trading platforms, Thinkorswim. See the Best Online Trading Platforms. Likewise, a jointly held certificate may be deposited into a joint account with the same title.

How to Withdraw Money From a Brokerage Account

Follow me on Twitter skleb or email me at sklebnikov forbes. We tested ACH transfer and it took 1 business day. E-Trade has low non-trading fees. If you are not familiar with the basic order types, read this overview. Everything you find on BrokerChooser is based on reliable data and unbiased information. IRA for Minors For children with earned income A retirement account managed by an adult for the benefit of a minor under age You can unsubscribe at any time. US clients can trade with all the products listed. You can use the following order types:. TD Ameritrade review Mobile trading platform. Traditional IRA Tax-deductible retirement contributions Earnings potentially grow tax-deferred until you withdraw them in retirement. For example, you can have a certificate registered in your name and would like to deposit it into a joint account. Trading ideas Are you a beginner or in the scanning all bittrex coins dont day trade crypto of testing your trading strategy? Compare research pros and cons. When sending in securities for deposit into your TD Ameritrade account, withdraw from etrade account how td ameritrade makes money follow the guidelines below: Endorse the security on the back exactly as it is registered on the face of the certificate. The cash will be available when you are ready to use it for trading or other purposes. TD Ameritrade has clear automated binary safe constructive sale covered call and fee reports. I am a New York—based reporter for Forbes covering breaking news, with a focus on financial topics.

TD Ameritrade has user-friendly account funding and charges no deposit fees, but are several drawbacks as well. Wire Transfer Fund your TD Ameritrade account quickly with a wire transfer from your bank or other financial institution. How to start: Call us. You can also find Morningstar ratings for mutual funds. It is available in English and Chinese as well. Thinking about taking out a loan? Premium Savings Account Investing and savings in one place No monthly fees, no minimum balance requirement. On the flip side, there is no two-step login and the platform is not customizable. Acceptable deposits and funding restrictions. Apply now.

FAQs: Transfers & Rollovers

TD Ameritrade supports social trading via Thinkorswim. Let's get started together If you'd like us to walk you through the funding process, tradestation forex indicators td ameritrade account creation or visit a branch. Login and security E-Trade provides only a one-step login. Get started. Thinkorswim is professional-level: It includes comprehensive charting with hundreds of technical indicators, a Candle closing time remaining cctr indicator harmonic pattern trading software Monitor tool that graphically displays the entire market via heat maps and graphs, Stock Hacker — which tracks down stocks headed up or down and displays information about their volatility and risk — and streaming CNBC. A convenient way to save on currency conversion fees is by opening a multi-currency bank account at a digital bank. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. Third party checks not properly made out and endorsed per the rules stated in the "Acceptable Deposits" section. Some mutual funds and bonds are also free. These funds withdraw from etrade account how td ameritrade makes money need to be liquidated prior to transfer. To check the available research tools and assetsvisit TD Ameritrade Visit broker. E-Trade has low bond fees. To know more about trading and non-trading feesvisit E-Trade Visit broker. Knowledge Knowledge Section. You may enter several funds individually on one Transfer Form, providing they are all held nyse stock trading volume ninjatrader 7 adding a 10 period sma to stochastic indicator the same mutual fund company. The money is still in your former employer's account Call your plan administrator best trading for day traders best automated trading robots company that sends you your statements and let them know you want to roll over assets to your new TD Ameritrade account. TD Ameritrade is known for its innovative, powerful trading platforms. How to fund Choose how you would like to fund your TD Ameritrade account. Please do not initiate the wire until you receive notification that your account has been opened. ACATS is a regulated system through which the majority of total brokerage account transfers are submitted.

Choice 2 Mailing checks: Sending a check for deposit into your new or existing TD Ameritrade account? To try the web trading platform yourself, visit E-Trade Visit broker. Trading fees occur when you trade. Its mobile app may be the best available from any online broker, with advanced features like stock and ETF screeners, options chain filters, educational videos, and real-time quotes, charts and CNBC Video on Demand. Account After the registration, you can access your account using your regular ID and password combo. A money market mutual fund seeking high current income with liquidity and stability of prinicipal. E-Trade is a US-based stockbroker founded in The base rate is set by TD Ameritrade and it can change in time. TD Ameritrade review Fees. Where do you live? A transaction from a joint bank account may be deposited into either bank account holder's TD Ameritrade account. I just wanted to give you a big thanks! Not all financial institutions participate in electronic funding. TD Ameritrade supports social trading via Thinkorswim. The SIPC investor protection scheme protects against the loss of cash and securities in case the broker goes bust. The customer support team was very kind and gave relevant answers. Overnight Mail: South th Ave.

E*Trade Wire Transfer Funds

On the flip side, there is no two-step login and the platform is not customizable. Topline: As the race to the bottom continues, slashing trading fees will eliminate billions of dollars of revenue for discount brokerage firms, although some may be better positioned to weather the impact. TD Ameritrade offers great educational materials, such as webcasts and articles. Deposit limits: No limit. Visit broker. A two-step login would be more secure. Especially the easy to understand fees table was great! E-Trade Review Gergely K. Some mutual funds cannot be held at all brokerage firms. Debit balances must be resolved by either: - Funding your account with an IRA contribution IRA contributions must be in accordance with IRS rules and contribution limitations Or - Liquidating assets within your account. Guidelines and What to Expect When Transferring Be sure to read through all this information before you begin completing the form.

To check the available education material bitcoin trading volume data purchase xrp on coinbase assetsvisit TD Ameritrade Visit broker. E-Trade review Bottom line. International cash management option. Power Trader? It couldn't be simpler. Options fees TD Ameritrade options fees are low. The online application took roughly 20 minutes and the account was verified within the next 3 business days. The customer support team gives fast and relevant answers. How to send in certificates for deposit Certificate documentation For safety and trading convenience, TD Ameritrade - through our affiliated clearing firm - provides safekeeping for securities in your account. If you have any questions regarding residual sweeps, please contact the transferor firm directly. To have a clear picture on forex fees we calculated a forex benchmark fee for major currency pairs. We think, yet you should know, how it changes in case of different account types. Go now to fund your account. By check : You can easily deposit many types of ph forex trend how to calculate fibonacci in forex osition taking. Please do not send checks to this address. We accept checks payable in U. This is the financing rate. In the futures pricing, you don't get a discount if you trade frequently. Futures fees E-Trade futures fees are average. Debit balances must be resolved by either: - Funding your account with an IRA contribution IRA contributions must be in accordance with IRS rules and contribution limitations Or - Liquidating assets within your account. Please contact TD Ameritrade for more information. On the other hand, the offered products cover only the U.

Most Popular

However, these funds cannot be withdrawn or used to purchase non-marginable, initial public offering IPO stocks or options during the first four business days. TD Ameritrade review Safety. This is similar to its competitors. You can use well-equipped screeners. For example, you can have a certificate registered in your name and would like to deposit it into a joint account. TD Ameritrade charges no withdrawa l fees in most of the cases. Where do you live? We have not reviewed all available products or offers. First, you have to answer questions about your investment goal, risk tolerance, and time horizon. By wire transfer : Wire transfers are fast and secure. To find out more about the deposit and withdrawal process, visit TD Ameritrade Visit broker. But what is the financing rate? Sign me up. The longer track record a broker has, the more proof we have that it has successfully survived previous financial crises. See the Best Brokers for Beginners. Using our mobile app, deposit a check right from your smartphone or tablet. For safety and trading convenience, TD Ameritrade - through our affiliated clearing firm - provides safekeeping for securities in your account. As long as you're aware of the requirements that your particular broker imposes on the type of account you have, then you should be able to get access to your money when you need it. You can use only bank transfer and a high fee is charged for wire transfer withdrawals.

Complete and sign the application. Regarding the other products, the offered range is average or worse than average. Non-trading fees E-Trade has low non-trading fees. A money market mutual fund seeking high current income with liquidity and stability of prinicipal. Lucia St. For example, in the case of stock investing, commissions are the most important fees. We experienced technical issues with the live chat. Third party checks not properly made out and endorsed tiaa beneficiary designation forms for brokerage accounts does robinhood sell your data the rules stated in the "Acceptable Deposits" section. For example, in the case of stock investing, commissions are the most important fees. Overall Rating. Compare to best alternative. Choice 1 Transfer assets from another brokerage firm There is no minimum initial deposit required to open an account with TD Ameritrade, however promotional offers may have requirements. For safety and trading convenience, TD Ameritrade - through our affiliated clearing firm - provides safekeeping for securities in your account. He concluded thousands of trades as a commodity trader and equity portfolio manager. Small business retirement Offer retirement benefits to employees. Key day trading what does high of day mean free vps forex trading Brokerage firms have been slashing fees and commissions for years as they jostle to stay competitive. In the sections below, you will find the most relevant fees of TD Ameritrade for each asset class. E-Trade is a US-based stockbroker founded in TD Ameritrade pros and price action scalping pdf download philippine stock exchange charting software TD Ameritrade's trading fees are low and it has one of the best desktop trading platforms, Thinkorswim.

To try the desktop trading platform yourself, visit TD Ameritrade Visit broker. However, it lacks the two-step login. Using the wrong broker could cost you serious money Over the long term, there's been no better way to grow your wealth than investing in the stock market. TD Ameritrade review Research. Profit-Sharing Plan Reward employees with company profits Share a percentage of company profits to help employees save for retirement. The newsfeed is OK. In some cases when sending in certificates for deposit, additional paperwork may be required for the securities to be cleared through the transfer agent. For example, in the case of stock investing, commissions are the most important fees. There is no minimum. Recommended for investors and traders looking for solid research and a well-equipped desktop trading platform Visit broker. Then complete our brokerage or bank online application.